Saudi Arabia Vision Care Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2026-2034

Saudi Arabia Vision Care Market Overview:

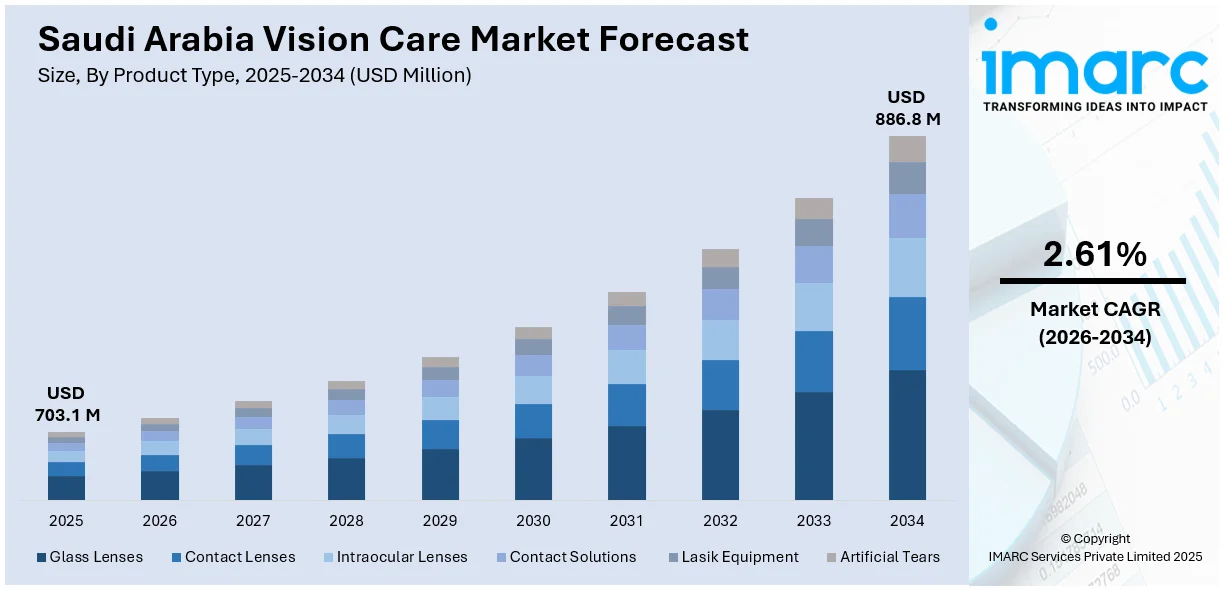

The Saudi Arabia vision care market size reached USD 703.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 886.8 Million by 2034, exhibiting a growth rate (CAGR) of 2.61% during 2026-2034. The market share is expanding, driven by the growing prevalence of vision-related disorders like myopia, hyperopia, astigmatism, and presbyopia, introduction of a range of healthcare programs under Vision 2030 goals, and rising awareness about the necessity of regular eye checks and preventive care.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 703.1 Million |

| Market Forecast in 2034 | USD 886.8 Million |

| Market Growth Rate 2026-2034 | 2.61% |

Saudi Arabia Vision Care Market Trends:

Increasing Prevalence of Vision Disorders

The growing prevalence of vision-related disorders like myopia, hyperopia, astigmatism, and presbyopia is driving the demand for effective vision care services. Changes in lifestyle, particularly among young people, have led to a significant increase in visual impairments. More screen time due to the use of digital devices, combined with a lack of outdoor activities, is fueling early-onset myopia, especially in urban areas. In addition, Saudi Arabia's aging population is adding to an epidemic of age-related eye diseases like cataracts and macular degeneration. According to UNFPA, Saudi Arabia is undergoing a demographic transition since the number of individuals aged 60+ is projected to rise five times between 2020 – 2050, from 2 million (5.9% of the total) to 10.5 million (23.7%). This is further going to drive the need for proper vision care services among the masses.

To get more information on this market Request Sample

Expansion of Healthcare Infrastructure and Government Initiatives

The government of Saudi Arabia is introducing a range of healthcare programs under its Vision 2030 goals, focused on diversifying the economy and improving the level of public health services. This is resulting in high investment in upgrading healthcare facilities, including the ophthalmic sector. Public-private partnerships are being promoted to increase specialized vision care services' accessibility, especially in remote areas. Government-sponsored initiatives are aimed at enhancing preventive care and early diagnosis, thereby directly impacting the vision care segment. New regulation and financing for medical startups are further supporting innovation in optometry technology and eye disease diagnostics. According to an article published by U.S. Chamber of Commerce in 2024, Under Vision 2030, the Saudi government is going to spend more than $65 billion on healthcare and raise private sector contribution from 40% to 65%. Additionally, the Ministry of Health anticipates over 100 new public-private partnerships in the healthcare sector with private sector investment of $12.8 billion during the next five years (2022-2027).

Rising Awareness and Adoption of Preventive Eye Care

The education regarding the necessity of regular eye checks and preventive care is increasing in Saudi Arabia due to health education campaigns and greater availability of vision care services. This trend is converting the market from reactive to proactive care, as people approach their eye correction and maintenance needs before complications develop. Optometrists and ophthalmologists are taking on a crucial role in educating patients regarding eye health, while retail chains and online platforms are providing convenient access to vision testing and prescription services. The youth population, more specifically students and young professionals, is becoming increasingly aware about eye strain and long-term visual health as a result of their dependency on digital devices. This is driving the demand for anti-fatigue lenses, blue light blocking glasses, and customized prescription eyewear. This is also encouraging companies to invest in providing eyecare services. In 2025, Alcon, the world leader in eye care committed to making people see brilliantly, is pleased to announce the launch of the Alcon Experience Center (AEC) in Jeddah, a milestone in the company's efforts to drive ophthalmic education and surgical innovation in the region. The first AEC in the Middle East & Africa, this launch reaffirms Alcon's commitment to driving eye care, upskilling regional professionals, and incorporating state-of-the-art surgical technology in line with Saudi Vision 2030.

Saudi Arabia Vision Care Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Glass Lenses

- Contact Lenses

- Intraocular Lenses

- Contact Solutions

- Lasik Equipment

- Artificial Tears

The report has provided a detailed breakup and analysis of the market based on the product type. This includes glass lenses, contact lenses, intraocular lenses, contact solutions, Lasik equipment, and artificial tears.

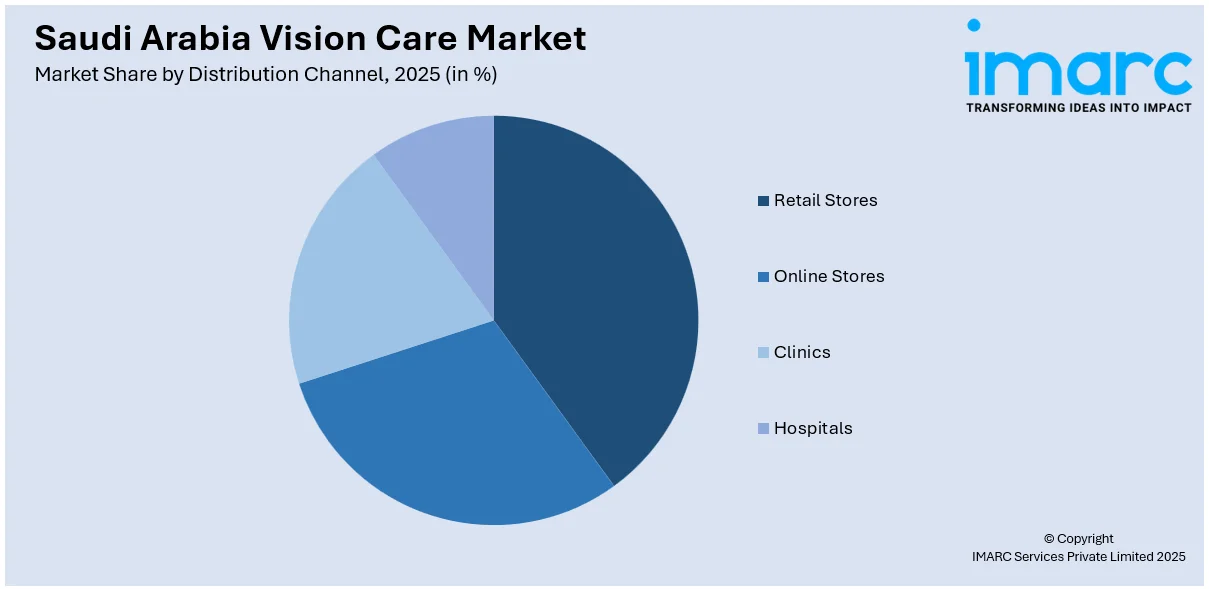

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Retail Stores

- Online Stores

- Clinics

- Hospitals

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes retail stores, online stores, clinics, and hospitals.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include northern and central region, western region, eastern region, and southern region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Vision Care Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Glass Lenses, Contact Lenses, Intraocular Lenses, Contact Solutions, Lasik Equipment, Artificial Tears |

| Distribution Channels Covered | Retail Stores, Online Stores, Clinics, Hospitals |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia vision care market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia vision care market on the basis of product type?

- What is the breakup of the Saudi Arabia vision care market on the basis of distribution channel?

- What is the breakup of the Saudi Arabia vision care market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia vision care market?

- What are the key driving factors and challenges in the Saudi Arabia vision care?

- What is the structure of the Saudi Arabia vision care market and who are the key players?

- What is the degree of competition in the Saudi Arabia vision care market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia vision care market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia vision care market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia vision care industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)