Saudi Arabia Vending Machine Market Size, Share, Trends and Forecast by Type, Technology, Payment Mode, Application, and Region, 2026-2034

Saudi Arabia Vending Machine Market Overview:

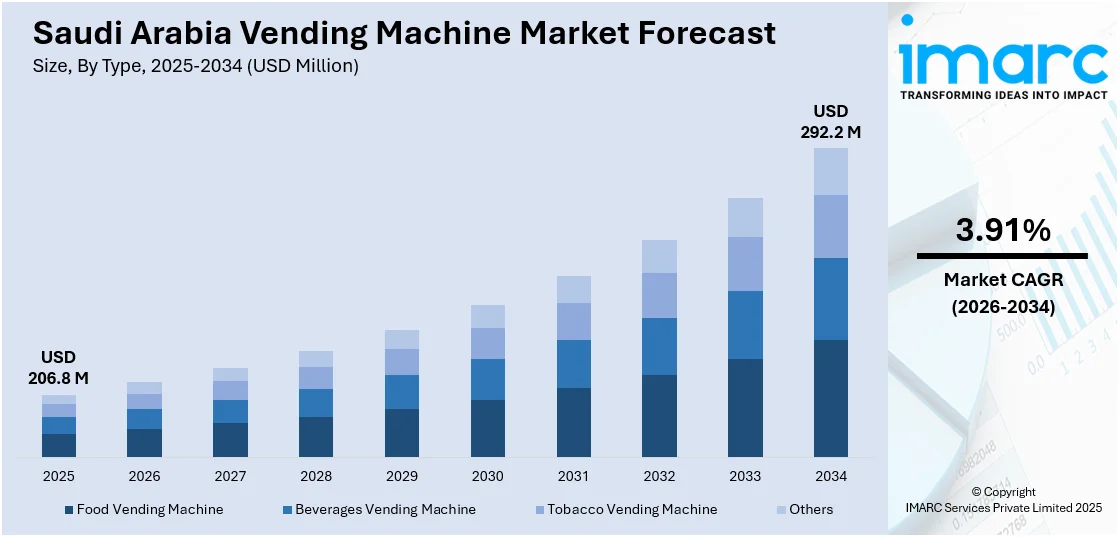

The Saudi Arabia vending machine market size reached USD 206.8 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 292.2 Million by 2034, exhibiting a growth rate (CAGR) of 3.91% during 2026-2034. The market in Saudi Arabia is expanding due to rapid growth in tourism, government-backed hospitality initiatives, and the widespread adoption of cashless payments, aligning with Vision 2030 goals to enhance visitor convenience and promote digital transactions across high-traffic and public spaces.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 206.8 Million |

| Market Forecast in 2034 | USD 292.2 Million |

| Market Growth Rate 2026-2034 | 3.91% |

Saudi Arabia Vending Machine Market Trends:

Growth of Tourism and Hospitality Industry

Saudi Arabia's hospitality and tourism sector, spearheaded by initiatives like Vision 2030 and mega-projects including NEOM and the Red Sea Project, is driving the demand for vending machines. Saudi Arabia's emergence as a global destination for tourists is seeing demand for convenient services among foreign visitors grow rapidly. Vending machines located at high-traffic zones such as tourist locations, hotels, airports, and recreation sites make it convenient to access snacks, beverages, and essential items, helping to meet the convenience needs of travelers. Additionally, the increased volume of international conferences and events occurring in Saudi Arabia are driving demand for vending machines in public spaces, exhibition halls, and transport hubs. The aggressive support for the tourism industry by the Saudi Government also plays a big role in this advancement. For example, the Saudi Arabian government is promoting engagement in the tourism industry through initiatives like the Tourism Investment Enabler Program (TIEP), introduced in March 2024, which simplified the licensing procedure for running tourism enterprises to merely 5 days. Extra assistance included the elimination of local licensing fees and the Tourism Development Fund, which has offered more than US$2 billion in aid. The e-visa initiative, currently available for 66 nations, has greatly enhanced tourist access, thereby creating better prospects for new businesses.

To get more information on this market Request Sample

Growing Demand for Convenience

The Saudi Arabian market for vending machines is being fueled by the growing demand for convenience. Individuals are always on the lookout for instant, convenient solutions to buy snacks, drinks, and other essential products without having to wait for long. Busy lifestyles, lengthy working hours, and lengthy commutes are encouraging individuals in urban areas to opt for self-service vending machines for speedy, touchless transactions. This is especially evident in busy places like malls, airports, offices, and schools, where vending machines are consistently providing time-saving services to shoppers. Ongoing urban developments and increasing disposable incomes are also promoting this move towards more convenient purchasing options, as people increasingly turn to vending machines for a quick, hassle-free experience. The CEO of Spinneys, a supermarket chain, stated that consumer expenditure in the Kingdom is projected to experience a compound annual growth rate of 6.4 percent between 2022 and 2028, while the UAE is anticipated to grow by 4.3 percent in that timeframe.

Greater Foot Traffic in Retail Outlets and Public Areas

The increased footfall in public areas like shopping centers, airports, hospitals, and schools is playing a major role in the growth of the vending machine industry. As people spend more time in these areas, there is always demand for quick and convenient food and beverage services. Vending machines are constantly giving consumers a convenient option for on-the-go shopping. Retail shops are also witnessing growth in the application of vending machines for offering ancillary services to consumers. As the traffic of people keeps on increasing within cities, vending machines are emerging as a mandatory component of the retail and service network, supporting the market growth. IMARC Group predicts that the Saudi Arabia retail market is projected to attain USD 402.7 Billion by 2033.

Saudi Arabia Vending Machine Market Growth Drivers:

Technological Progress in Vending Machines

The Saudi vending machine industry is growing as a result of continuous technological innovation in the sector. Manufacturers are constantly incorporating the latest features in machines, including touchless payment, interactive touch screens, and AI-driven customization features. This incessant innovation in technology is improving the user experience and increasing the appeal of vending machines among tech-loving consumers. Digital interfaces made available to customers enable them to customize their purchases, and contactless payment systems such as mobile wallets and credit cards are accelerating transactions and enhancing their security. These innovations are empowering vending machines to address changing customer needs seamlessly.

Changing Consumer Choices towards Health Products

The Saudi market is more and more experiencing a change in consumer demand towards healthier foods, and the vending machines are responding accordingly. When individuals are becoming more health-oriented, more demand for healthy snacks, organic foods, and fresh drinks emerges. Vending machines are filled with healthy options like granola bars, fruit juices, yogurt, and even salads, following the well-being trends. As healthy habits are going mainstream, vending operators are continually expanding their product lines to address this need, thereby propelling the market. These initiatives are redefining vending machines from legacy snack dispensers to centers for healthy products.

Increased Disposable Income and Affluent Population

The growing disposable income among the Saudi population is contributing significantly to the growth of the vending machine market. As affluence increases, consumers are investing more in convenience foods and high-end products in vending machines. Luxury snacks, upscale beverages, and organic foods are just some of the choices that the expanding middle and upper class continually drive demand for more premium and varied vending machine offerings. With more affluent consumers increasing in numbers, vending machine operators are continuously diversifying their products to meet the changing tastes and preferences of this group of consumers, thereby driving the market.

Saudi Arabia Vending Machine Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on type, technology, payment mode, and application.

Type Insights:

- Food Vending Machine

- Beverages Vending Machine

- Tobacco Vending Machine

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes food vending machine, beverages vending machine, tobacco vending machine, and others.

Technology Insights:

- Automatic Machine

- Semi-Automatic Machine

- Smart Machine

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes automatic machine, semi-automatic machine, and smart machine.

Payment Mode Insights:

- Cash

- Cashless

The report has provided a detailed breakup and analysis of the market based on the payment mode. This includes cash and cashless.

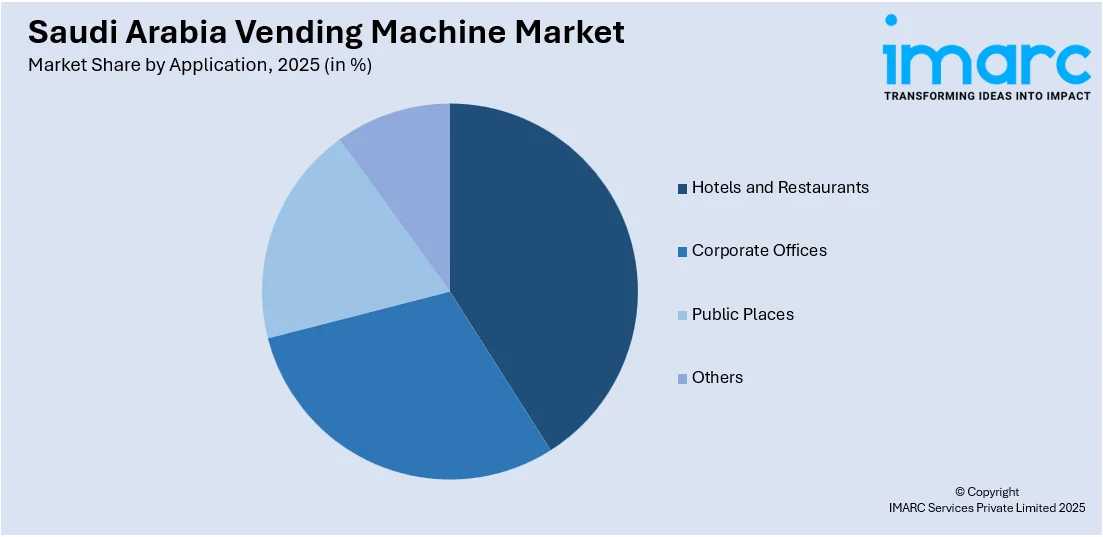

Application Insights:

Access the comprehensive market breakdown Request Sample

- Hotels and Restaurants

- Corporate Offices

- Public Places

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes hotels and restaurants, corporate offices, public places, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Vending Machine Market News:

- In July 2025, In line with its summer campaign for riders and a wider dedication to their welfare, talabat, the premier on-demand online ordering and delivery service in the region, has reintroduced its “Vending Machines for Summer Relief” program for the second consecutive year. As temperatures increase, a special vending machine has been set up in a busy rider area, providing talabat riders with crucial hydration and light snacks to ensure they remain safe, nourished, and energized while working. This initiative demonstrates talabat’s ongoing commitment to delivering practical, people-centric solutions that enhance rider health and safety throughout the year, particularly in summer.

- In May 2025, Floward has introduced its newest innovation: the first robotic flower vending machine in MENA, specifically created for Floward to transform the way individuals purchase flowers while on the move. Currently available in Saudi Arabia, the UAE, Qatar, and Kuwait, the machines provide a completely automated, technology-driven experience, combining convenience, personalization, and freshness in a single elegant unit.These vending machines represent a new standard of offline innovation, crafted from the ground up with Floward's e-commerce approach, uniting automation, personalization, and freshness within a single elegant unit.

- In December 2024, Indra unveiled its advanced ticketing technology, including innovative vending machines, which became operational on the first three lines of the Riyadh Metro. These machines, designed with smartphone-like usability, allowed users to easily purchase tickets and access information. The technology also integrated with Riyadh's bus network, providing a seamless, sustainable travel experience for the residents.

- In October 2024, the Ministry of Communications and Information Technology in Saudi Arabia issued a tender for the operation of self-service vending machines in its buildings in Riyadh. It was a part of an effort to enhance services within government facilities.

Saudi Arabia Vending Machine Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Food Vending Machine, Beverages Vending Machine, Tobacco Vending Machine, Others |

| Technologies Covered | Automatic Machine, Semi-Automatic Machine, Smart Machine |

| Payment Modes Covered | Cash, Cashless |

| Applications Covered | Hotels and Restaurants, Corporate Offices, Public Places, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia vending machine market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia vending machine market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia vending machine industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The vending machine market in Saudi Arabia was valued at USD 206.8 Million in 2025.

The Saudi Arabia vending machine market is projected to exhibit a CAGR of 3.91% during 2026-2034, reaching a value of USD 292.2 Million by 2034.

Key factors driving the Saudi Arabia vending machine market include increasing demand for convenience, technological advancements like contactless payments, a shift towards healthier food options, rising disposable incomes, government support for smart cities, and growing foot traffic in public spaces and retail outlets.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)