Saudi Arabia Waterproof Textiles Market Size, Share, Trends and Forecast by Raw Material, Fabric Type, Application, and Region, 2026-2034

Saudi Arabia Waterproof Textiles Market Overview:

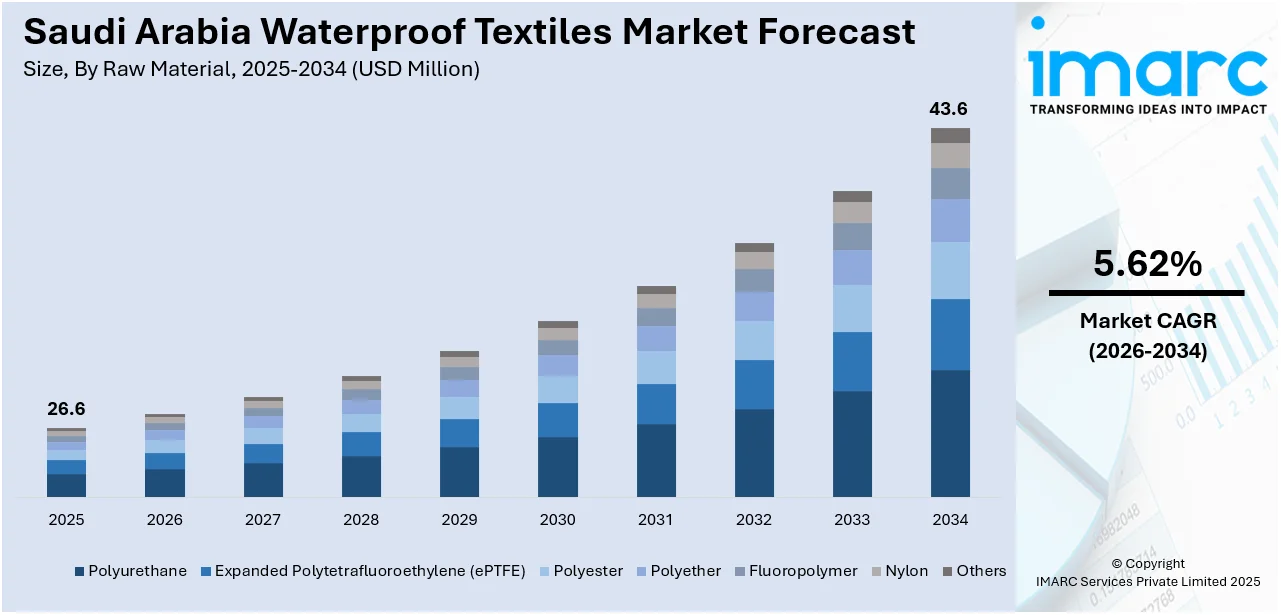

The Saudi Arabia waterproof textiles market size reached USD 26.6 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 43.6 Million by 2034, exhibiting a growth rate (CAGR) of 5.62% during 2026-2034. The improvements in construction and infrastructure developments in the country are contributing to the market growth. Moreover, the Saudi Arabian government is continuously enhancing its defense capabilities, and this trend is significantly driving the demand for waterproof materials. This, along with the escalating demand for enhanced textile solutions in the outdoor and performance apparel industry, is expanding the Saudi Arabia waterproof textiles market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 26.6 Million |

| Market Forecast in 2034 | USD 43.6 Million |

| Market Growth Rate 2026-2034 | 5.62% |

Saudi Arabia Waterproof Textiles Market Trends:

Expanding Construction and Infrastructure Projects

The waterproof textiles market in Saudi Arabia is witnessing rapid growth because of improvements in construction and infrastructure developments in the country. As the Vision 2030 program is driving huge investments in urban development, smart cities, and transport infrastructure, waterproof textiles are being used on a larger scale in applications like roofing membranes, concrete protection, and geotextiles. Construction firms are including these materials to increase the lifespan of buildings and avoid water-induced deterioration, particularly in regions exposed to flash floods or elevated humidity. Additionally, state-sponsored megaprojects like NEOM, the Red Sea Project, and Qiddiya are driving the performance building materials demand, where water resistance is essential for long-term asset resilience. Moreover, heatwaves in Saudi Arabia during June 2024 were 2.5°C warmer than the hottest heatwaves ever seen before in the country. As a result, developers and contractors were keenly looking for textile solutions that are capable of withstanding harsh climatic conditions while meeting tough environmental and safety regulations, thus increasing the significance of waterproof materials in the overall construction environment.

To get more information on this market Request Sample

Rising Demand in Outdoor and Performance Apparel

The escalating demand for enhanced textile solutions in the outdoor and performance apparel industry is impelling the Saudi Arabia waterproof textiles market growth. With lifestyles becoming more inclined toward fitness, adventure travel, and leisure activities, people are looking for clothing that offers functionality in addition to comfort. Waterproof and breathable materials are becoming popular in sporting apparel, trekking outfits, and military uniforms, particularly because of the country's mixed climate patterns, which involve unexpected rain showers and extreme heat. Local and international apparel companies are adopting cutting-edge waterproofing technologies to appeal to health-conscious and fashion-aware customers. In addition, the Ministry of Sports is encouraging outdoor activities and public involvement in physical exercise, indirectly driving the demand for high-performance apparel. Community sport, an integral part of the Ministry of Sport's objectives and Kingdom Vision 2030 to ensure healthy lifestyles and create an active society, witnessed a phenomenal boost in 2024, as participation increased by 121% and the number of events jumped by 142% from the previous year of 2023. Stores are also broadening their stock to incorporate all-weather wearables, thus supporting the market growth.

Increasing Focus on Military and Defense Applications

The Saudi Arabian government is continuously enhancing its defense capabilities, and this trend is significantly driving the demand for waterproof textiles. As part of its national defense modernization strategy, the country is investing heavily in technologically advanced uniforms and protective gear that incorporate waterproof, breathable, and durable fabrics. Military personnel operating in diverse and often harsh environmental conditions require textiles that can resist moisture while maintaining thermal regulation and comfort. These requirements are encouraging defense contractors and suppliers to source high-performance waterproof materials that comply with global military specifications. The growth of domestic defense manufacturing under the Vision 2030 localization initiative is also supporting the use of locally produced technical textiles, including waterproof variants. Moreover, with security forces frequently involved in field training and border operations, the need for tactical gear that maintains performance under wet conditions is becoming increasingly critical. The IMARC Group predicts that the Saudi Arabia defense market size is expected to attain USD 32,394.5 Million by 2033.

Saudi Arabia Waterproof Textiles Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on raw material, fabric type, and application.

Raw Material Insights:

- Polyurethane

- Expanded Polytetrafluoroethylene (ePTFE)

- Polyester

- Polyether

- Fluoropolymer

- Nylon

- Others

The report has provided a detailed breakup and analysis of the market based on the raw material. This includes polyurethane, expanded polytetrafluoroethylene (ePTFE), polyester. polyether, fluoropolymer, nylon, and others.

Fabric Type Insights:

- Dense Woven

- Laminated or Coated Woven

- Others

A detailed breakup and analysis of the market based on the fabric type have also been provided in the report. This includes dense woven, laminated or coated woven, and others.

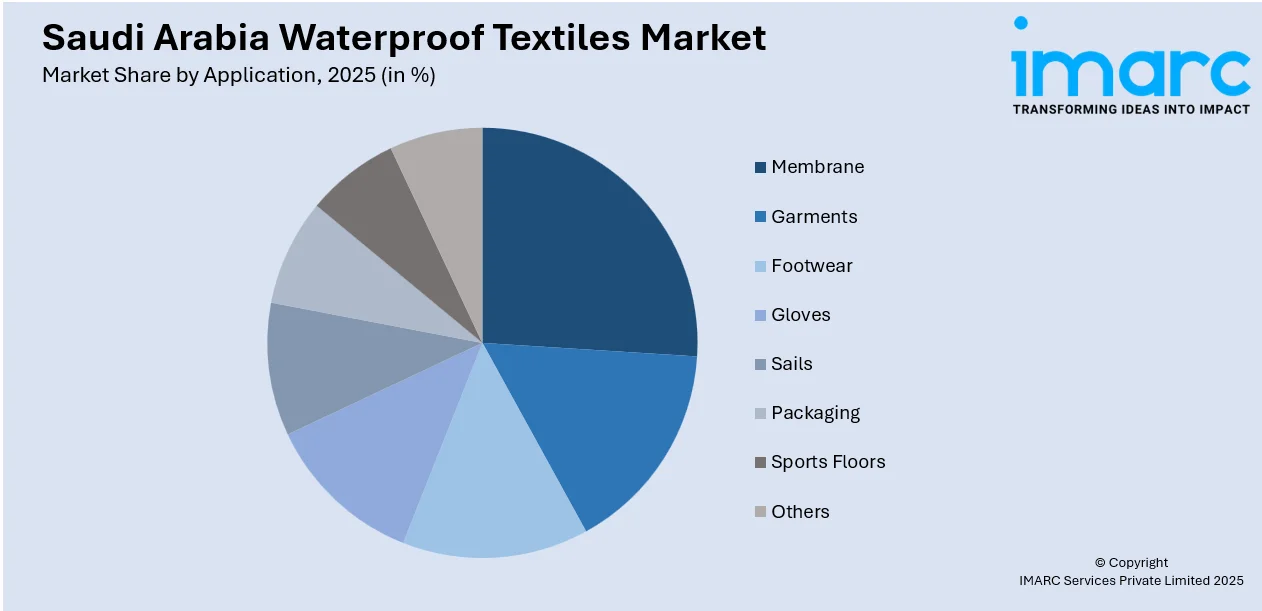

Application Insights:

Access the comprehensive market breakdown Request Sample

- Membrane

- Garments

- Jackets

- Waterproof Jackets

- Leisurewear

- Others

- Footwear

- Gloves

- Sails

- Packaging

- Sports Floors

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes membrane, garments (jackets, waterproof jackets, leisurewear, and others), footwear, gloves, sails, packaging, sports floors, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Waterproof Textiles Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Raw Materials Covered | Polyurethane, Expanded Polytetrafluoroethylene (ePTFE), Polyester, Polyether, Fluoropolymer, Nylon, Others |

| Fabric Types Covered | Dense Woven, Laminated or Coated Woven, Others |

| Applications Covered |

|

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia waterproof textiles market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia waterproof textiles market on the basis of raw material?

- What is the breakup of the Saudi Arabia waterproof textiles market on the basis of fabric type?

- What is the breakup of the Saudi Arabia waterproof textiles market on the basis of application?

- What is the breakup of the Saudi Arabia waterproof textiles market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia waterproof textiles market?

- What are the key driving factors and challenges in the Saudi Arabia waterproof textiles market?

- What is the structure of the Saudi Arabia waterproof textiles market and who are the key players?

- What is the degree of competition in the Saudi Arabia waterproof textiles market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia waterproof textiles market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia waterproof textiles market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia waterproof textiles industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)