Saudi Arabia Waste Plastic Recycling Market Size, Share, Trends and Forecast by Treatment, Material, Application, Recycling Process, and Region, 2026-2034

Saudi Arabia Waste Plastic Recycling Market Summary:

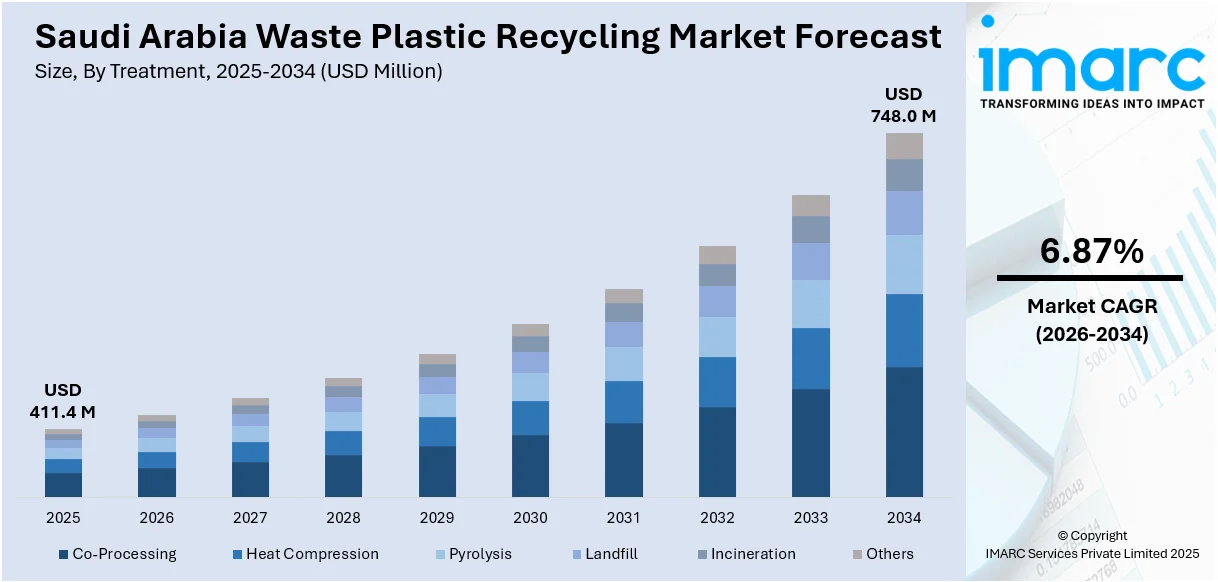

The Saudi Arabia waste plastic recycling market size was valued at USD 411.4 Million in 2025 and is projected to reach USD 748.0 Million by 2034, growing at a compound annual growth rate of 6.87% from 2026-2034.

As the Kingdom steps up its efforts to move toward a circular economy in line with Vision 2030 environmental goals, the waste plastic recycling sector in Saudi Arabia is growing rapidly. Demand for recycled polymers is rising across a number of industries as consumers and companies become more environmentally concerned. Waste management methods are changing as a result of supportive legal frameworks, such as recycling requirements and extended producer responsibility laws. Market growth is being accelerated by the government's large investments in cutting-edge recycling infrastructure and smart public-private partnerships. The market share for waste plastic recycling in Saudi Arabia is influenced by the substantial volumes of plastic waste produced by growing industrial production and packaging demand.

Key Takeaways and Insights:

- By Treatment: Pyrolysis dominates the market with a share of 32% in 2025, owing to its capability to process mixed and contaminated plastic waste streams that cannot be handled through conventional mechanical methods. Advanced thermal decomposition technologies enable conversion of low-grade polyolefins into valuable pyrolysis oil and chemical feedstocks.

- By Material: Polyethylene terephthalate (PET) leads the market with a share of 25% in 2025, reflecting the widespread consumption of PET bottles and food containers across the Kingdom. High recyclability rates, established collection networks, and strong demand from packaging manufacturers support segment dominance.

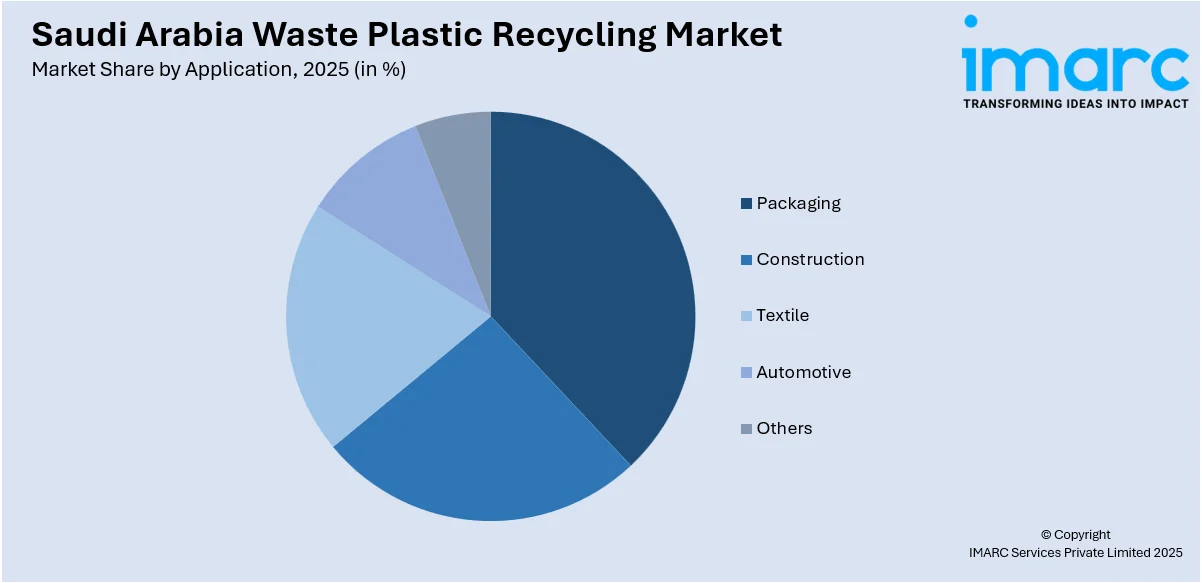

- By Application: Packaging represents the largest segment with a market share of 40% in 2025, driven by rapid growth in e-commerce, food and beverage industries, and consumer goods sectors requiring sustainable packaging solutions that align with corporate environmental commitments.

- By Recycling Process: Mechanical exhibits a clear dominance in the market with 78% share in 2025, supported by established infrastructure, lower operational costs, and proven technologies for processing clean, sorted plastic streams into high-quality recycled pellets.

- By Region: Northern and Central Region comprises the largest region with 30% share in 2025, driven by Riyadh's concentration of industrial activities, substantial population density, advanced waste management infrastructure, and proximity to major manufacturing clusters.

- Key Players: Leading companies are advancing the Saudi Arabia waste plastic recycling market through strategic investments in advanced recycling facilities, expanding collection networks across major cities, developing innovative pyrolysis technologies, and forging partnerships to strengthen circular economy initiatives.

To get more information on this market Request Sample

The Saudi Arabia waste plastic recycling market is witnessing transformative growth fueled by the Kingdom's comprehensive sustainability framework and circular economy ambitions. Vision 2030's environmental pillars have catalyzed unprecedented public and private sector investments in recycling infrastructure development. The government's allocation of significant financial resources toward establishing advanced material recovery facilities and chemical recycling plants demonstrates strong institutional commitment to reducing landfill dependency. Municipal waste collection systems are being modernized to incorporate plastic separation at source, enhancing feedstock quality for recyclers. In July 2024, a major plastic waste management project was launched through a joint venture between MVW Lechtenberg and Partner Middle East, Empower, and SIRC, designed to process approximately 3 Million Tons of municipal solid waste annually. Industrial sectors are increasingly adopting recycled polymers to meet environmental regulations and corporate sustainability targets. Technological innovations, including artificial intelligence-powered sorting systems and advanced depolymerization techniques, are improving processing efficiency while expanding the range of recyclable materials. These converging factors are establishing Saudi Arabia as an emerging regional leader in sustainable waste plastic recycling market growth.

Saudi Arabia Waste Plastic Recycling Market Trends:

Expansion of Domestic Reprocessing Capacity

Saudi Arabia is witnessing significant expansion of domestic plastic reprocessing capacity as new recycling facilities are being established in key industrial zones across Riyadh, Jeddah, and the Eastern Province. These facilities focus primarily on processing polyethylene terephthalate, high-density polyethylene, and polypropylene streams. The Saudi Investment Recycling Company is spearheading infrastructure development across more than 65 cities, with projected processing capacity reaching 35 Million Tons per annum by 2035, substantially enhancing the Kingdom's waste management capabilities.

Advancement of Chemical Recycling Technologies

As petrochemical corporations invest in sophisticated pyrolysis and depolymerization systems, chemical recycling technologies are becoming increasingly popular in Saudi Arabia. These technologies make it possible to manage contaminated and mixed plastic waste streams that traditional mechanical methods are unable to handle. Even for plastics that were previously headed for landfills, genuine circularity is made possible by sophisticated thermal breakdown technologies that break down complex polymers into their base monomers or oil-like feedstocks. The Kingdom is now a regional leader in high-value polymer upcycling thanks to the development of certified circular polymers appropriate for food-contact applications, which shows increasing technological competence.

Integration of Digital Waste Management Solutions

As businesses use blockchain-based traceability platforms and artificial intelligence-powered sorting systems, digital technologies are transforming the management of plastic waste throughout Saudi Arabia. Machine learning-based advanced optical sorting systems significantly increase recycled output's purity levels, improving material quality for use in subsequent processes. These technology advancements enable more effective garbage collection, better sorting accuracy, and increased transparency throughout the recycling value chain, all of which are in line with Vision 2030's focus on smart city growth and digital transformation.

How Vision 2030 is Transforming the Saudi Arabia Waste Plastic Recycling Market:

Vision 2030, which establishes comprehensive frameworks that prioritize environmental sustainability and circular economy concepts, is the cornerstone of Saudi Arabia's revolution in waste plastic recycling. The creation of specialized regulatory organizations, such as the National Center for Waste Management, which is in charge of infrastructure planning and policy development, has been accelerated by the national strategy. The Kingdom has set aggressive goals for trash recycling rates and landfill diversion as part of this agenda, encouraging the public and private sectors to make investments in cutting-edge recycling technologies. A division of the Public Investment Fund, the Saudi Investment Recycling Company oversees strategic projects involving hazardous, industrial, and municipal waste streams. Government-backed incentives and partnerships with international technology providers are accelerating the adoption of innovative recycling methods, creating employment opportunities, and positioning Saudi Arabia as a regional hub for sustainable resource management.

Market Outlook 2026-2034:

The Saudi Arabia waste plastic recycling market outlook remains highly favorable as the Kingdom accelerates its transition toward a sustainable circular economy. Continued government investments in recycling infrastructure, combined with strengthening regulatory frameworks mandating higher recycling rates, will drive substantial market expansion throughout the forecast period. The market generated a revenue of USD 411.4 Million in 2025 and is projected to reach a revenue of USD 748.0 Million by 2034, growing at a compound annual growth rate of 6.87% from 2026-2034. Rising industrial demand for recycled polymers across packaging, construction, and automotive sectors will sustain growth momentum. Technological advancements in chemical recycling and advanced sorting systems will expand the range of recyclable materials, while public-private partnerships will strengthen collection networks and processing capabilities across major urban centers.

Saudi Arabia Waste Plastic Recycling Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Treatment |

Pyrolysis |

32% |

|

Material |

Polyethylene Terephthalate (PET) |

25% |

|

Application |

Packaging |

40% |

|

Recycling Process |

Mechanical |

78% |

|

Region |

Northern and Central Region |

30% |

Treatment Insights:

- Co-Processing

- Heat Compression

- Pyrolysis

- Landfill

- Incineration

- Others

Pyrolysis dominates with a market share of 32% of the total Saudi Arabia waste plastic recycling market in 2025.

Pyrolysis breaks down polymeric polymers into valuable pyrolysis oil, syngas, and char that are used as feedstocks for the synthesis of new polymers at high temperatures in oxygen-free settings. The technology's supremacy in the industry is fueled by its capacity to treat mixed, contaminated, and multilayer polymers that are not suitable for mechanical recycling. By recovering elements from complicated waste streams that were previously headed for landfills or incineration, advanced thermal decomposition techniques greatly increase the variety of recyclable feedstocks available to the industry. Pyrolysis is positioned as a crucial facilitator of Saudi Arabia's circular economy aspirations under Vision 2030 sustainability frameworks due to the increased emphasis on chemical recycling technology.

In order to diversify revenue streams and address environmental concerns, major petrochemical corporations are making significant investments in pyrolysis infrastructure throughout key industrial zones. This process turns low-grade polyolefins into fuel-grade oil and chemical feedstocks. By utilizing current hydrocarbon processing expertise, these projects demonstrate a strategic synergy between waste management goals and petrochemical sector capabilities. The technique shows economic viability and promotes the development of the circular economy across the Kingdom by enabling the production of high-grade polymers appropriate for demanding applications, such as food-contact packaging.

Material Insights:

- Poly Vinyl Chloride (PVC)

- Low-Density Polyethylene (LDPE)

- High-Density Polyethylene (HDPE)

- Polyethylene Terephthalate (PET)

- Polypropylene (PP)

- Acrylonitrile Butadiene Styrene (ABS)

- Others

Polyethylene Terephthalate (PET) leads with a share of 25% of the total Saudi Arabia waste plastic recycling market in 2025.

Polyethylene terephthalate holds a commanding market share on account of the widespread use of PET bottles and food containers throughout the Kingdom. The material's inherent properties, including cost-effectiveness, lightweight characteristics, high strength, excellent electrical insulating capabilities, and regulatory approval for food contact applications, make it the preferred choice for beverage and packaging manufacturers. According to industry estimates, approximately ninety-seven percent of bottled water containers utilize plastic, with nearly eighty percent comprising PET, demonstrating the material's ubiquity.

The established collection networks and well-developed recycling infrastructure for PET materials support the segment's leading position. Recycled PET finds strong demand across textile fiber production, packaging applications, and automotive components, creating robust end markets for processed materials. Saudi Arabia's government initiatives promoting sustainable packaging solutions have accelerated PET recycling investments, with major facilities in Riyadh, Jeddah, and Dammam focusing specifically on PET stream processing. The Saudi PET packaging market continues expanding, generating substantial feedstock volumes that support the recycling industry's growth trajectory.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Packaging

- Construction

- Textile

- Automotive

- Others

Packaging is the largest segment with 40% share of the total Saudi Arabia waste plastic recycling market in 2025.

The packaging application dominates the market, reflecting the rapidly expanding consumer goods, food and beverage, pharmaceutical, and e-commerce sectors across Saudi Arabia. Growing urbanization and changing lifestyle patterns have accelerated demand for packaged products, generating substantial volumes of recyclable plastic waste that support recycling industry growth. Rising middle-class populations with increasing disposable incomes drive consumption of packaged goods, while expanding retail networks and online shopping platforms amplify packaging material usage throughout the Kingdom. The convenience-oriented consumer culture further strengthens demand for single-serve and portable packaging formats that utilize recyclable plastic materials.

The Kingdom's strategic positioning as a regional trade and manufacturing hub continues driving packaging industry expansion, creating strong downstream demand for recycled plastics across diverse applications. Corporate sustainability initiatives and evolving environmental regulations are compelling packaging manufacturers to adopt recycled materials in their product portfolios, fostering market development. Major food and beverage companies are increasingly incorporating recycled content into their packaging solutions to meet sustainability commitments and consumer preferences for environmentally responsible products. This industry transition toward sustainable packaging solutions demonstrates practical applications of recycled polymers while maintaining stringent product quality and safety standards required for consumer goods applications.

Recycling Process Insights:

- Mechanical

- Others

Mechanical represents the leading segment with 78% share of the total Saudi Arabia waste plastic recycling market in 2025.

Mechanical recycling maintains a dominant market position, supported by established infrastructure, proven technologies, and favorable economics for processing clean, sorted plastic streams. The process involves collecting, sorting, washing, shredding, and reprocessing plastic waste into pellets or flakes suitable for manufacturing new products. Material recovery facilities across major Saudi cities employ advanced optical sorting systems and automated washing equipment to produce high-quality recyclates meeting industrial specifications. SIRC operates modern sorting and mechanical recovery plants throughout the Kingdom, supporting national targets.

The cost-effectiveness and energy efficiency of mechanical recycling compared to chemical alternatives sustain its market leadership position. Processed recycled polymers find applications across packaging, construction, textiles, and automotive components, demonstrating versatility across industrial sectors. Automotive component suppliers are actively testing recycled high-density polyethylene and polypropylene in interior trims, achieving performance parity with virgin resins at considerable blend ratios. The integration of artificial intelligence-powered recognition systems enables real-time identification of polymer types, colors, and contamination levels, enhancing mechanical recycling efficiency.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and Central Region holds the largest share with 30% of the total Saudi Arabia waste plastic recycling market in 2025.

The highest market share is held by the Northern and Central Region, which is led by Riyadh. This is due to the capital city's high population density and wide-ranging industrial activity. Riyadh, the administrative and economic hub of Saudi Arabia, produces large amounts of plastic trash from commercial, industrial, and household sources, which increases the amount of feedstock available for recycling operations. The area gains from the development of cutting-edge waste management infrastructure and its advantageous location near important manufacturing hubs that require recycled polymers for consumer goods, construction, and packaging.

Government investment prioritizes this region for state-of-the-art recycling facility development, featuring modern sorting technologies and processing capabilities aligned with circular economy objectives. The concentration of petrochemical companies, packaging manufacturers, and consumer goods producers creates robust demand channels for recycled materials within short transportation distances. Public-private partnerships strengthen waste collection networks while enhancing processing capacities across the region's industrial zones. Strategic waste management initiatives targeting ambitious landfill diversion goals exemplify the region's leadership in sustainable practices, establishing operational models intended for nationwide implementation throughout the Kingdom.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Waste Plastic Recycling Market Growing?

Rising Industrial Demand for Recycled Polymers Across Manufacturing Sectors

The Saudi Arabia waste plastic recycling market is experiencing substantial growth driven by escalating demand for recycled polymers across diverse manufacturing sectors including construction, automotive, textiles, and consumer goods. Industrial manufacturers are increasingly integrating recycled plastics into their production processes to meet corporate sustainability commitments, reduce raw material costs, and respond to evolving customer preferences for environmentally responsible products. The construction sector utilizes recycled polymers in pipes, insulation materials, and building components, while automotive manufacturers incorporate recycled plastics in interior trims and non-structural components. Textile producers are expanding use of recycled polyethylene terephthalate fibers in fabric production, creating additional demand channels for processed plastic waste. This industrial adoption reflects broader recognition that recycled materials can deliver performance characteristics comparable to virgin polymers across numerous applications. Growing procurement requirements from multinational corporations operating in the Kingdom further strengthen demand, as global sustainability standards influence local supply chain practices. The convergence of cost efficiency benefits with environmental responsibility objectives positions recycled polymers as increasingly attractive alternatives throughout Saudi Arabia's expanding industrial base.

Rising Environmental Awareness and Industrial Demand

Growing environmental consciousness among Saudi consumers and businesses is accelerating demand for recycled polymers across multiple industrial sectors. Public awareness campaigns and educational initiatives are encouraging proper waste segregation practices, improving feedstock quality for recycling operations. Corporate sustainability commitments are driving major manufacturers to incorporate recycled content into their products, creating robust end markets for processed materials. The packaging, construction, textile, and automotive industries are increasingly adopting recycled plastics to meet environmental regulations, reduce carbon footprints, and align with global sustainability trends. Industrial symbiosis concepts are gaining traction, with waste from one business becoming raw material for another. Media coverage highlighting plastic pollution concerns has motivated behavioral changes, while businesses respond to consumer preferences for eco-friendly products. These shifting attitudes create strong market pull for recycled materials.

Technological Advancements in Recycling Methods

Technological innovations are revolutionizing plastic recycling efficiency and expanding the range of recyclable materials in Saudi Arabia. Advanced sorting systems utilizing artificial intelligence and machine learning enhance accuracy in separating different polymer types, ensuring higher quality recycled streams. Chemical recycling technologies including pyrolysis and depolymerization enable processing of contaminated and mixed plastics previously destined for landfills. Digital technologies including blockchain-based traceability platforms add transparency throughout the recycling value chain, building stakeholder trust. Automated recycling machinery and high-throughput material recovery facilities are increasing processing capacity while reducing operational costs. These technological breakthroughs position Saudi Arabia as a regional innovation hub for sustainable waste management solutions.

Market Restraints:

What Challenges the Saudi Arabia Waste Plastic Recycling Market is Facing?

Inefficient Waste Collection and Segregation Systems

The Saudi Arabia waste plastic recycling market faces significant challenges from inefficient waste collection systems and limited segregation at source. A substantial portion of plastic waste continues reaching landfills due to insufficient recycling practices at the household and commercial levels. Consumers often lack knowledge or motivation to separate plastic waste properly, making it difficult for recycling facilities to access clean, uncontaminated materials. This contamination increases operational costs and reduces the quality of recycled output, limiting applications for processed materials and affecting overall market economics.

Limited Public Recycling Infrastructure Accessibility

Public recycling infrastructure including drop-off points and collection bins remains insufficiently available across many regions of Saudi Arabia. Without convenient disposal options, consumers face barriers to participating in recycling programs, exacerbating collection challenges. The absence of strong financial incentives such as deposit return schemes limits engagement with recycling initiatives. Logistics fragmentation between waste generators and recyclers inflates costs and reduces supply consistency for processing facilities. Addressing these infrastructural gaps requires substantial investment in collection networks and public engagement programs throughout the Kingdom.

Competition from Lower-Cost Virgin Plastics

The abundant availability of economically attractive virgin plastics in Saudi Arabia poses significant challenges to recycling market economics. Virgin polymer production benefits from the Kingdom's petrochemical advantages and established infrastructure, often making new materials cheaper than recycled alternatives. This price disparity reduces private sector incentives to invest in advanced recycling systems without regulatory mandates or subsidies. Market dynamics require policy interventions to level the playing field and make recycled materials more competitive against virgin feedstocks across various industrial applications.

Competitive Landscape:

The Saudi Arabia waste plastic recycling market features an increasingly competitive landscape as domestic and international players expand their presence across the Kingdom. Companies are focusing on diversifying processing capabilities, investing in advanced recycling technologies, and establishing strategic partnerships to strengthen market positions. Competition is driven by investments in chemical recycling infrastructure, material recovery facilities, and innovative sorting technologies that improve recycled material quality. Strategic collaborations between petrochemical majors, waste management specialists, and government entities are fostering innovation and accelerating capacity expansion. Public-private partnerships enable knowledge transfer and technology deployment while creating employment opportunities. Market participants are continually refining strategies to meet ambitious national recycling targets and capitalize on the Kingdom's transition toward a circular economy.

Saudi Arabia Waste Plastic Recycling Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Treatments Covered | Co-Processing, Heat Compression, Pyrolysis, Landfill, Incineration, Others |

| Materials Covered | Poly-Vinyl Chloride (PVC), Low-Density Polyethylene (LDPE), High-Density Polyethylene (HDPE), Polyethylene Terephthalate (PET), Polypropylene (PP), Acrylonitrile Butadiene Styrene (ABS), Others |

| Applications Covered | Packaging, Construction, Textile, Automotive, Others |

| Recycling Processes Covered | Mechanical, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia waste plastic recycling market size was valued at USD 411.4 Million in 2025.

The Saudi Arabia waste plastic recycling market is expected to grow at a compound annual growth rate of 6.87% from 2026-2034 to reach USD 748.0 Million by 2034.

Pyrolysis dominated the market with a share of 32%, driven by its capability to process mixed and contaminated plastic waste streams through advanced thermal decomposition technologies that convert materials into valuable chemical feedstocks.

Key factors driving the Saudi Arabia waste plastic recycling market include Vision 2030 government sustainability initiatives, rising environmental awareness among consumers and industries, technological advancements in recycling methods, and increasing industrial demand for recycled polymers across packaging and manufacturing sectors.

Major challenges include inefficient waste collection and segregation systems, limited public recycling infrastructure accessibility, competition from lower-cost virgin plastics, insufficient consumer awareness about recycling practices, and logistics fragmentation between waste generators and recyclers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)