Saudi Arabia Water Pipeline Leak Detection System Market Size, Share, Trends and Forecast by Technology, Equipment, Pipe Type, End Use, and Region, 2026-2034

Saudi Arabia Water Pipeline Leak Detection System Market Overview:

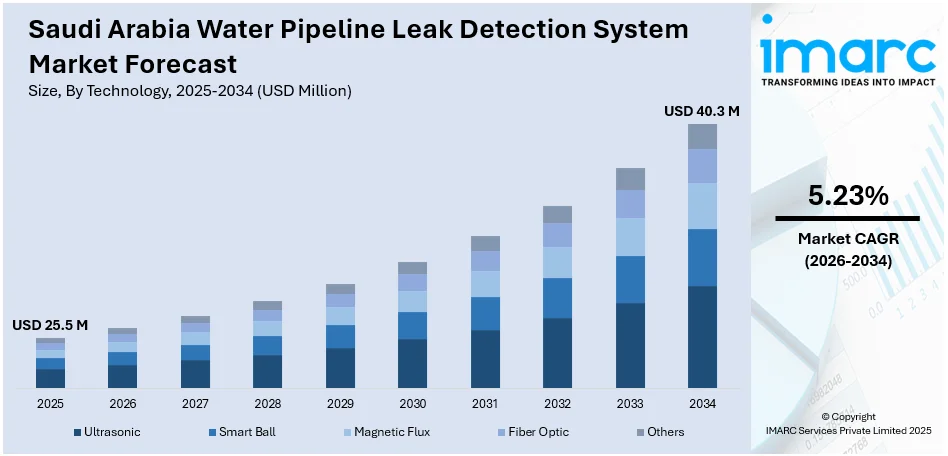

The Saudi Arabia water pipeline leak detection system market size reached USD 25.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 40.3 Million by 2034, exhibiting a growth rate (CAGR) of 5.23% during 2026-2034. The market is driven by the growing government investments in water infrastructure under its Vision 2030 plan, increasing concerns about water resource depletion, and technological advancements in leak detection technology like acoustic sensors, fiber-optic cables, and intelligent monitoring systems.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 25.5 Million |

| Market Forecast in 2034 | USD 40.3 Million |

| Market Growth Rate 2026-2034 | 5.23% |

Saudi Arabia Water Pipeline Leak Detection System Market Trends:

Increasing Government Investments in Water Infrastructure

Governing authorities of Saudi Arabia are considerably investing in water infrastructure under its Vision 2030 plan, which seeks to diversify the economy and enhance resource management. These investments are vital to meet the increasing demand for water in the country, which is traditionally dependent on desalination and vast pipeline networks to sustain its needs. When such networks grow larger and older, the likelihood of leaks and inefficiencies grows greater, and as a result, there is an increase in the demand for advanced leak detection technology. The governmental focus on promoting water distribution as well as efficient resource management created a favorable environment for the integration of leak detection technologies. Moreover, programs such as regional development plans alike place emphasis on water conservation and minimizing wastage, which, in turn, fuels the need for pipeline monitoring solutions. In October 2024, eight new projects worth $8 billion were announced to be awarded within the next 12 months, indicating the Saudi Water Partnership Company (SWPC) intention to provide a pipeline of projects to stimulate private sector interest, market competition and, ultimately, investment.

To get more information on this market Request Sample

Rising Water Scarcity Concerns

Saudi Arabia is a dry nation, and its heavy dependence on desalinated water and large pipeline networks makes it even more necessary to have effective water management systems. The nation has serious issues with water scarcity, which have been compounded by climate change, population increase and rising industrial needs. Consequently, every wastage of water, either through pipeline or other infrastructure leaks, has huge economic and environmental implications. Increased concerns about water resource depletion are driving the demand for advanced technologies to ensure that water is transported and managed efficiently. Leak detection systems as a part of smart water management can detect and locate leaks prior to their causing major losses. As a result, they are becoming an essential part of Saudi Arabia's water distribution networks management. The IMARC Group predicts that the Saudi Arabia smart water management market size is expected to reach USD 0.42 Billion by 2033.

Technological Advancements in Leak Detection Solutions

Technological enhancements in leak detection technology are offering a favorable market outlook. Exclusive systems like acoustic sensors, fiber-optic cables, and intelligent monitoring technologies allow for real-time leak detection with increased accuracy and response times. These technologies make it possible for operators to identify leaks even in remote and inaccessible pipeline sections, thus lowering operational costs as well as water loss. Moreover, the convergence of Internet of Things (IoT)-based technologies and artificial intelligence (AI) within pipeline monitoring systems is making predictive maintenance possible, keeping potential leaks from arising in the first instance. Such technology is increasingly considered because it can offer more efficient, cost-effective, and dependable leak detection solutions. The IMARC Group predicts that the Saudi Arabia AI market size is expected to reach USD 4,018 Million by 2033.

Saudi Arabia Water Pipeline Leak Detection System Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on technology, equipment, pipe type, and end use.

Technology Insights:

- Ultrasonic

- Smart Ball

- Magnetic Flux

- Fiber Optic

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes ultrasonic, smart ball, magnetic flux, fiber optic, and others.

Equipment Insights:

- Acoustic

- Non-Acoustic

A detailed breakup and analysis of the market based on the equipment have also been provided in the report. This includes acoustic and non-acoustic.

Pipe Types Insights:

- Plastic Pipes

- Ductile Iron Pipes

- Stainless Steel Pipes

- Aluminum Pipes

- Others

A detailed breakup and analysis of the market based on the pipe types have also been provided in the report. This includes plastic pipes, ductile iron pipes, stainless steel pipes, aluminum pipes, and others.

End-Use Insights:

.webp)

Access the comprehensive market breakdown Request Sample

- Industrial

- Residential

- Commercial

- Municipal

A detailed breakup and analysis of the market based on the end-use have also been provided in the report. This includes industrial, residential, commercial, and municipal.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include northern and central region, western region, eastern region, and southern region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Water Pipeline Leak Detection System Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Ultrasonic, Smart Ball, Magnetic Flux, Fiber Optic, Others |

| Equipment Covered | Acoustic, Non-Acoustic |

| Pipe Types Covered | Plastic Pipes, Ductile Iron Pipes, Stainless Steel Pipes, Aluminum Pipes, Others |

| End-Uses Covered | Industrial, Residential, Commercial, Municipal |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia water pipeline leak detection system market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia water pipeline leak detection system market on the basis of technology?

- What is the breakup of the Saudi Arabia water pipeline leak detection system market on the basis of equipment?

- What is the breakup of the Saudi Arabia water pipeline leak detection system market on the basis of pipe type?

- What is the breakup of the Saudi Arabia water pipeline leak detection system market on the basis of end-use?

- What are the various stages in the value chain of the Saudi Arabia water pipeline leak detection system market?

- What are the key driving factors and challenges in the Saudi Arabia water pipeline leak detection system market?

- What is the structure of the Saudi Arabia water pipeline leak detection system market and who are the key players?

- What is the degree of competition in the Saudi Arabia water pipeline leak detection system market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia water pipeline leak detection system market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia water pipeline leak detection system market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia water pipeline leak detection system industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)