Saudi Arabia Wind Power Market Size, Share, Trends and Forecast by Location and Region, 2026-2034

Saudi Arabia Wind Power Market Overview:

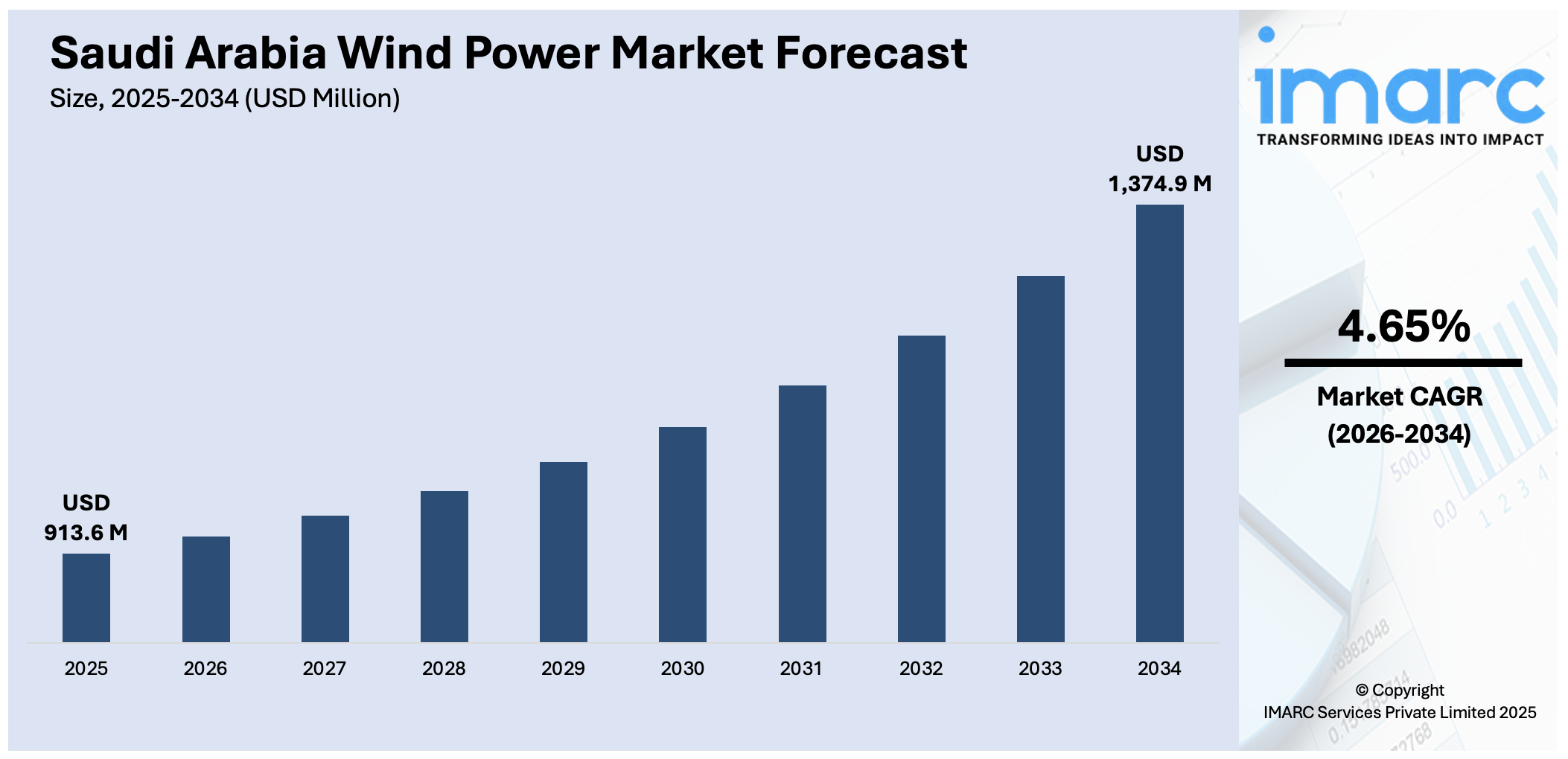

The Saudi Arabia wind power market size reached USD 913.6 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,374.9 Million by 2034, exhibiting a growth rate (CAGR) of 4.65% during 2026-2034. Energy diversification policies, structured procurement frameworks, and grid modernization initiatives are transforming renewable deployment. Technological enhancements, localized manufacturing capabilities, and international partnerships are improving feasibility and reducing costs. In addition to this, investor confidence, site suitability, and national workforce alignment are some of the major factors expanding the Saudi Arabia wind power market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 913.6 Million |

| Market Forecast in 2034 | USD 1,374.9 Million |

| Market Growth Rate 2026-2034 | 4.65% |

Saudi Arabia Wind Power Market Trends:

Strategic Energy Diversification under Vision 2030

Saudi Arabia’s national commitment to reducing its dependence on fossil fuels has reshaped its energy policy landscape. Under Vision 2030, the country has introduced an ambitious framework to diversify energy generation, with renewables occupying a central role. As part of this initiative, wind energy has emerged as a viable complement to solar, particularly in high-wind regions such as Al-Jouf and the Red Sea coastline. The Ministry of Energy and the Saudi Power Procurement Company has issued competitive tenders under the National Renewable Energy Program (NREP), encouraging private investment through structured power purchase agreements and long-term tariffs. The regulatory clarity and institutional support have led to greater confidence among investors and developers, stimulating interest in utility-scale installations. Grid modernization efforts and transmission infrastructure enhancements have also improved the viability of integrating wind-based electricity into the national grid. On December 19, 2024, SPARK Utilities and the Saudi Electricity Project Development Company signed a strategic partnership to enhance utility services within Saudi Arabia. The agreement, formalized at the Saudi Smart Grid Conference, aims to improve connectivity, technical support, and bulk supply customer connections within SPARK (King Salman Energy Park). This partnership focuses on modernizing infrastructure, leveraging the expertise of both companies to provide efficient utility services across the region. These policy-driven initiatives, combined with favorable site conditions and structured procurement models, are contributing significantly to Saudi Arabia wind power market growth as the Kingdom accelerates its transition to cleaner and more resilient energy sources.

To get more information on this market Request Sample

Advancements in Wind Technology and Localized Manufacturing

Technological innovation and localized supply chain development are shaping the competitive dynamics of the wind energy sector in Saudi Arabia. Improvements in turbine design, efficiency, and durability have made wind farms more economically viable, particularly in the country’s arid and harsh desert environments. Larger rotor diameters, higher hub heights, and improved blade materials are allowing projects to capture wind resources more effectively while reducing maintenance costs. Simultaneously, the government’s push for domestic industrial participation has encouraged the establishment of local manufacturing clusters that support component assembly, logistics, and service operations. This localization strategy not only reduces overall project cost and lead time but also creates employment opportunities aligned with national workforce development goals. Strategic collaborations between international technology providers and Saudi-based firms are further enhancing knowledge transfer and operational capacity. Through this ecosystem of innovation, domestic production, and cost efficiency, the Kingdom is advancing its wind sector on multiple fronts. On July 16, 2024, Saudi Arabia's Public Investment Fund (PIF) announced three new joint ventures aimed at localizing renewable energy equipment manufacturing within the Kingdom. These partnerships involve Envision Energy, Jinko Solar, and LUMETECH, alongside Vision Industries, and will focus on the production of wind turbine components, photovoltaic cells, modules, and solar wafers. The agreements align with Saudi Arabia’s Vision 2030, targeting the localization of 75% of renewable energy components by 2030 and contributing to PIF's broader goal of establishing the Kingdom as a global renewable energy hub.

Saudi Arabia Wind Power Market Segmentation:

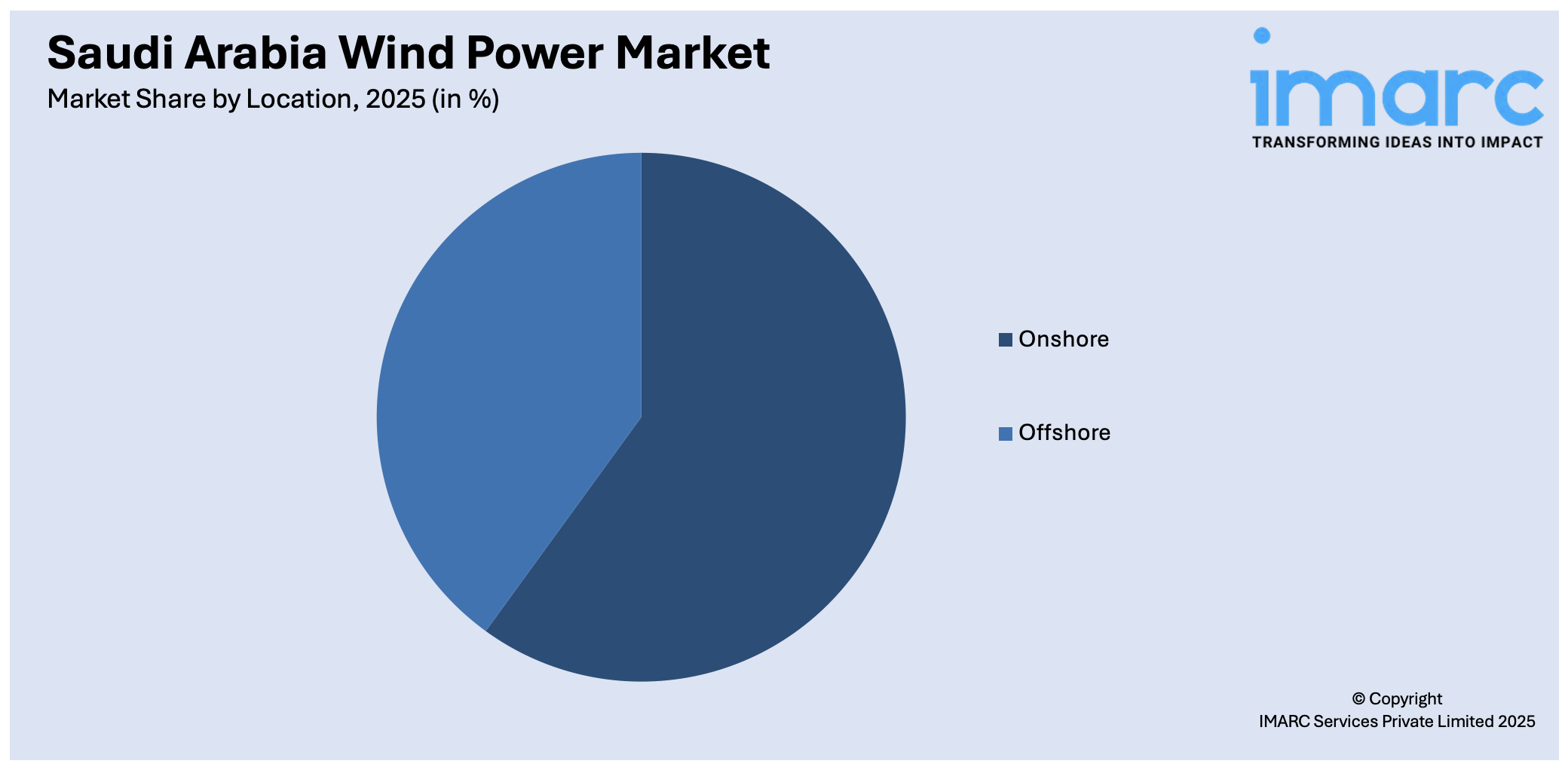

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on location.

Location Insights:

Access the comprehensive market breakdown Request Sample

- Onshore

- Offshore

The report has provided a detailed breakup and analysis of the market based on the location. This includes onshore and offshore.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Wind Power Market News:

- On November 28, 2024, the Saudi Power Procurement Company (SPPC) prequalified 11 global and regional developers for the 1,500 MW Dawadmi Wind IPP project located in Saudi Arabia's central province. The project is part of Saudi Arabia’s National Renewable Energy Program (NREP), aiming to diversify its energy mix with renewables and supply 50% of the country's electricity from these sources by 2030. Among the prequalified firms are EDF Renouvelables, Total Energies, Masdar, Engie, and Alfanar, with the overall capacity of Round 6 projects reaching 4,500 MW across wind and solar developments.

Saudi Arabia Wind Power Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Locations Covered | Onshore, Offshore |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia wind power market performed so far and how will it perform in the coming years?

- What is the breakup of the Saudi Arabia wind power market on the basis of location?

- What is the breakup of the Saudi Arabia wind power market on the basis of region?

- What are the various stages in the value chain of the Saudi Arabia wind power market?

- What are the key driving factors and challenges in the Saudi Arabia wind power market?

- What is the structure of the Saudi Arabia wind power market and who are the key players?

- What is the degree of competition in the Saudi Arabia wind power market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia wind power market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia wind power market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia wind power industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)