Saudi Arabia Warehouse Management Systems Market Size, Share, Trends and Forecast by Component, Deployment, Function, Application, and Region, 2026-2034

Saudi Arabia Warehouse Management Systems Market Overview:

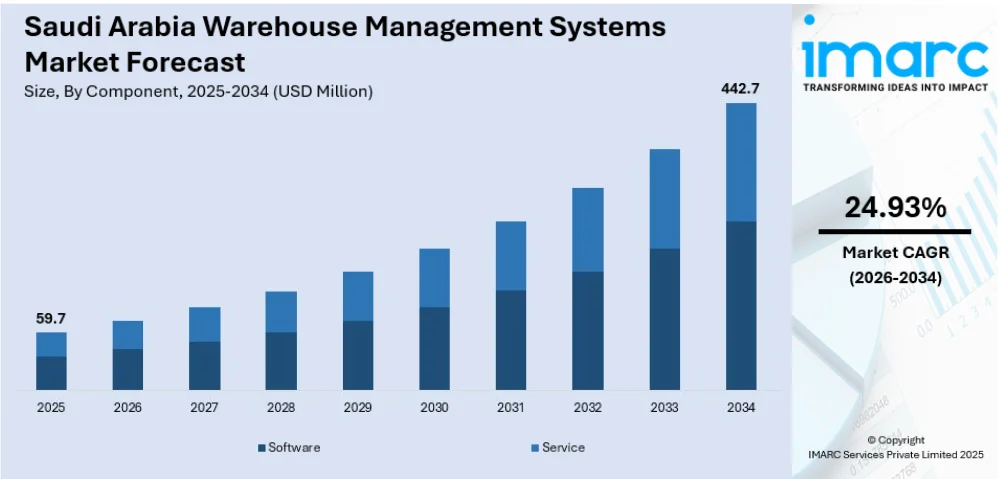

The Saudi Arabia warehouse management systems market size reached USD 59.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 442.7 Million by 2034, exhibiting a growth rate (CAGR) of 24.93% during 2026-2034. At present, with online shoppers expecting same-day or next-day delivery, warehouse management systems are being employed to enhance efficiency by optimizing workflows and lowering delays. Besides this, the growing reliance on third-party logistics (3PL) providers that offer customized services is contributing to the expansion of the Saudi Arabia warehouse management systems market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 59.7 Million |

| Market Forecast in 2034 | USD 442.7 Million |

| Market Growth Rate 2026-2034 | 24.93% |

Saudi Arabia Warehouse Management Systems Market Trends:

Expansion of e-commerce sites

The expansion of e-commerce portals is positively influencing the market. As more people are turning to online shopping, warehouses need to process a growing number of small individual orders with quick delivery expectations. Warehouse management systems help manage this shift by improving order accuracy, speeding up picking and packing processes, and tracking inventory in real time. The system allows warehouses to respond quickly to high order volumes and seasonal demand changes, which are common in the e-commerce sector. It also aids in managing multiple sales channels by integrating data from websites, apps, and marketplaces into a single platform. With online shoppers expecting same-day or next-day delivery, warehouse management systems refine efficiency by optimizing workflows and minimizing delays. In Saudi Arabia, where logistics networks are developing rapidly to support digital growth, this technology is supporting both local and cross-border e-commerce activities. According to the information provided on the official website of the International Trade Administration, by 2024, the total number of Saudi internet users engaging in e-commerce activities is projected to hit 33.6 Million, marking a 42% rise since 2019. Warehouse management systems also simplify the handling of returns, which are frequent in online retail. By using these solutions, businesses can scale up their operations, meet customer expectations, and stay competitive in the thriving e-commerce market. Consequently, warehouse management systems are becoming a key tool for success in the evolving retail landscape of Saudi Arabia.

To get more information on this market Request Sample

Increasing reliance on 3PL providers

The rising dependence on 3PL providers is impelling the Saudi Arabia warehouse management systems market growth. As more companies are outsourcing their logistics to third-party providers, warehouses must handle goods from multiple clients with different needs and expectations. Warehouse management systems help manage this complexity by organizing inventory, tracking shipments, and ensuring accurate order fulfillment for each client. The system allows 3PL providers to offer customized services while maintaining efficiency and reducing errors. Real-time data sharing improves communication between the warehouse and clients, helping them stay informed about stock levels and delivery status. With more 3PL providers entering the market, competition is growing, encouraging each provider to provide faster and more reliable services. Warehouse management systems support this by automating key processes and improving turnaround times. The system also handles billing, reporting, and performance tracking, which are important for client satisfaction. In Saudi Arabia, where trade and logistics are expanding rapidly, the role of 3PL providers is becoming significant, and warehouse management systems assist them in scaling their services, staying organized, and meeting the increasing demand for high-quality logistics solutions. As per the IMARC Group, the Saudi Arabia 3PL market size reached USD 13.6 Billion in 2024.

Saudi Arabia Warehouse Management Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on component, deployment, function, and application.

Component Insights:

- Software

- Service

The report has provided a detailed breakup and analysis of the market based on the component. This includes software and service.

Deployment Insights:

- On-premise

- Cloud

A detailed breakup and analysis of the market based on the deployment have also been provided in the report. This includes on-premise and cloud.

Function Insights:

- Labor Management System

- Analytics and Optimization

- Billing and Yard Management

- Systems Integration and Maintenance

- Consulting Services

The report has provided a detailed breakup and analysis of the market based on the function. This includes labor management system, analytics and optimization, billing and yard management, systems integration and maintenance, and consulting services.

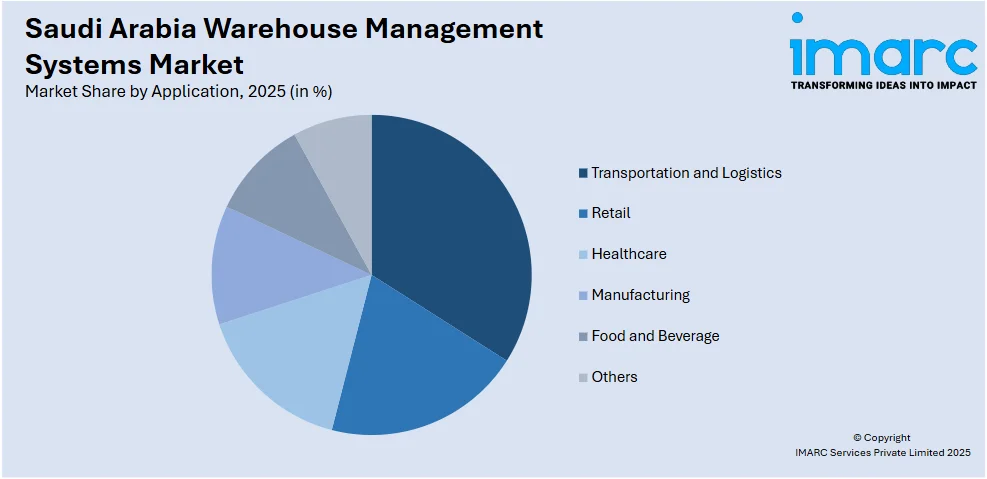

Application Insights:

Access the comprehensive market breakdown Request Sample

- Transportation and Logistics

- Retail

- Healthcare

- Manufacturing

- Food and Beverage

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes transportation and logistics, retail, healthcare, manufacturing, food and beverage, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Warehouse Management Systems Market News:

- In May 2024, Shipsy, the prominent supply chain orchestration and execution solution provider, announced the entry of its warehouse management system in the GCC area and the Kingdom of Saudi Arabia. Adding a WMS to its core services would allow companies in the region to benefit from a fully integrated fulfillment and logistics platform. Businesses could achieve extensive logistics optimization, supply chain management, and effortless fulfillment to guarantee cost-effective, compliant, agile, and customer-focused supply chain activities.

- In May 2024, SAL, the foremost logistics and supply chain solutions provider in Saudi Arabia, unveiled its Fulfillment Business Unit, which offered a comprehensive solution designed to transform the logistics and supply chain sector in the Kingdom. SAL's Fulfilment centers featured a sophisticated warehouse management system, which highlighted its digital strategy, giving customers real-time access to operational data and metrics. This online platform allowed users to make orders, monitor their status, and create personalized reports, improving operational clarity and productivity.

Saudi Arabia Warehouse Management Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Software, Service |

| Deployments Covered | On-premise, Cloud |

| Functions Covered | Labor Management System, Analytics and Optimization, Billing and Yard Management, Systems Integration and Maintenance, Consulting Services |

| Applications Covered | Transportation and Logistics, Retail, Healthcare, Manufacturing, Food and Beverage, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia warehouse management systems market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia warehouse management systems market on the basis of component?

- What is the breakup of the Saudi Arabia warehouse management systems market on the basis of deployment?

- What is the breakup of the Saudi Arabia warehouse management systems market on the basis of function?

- What is the breakup of the Saudi Arabia warehouse management systems market on the basis of application?

- What is the breakup of the Saudi Arabia warehouse management systems market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia warehouse management systems market?

- What are the key driving factors and challenges in the Saudi Arabia warehouse management systems market?

- What is the structure of the Saudi Arabia warehouse management systems market and who are the key players?

- What is the degree of competition in the Saudi Arabia warehouse management systems market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia warehouse management systems market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia warehouse management systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia warehouse management systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)