Saudi Arabia Vehicle Leasing Market Size, Share, Trends and Forecast by Type, Mode of Booking, and Region, 2026-2034

Saudi Arabia Vehicle Leasing Market Overview:

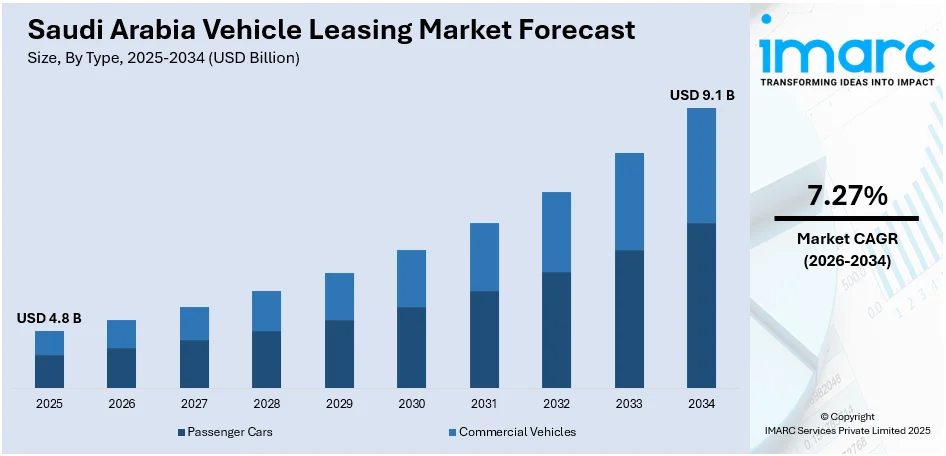

The Saudi Arabia vehicle leasing market size reached USD 4.8 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 9.1 Billion by 2034, exhibiting a growth rate (CAGR) of 7.27% during 2026-2034. The market is witnessing remarkable growth because of a number of government-driven factors. Various initiatives by the government, including the Regional Headquarters Programme, have drawn in multinational corporations, leading to growing demand for vehicles on lease. Moreover, growth in electric vehicles and transition towards digital platforms have further fueled the expansion of the market. These trends have cumulatively helped in enhancing the Saudi Arabia vehicle leasing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 4.8 Billion |

| Market Forecast in 2034 | USD 9.1 Billion |

| Market Growth Rate 2026-2034 | 7.27% |

Saudi Arabia Vehicle Leasing Market Trends:

Government Initiatives and Economic Diversification

Saudi Arabia's government strategic plans under Vision 2030 have been instrumental in the development of the vehicle leasing industry. Initiatives such as the Regional Headquarters (RHQ) Programme motivate multinational corporations to set up regional headquarters in Saudi Arabia, consequently boosting the demand for corporate-used leased vehicles. In addition, the government's emphasis on economic diversification has resulted in massive investments in infrastructure, tourism, and logistics, industries which greatly depend on effective transport solutions. For instance, according to industry reports, Saudi Arabia’s new government vehicle regulations, effective August 2025, establish a unified framework for procurement and leasing. They prioritize leasing, local content, digital fleet management, and insurance compliance. Civilian vehicles are covered, with key exclusions. Entities must register fleets, follow fuel and maintenance rules, and report accidents. The framework aims to enhance efficiency, transparency, and national security in public vehicle management. These developments have created a conducive environment for the expansion of the vehicle leasing market, as businesses seek flexible and cost-effective mobility options to support their operations. The cumulative effect of these initiatives has significantly contributed to the Saudi Arabia vehicle leasing market growth.

To get more information on this market Request Sample

Shift Towards Sustainable and Electric Vehicles

The growing emphasis on sustainability and environmental consciousness has led to a significant shift towards electric vehicles (EVs) in Saudi Arabia's vehicle leasing market. The government's commitment to reducing carbon emissions and promoting green transportation solutions has spurred the introduction of EVs into the leasing fleets of various companies. For instance, as per recent industry trends, Saudi Arabia plans to transition 30% of Riyadh’s vehicles to electric by 2030 as part of a larger effort to reduce emissions in the capital by 50% and reach carbon neutrality by 2060. It further expects the launch of more dealerships, including those for American and European brands, along with a rise in local EV production by the end of 2026. Moreover, consumers and businesses alike are increasingly opting for EVs due to their lower environmental impact and cost-effectiveness in the long run. This shift towards sustainable transportation options is expected to continue driving the Saudi Arabia vehicle leasing market growth in the coming years.

Saudi Arabia Vehicle Leasing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type and mode of booking.

Type Insights:

- Passenger Cars

- Commercial Vehicles

The report has provided a detailed breakup and analysis of the market based on the types. This includes passenger cars and commercial vehicles.

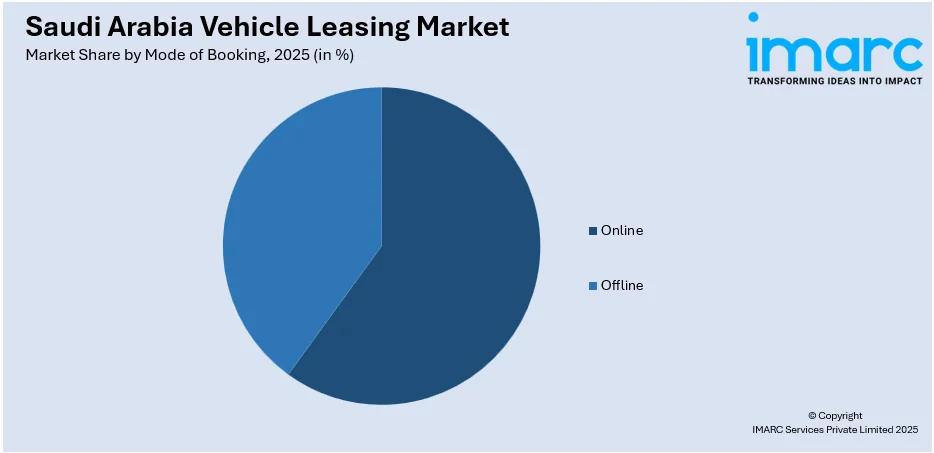

Mode of Booking Insights:

Access the comprehensive market breakdown Request Sample

- Online

- Offline

A detailed breakup and analysis of the market based on the mode of bookings have also been provided in the report. This includes online and offline.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Vehicle Leasing Market News:

- In June 2024, Budget Saudi acquired AutoWorld from SEDCO Holding, marking a key strategic expansion. The deal boosts Budget Saudi’s market share in the KSA vehicle leasing sector from 12% to 18%, adds 14,000 vehicles to its fleet, and enhances B2B and B2G offerings.

- In April 2024, Tawuniya, a leading Saudi insurer, partnered with car rental platform Ejaro. The collaboration enables Ejaro to offer daily motor insurance to its hosts, reflecting the evolving insurance needs of the car-sharing industry and supporting innovative coverage solutions in Saudi Arabia.

- In January 2024, Budget Saudi renewed its franchise agreement with Avis Budget Group (ABG) for 10 years, extending through 2033. As ABG’s largest global franchisee, Budget Saudi reaffirmed its leadership in car rental and leasing in the Kingdom. Budget is also expanding its EV fleet and infrastructure, aligning with Saudi Vision 2030 and sustainability goals.

Saudi Arabia Vehicle Leasing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Passenger Cars, Commercial Vehicles |

| Mode of Bookings Covered | Online, Offline |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia vehicle leasing market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia vehicle leasing market on the basis of type?

- What is the breakup of the Saudi Arabia vehicle leasing market on the basis of mode of booking?

- What is the breakup of the Saudi Arabia vehicle leasing market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia vehicle leasing market?

- What are the key driving factors and challenges in the Saudi Arabia vehicle leasing market?

- What is the structure of the Saudi Arabia vehicle leasing market and who are the key players?

- What is the degree of competition in the Saudi Arabia vehicle leasing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia vehicle leasing market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia vehicle leasing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia vehicle leasing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)