Saudi Arabia Video Surveillance Systems Market Size, Share, Trends and Forecast by System Type, Component, Application, Enterprise Size, Customer Type, and Region, 2026-2034

Saudi Arabia Video Surveillance Systems Market Overview:

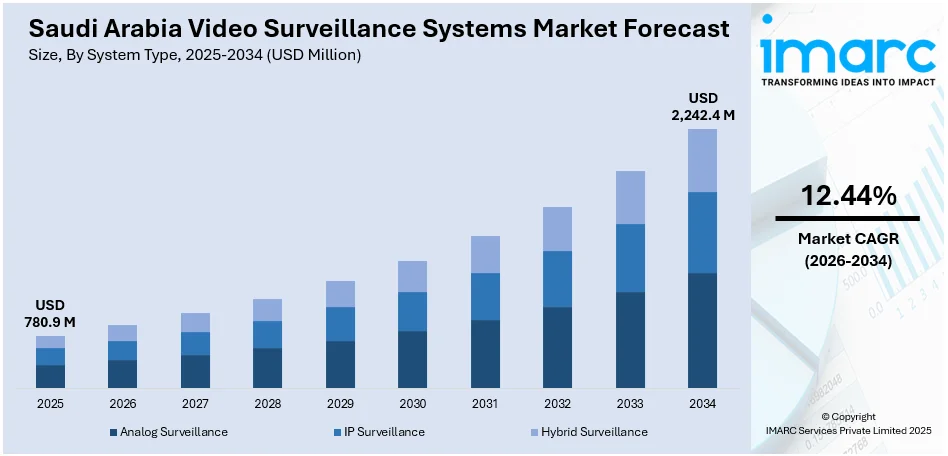

The Saudi Arabia video surveillance systems market size reached USD 780.9 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 2,242.4 Million by 2034, exhibiting a growth rate (CAGR) of 12.44% during 2026-2034. The market is driven by implementation of supportive government initiatives such as Vision 2030, smart city projects, and rising security demands. AI and IoT adoption, infrastructure expansion, and increasing investments in public safety further propel market growth. Moreover, the shift toward advanced analytics, cloud-based solutions, and 5G-enabled surveillance is also expanding the Saudi Arabia video surveillance systems market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 780.9 Million |

| Market Forecast in 2034 | USD 2,242.4 Million |

| Market Growth Rate 2026-2034 | 12.44% |

Saudi Arabia Video Surveillance Systems Market Trends:

Increasing Adoption of AI-Powered Video Surveillance Systems

The market is witnessing a growing shift toward AI-powered solutions, driven by the need for advanced security and operational efficiency. The implementation of government initiatives, such as smart city projects under Vision 2030, is accelerating the deployment of intelligent surveillance systems with features including facial recognition, license plate recognition, and behavioral analytics. AI integration enhances real-time threat detection, reducing reliance on manual monitoring and improving response times. Additionally, businesses across retail, healthcare, and transportation sectors are adopting AI-driven surveillance to enhance safety and customer experience. The demand for cloud-based video analytics is also rising, enabling remote monitoring and data-driven decision-making. With increasing cybersecurity concerns, vendors are focusing on secure, scalable AI solutions, further propelling Saudi Arabia video surveillance systems market growth. Saudi Arabia experienced over 180 major cyber incidents in 2023, while 47% of hacked data linked to domestic organizations was offered for sale on the dark web. Moreover, more than 50 Million email threats and 34 Million malware attacks were blocked. This data underlines the urgency for cybersecurity, risk, and compliance solutions to protect national infrastructure and compliance with the regulatory framework. As Saudi Arabia continues to invest in digital transformation, AI-powered surveillance systems are expected to witness significant growth.

To get more information on this market Request Sample

Expansion of Smart City and Infrastructure Projects

The market is experiencing significant growth due to the rapid development of smart cities and large-scale infrastructure projects. Mega initiatives such as NEOM, the Red Sea Project, and Qiddiya are incorporating advanced surveillance systems to ensure public safety and efficient urban management. The government’s focus on enhancing security in critical areas, including airports, transportation hubs, and public spaces, is driving demand for high-resolution, IP-based cameras with night vision and thermal imaging capabilities. Furthermore, the integration of IoT and 5G technology is enabling seamless connectivity and real-time data transmission, thereby improving surveillance effectiveness. Private sector investments in commercial and residential security solutions are also contributing to market expansion. Saudi Arabia ranked as the safest of all G20 countries in the 2023 Safety Index, where 92.6 percent of the country's residents said they feel safe walking alone in their local area at night. This figure highlights the success of the nation’s residential security protocols, which utilize cutting-edge video surveillance technology. These initiatives are part of Saudi Vision 2030 efforts that seek to enhance security and quality of life across the Kingdom. As urbanization and digital transformation accelerate, the demand for sophisticated video surveillance systems is rising, creating a positive Saudi Arabian video surveillance market outlook.

Saudi Arabia Video Surveillance Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on system type, component, application, enterprise size, and customer type.

System Type Insights:

- Analog Surveillance

- IP Surveillance

- Hybrid Surveillance

The report has provided a detailed breakup and analysis of the market based on the system type. This includes analog surveillance, IP surveillance, and hybrid surveillance.

Component Insights:

- Hardware

- Software

- Services

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes hardware, software, and services.

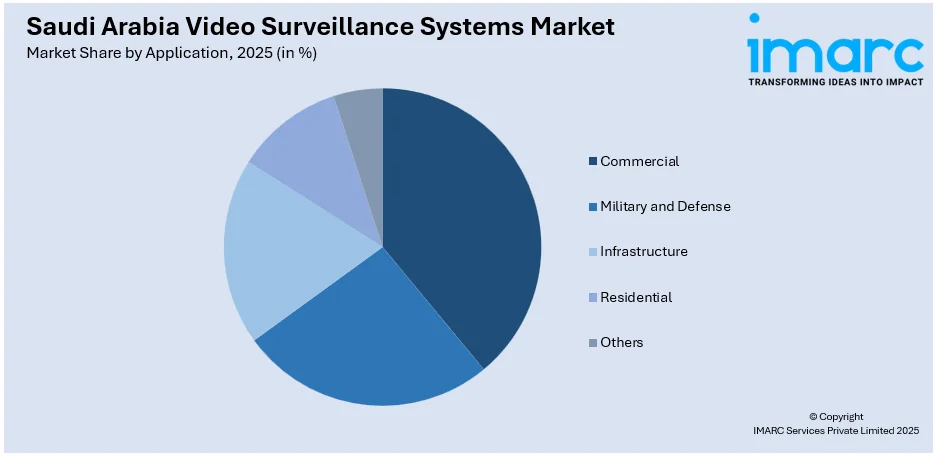

Application Insights:

Access the comprehensive market breakdown Request Sample

- Commercial

- Military and Defense

- Infrastructure

- Residential

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes commercial, military and defense, infrastructure, residential, and others.

Enterprise Size Insights:

- Small Scale Enterprise

- Medium Scale Enterprise

- Large Scale Enterprise

A detailed breakup and analysis of the market based on the enterprise size have also been provided in the report. This includes small scale enterprise, medium scale enterprise, and large scale enterprise.

Customer Type Insights:

- B2B

- B2C

The report has provided a detailed breakup and analysis of the market based on the customer type. This includes B2B and B2C.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Video Surveillance Systems Market News:

- March 25, 2025: Teledyne FLIR secured a USD 7.8 Million contract to deliver to Saudi Arabia its cutting-edge Lightweight Vehicle Surveillance System (LVSS), optimized for long-range thermal surveillance. These systems will enhance border security, help to secure critical infrastructure and include mission equipment and training as needed. This agreement reinforces Saudi Arabia's commitment to future-proofing its national security with state-of-the-art video surveillance technology.

- September 18, 2024: Eagle Eye Networks opened a new data center purposely equipped to meet the expected demand for AI-enhanced cloud video surveillance solutions in Riyadh, Saudi Arabia. Designed to align with local cybersecurity and data privacy regulations, this facility will enable scalable and secure video surveillance services for businesses across the Kingdom. This effort is part of Saudi Arabia's ongoing digitization drive, which supports national security and enhances business activities.

Saudi Arabia Video Surveillance Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| System Types Covered | Analog Surveillance, IP Surveillance, Hybrid Surveillance |

| Components Covered | Hardware, Software, Services |

| Applications Covered | Commercial, Military and Defense, Infrastructure, Residential, Others |

| Enterprise Sizes Covered | Small Scale Enterprise, Medium Scale Enterprise, Large Scale Enterprise |

| Customer Types Covered | B2B, B2C |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia video surveillance systems market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia video surveillance systems market on the basis of system type?

- What is the breakup of the Saudi Arabia video surveillance systems market on the basis of component?

- What is the breakup of the Saudi Arabia video surveillance systems market on the basis of application?

- What is the breakup of the Saudi Arabia video surveillance systems market on the basis of enterprise size?

- What is the breakup of the Saudi Arabia video surveillance systems market on the basis of customer type?

- What is the breakup of the Saudi Arabia video surveillance systems market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia video surveillance systems market?

- What are the key driving factors and challenges in the Saudi Arabia video surveillance systems?

- What is the structure of the Saudi Arabia video surveillance systems market and who are the key players?

- What is the degree of competition in the Saudi Arabia video surveillance systems market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia video surveillance systems market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia video surveillance systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia video surveillance systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)