Saudi Arabia Yoga Accessories Market Size, Share, Trends and Forecast by Product, Application, Sales Channel, and Region, 2026-2034

Saudi Arabia Yoga Accessories Market Summary:

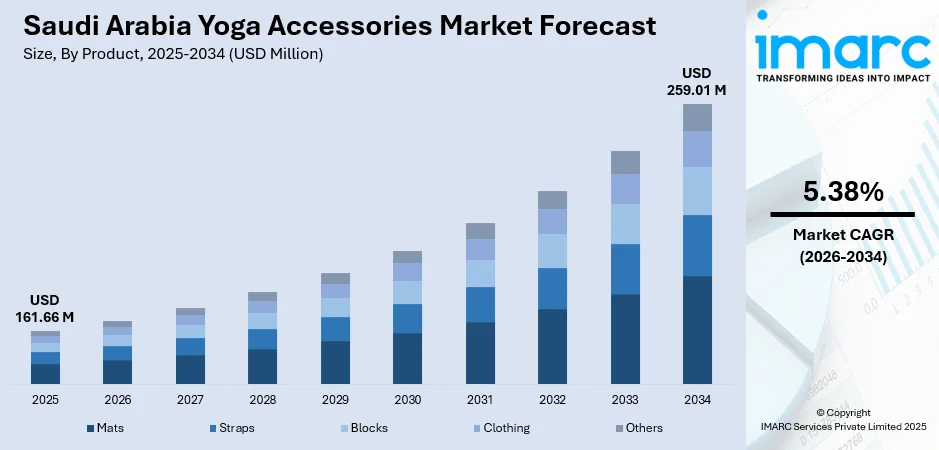

The Saudi Arabia yoga accessories market size was valued at USD 161.66 Million in 2025 and is projected to reach USD 259.01 Million by 2034, growing at a compound annual growth rate of 5.38% from 2026-2034.

The Saudi Arabia yoga accessories market is witnessing expansion driven by increasing health consciousness among the population, the growing adoption of holistic wellness practices, and the proliferation of fitness centers and yoga studios across major urban areas. The rising participation of women in physical fitness activities following social reforms has significantly boosted demand for yoga mats, blocks, straps, and apparel. Additionally, government-backed wellness initiatives under Vision 2030 and the integration of yoga into corporate wellness programs are fostering widespread acceptance. The expanding e-commerce infrastructure and social media influence further accelerate accessibility and consumer awareness, strengthening the Saudi Arabia yoga accessories market share.

Key Takeaways and Insights:

- By Product: Mats dominate the market with a share of 52% in 2025, owing to their essential role in yoga practice, growing consumer preference for high-quality and eco-friendly materials, and increasing adoption among home practitioners seeking comfort and durability for daily wellness routines.

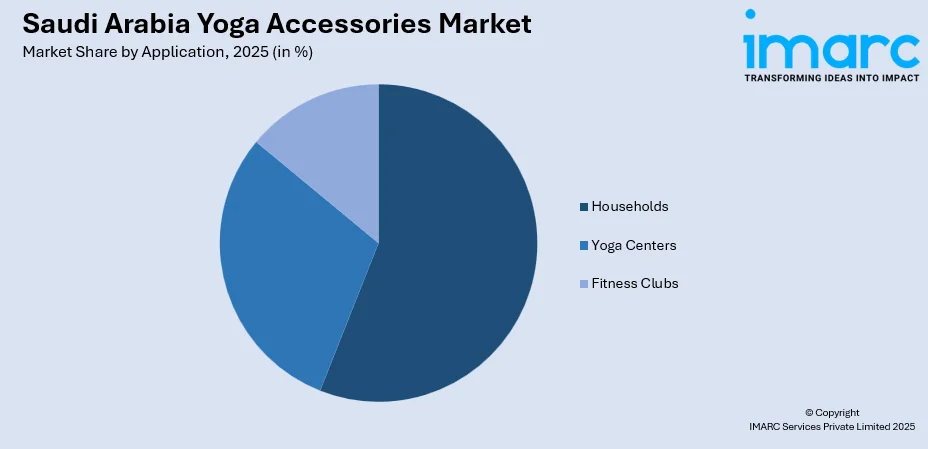

- By Application: Households lead the market with a share of 56% in 2025, driven by the rising trend of home-based fitness routines, convenience of practicing yoga at home, and growing availability of online yoga instruction platforms that encourage personal practice spaces.

- By Sales Channel: Offline exhibits a clear dominance in the market with 54% share in 2025, reflecting consumer preference for physically examining product quality, immediate availability through specialty sports retailers, and the growing presence of international fitness brands in premium shopping destinations.

- By Region: Northern and Central Region dominates the market with 40% share in 2025, driven by the concentration of population in Riyadh, higher disposable incomes, presence of premium fitness facilities, and the establishment of flagship wellness brands in the capital region.

- Key Players: Key players drive the Saudi Arabia yoga accessories market by expanding product portfolios, introducing premium and culturally adapted offerings, and strengthening distribution networks. Their investments in brand partnerships, social media marketing, and collaborations with fitness influencers enhance consumer engagement and market penetration.

To get more information on this market Request Sample

The Saudi Arabia yoga accessories market is undergoing a transformative phase, supported by shifting lifestyle preferences and heightened awareness of mental and physical well-being. According to GASTAT's 2024 Health Determinants Statistics, 23.1% of the population aged 15 and above is classified as obese, while 45.1% are overweight, creating substantial demand for fitness solutions including yoga practice. Moreover, the Government's Quality of Life Program under Vision 2030 prioritizes increasing public participation in physical activities, creating substantial opportunities for yoga accessory manufacturers. The proliferation of women-only fitness facilities and yoga studios has particularly accelerated demand for gender-specific products including modest activewear and vibrant yoga mats. Urban centers such as Riyadh and Jeddah are witnessing rapid establishment of boutique wellness studios offering specialized yoga classes. Furthermore, collaborations between international brands and Saudi retailers are expanding product accessibility, while digital platforms enable consumers to explore premium offerings. Corporate wellness programs integrating yoga sessions are also emerging as significant demand drivers, positioning the market for sustained expansion.

Saudi Arabia Yoga Accessories Market Trends:

Rising Popularity of Women-Centric Yoga Products

Brands are creating yoga accessories especially for women in response to societal reforms and the rise in female involvement in fitness. This entails creating comfortable, adaptable, fashionable, and modest yoga clothing that respects cultural standards. Lightweight portable mats, compact yoga kits, and vibrant colored accessories designed for personalization and self-expression are gaining traction. Retailers are leveraging social media platforms popular among Saudi women to market women-focused products through influencers and fitness communities.

Integration of Technology in Wellness Practices

The adoption of technology-enhanced yoga accessories is presently emerging as a key trend in the Saudi Arabia market. Smart yoga mats with embedded sensors for posture correction and alignment monitoring are gaining interest among tech-savvy consumers. Mobile applications offering virtual yoga classes and personalized workout recommendations are driving demand for compatible accessories. Wearable fitness technology integration with yoga practice is enhancing user experience and encouraging consistent engagement with wellness routines.

Growing Preference for Sustainable and Eco-Friendly Materials

Environmental consciousness is increasingly influencing the purchasing decision of people in the Saudi yoga accessories market. People are showing preference for products that ae made from natural rubber, organic cotton, and recycled materials. Brands are consequently offering eco-friendly yoga mats that are non-toxic, biodegradable, and free from harmful chemicals are witnessing growing demand. The trend aligns with broader sustainability initiatives and appeals to health-conscious consumers seeking products that minimize environmental impact.

How Vision 2030 is Transforming the Saudi Arabia Yoga Accessories Market:

Saudi Arabia's Vision 2030 is fundamentally reshaping the wellness landscape and driving unprecedented growth in the yoga accessories market. The Quality of Life Program emphasizes increasing public participation in sports and athletic activities, creating favorable conditions for yoga adoption across the Kingdom. Government-backed recognition has removed cultural barriers and legitimized yoga practice nationwide, encouraging individuals to integrate wellness routines into their daily lives. The establishment of PIF-backed wellness brands and substantial investments in fitness infrastructure are creating a robust ecosystem that positions yoga accessories as essential components of the Kingdom's health transformation agenda. These systematic efforts demonstrate the government's commitment to promoting holistic well-being and fostering an active lifestyle culture among citizens and residents.

Market Outlook 2026-2034:

The Saudi Arabia yoga accessories market outlook remains positive, supported by favorable government policies, expanding fitness infrastructure, and growing consumer interest in holistic wellness practices. The market generated a revenue of USD 161.66 Million in 2025 and is projected to reach a revenue of USD 259.01 Million by 2034, growing at a compound annual growth rate of 5.38% from 2026-2034. The ongoing expansion of yoga studios, wellness centers, and fitness clubs in urban areas will continue driving accessory demand. Rising disposable incomes and increasing preference for premium products will further strengthen market growth prospects.

Saudi Arabia Yoga Accessories Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product | Mats | 52% |

| Application | Households | 56% |

| Sales Channel | Offline | 54% |

| Region | Northern and Central Region | 40% |

Product Insights:

- Mats

- Straps

- Blocks

- Clothing

- Others

Mats dominate with a market share of 52% of the total Saudi Arabia yoga accessories market in 2025.

Yoga mats represent the foundational accessory for practitioners, driving their dominant position in the Saudi market. The demand is propelled by growing home fitness adoption, where consumers prioritize high-quality mats offering superior grip, cushioning, and durability for safe and comfortable practice sessions. Premium mats featuring natural rubber and eco-friendly materials are gaining popularity among health-conscious consumers seeking sustainable options. The variety of thickness levels, textures, and designs available enables practitioners to select products tailored to their specific practice styles and personal preferences.

The expansion of fitness retail infrastructure has enhanced mat accessibility across the Kingdom. Specialty sports retailers, wellness boutiques, and department stores are increasingly dedicating shelf space to yoga accessories, providing consumers with opportunities to physically examine products before purchase. The parallel growth of e-commerce platforms has further broadened market reach, enabling consumers in smaller cities and remote areas to access premium offerings. This dual-channel retail ecosystem supports mat sales by catering to diverse consumer preferences, price sensitivities, and shopping behaviors across the Kingdom.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Yoga Centers

- Households

- Fitness Clubs

Households lead with a share of 56% of the total Saudi Arabia yoga accessories market in 2025.

The household segment dominates due to the increasing preference for home-based fitness routines among Saudi Arabian people. The convenience of practicing yoga at home, combined with proliferation of online yoga instruction platforms, has encouraged individuals to invest in personal yoga accessories. Rising digital fitness adoption enables consumers to follow guided sessions and maintain consistent practice schedules without requiring studio memberships. Mobile applications and streaming services provide access to diverse yoga styles and skill levels, making home practice increasingly accessible and appealing.

The shift toward home wellness spaces has accelerated accessory purchases for residential use. Consumers are creating dedicated practice areas equipped with mats, blocks, and straps for comprehensive home workout setups. The trend is particularly strong among working professionals and women who value privacy and flexibility in scheduling their fitness activities, driving sustained demand for household-oriented yoga accessories. Families are also recognizing the benefits of shared wellness activities, prompting purchases of multiple accessories for household members to practice together in comfortable home environments.

Sales Channel Insights:

- Online

- Offline

Offline exhibits a clear dominance with a 54% share of the total Saudi Arabia yoga accessories market in 2025.

Offline sales channels maintain market leadership due to consumer preference for physically examining product quality before purchase. Specialty sports retailers, department stores, and fitness brand outlets provide tactile shopping experiences where customers can assess mat thickness, texture, and durability. The presence of international brands in premium shopping destinations enhances consumer confidence in product authenticity and quality. Sales associates offer personalized guidance, helping consumers select appropriate accessories based on their practice level and specific requirements.

The expansion of fitness retail networks across Saudi Arabia strengthens offline channel dominance. Major retailers operate extensive store networks offering curated yoga accessory collections across urban centers and shopping malls. Franchise agreements between Saudi retailers and international brands have introduced premium offerings to the Kingdom, with flagship stores serving as destination shopping experiences for yoga enthusiasts. The ability to compare products side-by-side, test material quality, and receive immediate product availability continues attracting consumers who prioritize informed purchasing decisions. This established retail infrastructure creates strong consumer relationships and brand loyalty that sustains offline channel performance.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and Central Region represents the leading segment with a 40% share of the total Saudi Arabia yoga accessories market in 2025.

The Northern and Central Region commands market leadership driven by Riyadh's position as the Kingdom's commercial and population center. The concentration of high-income professionals, presence of premium fitness facilities, and establishment of flagship wellness brands create a robust demand ecosystem. Government investments in sports infrastructure and hosting of major wellness events including FIBO Arabia in September-October 2026 at Riyadh Front Exhibition Center further strengthen the region's market position and consumer engagement.

The capital city's rapid urban development incorporates wellness amenities within residential compounds and commercial complexes, normalizing fitness participation among diverse demographic groups. Corporate wellness programs implemented by Riyadh-based organizations generate institutional demand for yoga accessories, while the region's expatriate community introduces diverse practice preferences that expand product category requirements. The convergence of retail infrastructure, fitness facility density, and consumer purchasing power positions the Northern and Central Region as the primary growth engine for yoga accessories, with secondary cities within the region increasingly contributing to overall demand expansion.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Yoga Accessories Market Growing?

Rising Health Consciousness and Wellness Culture

The market for yoga accessories is primarily driven by Saudi consumers' increasing knowledge of the advantages of fitness and wellness. People are adopting preventative health measures due to growing worries about lifestyle-related ailments like obesity, diabetes, and cardiovascular disorders. According to the General Authority for Statistics, the obesity rate among Saudi adults remains significant, prompting public and private initiatives to encourage physical activity. Yoga offers an accessible, low-impact exercise option that addresses both physical fitness and mental well-being, attracting consumers seeking holistic health solutions. The proliferation of health information through digital channels and social media has amplified awareness about yoga benefits, encouraging accessory purchases for home and studio practice.

Government Initiatives and Vision 2030 Support

Saudi Arabia's Vision 2030 framework provides substantial support for the wellness industry through the Quality of Life Program, which aims to increase public participation in sports and athletic activities. Government recognition of yoga as a legitimate sport has removed regulatory barriers and encouraged mainstream adoption. Substantial investments in the sports sector are creating infrastructure that supports yoga studios and wellness facilities across the Kingdom. Public-private partnerships between the Ministry of Sports and fitness organizations facilitate community wellness initiatives and promote active lifestyle adoption. Regulatory reforms have simplified licensing procedures for fitness establishments, enabling entrepreneurs to open specialized yoga studios. These systematic efforts create a favorable regulatory environment and consumer acceptance that drives sustained accessory demand.

Increasing Female Involvement in Exercise

The remarkable increase in female engagement with sports and fitness activities is transforming the Saudi yoga accessories market. Female sports participation has increased by over 150% since the launch of Vision 2030, with over 330,000 registered female athletes and more than 500 women's sports centers now operating across the Kingdom. Social reforms enabling women's participation in public fitness activities and the establishment of women-only facilities have created unprecedented demand for gender-specific yoga products. Brands responding to this demographic shift are developing modest activewear, vibrant accessory designs, and women-centric marketing strategies. The growth of female yoga practitioners drives demand for personalized accessories that combine functionality with cultural appropriateness.

Market Restraints:

What Challenges the Saudi Arabia Yoga Accessories Market is Facing?

Cultural Perceptions and Social Barriers

Despite growing acceptance, yoga still faces cultural skepticism in certain segments of Saudi society, particularly in traditional and rural areas. Some consumers associate yoga with foreign spiritual practices, limiting widespread adoption. Marketing strategies require careful cultural sensitivity to navigate these perceptions and emphasize yoga's health benefits without conflicting with local values.

Premium Pricing of Quality Products

High-quality yoga accessories from international brands command premium prices that may limit market penetration among price-sensitive consumers. Eco-friendly and sustainably produced products often carry higher costs compared to conventional alternatives. This pricing dynamic creates barriers for entry-level practitioners who may opt for lower-quality alternatives, affecting overall market growth potential.

Limited Specialized Retail Infrastructure

While urban centers have established fitness retail networks, specialized yoga accessory stores remain limited in smaller cities and regions outside major metropolitan areas. This distribution gap restricts product accessibility and consumer exposure to quality offerings. The challenge of reaching underserved markets affects overall market expansion and limits consumer choice in peripheral locations.

Competitive Landscape:

The Saudi Arabia yoga accessories market exhibits a competitive landscape comprising international brands, regional distributors, and emerging local players. Market participants compete through product differentiation, quality positioning, and distribution network expansion. International brands leverage franchise partnerships with established Saudi retailers to access consumer markets. Key strategies include development of culturally adapted product lines, collaborations with fitness influencers, and expansion into e-commerce channels. The entry of premium wellness brands through flagship retail concepts and the establishment of PIF-backed ventures are intensifying competition. Players focus on building brand awareness through social media marketing, participating in wellness events, and developing omnichannel retail experiences to capture market share.

Saudi Arabia Yoga Accessories Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Mats, Straps, Blocks, Clothing, Others |

| Applications Covered | Yoga Centers, Households, Fitness Clubs |

| Sales Channels Covered | Online, Offline |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia yoga accessories market size was valued at USD 161.66 Million in 2025.

The Saudi Arabia yoga accessories market is expected to grow at a compound annual growth rate of 5.38% from 2026-2034 to reach USD 259.01 Million by 2034.

Mats dominate the market with a share of 52%, driven by their essential role in yoga practice, growing consumer preference for high-quality materials, and increasing adoption among home practitioners.

Key factors driving the Saudi Arabia yoga accessories market include rising health consciousness, government support through Vision 2030 initiatives, increasing female participation in fitness activities, proliferation of yoga studios, and growing e-commerce accessibility.

Major challenges include cultural perceptions limiting adoption in traditional communities, premium pricing of quality products affecting price-sensitive consumers, limited specialized retail infrastructure outside major cities, and competition from alternative fitness equipment categories.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)