Saudi Arabia Wireless Charging Market Size, Share, Trends and Forecast by Technology, Transmission Range, Application, and Region, 2026-2034

Saudi Arabia Wireless Charging Market Summary:

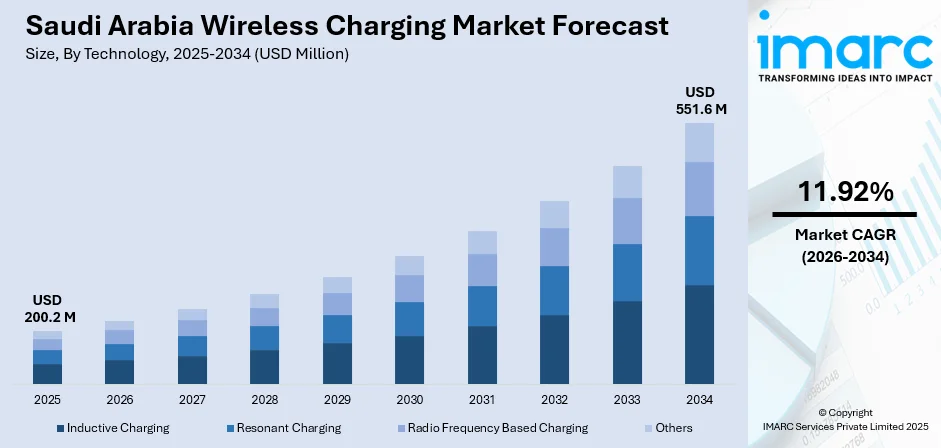

The Saudi Arabia wireless charging market size reached USD 200.2 Million in 2025 and is projected to reach USD 551.6 Million by 2034, exhibiting a compound annual growth rate of 11.92% from 2026-2034.

The market expansion is primarily driven by the Kingdom's ambitious Vision 2030 initiative, which emphasizes technological modernization and digital infrastructure development across smart city projects. Rising smartphone penetration rate, coupled with increasing adoption of wearable devices and Internet of Things (IoT) applications, are creating substantial demand for convenient, cable-free charging solutions. Government investments in mega-projects, including NEOM and smart urban developments, are establishing advanced digital ecosystems that integrate wireless power technologies into everyday infrastructure.

Key Takeaways and Insights:

-

By Technology: Inductive charging dominates the market with a share of 52% in 2025, driven by its widespread integration in Qi-certified smartphones and consumer electronics, established standardization protocols ensuring cross-device compatibility, and proven efficiency in short-range power transfer applications.

-

By Transmission Range: Short range leads the market with a share of 68% in 2025, owing to its optimal efficiency for consumer electronics charging, alignment with predominant inductive technology applications, and suitability for smartphone and wearable device power delivery requirements.

-

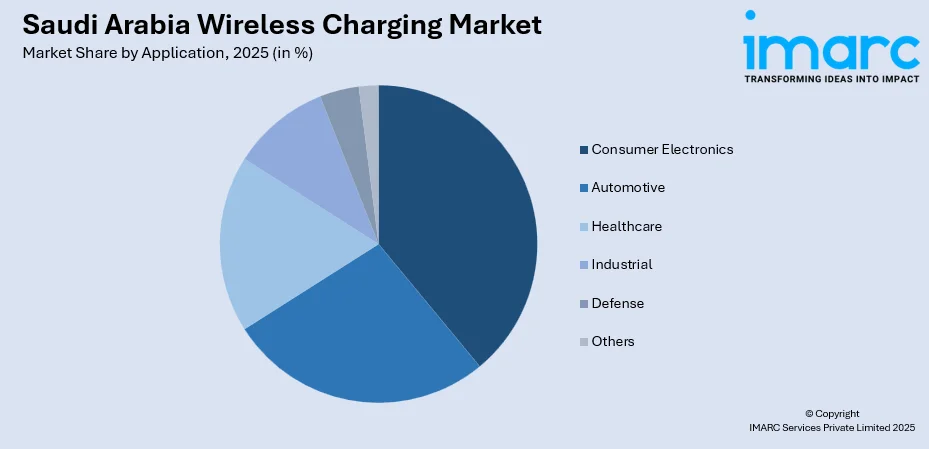

By Application: Consumer electronics represent the largest segment with a market share of 39% in 2025. This dominance is attributed to the high smartphone penetration rate, growing adoption of wireless earbuds and smartwatches, and increasing consumer preference for cable-free charging convenience across personal electronic devices.

-

Key Players: Key players are driving the market expansion through product innovations, faster charging solutions, and device compatibility improvements. They expand retail and online presence, partner with electronics brands, and invest in marketing to raise awareness, accessibility, and consumer confidence in wireless charging technology.

To get more information on this market Request Sample

The market benefits substantially from Saudi Arabia's rapid digital transformation and infrastructure modernization efforts. The proliferation of Qi-certified devices ensures broad compatibility and consumer adoption across the Kingdom's technology-savvy population. The expansion of smart homes, offices, and public charging infrastructure in cafés, airports, and vehicles is further encouraging adoption. As per IMARC Group, the Saudi Arabia smart homes market size reached USD 1.2 Billion in 2024. Retail availability of wireless charging pads, stands, and multi-device chargers continues to improve across online and offline channels. Technological improvements, such as faster charging speeds and better heat management, are enhancing performance and user trust. Businesses are also adopting wireless charging to improve customer experience in hospitality and commercial spaces. As digital lifestyles expand and consumers prefer clutter-free environments, demand is expected to grow steadily.

Saudi Arabia Wireless Charging Market Trends:

Growing Integration of Wireless Charging in Smart City Infrastructure

Saudi Arabia's ambitious smart city projects are incorporating wireless charging capabilities into public infrastructure design. In November 2024, Tilal Real Estates announced a new initiative to construct a smart city on the Gulf Kingdom’s eastern side, with an estimated cost of approximately 6 Billion Saudi Riyals (USD 1.6 Billion). The development of cognitive urban environments, including NEOM and Riyadh's digital transformation initiatives, emphasizes seamless technology integration across transportation hubs, commercial centers, and public spaces. These projects prioritize cable-free power solutions that enhance user convenience while maintaining aesthetic design principles aligned with futuristic city planning concepts.

Advancements in Fast Wireless Charging Technologies

Technological innovations are enabling significantly faster wireless charging speeds while maintaining energy efficiency standards. The introduction of higher wattage Qi-compatible systems for consumer electronics addresses limitations regarding charging duration. Saudi consumers demonstrate strong interest in premium charging solutions that minimize device downtime, particularly among the tech-savvy urban population concentrated in metropolitan areas.

Broadening of retail outlets

The expansion of retail outlets is driving the market expansion by making products more visible and accessible to consumers. Availability across electronics stores, mobile shops, supermarkets, and e-commerce platforms increases impulse purchases and brand awareness. As per ITA, by 2024, the total of Saudi internet users engaging in e-commerce (buying and selling) was projected to hit 33.6 Million, marking a 42% rise since 2019. Wider retail reach also allows customers to compare options easily, boosting confidence and accelerating adoption among different income groups.

How Vision 2030 is Transforming the Saudi Arabia Wireless Charging Market:

Saudi Arabia's comprehensive Vision 2030 initiative prioritizes technological modernization and digital infrastructure development as cornerstones of economic diversification. The government's commitment to positioning major cities, including Riyadh, Jeddah, and Dammam, among the world's most livable urban centers by 2030 drives substantial investments in smart technologies, including wireless charging infrastructure. The IMD Smart City Index 2025 features 6 Saudi cities, with AlUla being the latest addition. These initiatives create integrated ecosystems where wireless power solutions enhance convenience and support sustainable development objectives. The development of megaprojects, such as NEOM, establishes blueprints for technology-integrated living environments that incorporate wireless charging throughout public and private spaces. These smart city developments prioritize seamless user experiences that eliminate cable clutter while maintaining aesthetic design principles.

Market Outlook 2026-2034:

The Saudi Arabia wireless charging market is positioned for substantial revenue growth, driven by continued government investments in digital infrastructure and smart city development aligned with Vision 2030 objectives. The expanding ecosystem of wireless charging-enabled devices, ranging from consumer electronics to automotive applications, will create diversified revenue streams across market segments. The market generated a revenue of USD 200.2 Million in 2025 and is projected to reach a revenue of USD 551.6 Million by 2034, growing at a compound annual growth rate of 11.92% from 2026-2034. Integration of renewable energy sources with wireless charging infrastructure presents significant opportunities, particularly given Saudi Arabia's substantial solar energy potential.

Saudi Arabia Wireless Charging Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Technology | Inductive Charging | 52% |

| Transmission Range | Short Range | 68% |

| Application | Consumer Electronics | 39% |

Technology Insights:

- Inductive Charging

- Resonant Charging

- Radio Frequency Based Charging

- Others

Inductive charging dominates with a market share of 52% of the total Saudi Arabia wireless charging market in 2025.

Inductive charging has established market leadership through its proven efficiency in electromagnetic energy transfer between closely positioned coils. The technology forms the foundation of the globally recognized Qi wireless charging standard, which ensures interoperability across devices from multiple manufacturers.

The prevalence of inductive charging in smartphones represents a significant market driver, as major device manufacturers integrate Qi-compatible receivers as standard features. The technology's reliability, combined with mature manufacturing processes that reduce production costs, positions inductive charging for continued dominance throughout the forecast period as smartphone replacement cycles drive consistent accessory demand. In addition, inductive chargers are available in different designs, such as stands, pads, and multi-device docks, appealing to both personal and office use.

Transmission Range Insights:

- Short Range

- Medium Range

- Long Range

Short range leads with a share of 68% of the total Saudi Arabia wireless charging market in 2025.

Short range wireless charging demonstrates superior energy transfer efficiency when devices are positioned within close proximity to charging surfaces. This transmission category aligns optimally with inductive technology characteristics, enabling effective power delivery across distances up to four centimeters while minimizing energy loss during transfer.

Consumer electronics applications predominantly utilize short range transmission due to the practical charging scenarios where devices rest directly on charging pads or stands. The market preference for short range solutions reflects established consumer behavior patterns and proven technology performance in everyday usage scenarios. The wearable technology's alignment with existing product designs and charging infrastructure investments ensures continued market leadership as manufacturers optimize products for established transmission parameters rather than emerging long-range alternatives.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Consumer Electronics

- Automotive

- Healthcare

- Industrial

- Defense

- Others

Consumer electronics exhibit a clear dominance with a 39% share of the total Saudi Arabia wireless charging market in 2025.

Consumer electronics applications drive wireless charging adoption through the pervasive use of smartphones, tablets, smartwatches, and wireless earbuds requiring regular power replenishment. The convenience factor of cable-free charging resonates strongly with Saudi consumers who increasingly own multiple wireless-enabled devices requiring daily charging.

The segment benefits from continuous product innovations as manufacturers enhance charging speed, introduce multi-device capabilities, and integrate wireless charging into furniture and automotive accessories. Saudi Arabia's mobile phone accessories market demonstrates robust growth potential, with consumers actively seeking charging solutions that complement their device ecosystems. The introduction of Qi2-compatible accessories and the proliferation of embedded charging surfaces in thriving retail and hospitality environments expand touchpoints for consumer electronics wireless charging throughout daily routines. Consumer retail expenditure in Saudi Arabia is anticipated to see substantial growth, with e-commerce expected to make up 46% of the total retail industry by 2030, as stated by a Visa executive.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The Northern and Central Region holds prominence in the market, driven by Riyadh's position as the economic and technological hub with advanced retail infrastructure and high consumer electronics adoption rates. The capital hosts numerous smart city initiatives and serves as headquarters for major technology distributors and telecommunications companies, driving market development.

The Western Region contributes significantly to market revenue through Jeddah's commercial importance and substantial population concentration along the Red Sea corridor. The region benefits from tourism infrastructure investments and retail modernization creating opportunities for wireless charging deployment in hospitality and commercial venues.

The Eastern Region demonstrates growing market potential, supported by industrial diversification efforts in cities, including Dammam, and the concentration of petroleum industry headquarters driving corporate technology adoption. The region's economic development initiatives align with increased demand for modern electronic infrastructure.

The Southern Region represents an emerging market opportunity, as urban development expands and infrastructure investments improve connectivity with major metropolitan areas. Government initiatives targeting regional economic diversification create foundations for technology adoption growth.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Wireless Charging Market Growing?

Surging adoption of smartphones

The growing use of smartphones is benefiting the market expansion in Saudi Arabia. As per industry reports, by 2024, approximately 92% of Saudis owned or could access a smartphone. With an increasing number of individuals in the country using smartphones for employment, communication, leisure, and everyday activities, the demand for dependable and effective charging solutions is growing. This trend is prompting users to explore wireless charging solutions that provide convenience and lessen reliance on conventional wired chargers. As the number of tech-savvy individuals increases, preferences lean towards contemporary devices that offer rapid and wireless charging capabilities. The extensive presence of smartphones featuring integrated wireless charging capability is driving the market expansion. Furthermore, since smartphone users frequently possess various gadgets, like smartwatches and earbuds, the attraction of multi-device wireless charging pads is increasing. Retailers and electronics companies in Saudi Arabia are advertising wireless charging products via package offers and in-store exhibits, increasing awareness.

Rising EV production

Increasing EV manufacturing is driving the expansion of the wireless charging market in Saudi Arabia. With the nation transitioning to electric mobility, manufacturers and consumers are seeking innovative technologies that facilitate convenience and rapid charging. Wireless charging systems enable EV owners to charge their vehicles without managing cords, providing a smooth experience. This is in line with the government's promotion of eco-friendly transit and intelligent urban development efforts. The rise of EVs in city environments is driving infrastructure progress, such as wireless charging stations in both public and residential locations. Car manufacturers are incorporating wireless charging features in their latest electric vehicle models. With the increasing acceptance of EVs, such as electric cars, wireless charging is emerging as a compelling choice to enhance the changing transportation scene in Saudi Arabia. As per the IMARC Group, the electric car market in Saudi Arabia is set to reach USD 2,600 Million by 2033, demonstrating a growth rate (CAGR) of 17.20% from 2025 to 2033.

Growing investments in electronics

Increasing investments in electronics are fueling the market expansion in Saudi Arabia. With local and global firms wagering on the creation and manufacturing of cutting-edge electronic devices, the need for wireless charging solutions is rising. These investments are fostering the development of more effective, quicker, and compact wireless charging technologies that attract tech-savvy consumers. The expanding electronics landscape is fostering collaborations between device makers and charging technology suppliers. The government is actively backing the electronics industry in encouraging the adoption of advanced portable electronic devices nationwide. In July 2024, officials in Saudi Arabia, represented by SASO, announced the initiative to standardize charging ports for portable electronic devices within the country. The first phase was scheduled to start on 1 January 2025 and included devices tied to 18 HS Codes, covering mobile phones, tablets, headphones, earphones, amplifiers, and others. The second phase is set to begin on April 1, 2026, and will include laptops. The objective is to enhance user contentment, reduce costs, and minimize electronic waste (e-waste).

Market Restraints:

What Challenges the Saudi Arabia Wireless Charging Market is Facing?

Higher Costs Compared to Conventional Wired Charging Solutions

Wireless charging products typically command premium pricing relative to traditional wired alternatives, creating adoption barriers among price-sensitive consumer segments. The additional components required for wireless power transfer, including transmitter coils and electronic control systems, contribute to higher manufacturing costs that translate to elevated retail prices.

Thermal Management and Energy Efficiency Concerns

Wireless charging generates heat during energy transfer that may affect device battery longevity and charging efficiency, particularly in Saudi Arabia's elevated ambient temperature environment. The energy conversion losses inherent in electromagnetic induction reduce overall efficiency compared to direct wired connections, creating concerns among environmentally conscious consumers.

Standardization and Interoperability Challenges

Despite Qi standard dominance, proprietary fast charging protocols from different manufacturers create fragmentation that may confuse consumers and limit cross-brand compatibility. Variations in optimal charging alignment requirements and power delivery specifications across devices complicate the user experience and may reduce perceived convenience benefits.

Competitive Landscape:

The Saudi Arabia wireless charging market features participation from global technology corporations, specialized wireless power companies, and regional distributors serving diverse market segments. International consumer electronics manufacturers leverage established brand recognition and extensive distribution networks to capture market share in the consumer segment. These companies invest substantially in research and development (R&D) activities to advance charging speed capabilities and multi-device functionality. Regional players focus on localized distribution strategies and customer service networks that address specific market requirements. The competitive environment encourages continuous innovations in product features, pricing strategies, and retail partnerships, as companies seek differentiation in an evolving market landscape.

Recent Developments:

-

In September 2025, UGREEN, a global leader in charging solutions, introduced its MagFlow Qi2 25W series in the United Arab Emirates and Saudi Arabia, following its debut at IFA 2025 in Berlin. The refreshed collection strived to deliver faster wireless charging and improved magnetic connections via the latest Qi2 standard, setting a new benchmark for convenience and performance in the field.

Saudi Arabia Wireless Charging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | USD Million |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Inductive Charging, Resonant Charging, Radio Frequency Based Charging, Others |

| Transmission Ranges Covered | Short Range, Medium Range, Long Range |

| Applications Covered | Consumer Electronics, Automotive, Healthcare, Industrial, Defense, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia wireless charging market size was valued at USD 200.2 Million in 2025.

The Saudi Arabia wireless charging market is expected to grow at a compound annual growth rate of 11.92% from 2026-2034 to reach USD 551.6 Million by 2034.

Inductive charging dominated the market with 52% share, driven by widespread Qi standard adoption in smartphones and consumer electronics, ensuring cross-device compatibility and proven operational reliability.

Key factors driving the Saudi Arabia wireless charging market include Vision 2030 smart city initiatives and digital transformation investments, rising smartphone penetration and consumer electronics adoption, growing EV infrastructure development, and increasing consumer preference for cable-free convenience.

Major challenges include higher product costs compared to wired alternatives, thermal management concerns in elevated temperature environments, energy efficiency limitations inherent in electromagnetic power transfer, standardization fragmentation across proprietary fast charging protocols, and consumer awareness gaps regarding technology benefits and compatibility requirements.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)