Saudi Arabia White Cement Market Size, Share, Trends and Forecast by Type, Application, and Region, 2026-2034

Saudi Arabia White Cement Market Overview:

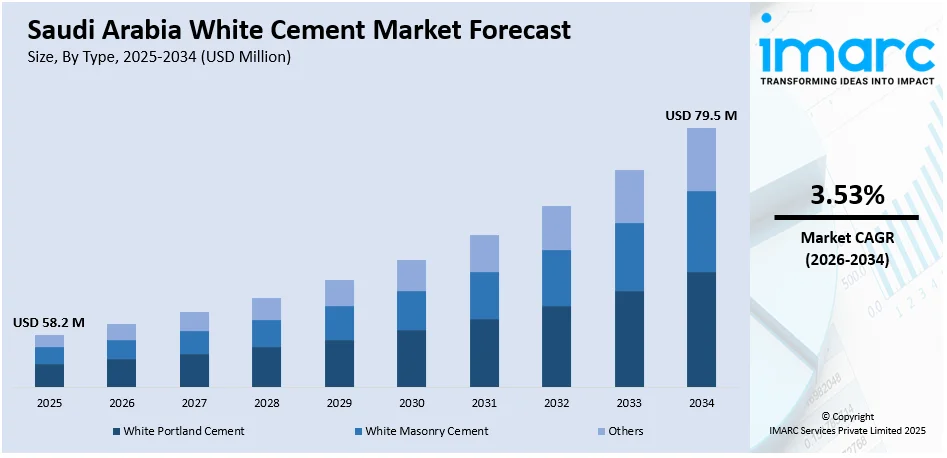

The Saudi Arabia white cement market size reached USD 58.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 79.5 Million by 2034, exhibiting a growth rate (CAGR) of 3.53% during 2026-2034. Increasing investments in mega construction projects are fueling the market growth. Apart from this, the expansion of retail channels and specialty construction material stores, which is making the product more accessible to a broader customer base, is strengthening the Saudi Arabia white cement market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 58.2 Million |

| Market Forecast in 2034 | USD 79.5 Million |

| Market Growth Rate 2026-2034 | 3.53% |

Saudi Arabia White Cement Market Trends:

Rising construction activities

Increasing construction activities are positively influencing the market. With governing agencies actively investing in mega projects like smart cities and tourism infrastructure under the Vision 2030 initiative, the demand for high-quality construction materials continues to grow. As per the details provided by officials of the Saudi Arabian government, Minister of Municipalities and Housing Majid bin Abdullah Al-Hogail announced at the Real Estate Future Forum 2025 that Saudi Arabia granted 192 licenses for real estate developments in 2024, totaling over 147 Billion Saudi Riyals (USD 39 Billion). White cement has become a preferred choice for architects and developers due to its superior strength and versatility in structural applications. It is widely used in facades, floorings, precast elements, and interior finishes wherein brightness and color consistency are important. As urbanization is accelerating, more residential, commercial, and public buildings are emerging, encouraging the use of white cement in modern designs. Domestic manufacturers are expanding their production capacities to meet the rising demand.

To get more information on this market Request Sample

Growing preferences for architectural aesthetics

Rising preferences for architectural aesthetics are impelling the Saudi Arabia white cement market growth. Builders, architects, and homeowners increasingly favor materials that enhance the visual appeal of structures. White cement offers a sleek, clean, and polished finish, making it ideal for decorative applications, tiles, mosaics, and interior designs. In both residential and commercial sectors, there is a high demand for aesthetically pleasing construction materials that align with modern design trends. The use of white cement in innovative architectural projects is helping to achieve brighter surfaces, intricate patterns, and high-end finishes that regular grey cement cannot provide. As luxury developments are growing, the demand for premium materials like white cement is increasing. Additionally, the expansion of retail channels, such as specialty construction material stores and e-commerce platforms, is making white cement more accessible to a broader customer base. According to the IMARC Group, the Saudi Arabia retail market is set to attain USD 408.7 Billion by 2033, exhibiting a growth rate (CAGR) of 4.2% during 2025-2033. This increased availability is supporting user awareness and adoption. The focus on sustainability and durable and low-maintenance materials is also complementing the utilization of white cement. As design expectations are rising across Saudi Arabia, white cement continues to gain traction in the construction industry.

Saudi Arabia White Cement Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type and application.

Type Insights:

- White Portland Cement

- White Masonry Cement

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes white Portland cement, white masonry cement, and others.

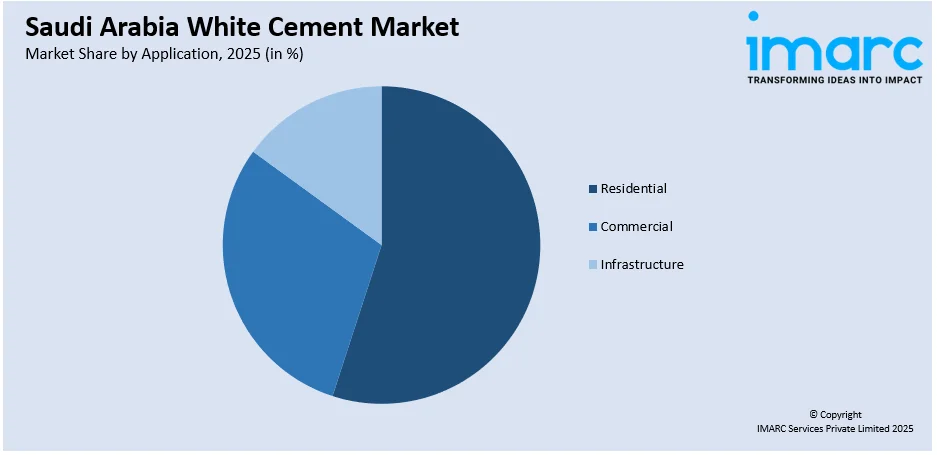

Application Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

- Infrastructure

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential, commercial, and infrastructure.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia White Cement Market News:

- In February 2025, Riyadh Cement announced that it transformed its grey cement Line 1 into a versatile line capable of producing 1800tpd of white cement. It was manufactured in response to the growing demand for white cement in Saudi Arabia.

Saudi Arabia White Cement Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | White Portland Cement, White Masonry Cement, Others |

| Applications Covered | Residential, Commercial, Infrastructure |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia white cement market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia white cement market on the basis of type?

- What is the breakup of the Saudi Arabia white cement market on the basis of application?

- What is the breakup of the Saudi Arabia white cement market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia white cement market?

- What are the key driving factors and challenges in the Saudi Arabia white cement market?

- What is the structure of the Saudi Arabia white cement market and who are the key players?

- What is the degree of competition in the Saudi Arabia white cement market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia white cement market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia white cement market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia white cement industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)