Saudi Arabia Women Apparel Market Size, Share, Trends and Forecast by Product Type, Season, Distribution Channel, and Region, 2026-2034

Saudi Arabia Women Apparel Market Overview:

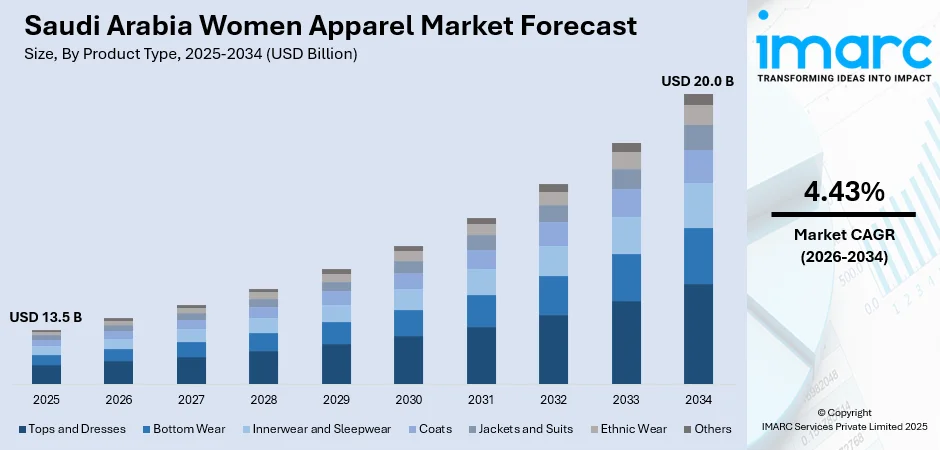

The Saudi Arabia women apparel market size reached USD 13.5 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 20.0 Billion by 2034, exhibiting a growth rate (CAGR) of 4.43% during 2026-2034. Increasing female workforce participation, rising disposable incomes, cultural shifts toward modern fashion, growing e-commerce platforms, international brand penetration, government initiatives supporting women's empowerment, and heightened fashion awareness influenced by social media and global fashion trends are some of the factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 13.5 Billion |

| Market Forecast in 2034 | USD 20.0 Billion |

| Market Growth Rate 2026-2034 | 4.43% |

Saudi Arabia Women Apparel Market Trends:

Impact of Social Media and Fashion Awareness

The influence of social media channels, influencers, and fashion bloggers, with more people being active on digital channels, is reshaping the market in Saudi Arabia. As per industry reports, by 2024, the total count of individuals with social media accounts in Saudi Arabia rose to 35.33 Million. Social media platforms allow women to explore styles, compare options, and engage with brands directly. This digital exposure encourages experimentation with modern and fusion clothing, blending traditional modest wear with contemporary designs. Social media campaigns and influencer endorsements have a strong impact on purchase decisions, particularly among younger women who actively follow style icons and lifestyle bloggers. Fashion awareness is also spreading through virtual fashion shows, e-commerce promotions, and global collaborations that are easily accessible online. By inspiring creativity and shaping tastes, social media has become a critical force in driving the demand for new apparel categories, boosting sales, and diversifying fashion choices in Saudi Arabia.

To get more information on this market, Request Sample

Expansion of E-commerce and Online Shopping

E-commerce is becoming a dominant driver of the market growth, as online shopping offers convenience, variety, and affordability. According to the IMARC Group, the Saudi Arabia e-commerce market size reached USD 222.9 Billion in 2024. Women have access to global brands and local designers through digital platforms that provide easy browsing, secure payments, and doorstep delivery. Online platforms also allow for discounts, exclusive launches, and seasonal promotions that attract price-sensitive as well as premium shoppers. With the growing smartphone penetration and reliable logistics networks, the e-commerce ecosystem has made fashion more accessible to women across urban and semi-urban areas. The capacity to evaluate products, check reviews, and obtain customer support also enhances trust in online platforms.

Influence of Cultural Transformation and Vision 2030

Saudi Arabia’s Vision 2030 reforms, encouraging women’s participation in the workforce and public life, are catalyzing the demand for women’s apparel. As more women continue to join offices, universities, and social events, the need for professional attire, casual wear, and occasion-specific outfits is growing significantly. Cultural transformation also encourages women to adopt modern fashion while still respecting traditional values, leading to a unique fusion of modest yet stylish clothing. Retailers and designers are responding by creating collections that balance cultural norms with global fashion appeal. In November 2024, Adidas opened its inaugural Women's Concept Store in Saudi Arabia. Drawing on perspectives from local women, the team concentrated on developing a shopping experience that was inviting, cozy, and reflective of women's shopping preferences. Furthermore, government efforts to host entertainment, cultural, and sporting events provide new occasions where women invest in diverse clothing styles.

Key Growth Drivers of Saudi Arabia Women Apparel Market:

High Disposable Incomes and Evolving Lifestyles

Increasing disposable incomes among Saudi women, fueled by broader economic reforms and workforce participation, are significantly driving apparel demand. As financial independence is increasing, women are investing more in clothing that reflects personal style, professional needs, and social aspirations. Modern lifestyles that include frequent social outings, workplace participation, and leisure activities have amplified the need for diverse apparel collections ranging from traditional attire to contemporary fashion. Retailers are tailoring product lines to appeal to women who desire quality, style, and functionality. This trend is also supported by the rise of aspirational spending, where apparel is seen as a key part of identity expression. Consequently, increasing purchasing power and lifestyle diversification are encouraging both domestic and international brands to expand their offerings in Saudi Arabia’s dynamic women apparel market.

Growth of Organized Retail and Shopping Malls

Organized retail expansion, particularly the rise of shopping malls and branded outlets, is fueling the market growth in Saudi Arabia. Malls provide women with safe, comfortable environments to explore fashion brands, interact with sales staff, and enjoy shopping as a leisure activity. International brands, local designers, and boutique stores are increasingly present in malls, offering women access to a wide range of apparel options. Retailers also enhance engagement by hosting fashion events, loyalty programs, and seasonal sales that encourage repeat purchases. The rise of retail destinations in urban centers like Riyadh, Jeddah, and Dammam has made women’s fashion shopping more experiential. This retail transformation aligns with changing user behavior where women seek quality shopping experiences in addition to products, thereby making organized retail an essential driver of the market growth in the Kingdom.

Increasing Participation of International and Local Brands

International brands are entering the Kingdom with localized collections that suit cultural preferences while offering global style options. Meanwhile, local designers and homegrown brands are gaining popularity by introducing innovative designs that blend tradition with modernity. This competitive environment provides women with more choices across different price points, styles, and categories. Brands are also investing in marketing campaigns, influencer collaborations, and in-store experiences to capture consumer loyalty. Partnerships between international players and local businesses are further strengthening distribution networks and supply chains. This increased participation is not only diversifying the market but also elevating fashion standards, ensuring that Saudi women have access to dynamic, high-quality apparel offerings that meet both cultural expectations and global fashion benchmarks.

Saudi Arabia Women Apparel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on product type, season, and distribution channel.

Product Type Insights:

- Tops and Dresses

- Bottom Wear

- Innerwear and Sleepwear

- Coats

- Jackets and Suits

- Ethnic Wear

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes tops and dresses, bottom wear, innerwear and sleepwear, coats, jackets and suits, ethnic wear, and others.

Season Insights:

- Summer Wear

- Winter Wear

- All Season Wear

The report has provided a detailed breakup and analysis of the market based on the season. This includes summer wear, winter wear, and all season wear.

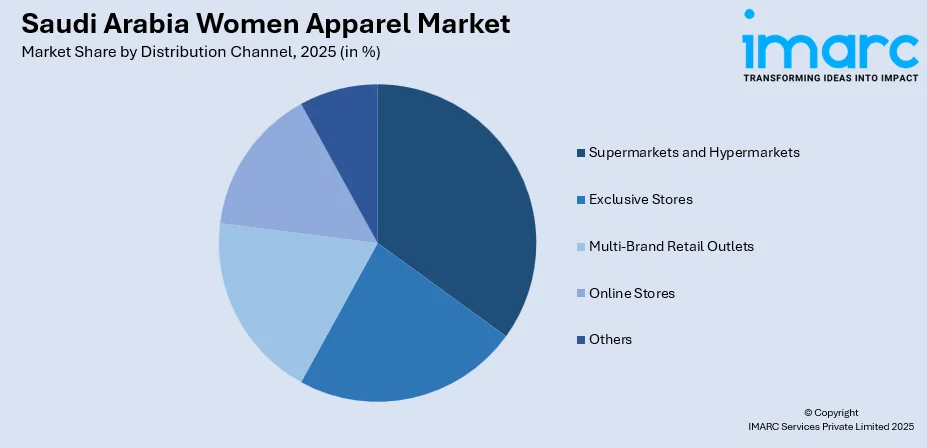

Distribution Channel Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Supermarkets and Hypermarkets

- Exclusive Stores

- Multi-Brand Retail Outlets

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, exclusive stores, multi-brand retail outlets, online stores, and others.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include the Northern and Central region, Western region, Eastern region, and Southern region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Women Apparel Market News:

- September 2025: Missoni, famous for its vibrant knitwear, inaugurated its first store in Saudi Arabia. The boutique featured Missoni's ready-to-wear lines for both women and men, alongside offerings for children, accessories, swimwear, and products from the home collection.

- April 2025: LOLA CASADEMUNT, the renowned women's fashion and accessories label, launched its third store in Saudi Arabia at one of Riyadh's most prestigious shopping centers, Solitaire Mall. The decor featured a blend of simplicity and elegance, presenting a clean, functional, and monochrome aesthetic that highlighted the apparel and accessories, creating a shopping experience that could directly interact with the product.

- September 2024: The Saudi Fashion Commission unveiled its 2024 State of Fashion Report while on an investment tour in London. The report emphasized that the fashion industry's share of the Kingdom's GDP rose to 2.5%, up from 1.4% in 2023, and mentioned that women made up 52% of the workforce in fashion.

Saudi Arabia Women Apparel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Tops and Dresses, Bottom Wear, Innerwear and Sleepwear, Coats, Jackets and Suits, Ethnic Wear, Others |

| Seasons Covered | Summer Wear, Winter Wear, All Season Wear |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Exclusive Stores, Multi-Brand Retail Outlets, Online Stores, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia women apparel market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia women apparel market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia women apparel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The women apparel market in Saudi Arabia was valued at USD 13.5 Billion in 2025.

The Saudi Arabia women apparel market is projected to exhibit a CAGR of 4.43% during 2026-2034, reaching a value of USD 20.0 Billion by 2034.

Younger demographics are driving the demand for modern and trendy fashion brands while still valuing traditional and modest styles. E-commerce platforms and international retail chains have improved accessibility and variety, encouraging higher spending on apparel. Additionally, the growing disposable incomes and exposure to worldwide fashion styles through social media are catalyzing the demand in both casual and luxury segments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)