Saudi Arabia Waste to Energy Solutions Market Size, Share, Trends and Forecast by Technology, Waste Type, and Region, 2026-2034

Saudi Arabia Waste to Energy Solutions Market Overview:

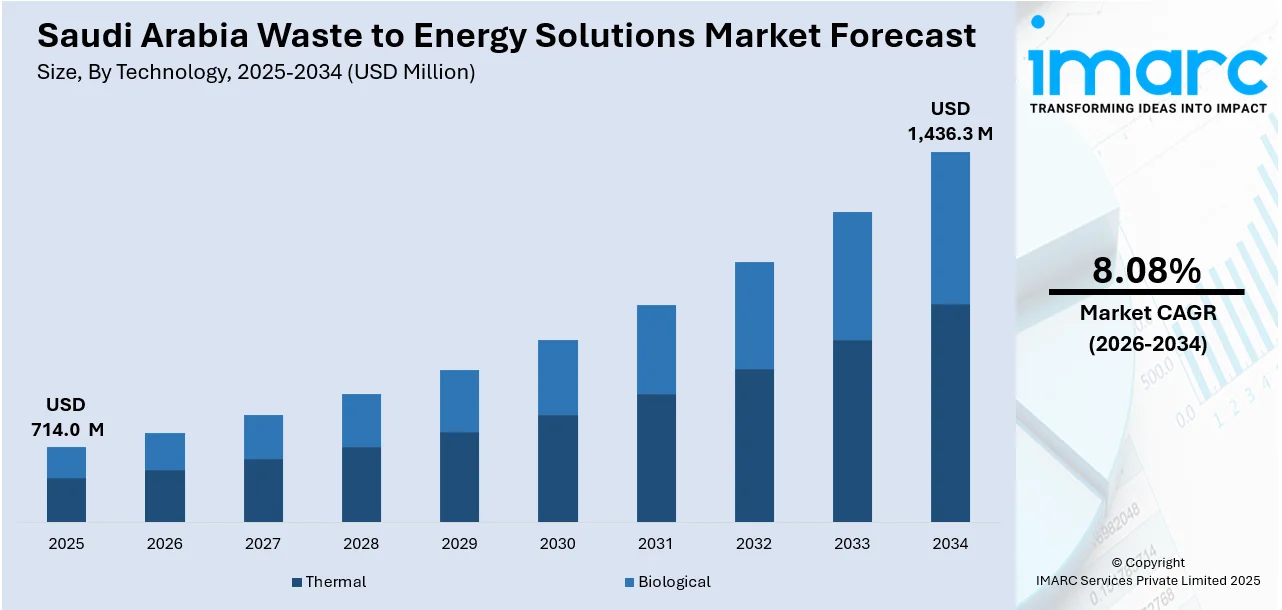

The Saudi Arabia waste to energy solutions market size reached USD 714.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,436.3 Million by 2034, exhibiting a growth rate (CAGR) of 8.08% during 2026-2034. At present, increasing debris generation is creating the need for efficient and sustainable waste management practices. Waste to energy solutions aid in converting large quantities of waste into practical types of energy, including electricity and heat, while minimizing landfill dependency. Besides this, the government is wagering on modern technologies and encouraging private sector participation through incentives and public-private partnerships, thereby contributing to the expansion of the Saudi Arabia waste to energy solutions market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 714.0 Million |

|

Market Forecast in 2034

|

USD 1,436.3 Million |

| Market Growth Rate 2026-2034 | 8.08% |

Saudi Arabia Waste to Energy Solutions Market Trends:

Government Support and Sustainability Policies

The dedicated of the governing body in Saudi Arabia to sustainability is leading to the implementation of various regulations and initiatives to reduce environmental effects. WTE strategies are an essential part of the kingdom’s Vision 2030, which seeks to minimize landfill waste, enhance renewable energy utilization, and attain environmental sustainability. Public policies proactively promote investment in green technologies by providing government-supported incentives and cultivating partnerships that enhance the growth of WTE projects. This dedication is also apparent in efforts like the ambitious 2024 strategy from the Ministry of Environment, Water and Agriculture, which aimed to recycle 95% of the nation's waste and process 100 million tons each year. The project sought to add SR120 billion ($31.99 billion) to the GDP and create more than 100,000 jobs, enhancing the Kingdom’s resource efficiency. This extensive plan, supported by over 65 initiatives and an investment of SR55 billion, is crucial for expediting the implementation of WTE technologies, fostering a vibrant market for WTE options, and aiding in Saudi Arabia's sustainability and economic diversification goals.

To get more information on this market Request Sample

Increasing Waste Generation and Energy Demand

The swift urban development and industrial expansion in Saudi Arabia are raising the amount of waste produced, putting pressure on conventional waste management systems. The increase in population, coupled with rising industrial operations and usage, is leading to a greater production of municipal and industrial waste. The rising waste generation, along with heightened worries about environmental sustainability, is catalyzing the demand for creative solutions such as WTE technologies to tackle the twin issues of waste management and energy production. Furthermore, there is an increase in the need for clean, renewable energy as Saudi Arabia aims to lessen its dependence on fossil fuels and broaden its energy options. WTE solutions present an effective answer to these issues by both offering an eco-friendly method of waste management and producing useful energy from it. With waste volume rising and the need for renewable energy escalating, WTE technologies emerge as a vital element in Saudi Arabia’s energy strategy, tackling environmental and energy security objectives at the same time.

Technological Advancements and Efficiency

Continuous progress in waste-to-energy innovations is greatly enhancing the efficiency and efficacy of energy recovery methods in Saudi Arabia. Advancements in waste management, including improved incineration, gasification, and anaerobic digestion methods, are resulting in better energy conversion efficiencies and minimized environmental effects. These technologies allow for a larger quantity of waste to be converted into usable energy with reduced emissions, thereby enhancing resource efficiency. With the advancement of these technologies, they are becoming more affordable, scalable, and flexible for different kinds of waste, enhancing their overall market opportunities. Additionally, the incorporation of automation and intelligent technologies into WTE activities is enhancing operational efficiency, lowered labor expenses, and increasing the accuracy of energy production methods. This advancement in technology draws investment from both public and private sectors, which in turn supports the market growth. The integration of cost savings and enhancements in operations makes WTE solutions more competitive within the renewable energy sector, securing their ongoing growth in Saudi Arabia's energy landscape.

Saudi Arabia Waste to Energy Solutions Market Growth Drivers:

Waste Segregation and Recycling Initiatives

Saudi Arabia is achieving significant advancements in improving its waste separation and recycling methods, which are crucial for the effectiveness of WTE systems. The Kingdom’s heightened emphasis on categorizing waste into types like organic, recyclable, and non-recyclable materials is improving the overall quality of waste streams, allowing for more efficient processing in WTE facilities. By making sure that waste is accurately sorted at the point of origin, the materials utilized in energy recovery become more consistent and manageable, enhancing the dependability of energy production from waste. This method enhances the effectiveness of WTE processes while simultaneously improving the overall recycling rate, leading to less waste in landfills. Public awareness initiatives and enabling government policies are also crucial in advancing waste separation in homes and businesses. These initiatives are in harmony with Saudi Arabia's wider sustainability objectives and offer a reliable, continuous source of appropriate materials for energy recovery, thereby expediting the expansion of the WTE market in the area.

International Collaboration and Knowledge Transfer

Saudi Arabia is progressively promoting global partnerships to improve its waste-to-energy (WTE) abilities, collaborating with international specialists, research organizations, and prominent firms to speed up the advancement and implementation of WTE technologies. These strategic alliances promote the exchange of cutting-edge technologies, optimal practices, and knowledge, strengthening the local market and improving the efficiency of WTE initiatives. Moreover, these partnerships aid in the growth of the local workforce by offering chances for skill improvement and job opportunities in the green energy industry. This rise of international knowledge and innovation is set to enhance Saudi Arabia’s role as a leader in the WTE market. A significant instance of this partnership took place in 2024 when Aramco, TotalEnergies, and the Saudi Investment Recycling Company (SIRC) established a Joint Development and Cost Sharing Agreement to investigate the development of a sustainable aviation fuel (SAF) production facility. This facility, designed to transform local waste into SAF, aligned with Saudi Arabia's Vision 2030 and the Green Initiative, enhancing the Kingdom’s shift toward a circular economy.

Energy Storage and Grid Integration Advancements

Advancements in energy storage and grid integration are greatly improving the attractiveness and effectiveness of WTE solutions in Saudi Arabia. With the growing incorporation of renewable energy sources like wind and solar into its energy portfolio, the demand for dependable and stable energy storage solutions becomes increasingly vital. WTE facilities can deliver a stable and manageable energy supply, enhancing the variable characteristics of renewable energy production. Enhanced grid integration solutions further refine the handling and distribution of energy from WTE facilities, boosting the overall effectiveness of the Kingdom’s renewable energy systems. The collaboration between WTE and renewable energy sources enhances the variety of Saudi Arabia's energy portfolio while increasing the prospects for a sustainable energy future. In 2024, the renewable energy sector in Saudi Arabia was valued at 2.09 gigawatts, as reported by the IMARC Group, highlighting the increasing significance of renewable energy in the Kingdom.

Saudi Arabia Waste to Energy Solutions Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on technology and waste type.

Technology Insights:

- Thermal

- Biological

The report has provided a detailed breakup and analysis of the market based on the technology. This includes thermal and biological.

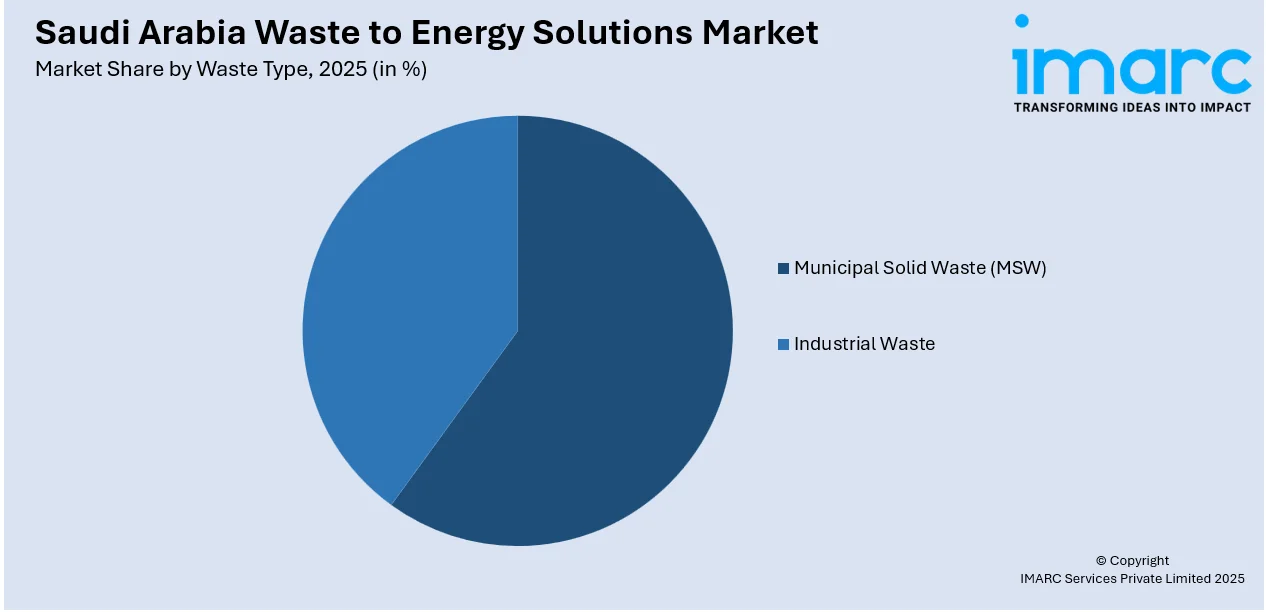

Waste Type Insights:

Access the comprehensive market breakdown Request Sample

- Municipal Solid Waste (MSW)

- Industrial Waste

A detailed breakup and analysis of the market based on the waste type have also been provided in the report. This includes municipal solid waste (MSW) and industrial waste.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Waste to Energy Solutions Market News:

- In September 2025: Veolia announced a joint venture with the Royal Commission for Jubail and Yanbu to develop a sustainable hazardous waste-to-energy facility in Jubail 2, with an incineration capacity of 121,000 tons per year. Additionally, Veolia, alongside Marafiq and Lamar, signed a $500 million agreement with SATORP for a major water recycling plant in Jubail, set to begin operations in 2028. Both projects aim to enhance industrial waste treatment and support Saudi Arabia's environmental goals.

- In October 2024: Saudi Arabia announced plans to build a plant in the Eastern region that will convert waste into green hydrogen and biofuels. The facility utilized methane gas emitted from landfills and was a part of the Kingdom's Vision 2030 economic diversification efforts. The investment contract for the project was signed by the Emir of the Eastern region, Prince Saud bin Abdul Aziz.

- In July 2024: MVW Lechtenberg & Empower, in collaboration with Saudi Investment Recycling (SIRC), launched a major plastic waste management project in Saudi Arabia. The initiative aimed to process 3 million tons of municipal waste annually, converting 35% into sustainable fuels and recycling 14%.

- In December 2024, SUEZ and the Saudi Investment Recycling Company (SIRC) revealed a ‘Strategic Partnership Framework’ to expedite the execution of joint projects aimed at enhancing circularity in Saudi Arabia. This collaboration strengthened SUEZ's enduring dedication to the SIRC and sought to enhance essential waste-to-energy infrastructures while providing high-quality waste treatment solutions for municipal, medical, and hazardous wastes in the Kingdom.

- In September 2024, the UNDP Saudi Arabia Country Office and Balad Alkhieer Endowment Foundation organized a significant event in recognition of the International Day of Awareness of Food Loss and Waste in Saudi Arabia. An especially motivational case study emerged from Jubail, where an innovative company was the first to create biofuel from waste and used cooking oils, emphasizing the possibilities of waste-to-energy initiatives for the environment and the economy.

Saudi Arabia Waste to Energy Solutions Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Thermal, Biological |

| Waste Types Covered | Municipal Solid Waste (MSW), Industrial Waste |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia waste to energy solutions market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia waste to energy solutions market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia waste to energy solutions industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The waste to energy solutions market in Saudi Arabia was valued at USD 714.0 Million in 2025.

The Saudi Arabia waste to energy solutions market is projected to exhibit a CAGR of 8.08% during 2026-2034, reaching a value of USD 1,436.3 Million by 2034.

The Saudi Arabia waste-to-energy solutions market is driven by increasing environmental awareness, government support for sustainability initiatives, and the growing demand for renewable energy. The Kingdom’s focus on reducing landfill waste, coupled with advancements in waste management technologies, fosters the development of efficient, eco-friendly energy solutions, contributing to economic and environmental benefits.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)