Security Market Size, Share, Trends and Forecast by System, Service, End User, and Region, 2025-2033

Security Market Size and Share:

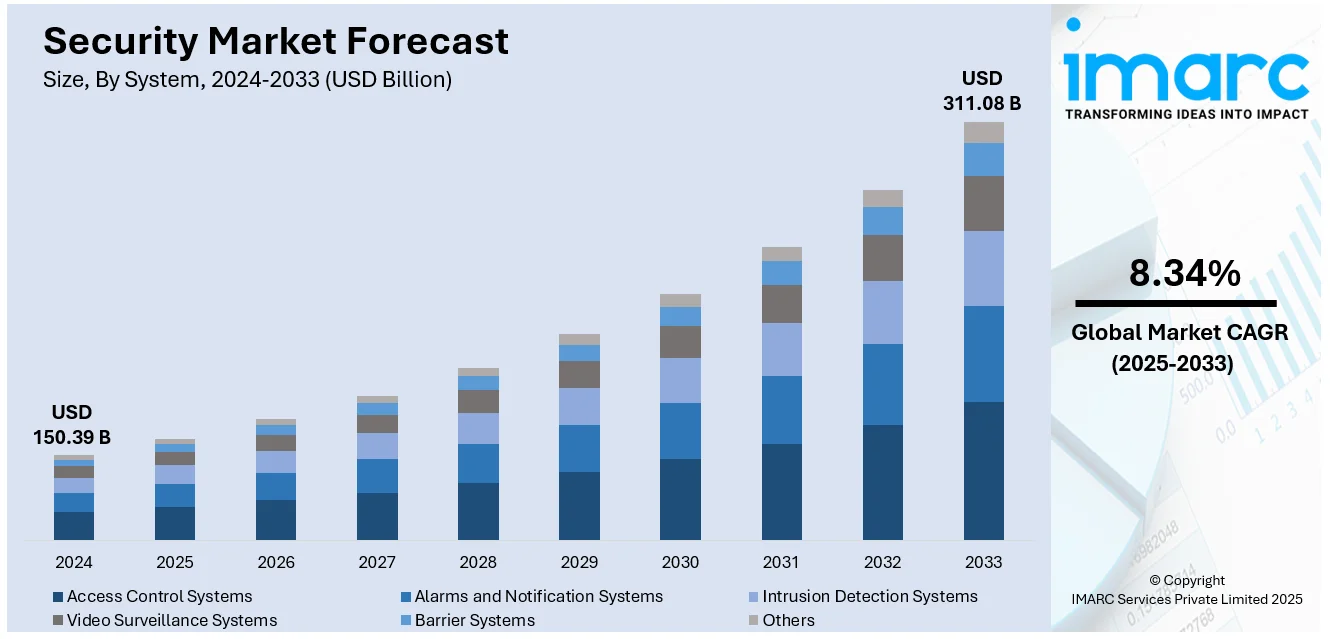

The global security market size was valued at USD 150.39 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 311.08 Billion by 2033, exhibiting a CAGR of 8.34% from 2025-2033. North America currently dominates the market, with 33.8% of the market share. The escalating cyberattacks and geopolitical tensions, rising terrorism and organized crime, rapid expansion of smart cities, regulatory compliance, and advancements in artificial intelligence (AI) are facilitating the expansion of the security market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 150.39 Billion |

| Market Forecast in 2033 | USD 311.08 Billion |

| Market Growth Rate (2025-2033) | 8.34% |

The global security market is experiencing significant growth, driven by a combination of technological advancements, increasing threats to cybersecurity, and evolving consumer demand for enhanced safety measures. Key security industry trends include the widespread usage of advanced technologies like machine learning (ML), artificial intelligence (AI), and blockchain to bolster both physical and digital security infrastructures. AI and ML, in particular, are being leveraged to develop predictive threat detection systems, enabling organizations to identify and respond to potential risks in real time. The growing use of biometric systems, including facial recognition, fingerprint scanning, and voice recognition, is transforming access control and authentication processes across industries, with sectors such as banking, healthcare, and retail leading the way in implementation.

The United States has emerged as a major region in the security market because of several factors. The adoption of cutting-edge technologies such as artificial intelligence (AI), machine learning (ML), and blockchain is transforming security measures across industries. AI and ML are enabling the development of predictive analytics and real-time threat detection systems, which are critical for mitigating risks in an era marked by growing cybersecurity incidents. These advancements are particularly significant in sectors such as financial services, healthcare, and retail, where safeguarding sensitive data is paramount. As IoT adoption grows, so does the need for robust IoT security solutions to protect devices and networks from sophisticated cyberattacks, such as ransomware and distributed denial-of-service (DDoS) attacks, which continue to rise in frequency and complexity. Cloud security has become a focal point in the US market, as enterprises increasingly shift to cloud-based services. Organizations are prioritizing cloud-native security tools, including identity and access management (IAM) and secure web gateways, to protect data in transit and at rest, while maintaining compliance with regulatory standards. As per the predictions of the IMARC Group, the US application security market is expected to reach US$ 8.68 billion by 2032.

Security Market Trends:

Escalating Cyberattacks Emphasizing the Need for Robust Cybersecurity Solutions

Cyberattacks have emerged as a significant growth driver in the global security market. With the increased interconnectivity and dependency of businesses on digital operations, the need for robust cybersecurity strategies continues to rise. The report by Cybersecurity Ventures puts the estimated cost of cybercrime globally at more than USD 10.5 trillion annually by 2025, thus highlighting the importance of enhanced cybersecurity measures. According to IBM, global average data breach cost was recorded at USD 4.45 million in 2023, which increased by 15% over the past three years, with the United States having the highest cost of a data breach, which had surpassed USD 5.09 million. Besides this, data extracted from industrial reports indicated that in 2023, more than 72.7% of all organizations around the globe were a victim of a ransomware attack. In February 2022, IBM Corp. revealed a multi-million-dollar investment that will expand the resources in cyber security, which further helps businesses prepare for and manage the growing threat of cyberattack across the APAC region.

Geopolitical Tensions and Demand for Defense Technologies

Geopolitical tensions and regional conflicts have a profound impact on the global security market. As countries focus on national security, spending on R&D of new defense technologies increases. For example, the US Department of Defense used novel acquisitions and budgeting authorities to achieve access to commercial technology to elevate the prominence of the Defense Innovation Unit. It led them to establish the Replicator initiative in 2023 in order to rapidly field autonomous aerial, ground, surface, sub-surface, and/or space systems. Similarly, NATO's DIANA (Defense Innovation Accelerator for the North Atlantic) has announced in March 2024 that it is expanding the transatlantic network of accelerator sites and its test center, enhancing DIANA's capacity to contribute to the defense sector innovator community. A UK-based security and artificial intelligence company focused on the defense sector signed a strategic cooperation agreement with Saab AB, the Swedish aerospace and defense company, in September 2023. Saab AB has invested EUR 75 million, or USD 76.91 Million in cash, to acquire a 5% stake in Helsing GmBH. The objective of the partnership was to merge Helsing's advanced AI capabilities with Saab's hardware-based sensors and self-protection systems to further improve Saab's portfolio to meet the changing needs of customers and organizations.

Rising Instances of Terrorism and Advanced Threat Detection

The escalating instances of terrorism and organized crime underpin the critical need for advanced threat detection and prevention mechanisms. A Global Terrorism Index (GTI) report of 2024 indicates that terrorism-related deaths rose by 22% to 8,352, marking the highest level since 2017. As the nature of threats evolves, the continuous development and deployment of state-of-the-art security technologies remain pivotal in safeguarding societies and maintaining public safety. For example, in December 2022, LogRhythm Inc. announced its partnership with SentinelOne, an autonomous cybersecurity platform company, to provide an integrated enterprise solution. This integration aims to expand visibility through centralized data collection, initiate automation, and reduce complexity, further streamlining security operations and improving response workflow. Together, the companies will offer advanced threat intelligence capabilities with enhanced analytics to reduce the number of cybersecurity risks globally.

Security Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global security market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on system, service, and end user.

Analysis by System:

- Access Control Systems

- Alarms and Notification Systems

- Intrusion Detection Systems

- Video Surveillance Systems

- Barrier Systems

- Others

Video surveillance systems hold 47.8% of the market share. According to the report, video surveillance systems represented the largest segment. The video surveillance systems segment is dominating the security market due to the increasing need for crime prevention and public safety. In line with this, rapid urbanization has considerably surged the requirement for monitoring public spaces, transportation hubs, and critical infrastructure intensifies, which is supporting the security market growth. Moreover, technological advancements such as high-definition cameras, video analytics, and real-time monitoring capabilities enhance the effectiveness of surveillance systems, making them indispensable tools for law enforcement and security personnel. Additionally, the integration of video surveillance with other security technologies like access control and intrusion detection creates comprehensive security ecosystems that offer seamless threat detection and response. Furthermore, regulatory mandates and compliance requirements in sectors such as retail, finance, and healthcare propel the adoption of video surveillance systems to ensure compliance and deter unauthorized activities.

Analysis by Service:

- System Integration and Consulting

- Risk Assessment and Analysis

- Managed Services

- Maintenance and Support

System integration and consulting account for 50.3% of the market share. According to the report, system integration and consulting represented the largest segment. The system integration and consulting segment is driven by several key factors, including the increasing complexity of modern business processes and technologies, which has necessitated expert guidance to seamlessly integrate diverse systems and applications. This complexity arises from the need to optimize operations, enhance efficiency, and ensure data consistency across an organization's IT ecosystem. Moreover, the rapid pace of technological innovation compels businesses to continually adopt and adapt new tools and platforms. System integration and consulting provide the expertise needed to select, customize, and integrate these technologies effectively, enabling companies to remain competitive in dynamic markets. Additionally, the demand for streamlined workflows and enhanced user experiences drives organizations to seek holistic solutions that bridge gaps between various systems. System integration and consulting services play a pivotal role in crafting solutions that align with specific business goals, facilitating smoother operations and improved user interactions. The market underscores the importance of system integration and consulting services in addressing the increasingly complex cybersecurity landscape.

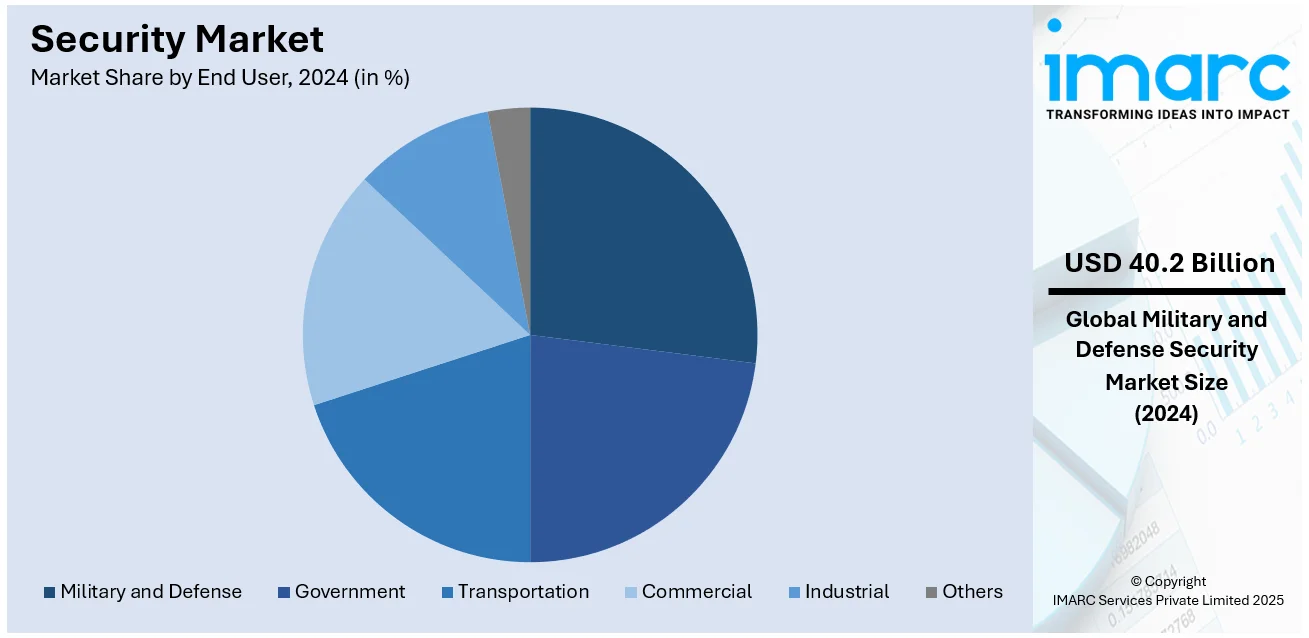

Analysis by End User:

- Government

- Military and Defense

- Transportation

- Commercial

- Industrial

- Others

According to recent security industry statistics, the military and defense segment's significant 26.7% market share underscores the robust demand for advanced security solutions and technologies across global markets. The military and defense segment is influenced by geopolitical tensions and regional conflicts, which has driven nations to prioritize their defense capabilities, leading to increased investments in military modernization and technological advancements. Moreover, the need to counter evolving security threats, such as cyberattacks and asymmetric warfare, fuels demand for cutting-edge defense technologies and strategies. Additionally, the pursuit of national security and sovereignty prompts governments to enhance their defense preparedness, leading to investments in areas like intelligence, surveillance, and reconnaissance systems. Furthermore, the emergence of non-traditional threats like pandemics and environmental crises highlights the importance of versatile defense capabilities that can address a range of challenges, thereby offering a favorable security market outlook. The collaborations between nations in joint defense projects also contribute to the growth of the military and defense segment.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America holds 33.8% of the market share. North America accounted for the largest market share as per the security market report. In North America, several key factors drive the dynamics of the security market, including the region's technological advancement and widespread digitalization create a pressing need for robust cybersecurity measures. With a significant reliance on digital platforms for commerce, communication, and critical infrastructure, the demand for advanced threat detection, encryption, and data protection solutions remains high. Furthermore, the region's geopolitical landscape, marked by international trade dynamics and diplomatic relations, underscores the importance of defense technologies and drives the security market demand. The need to ensure national security, counter potential threats, and support allied nations drives investments in defense systems, surveillance technologies, and military communication networks. Apart from this, the region's proactive approach towards addressing evolving threats, such as terrorism and cyberattacks, fosters a climate of innovation. This encourages the development and implementation of cutting-edge security solutions, leveraging technologies like artificial intelligence (AI), biometrics, and internet of things (IoT) integration to provide comprehensive protection across physical and digital domains. In 2024, Johnson Controls International PLC declared the commercia availability of its Security Operations Centers (SOC) service offering in the North American industry.

Key Regional Takeaways:

United States Security Market Analysis

The United States hold 83.30% share in North America. The US security market is being driven by growing investments in advanced surveillance systems, cybersecurity protection, and physical security solutions. In 2022, the federal government spent more than USD 11 Billion on cybersecurity projects to protect critical infrastructure, as per reports. Businesses are investing heavily in firewalls, intrusion detection systems, and endpoint security solutions due to increasing cyber-attack fears. More than 70% of American businesses have implemented cloud-based security solutions as per reports. The proliferation of Internet of Things (IoT) devices, which will surpass 16 billion linked devices by 2023 as per reports, requires strong security measures to handle risks. More than a million additional security cameras are installed every year. Thus, the business sector increases demand for access control and video surveillance systems. In addition, the residential market is growing, with 40% of all home automation systems being smart home security solutions, according to reports. Adoption is further hastened by regulatory frameworks including the Cybersecurity Maturity Model Certification (CMMC).

Europe Security Market Analysis

Strict data protection laws such as the GDPR have stimulated the European security market by encouraging companies to invest in strong cybersecurity infrastructure. A 57% rise in ransomware attacks from 2022 to 2023, according to the European Digital SME Alliance's "Ransomware Landscape in Europe" research, depicts the landscape of cyber threats in detail. In order to upgrade surveillance and monitoring technologies, Safe City programs implemented by governments of countries such as the UK, Germany, and France have seen considerable investment in public safety measures. European airports already apply face recognition technology as an example of increasing biometric security systems especially at financial institution and airports. For example, all airlines to be allowed using face biometric identification from the check-in time up to board the aircraft under SITA collaboration with Fraport. Airline passengers across the world could now pass Frankfurt faster and in a hassle-free way through this airport's very first biometric touchpoints across Europe. Considering the fact that 45% of the businesses in Europe have shifted their workload to the cloud, cloud security is another reason driving the requirement. The surge in smart home has increased demand for IoT-based home security products such as motion sensors and video doorbells, which will also enhance the security industry growth rate.

Asia Pacific Security Market Analysis

Asia-Pacific security market is driven due to rapid urbanization and industry-wise digital transformation. China and India are two of the largest contributors, accounting for more than 50% of the world's population, with huge investments in smart city initiatives, as per reports. China alone spends billions of dollars on surveillance and public safety systems, including installing the most advanced cameras that can use AI. Due to increased cyberattacks, businesses have been compelled to make use of endpoint protection and managed security services. According to reports, more than 25% of the worldwide breaches occur in this region. Over 80% of their banks utilize biometric authentication, hence South Korea and Japan lead the pack in biometric security. According to an industry report, the growth of e-commerce and online transactions, which created more than USD 3 Trillion in sales in 2022, has led to greater focus on protection of payment gateways and customer data. Furthermore, the expansion of 5G networks is also fueling the region's demand for advanced security solutions.

Latin America Security Market Analysis

Crime is increasing in Latin America, as well as people's need to feel safe within their communities. Brazil witnessed 4,047 instances of cargo theft during July and August of 2024. According to statistics, the combined states of São Paulo and Rio de Janeiro were responsible for 78% of all thefts, with miscellaneous products accounting for 44% of instances and auto & parts for 15%. This prompted government measures to install sophisticated surveillance systems in urban areas. A significant number of homeowners in big cities have invested in video doorbells and alarm systems, indicating the growing popularity of smart home security solutions. Another important factor is cybersecurity, since the region sees 91% of region’s companies recorded one cyberattacks in 2023, as per reports which prompts companies to purchase firewalls and anti-phishing software. International corporations expanding their operations in the region are also enforcing global security standards, which is driving the adoption of advanced access control and monitoring systems.

Middle East and Africa Security Market Analysis

Considerable funding in infrastructure development and public safety are supporting the security sector in the Middle East and Africa. Smart city projects in such countries as Saudi Arabia and United Arab Emirates already have set up over USD 50 Billion towards access control and surveillance technologies in the data revealed by Smart Cities Saudi, as per reports. Government agencies have therefore established national cyber security agencies so as to answer the region's growing cyber threats and geopolitical instability, making security a high priority. The largest contributor to the economy, the oil and gas sector, is ensuring vital infrastructure with robust security measures. As of now, more than 60% of the businesses in the region are spending money on cloud-based security solutions, according to an industry report. In order to ensure safe online consumer interactions, the growth of e-commerce platforms and digital transactions is also driving the demand for secure payment gateways and fraud detection systems.

Competitive Landscape:

Security companies are heavily investing in R&D to introduce unique solutions that help eradicate evolving threats and challenges. For instance, firms are leveraging artificial intelligence (AI), machine learning (ML), and big data analytics to create predictive threat detection systems, improve incident response times, and provide actionable insights. In 2024, Safe Security declared the release of SAFE X a generative AI-powered mobile application for CISOs. SAFE X provides CISOs real time business insights into their cybersecurity scenario, facilitating enhanced decision making and risk management. Biometrics, blockchain-based security, and advanced encryption methods are also being developed to enhance authentication and data protection capabilities. To address the complexities of modern threats, market players are integrating emerging technologies like cloud computing, Internet of Things (IoT), and quantum encryption into their offerings. Acquisitions and partnerships are key growth strategies employed by major players to expand their capabilities, access new markets, and accelerate innovation.

The report provides a comprehensive analysis of the competitive landscape in the security market with detailed profiles of all major companies, including:

- Ameristar Perimeter Security (Assa Abloy AB)

- ATG Access Ltd.

- Avon Barrier Corporation Ltd. (Perimeter Protection Group)

- Barrier1 Systems LLC

- CIAS Elettronica Srl

- Delta Scientific Corporation

- EL-Go Team

- Frontier Pitts Ltd.

- Honeywell International Inc.

- Johnson Controls International PLC

- Senstar Corporation (Senstar Technologies Ltd.)

- Teledyne FLIR LLC (Teledyne Technologies Incorporated)

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News and Developments:

- January 2025: Axis Bank and AutumnGrey launched the ‘Devanagari PIN,’ a new approach to digital security. By embedding hidden numbers in the Devanagari script, this innovative PIN system enhances security while making it easier for users to remember. It offers a personalized, culturally rooted solution to secure banking.

- January 2025: Hisdesat, in partnership with ESA, announced the upcoming launch of the SpainSat Next Generation I (SNG I) satellite on January 29, 2025, via a SpaceX Falcon 9 rocket. This satellite will provide secure, adaptable communication services for governments and emergency responders across various regions. It features advanced technology, including real-time adjustable antennas, ensuring secure and efficient communications.

- January 2025: MeitY and DSCI launched the Cyber Security Grand Challenge 2.0 with a prize fund of Rs. 6.85 crore. The challenge invites innovators to address key cybersecurity issues such as API security, data security, and AI for threat detection. Winners in each category will receive cash prizes, with the overall Platinum Winner receiving Rs. 1 crore.

- January 2025: AWS launched the £5 million UK Cyber Education Grant Program to enhance cybersecurity in educational institutions across the UK. The program offers AWS credits, security training, and well-architected reviews to help schools and universities improve their cyber resilience. It aims to protect sensitive data and strengthen cybersecurity capabilities in the education sector.

- January 2025: Quantum eMotion launched its quantum-based hardware wallet, QaaS, designed to enhance security in blockchain transactions. The wallet uses Quantum Random Number Generation (QRNG) technology, reducing the risk of monetary loss by up to 98% compared to traditional HD wallets. It integrates deep learning algorithms for optimized key generation, offering a secure and efficient solution for Ethereum transactions.

- November 2024: HCLTech partnered with Intel to launch DataTrustShield, an enterprise data security service designed to protect sensitive information in cloud environments. Leveraging Intel’s Trusted Execution Environments and zero-trust security principles, the solution ensures secure data sharing and compliance with regulatory requirements. The service is tested on Google Cloud and will expand to other major cloud providers.

- October 2024: Leonardo, an Italian defense company, anticipates double-digit growth in its cybersecurity industry in the upcoming years due to the growing need for cutting-edge digital defence solutions worldwide. In order to meet the growing demands for cybersecurity across a range of sectors, including national defence and vital infrastructure, the company is concentrating on growing its investments and portfolio. This expansion is in line with Leonardo's strategic goal of enhancing its global market presence and digital know-how.

- July 2024: Milestone Systems and Arcules have announced a merger to enhance their video technology offerings. By combining Arcules' cloud-based solutions with Milestone's experience in video management software, the partnership seeks to provide cutting-edge video technology and services. The purpose of this calculated action is to improve their market position and increase their ability to provide cutting-edge video solutions to a variety of businesses.

Security Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Systems Covered | Access Control Systems, Alarms and Notification Systems, Intrusion Detection Systems, Video Surveillance Systems, Barrier Systems, Others |

| Services Covered | System Integration and Consulting, Risk Assessment and Analysis, Managed Services, Maintenance and Support |

| End Users Covered | Government, Military and Defense, Transportation, Commercial, Industrial, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Ameristar Perimeter Security (Assa Abloy AB), ATG Access Ltd., Avon Barrier Corporation Ltd. (Perimeter Protection Group), Barrier1 Systems LLC, CIAS Elettronica Srl, Delta Scientific Corporation, EL-Go Team, Frontier Pitts Ltd., Honeywell International Inc., Johnson Controls International PLC, Senstar Corporation (Senstar Technologies Ltd.), Teledyne FLIR LLC (Teledyne Technologies Incorporated), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the security market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global security market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the security industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The security market was valued at USD 150.39 Billion in 2024.

IMARC estimates the security market to exhibit a CAGR of 8.34% during 2025-2033.

Key factors driving the security market include the increasing frequency of cyberattacks, the growth of the Internet of Things (IoT), rising data privacy concerns, advancements in AI and machine learning, regulatory compliance requirements, and the need for businesses to safeguard sensitive information and infrastructure.

North America currently dominates the security market, accounting for a share exceeding 33.8%. This dominance is fueled by rising demand for effective cybersecurity services and increase in malicious activities online.

Some of the major players in the security market include Ameristar Perimeter Security (Assa Abloy AB), ATG Access Ltd., Avon Barrier Corporation Ltd. (Perimeter Protection Group), Barrier1 Systems LLC, CIAS Elettronica Srl, Delta Scientific Corporation, EL-Go Team, Frontier Pitts Ltd., Honeywell International Inc., Johnson Controls International PLC, Senstar Corporation (Senstar Technologies Ltd.), Teledyne FLIR LLC (Teledyne Technologies Incorporated), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)