Saudi Arabia Vehicle Financing Market Size, Share, Trends and Forecast by Vehicle Type, Loan Provider, Vehicle Condition, Purpose Type, and Region, 2026-2034

Saudi Arabia Vehicle Financing Market Overview:

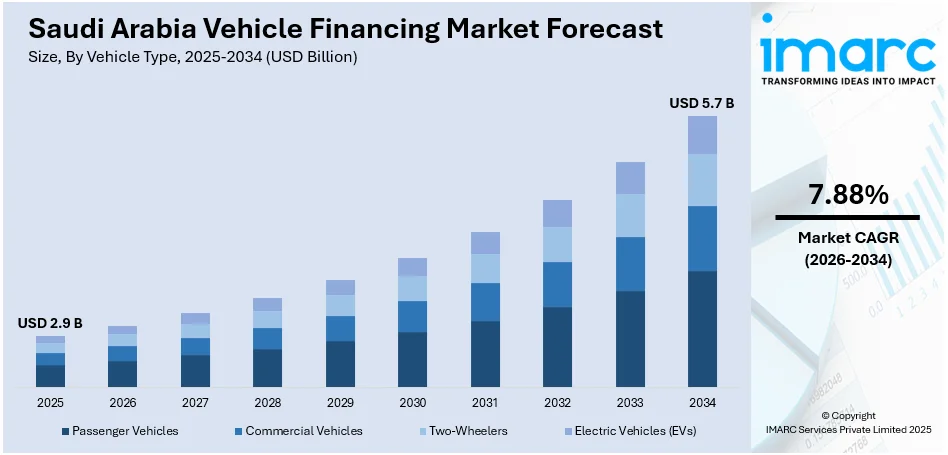

The Saudi Arabia vehicle financing market size reached USD 2.9 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 5.7 Billion by 2034, exhibiting a growth rate (CAGR) of 7.88% during 2026-2034. The market is driven by rising disposable income, increased demand for personal vehicles, supportive government initiatives, and growing adoption of Islamic financing models. The expansion of digital lending platforms and favorable interest rates also contribute significantly to market expansion, boosting the Saudi Arabia vehicle financing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2.9 Billion |

| Market Forecast in 2034 | USD 5.7 Billion |

| Market Growth Rate 2026-2034 | 7.88% |

Saudi Arabia Vehicle Financing Market Trends:

Integration of Fintech in Auto Financing

A major trend propelling Saudi Arabia vehicle financing market growth is the increasing integration of fintech solutions across the lending landscape. According to the Saudi Central Bank, finance company credit rose to SR96.26 billion in 2024, with fintech-driven services playing a growing role in this expansion. Innovations such as AI-powered credit scoring, mobile-based loan applications, and real-time approval systems are streamlining processes and broadening access to vehicle loans, especially among younger and digitally savvy consumers. Platforms like Buy-Now-Pay-Later (BNPL) and debt-based crowdfunding are also reshaping access to auto finance, offering alternative paths to credit. As digital lending gains regulatory backing and customer trust, fintech adoption is expected to significantly accelerate Saudi Arabia vehicle financing market growth.

To get more information on this market Request Sample

Surge in Electric Vehicle Financing

Another significant trend in the vehicle finance market in Saudi Arabia is increasing interest in financing electric vehicles (EVs). With the government focusing on sustainability and lowering carbon emissions, financial institutions are launching special financing plans for EVs, such as lower interest rates and extended repayment periods. The drive for electric mobility is complemented by growing availability of charging stations and tax benefits. This focused strategy is also persuading consumers to look at EVs as genuine substitutes for conventional fuel-run vehicles. Consequently, banks are adjusting their lending portfolios to address this niche segment that will expand steadily in the future. These targeted strategies not only address environmental objectives but also drive the growth of the Saudi Arabia vehicle financing market through product diversification. For instance, in May 2025, Hyundai Motor Manufacturing Middle East (HMMME), a joint venture between Saudi Arabia’s Public Investment Fund (PIF) and Hyundai, began construction on a $500M vehicle plant in King Abdullah Economic City. The facility will produce both internal combustion engine and electric vehicles, with an annual capacity of 50,000 units starting in Q4 2026. PIF holds a 70% stake, aiming to localize production, boost jobs, and advance Saudi Arabia’s automotive industry under Vision 2030.

Saudi Arabia Vehicle Financing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional levels for 2026-2034. Our report has categorized the market based on vehicle type, loan provider, vehicle condition, and purpose type.

Vehicle Type Insights:

- Passenger Vehicles

- Commercial Vehicles

- Two-Wheelers

- Electric Vehicles (EVs)

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes passenger vehicles, commercial vehicles, two-wheelers, and electric vehicles (EVs).

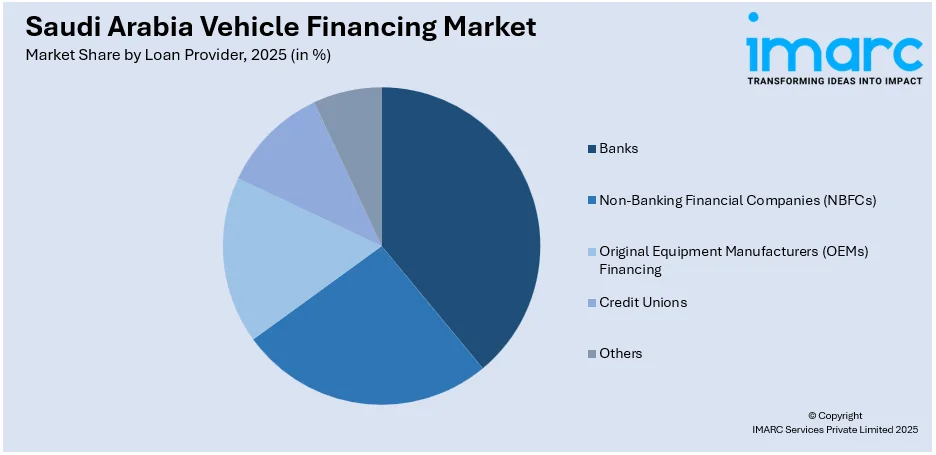

Loan Provider Insights:

Access the comprehensive market breakdown Request Sample

- Banks

- Non-Banking Financial Companies (NBFCs)

- Original Equipment Manufacturers (OEMs) Financing

- Credit Unions

- Others

The report has provided a detailed breakup and analysis of the market based on the loan provider. This includes banks, non-banking financial companies (NBFCs), original equipment manufacturers (OEMs) financing, credit unions, and others.

Vehicle Condition Insights:

- New Vehicles

- Used Vehicles

The report has provided a detailed breakup and analysis of the market based on the vehicle condition. This includes new vehicles and used vehicles.

Purpose Type Insights:

- Loan

- Leasing

The report has provided a detailed breakup and analysis of the market based on the purpose type. This includes loan and leasing.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Vehicle Financing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Passenger Vehicles, Commercial Vehicles, Two-Wheelers, Electric Vehicles (EVs) |

| Loan Providers Covered | Banks, Non-Banking Financial Companies (NBFCs), Original Equipment Manufacturers (OEMs) Financing, Credit Unions, Others |

| Vehicle Conditions Covered | New Vehicles, Used Vehicles |

| Purpose Types Covered | Loan, Leasing |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia vehicle financing market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia vehicle financing market on the basis of vehicle type?

- What is the breakup of the Saudi Arabia vehicle financing market on the basis of loan provider?

- What is the breakup of the Saudi Arabia vehicle financing market on the basis of vehicle condition?

- What is the breakup of the Saudi Arabia vehicle financing market on the basis of purpose type?

- What is the breakup of the Saudi Arabia vehicle financing market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia vehicle financing market?

- What are the key driving factors and challenges in the Saudi Arabia vehicle financing market?

- What is the structure of the Saudi Arabia vehicle financing market and who are the key players?

- What is the degree of competition in the Saudi Arabia vehicle financing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia vehicle financing market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia vehicle financing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia vehicle financing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)