Scientific and Technical Publication Market Size, Share, Trends and Forecast by Product, End User, and Region, 2025-2033

Scientific and Technical Publication Market Size and Share:

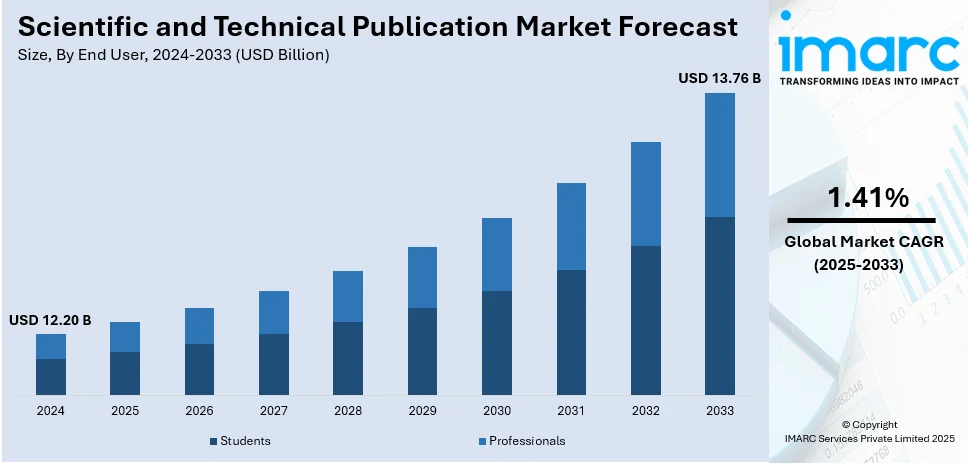

The global scientific and technical publication market size was valued at USD 12.20 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 13.76 Billion by 2033, exhibiting a CAGR of 1.41% from 2025-2033. North America currently dominates the market, holding a market share of over 35% in 2024. The widespread adoption of scientific and technical publications across universities to gain in-depth knowledge regarding inventions, discoveries, novel technologies, and their applications in agriculture, botanical and environmental sciences, and aerospace represents some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 12.20 Billion |

|

Market Forecast in 2033

|

USD 13.76 Billion |

| Market Growth Rate (2025-2033) | 1.41% |

The scientific and technical publishing market growth is stimulated by the global acceleration of academic and research content digitization, with an expanding movement toward online media for the delivery of scientific information. This has seen the high use of e-journals, research articles, and online conferences, providing quicker and more efficient access to content. The shift from print to online publications has been boosted by the COVID-19 pandemic, which underlined the value of distance access to scientific and educational materials. Another strong push is the emergence of open access (OA) publishing, which makes scientific and technical material freely accessible, making wider dissemination possible and inclusivity in sharing knowledge possible. This increasing access is facilitating innovation and collaboration among sectors, with an overall contribution towards the development of the market.

In the United States, the demand for scientific and technical publications is fueled by the expanding number of research institutions, universities, and government initiatives focused on advancing scientific knowledge, representing one of the key scientific and technical publication market trends. For instance, as of the 2023-24 academic year, the United States has 5,819 Title IV degree-granting institutions, which include both colleges and universities, contributing to the market growth in the United States. The continued evolution of digital platforms has enabled researchers to access and share information more effectively, further boosting the use of digital publications. Additionally, increasing collaboration between sectors, such as healthcare and technology, enhances the need for accessible, reliable, and up-to-date scientific literature. These factors are helping to solidify the U.S. as a major contributor to the global scientific publishing industry.

Scientific and Technical Publication Market Trends:

Adoption of Digital and Scientific Publications

The widespread adoption of scientific and technical publications across educational institutions and universities represents one of the key factors driving the market growth. Additionally, the steadily expanding publishing sector is acting as another major growth-inducing factor. In line with this, there is an increasing amount of literature that is being published pertaining to scientific and technical knowledge. For instance, as per industry reports, the total number of scientific articles published has increased, with an annual rise of approximately 5.6%. This surge reflects that expanding global research community and the increasing volume of scientific output. Additionally, the steadily rising popularity of digital publications as compared to print publications is also driving the market toward growth. This was further facilitated during the sudden outbreak of the COVID-19 pandemic, which propelled the digital dissemination of scientific knowledge significantly, thus contributing to the market growth.

Revenue Growth in the Publishing Sector

The Association of American Publishers (AAP) reported a total revenue rise of 8.5% in August 2024, to USD 1.7 Billion, and an increase of 7.8% year to date, for a total of USD 9.3 Billion through the first eight months of 2024. The market is also driven by the increasing initiatives to make scientific and technical publications open access (OA). Such endeavors ensure free and widespread dispersal of scientific and technical skills, expertise, and crucial information in various forms, such as research papers, journal articles, and conference proceedings. In line with this, an increasing number of e-journal publications and hosting of webinars on subjects of scientific importance are contributing to the market growth.

Government Investments and Technological Advancements

Other factors, such as the increasing penetration of high-speed internet, affordable costs of print publications, rising number of establishments and institutes focusing on scientific and technical research, the allocation of increased budgets to the science and technology sector by governments of various nations, for example, the White House states that President Biden's budget focused on investing in America, including a record-breaking USD 210 Billion for federal R&D, the highest-ever investment in this area, and extensive research and development activities, are creating a positive outlook for the market.

Scientific and Technical Publication Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global scientific and technical publication market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product and end user.

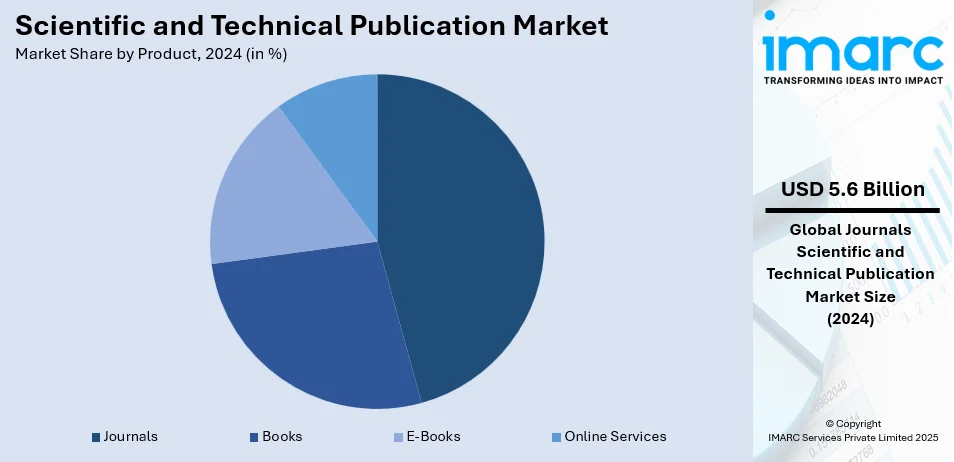

Analysis by Product:

- Books

- Journals

- E-Books

- Online Services

Journals leads the market with around 45.5% of the scientific and technical publication market share in 2024, driven by their crucial role in disseminating peer-reviewed research and advancements. As a primary source of scholarly content, journals cater to diverse fields, including healthcare, engineering, and environmental sciences. Their significance is heightened by the growing demand for high-quality, up-to-date information from academia, industry professionals, and researchers. Digital platforms and open access models have further expanded the reach and accessibility of journals, enhancing their role in global knowledge sharing and advancing scientific progress.

Analysis by End User:

- Students

- Professionals

Students leads the market in 2024, propelled by their increasing demand for academic resources to support their studies. Access to scientific journals, research papers, and technical publications is essential for students across a range of disciplines, particularly in fields like science, engineering, and medicine. The growing shift to digital platforms and online repositories has further facilitated access to a vast array of scholarly content. As education continues to evolve, students' reliance on updated scientific and technical literature to enhance their knowledge and research capabilities contributes significantly to market growth.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 35%, driven by a robust academic and research infrastructure. The region is home to numerous prestigious universities, research institutions, and tech companies that rely heavily on scientific and technical publications for innovation and development. Additionally, the widespread adoption of digital platforms and open-access initiatives has further enhanced the accessibility of scholarly resources. Furthermore, government support for research and development, along with significant investments in higher education, continues to foster demand for scientific publications, solidifying North America's dominant position in the scientific and technical publication market outlook.

Key Regional Takeaways:

United States Scientific and Technical Publication Market Analysis

In 2024, United States accounted for 88.30% of the market share in North America. The United States dominates the world's scientific and technical publishing market based on a rich research environment, large government financing, and a high-quality network of top universities and research centers. Institutions like the National Science Foundation (NSF) and the National Institutes of Health (NIH) serve as a foundation for supporting superior quality research work. The White House has reaffirmed this pledge, with the President's Budget proposing USD 1.2 Billion for the Directorate for Technology, Innovation, and Partnerships at NSF, to drive scientific research into innovations, industries, and jobs. This enhanced funding fortifies the foundation for leading-edge research and further advances the U.S. leadership in scientific progress. The industry also has a strong publishing sector, with big names such as Elsevier, Wiley, and Springer Nature playing a key role in its development. Open-access programs, endorsed by initiatives like the White House's open science directive, are further increasing accessibility and global reach. In addition, digitalization, AI-enabled research tools, and sophisticated data analytics are transforming content discovery and publishing processes. Growing demand for specialized publications in areas like artificial intelligence, biotechnology, and climate science is also contributing to market growth.

Europe Scientific and Technical Publication Market Analysis

Germany, the UK, and France are at the forefront of promoting innovation and research output and significantly contribute to the world's knowledge economy. Open-access initiatives, especially Plan S, are making high-quality research more widely available, ensuring that scientific research becomes more globally accessible. The European Commission indicates that as of early 2024, the overall Recovery and Resilience Facility (RRF) budget allotted to digital reforms and investments was up to around EUR 150 Billion, accounting for 26% of all RRF funds. This deep investment in digital change is also driving scientific research, publishing tools based on AI, and open-access platforms more quickly, allowing more collaboration and exchanging of knowledge between disciplines. Also, the fact that there are big publishing companies such as Springer Nature and Elsevier enhances scientific publishing in Europe. Latin America's technical and scientific publication sector is expanding, with Brazil, Mexico, and Argentina dominating research output.

Asia Pacific Scientific and Technical Publication Market Analysis

The scientific and technical publishing market is experiencing high growth in the Asia Pacific region, boosted by rising research output from China, India, Japan, and South Korea. China has become a world leader in research articles, backed by national policies such as the "Double First-Class" university program. India is also making great leaps in research contribution, with the Press Information Bureau (PIB) stating that India's contribution to global research publications increased from 3.5% in 2017 to 5.2% in 2024. This growth is being boosted by efforts such as India's National Research Foundation which will boost the nation's research infrastructure and international position. Likewise, Japan's strong emphasis on tech research and South Korea's leadership in innovation-oriented industries also support the market growth. The area enjoys increased government investments, foreign partnerships, and the emergence of open-access platforms that increase access to scientific research. Furthermore, the developments in digital publishing, AI-based analytics, and the integration of big data are also considerably enhancing research sharing. Europe is a world leader in scientific and technical literature, bolstered by solid research centers and funding programs, including the European Union's Horizon Europe initiative.

Latin America Scientific and Technical Publication Market Analysis

The region is supported by government-sponsored research initiatives and open-access schemes, including SciELO (Scientific Electronic Library Online), which further promote the visibility and availability of scientific information. Growing digitalization within publishing and the utilization of AI tools are simplifying research dissemination and making knowledge increasingly accessible. According to reports, Brazil's FINEP offers grants from €280,000 to €400,000, which is 50% of the costs of projects to SMEs, universities, and research institutions and up to €940,000 for large businesses. These financings drive innovation and research promote scientific discovery and increase the output of publications within different fields. Latin America's heavy research emphasis on biodiversity, environmental science, and public health is fueling growth in publications, especially in subjects that respond to global sustainability needs. Enhancing academic partnerships with foreign institutions and investments in tertiary education are further fueling scientific output growth. The Middle East and Africa are also experiencing upbeat growth in scientific and technical publications, fueled by government investments in research and tertiary education.

Middle East and Africa Scientific and Technical Publication Market Analysis

Saudi Arabia, the UAE, and South Africa are leading the way in scientific research, with open-access publishing initiatives and global collaborations. Saudi Arabia spends USD 1.2 Billion per year on the publishing industry, as reported by the MONSHA'AT QUARTERLY REPORT Q3 2024, demonstrating the nation's focus on developing research and knowledge sharing. These investments are contributing to the strengthening of digital publishing platforms, the enlargement of AI-powered research tools, and the worldwide availability of scientific content. Principal research areas of concentration in the region include renewable energy, water conservation, medical advancements, and space research.

Competitive Landscape:

The competitive landscape of the scientific and technical publications market is marked by the presence of key global players, including traditional publishing houses, academic institutions, and emerging digital platforms. Leading publishers focus on expanding their digital portfolios, integrating open access models, and enhancing content discoverability. The rise of open access publishing has intensified competition, pushing companies to innovate and offer more accessible and affordable solutions. For instance, in March 2023, the Royal Astronomical Society (RAS) announced plans that all its journals will transition to Open Access (OA), which will be effective from January 2024. This change will provide the global community with free, immediate, and unrestricted access to high-quality research. Additionally, partnerships between publishers and academic institutions are becoming more common to streamline content dissemination. Furthermore, the growing demand for specialized, high-quality scientific content further drives competition, requiring companies to continuously adapt to evolving industry trends and technologies.

The report provides a comprehensive analysis of the competitive landscape in the scientific and technical publication market with detailed profiles of all major companies, including:

- ACTA Press

- Canadian Science Publishing

- Elsevier (RELX plc)

- Informa PLC

- John Wiley & Sons Inc.

- Springer Science+Business Media

- Wolters Kluwer N.V.

Latest News and Developments:

- October 2024: The American Council of Trustees and Alumni (ACTA) initiated a campus freedom initiative at the University of Pittsburgh in the form of its Campus Freedom Initiative. Based on a campus survey, broad self-censorship, intolerance of viewpoints, and absence of training in free expression among the students prompted the university to incorporate ACTA's Gold Standard on freedom of expression.

- August 2024: The University of Toronto Press collaborated with Canadian Science Publishing to publish a new program of science books. The effort aimed to explore vital scientific concerns like Arctic science, climate change, biodiversity, and ocean health. The partnership brought together CSP's experience in producing influential scholarly publications with UTP's strength in doing so.

- March 2024: Elsevier introduced Scopus a generative AI application embedded in Scopus' vast research database. Following a five-month trial, the product was launched in its final form in January 2024. Scopus AI enables researchers to rapidly access credible references, propose further research avenues, and improve research efficiency while being transparent about data sources.

- October 2024: Wiley announced a growth in its Advanced Portfolio, expanding six new life and health science journals by 2026, two of which are dedicated to AI. The portfolio, which already comprises prestigious titles such as Advanced Materials, will also extend its presence further in physical sciences, including chemistry and AI research.

- January 2025: Springer Nature introduced an AI tool to automate editorial quality checks, assisting editors and peer reviewers in recognizing inappropriate manuscripts before peer review. Incorporating into its Snapp platform, the tool seeks to accelerate the publishing process, enhance manuscript quality, and maintain research integrity, while human experts validate AI findings.

Scientific and Technical Publication Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Books, Journals, E-Books, Online Services |

| End Users Covered | Students, Professionals |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ACTA Press, Canadian Science Publishing, Elsevier (RELX plc), Informa PLC, John Wiley & Sons Inc., Springer Science+Business Media, Wolters Kluwer N.V., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the scientific and technical publication market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global scientific and technical publication market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the scientific and technical publication industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The scientific and technical publication market was valued at USD 12.20 Billion in 2024.

IMARC estimates the global scientific and technical publication market to reach USD 13.76 Billion in 2033, exhibiting a CAGR of 1.41% during 2025-2033.

The market is driven by rising research activities, digital transformation, and the growing need for accessible scholarly content. Additionally, open access initiatives, academic collaborations, and government investments in research contribute to the increasing scientific and technical publication market demand.

North America currently dominates the market, holding a market share of over 35% in 2024. This leadership is driven by its strong academic institutions, research initiatives, and technological advancements. The region's investment in digital platforms and open-access models further drives its dominance in the market.

Some of the major players in the scientific and technical publication market include ACTA Press, Canadian Science Publishing, Elsevier (RELX plc), Informa PLC, John Wiley & Sons Inc., Springer Science+Business Media, Wolters Kluwer N.V., etc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)