Seed Coating Market Size, Share, Trends and Forecast by Additive Type, Process, Crop Type, and Region, 2026-2034

Seed Coating Market Size and Share:

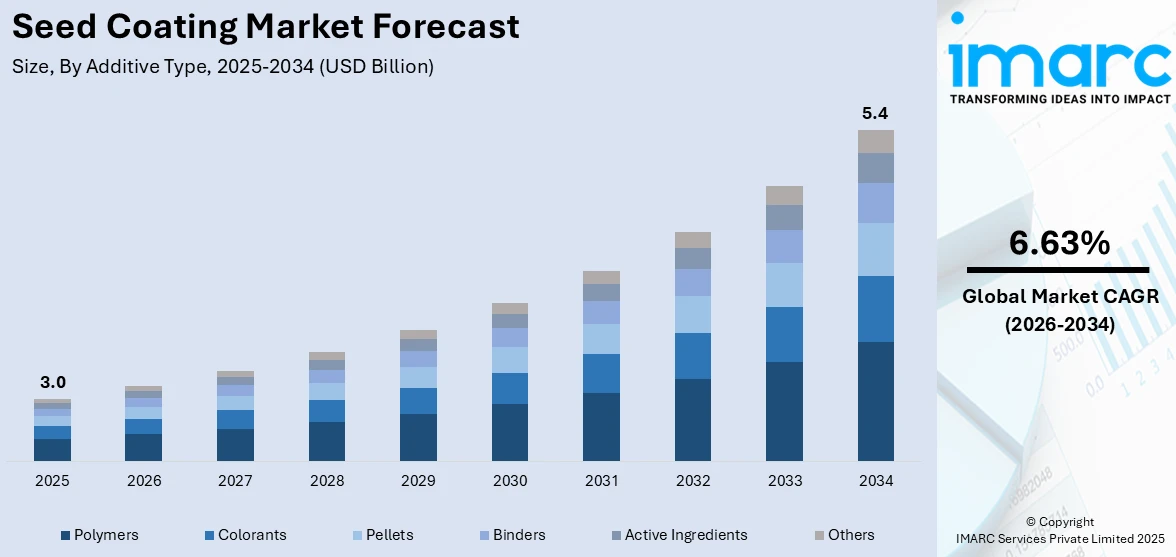

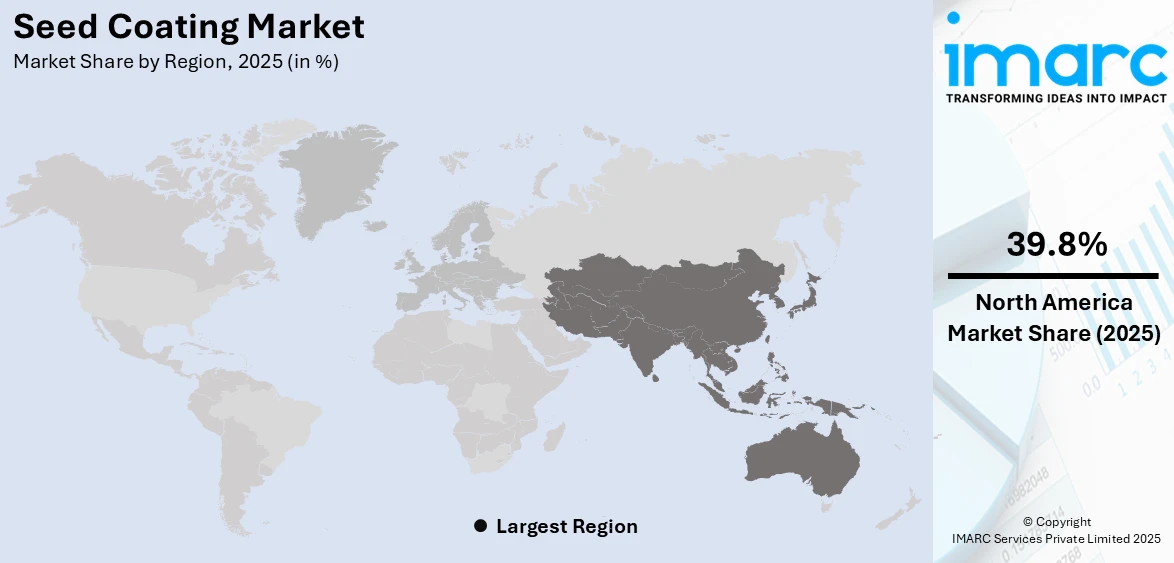

The global seed coating market size was valued at USD 3.0 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 5.4 Billion by 2034, exhibiting a CAGR of 6.63% from 2026-2034. North America currently dominates the market, holding a market share of over 39.8% in 2025. The growth of the North American region is driven by advanced farming technologies, high-yield crop demand, and strong research and development (R&D) initiatives.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 3.0 Billion |

|

Market Forecast in 2034

|

USD 5.4 Billion |

| Market Growth Rate (2026-2034) | 6.63% |

With the population rising and agricultural land getting limited, the need to enhance crop productivity is encouraging the adoption of seed coatings. These coatings improve germination rates, leading to better yields and more efficient use of resources. Moreover, innovations in seed coating materials, particularly polymers and biodegradable options, are enhancing seed protection while aligning with environmental sustainability. These advancements enable the integration of nutrients, pesticides, and other active ingredients, improving seed performance and reducing environmental impact. Besides this, farmers and agricultural organizations are prioritizing eco-friendly methods. Seed coatings help reduce reliance on chemical fertilizers and pesticides, promoting sustainability and improving soil health. Additionally, governing bodies in various regions are promoting the use of seed coatings through subsidies and educational programs to support agricultural development and ensure food security.

To get more information on this market Request Sample

The United States plays a crucial role in the market, driven by the introduction of innovative seed treatment products. These advanced solutions combine proprietary technologies with seed finishers to improve root development, nutrient absorption, and overall crop health. By enhancing nutrient availability and supporting plant vigor, such products meet the demand for higher yields and more efficient farming practices, further advancing the adoption of seed coatings. For example, in 2024, Lallemand Plant Care launched LALRISE SHINE DS, a dry seed treatment for corn and dry beans in the US. The product combines a seed finisher with a proprietary microbe, boosting root vigor, nutrient uptake, and crop growth. It enhances phosphorus availability and supports plant health for higher yields. Apart from this, the rising adoption of precision agriculture practices in the country are driving the demand for coated seeds, which facilitate accurate planting, reduce wastage, and ensure uniform crop growth.

Seed Coating Market Trends:

Addressing Challenges of Declining Arable Land

As reported by the FAO, the total area of arable land worldwide was 1.38 billion hectares in 2019. Furthermore, as stated by UNCCD, there has been a loss of at least 100 million hectares of healthy and productive land annually from 2015 to 2019. The worldwide seed coating industry is experiencing considerable expansion as the decreasing availability of arable land heightens the demand for effective and sustainable farming methods. Due to the scarcity of farmland, increasing crop yields has become a key focus for farmers and agricultural stakeholders. Seed coatings boost germination rates, safeguard against pests and diseases, and strengthen seedling resistance to environmental stress, allowing for optimal utilization of current land. These coatings typically include nutrients, growth enhancers, and microbial treatments that enhance plant strength and promote healthier crops, even in difficult situations. By enhancing planting efficiency and minimizing waste, seed coatings enable farmers to attain greater productivity on smaller land areas. Moreover, the incorporation of innovative seed coating technologies corresponds with worldwide initiatives to tackle food security issues. With the increasing demand to achieve more with fewer resources, seed coatings are becoming an essential solution for contemporary, resource-efficient agriculture.

Advancements in Coating Materials and Technologies

Advancements in seed coating materials, especially biopolymers and sustainable alternatives, are revolutionizing conventional farming methods by increasing seed protection, elevating germination rates, and augmenting crop production. These developments incorporate active components like growth boosters, pest repellents, and nutrient enhancers, guaranteeing ideal seed performance in different environmental settings. The emergence of affordable and sustainable technologies corresponds with the increasing need for environment-friendly farming practices, equipping farmers with effective resources to address issues such as climate change and limited resources. These advanced innovations are enhancing productivity while also lowering input expenses for farmers, thereby making high-quality seeds more attainable. In 2024, the Indian Institute of Oilseeds Research (IIOR) unveiled a patented biopolymer technology aimed at boosting seed protection and increasing crop yields by 25-30%. This innovation, made available to private firms, seeks to lower expenses for farmers and assist crops in enduring climate challenges. The breakthrough is anticipated to transform agricultural methods.

Rising Adoption of Precision Agriculture

The increasing use of precision agriculture techniques is driving the demand for seed coatings, revolutionizing modern farming practices. Precision agriculture enables farmers to optimize planting accuracy, resource efficiency, and crop management, aligning with the need for sustainable and high-yield farming methods. Coated seeds, with their uniform size and shape, enhance mechanical planting efficiency, reduce seed wastage, and ensure uniform crop growth. This compatibility with advanced machinery and planting systems is particularly valuable in precision farming, where even slight inaccuracies can impact productivity. In addition, seed coatings often include active ingredients such as nutrients and pest deterrents, further supporting crop health and growth. According to the IMARC Group, the global precision agriculture market reached a value of USD 9.3 billion in 2024, underscoring the increasing adoption of these technologies.

Seed Coating Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global seed coating market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on additive type, process, and crop type.

Analysis by Additive Type:

- Polymers

- Colorants

- Pellets

- Binders

- Active Ingredients

- Others

Polymers stand as the largest component in 2025, holding 30.2% of the market share. Polymers dominate the market owing to their ability to form a durable, uniform film around seeds, enhancing their physical properties and overall performance. These coatings improve seed flowability, ensuring precision in planting and reducing mechanical damage during sowing. Polymers are widely preferred due to their compatibility with various active ingredients, allowing for the integration of nutrients, pesticides, and growth stimulants. This versatility enables tailored solutions for different crops and growing conditions, supporting higher germination rates and early-stage plant vigor. Moreover, polymer coatings provide protection against environmental stresses, such as moisture and temperature fluctuations, which can otherwise compromise seed viability. Their use also facilitates controlled release of active ingredients, optimizing resource utilization and reducing wastage. Innovations in biodegradable polymers are further boosting their appeal, aligning with sustainability goals and regulatory requirements.

Analysis by Process:

- Film Coating

- Encrusting

- Pelleting

Film coating is the largest segment, driven by its ability to provide a thin, uniform layer of protective material around the seed without significantly altering its size or weight. This process enhances seed performance by improving flowability, ensuring precision in mechanical sowing, and reducing dust-off, which minimizes product loss and environmental impact. Film coating also allows for the integration of active ingredients such as nutrients, fungicides, and insecticides, delivering targeted protection and promoting healthy germination. The process ensures consistent application, optimizing the efficiency of these additives while preserving seed integrity. Its compatibility with a wide range of crops and ability to meet specific agricultural needs make it a preferred choice among farmers and seed producers. Additionally, advancements in coating materials, including biodegradable options, are further enhancing the appeal of film coating by aligning with sustainable agricultural practices and regulatory standards. This combination of efficiency, flexibility, and environmental considerations underpins its market dominance.

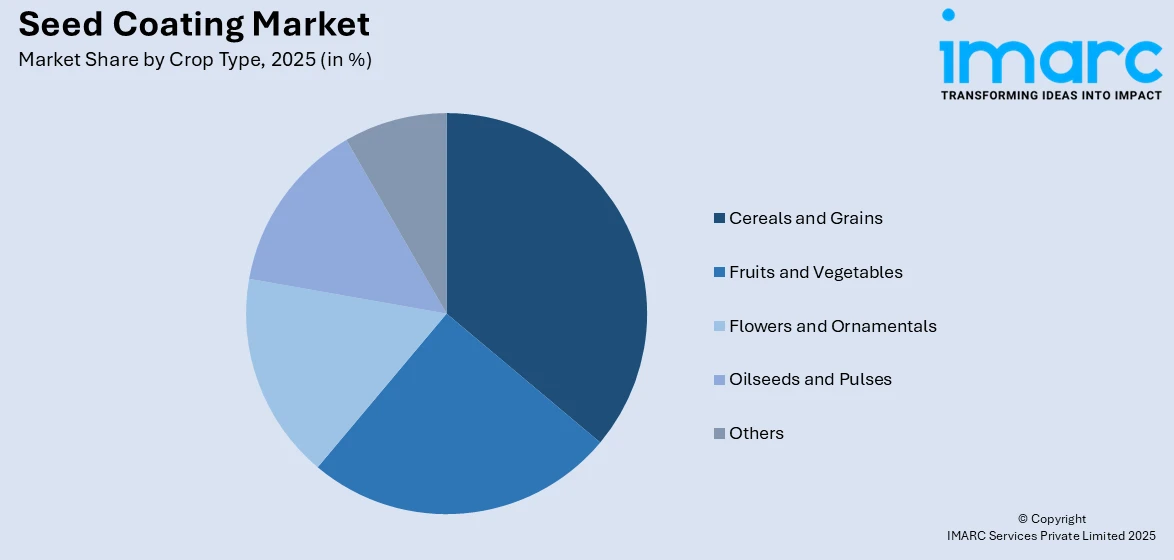

Analysis by Crop Type:

Access the comprehensive market breakdown Request Sample

- Cereals and Grains

- Fruits and Vegetables

- Flowers and Ornamentals

- Oilseeds and Pulses

- Others

Cereals and grains lead the market with 26.8% of market share in 2025. Cereals and grains represent the largest segment attributed to their significant role in global food production and agriculture. The high demand for cereals like wheat, rice, and corn drives the adoption of seed coating technologies to enhance germination, yield, and crop resilience. Seed coatings for cereals and grains are formulated to address specific challenges, such as pest resistance, disease management, and tolerance to environmental stresses like drought and salinity. These coatings improve seed handling and planting efficiency, ensuring uniform growth and optimized field performance. The incorporation of active ingredients, including nutrients and growth promoters, in seed coatings further enhances crop vigor and productivity. Additionally, the focus on sustainable farming practices and precision agriculture is encouraging farmers to use coated seeds for better resource efficiency and reduced environmental impact. The dominance of cereals and grains in the market highlights their critical role in meeting global food security needs.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

-

North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, North America accounted for the biggest market share, holding 39.8% of the total market. This can be accredited to its advanced agricultural sector and widespread adoption of innovative farming technologies. The region's focus on high-yield and sustainable crop production has led to significant investments in seed enhancement solutions, including seed coatings. Farmers in North America prioritize coated seeds to improve germination rates, crop uniformity, and resistance to pests and diseases, especially in crops like corn, soybeans, and wheat, which dominate the regional agricultural landscape. The region benefits from strong R&D efforts and collaborations between agricultural companies and research institutions, resulting in the continuous improvement of seed coating materials and technologies. Additionally, the adoption of precision agriculture practices is driving the demand for tailored seed coatings that align with specific crop and field requirements. The IMARC Group anticipates that the precision agriculture sector will reach US$ 10.7 Billion by 2032, demonstrating a compound annual growth rate (CAGR) of 10.4% from 2024 to 2032.

Key Regional Takeaways:

United States Seed Coating Market Analysis

In North America, the United States accounted for 70% of the total market share in 2025. The US seed coating market is currently growing significantly with the demand for enhanced crop yield and quality through adoption of advanced agricultural technologies. The farmers are actively incorporating coated seeds for better germination rates and seedling health, owing to various problems caused by changing soil conditions and fluctuations in climate. According to the Department of Agriculture (USDA), there were 1.89 Million farms in the United States in 2023. The ongoing development of seed coatings with reduced chemical inputs, including pesticides and fertilizers, is gaining market acceptance. Major players in agriculture are shifting towards bio-based coatings with beneficial microorganisms, providing disease and pest resistance. The regulatory environment is pushing innovation toward green coatings. Companies are also introducing specific custom seed treatment solutions suited for particular crop requirements. They are gaining greater traction in commercial growers' applications. Targeted progress is further consolidating the growth of the market in the United States.

Europe Seed Coating Market Analysis

The market in Europe is currently experiencing robust growth due to the increasing adoption of advanced agricultural practices that aim to improve crop yield and quality. Farmers and agribusinesses are actively seeking innovative seed treatment solutions to improve germination rates and protect seeds from pests and diseases, driven by stringent EU regulations on agrochemical usage. According to the Government of UK, the United Kingdom agriculture industry is made up of 209,000 farm holdings, using 17 Million Hectares of land. Manufacturers are consistently innovating bio-based and sustainable coating materials, responding to the growing demand for environmentally friendly agricultural inputs. The rising integration of micronutrients and biological agents into coatings is further addressing the region's focus on soil health and precision farming. Additionally, the adoption of hybrid and genetically modified seeds is expanding the need for coatings to ensure uniform planting and maximize their performance. Meanwhile, the emphasis on tackling climate variability is prompting market players to develop coatings that improve seed tolerance to extreme weather conditions. Investments in research and development for customized, crop-specific coatings are steadily supporting the market’s advancement.

Asia Pacific Seed Coating Market Analysis

Some specific factors are driving the growth of the Asia-Pacific market. Farmers across the region are increasingly adopting advanced agricultural practices to enhance crop yields and mitigate pest-related losses, thereby triggering an increase in demand for coated seeds that contain properties such as pest resistance and nutrient enhancement. According to the Ministry of Agriculture and Rural Affairs of the People's Republic of China, foreign trade in farm produce in China increased 0.4 percent year on year in the first 11 months of 2023. The governments of India and China are actively encouraging the adoption of modernized seed technologies through subsidies and awareness campaigns, which is significantly accelerating the adoption of coated seeds. Agrochemical companies are continuously innovating with biodegradable and environmentally friendly seed coating formulations, catering to the growing preference of the region towards sustainable agricultural inputs. Also, seed manufacturers are coming up with collaborations with regional distributors and agricultural cooperatives for their market reach and ensuring seed coatings tailored to diverse climatic and soil conditions. This also contributes to the demand for seed coating solutions because high-value crops, like fruits and vegetables, have a high incidence rate in recent years.

Latin America Seed Coating Market Analysis

The Latin America market is being propelled by the increasing adoption of advanced agricultural practices to increase crop yields and productivity. Farmers are actively seeking innovative seed treatments that can improve seed germination rates and provide protection against pests and diseases. As reported by the Government of Brazil, the nation presently utilizes 30% of its land for agricultural purposes. There is an increasing demand in the market for biological seed coatings due to the rising popularity of sustainable and eco-friendly farmland solutions. Therefore, governments in the region are encouraging seed coatings through subsidies and awareness campaigns to promote agricultural resilience against climate variability. Seed companies are constantly releasing region-specific crop-specific formulations for soybean, corn, and wheat, the three major Latin American staples. Furthermore, research institutions and private companies are working together to develop seed coatings with enhanced micronutrient content that would help solve soil fertility problems. These trends are steadily forming the market's growth trajectory in line with the new agricultural landscape and sustainability goals of Latin America.

Middle East and Africa Seed Coating Market Analysis

The market in the Middle East and Africa is growing because agricultural practices are increasingly focusing on improving crop productivity in challenging climatic conditions. Farmers are actively adopting seed coating technologies to protect seeds from pests, diseases, and adverse environmental factors, which are prevalent in the region. According to the International Trade Administration, large commercial (+/- 32000) and smaller subsistence farms are available in South Africa. The market is experiencing increased demand for coated seeds, especially in drought-prone areas, where seed coatings are improving water retention and germination rates. Governments and agricultural organizations are also promoting the use of coated seeds to achieve food security and reduce dependency on imports, in line with regional self-sufficiency goals. The producers are constantly innovating by coming out with eco-friendly and biodegradable seed coating materials to meet the increased demand for sustainable agricultural practices. Expansion of precision farming along with a growing adoption of high technologies enhances the use of seed coatings in terms of yield efficiency. All these factors altogether explain the dynamic growth of the market in the region.

Competitive Landscape:

Major participants in the industry are emphasizing innovation and strategic partnerships to enhance their product ranges and reinforce their market standings. They are focusing on aggressive strategies like enhancing the accuracy and effectiveness of seed treatments, as well as broadening distribution networks to access emerging markets. Moreover, participants are utilizing digital resources to deliver customized solutions and offer technical assistance to farmers. These efforts seek to tackle the increasing need for high-yield crops while fulfilling worldwide sustainability objectives. They are also allocating funds for research activities to develop advanced formulations that improve seed performance, including environment-friendly and biodegradable coatings. In 2023, Bayer and BIOWEG revealed a collaboration aimed at creating biodegradable seed coatings and formulation substances. The collaboration focuses on sustainable solutions to enhance seed performance, reduce environmental impact, and support Bayer's regenerative agriculture strategy. BIOWEG’s R&D team will work onsite at Bayer’s LifeHub Monheim.

The report provides a comprehensive analysis of the competitive landscape in the seed coating market with detailed profiles of all major companies, including:

- BASF SE

- Brett-Young Seeds Limited

- Centor Oceania

- Chromatech Incorporated

- Cistronics Innovations Pvt. Ltd.

- Croda International plc

- Germains Seed Technology

- Precision Laboratories LLC

- Sensient Colors LLC (Sensient Technologies Corporation)

- Solvay

Latest News and Developments:

- December 2024: BioConsortia partnered with New Zealand’s H&T to launch FixiN 33, a nitrogen-fixing microbial seed treatment for crops like corn, brassicas, and cereals. This innovation reduces nitrogen fertilizer dependency while maintaining crop yields and minimizing environmental impact. The product features unmatched shelf stability and is tailored to New Zealand's regulatory standards.

- January 2024: Nutreos, a non-toxic, plant-based, and biodegradable micronutrient seed coating, is a ground-breaking invention from Lucent BioSciences, a pioneer in sustainable agricultural input solutions. In light of the anticipated EU microplastic ban laws, this eco-friendly solution is in line with upcoming legislative changes that address the environmental impact of microplastics in seed treatments.

Seed Coating Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Additive Types Covered | Polymers, Colorants, Pellets, Binders, Active Ingredients, Others |

| Processes Covered | Film Coating, Encrusting, Pelleting |

| Crop Types Covered | Cereals and Grains, Fruits and Vegetables, Flowers and Ornamentals, Oilseeds and Pulses, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | BASF SE, Brett-Young Seeds Limited, Centor Oceania, Chromatech Incorporated, Cistronics, Innovations Pvt. Ltd., Croda International plc, Germains Seed Technology, Precision Laboratories LLC, Sensient Colors LLC (Sensient Technologies Corporation), and Solvay |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the seed coating market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global seed coating market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the seed coating industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Seed coating is a process that enhances seeds by applying a protective layer containing nutrients, pesticides, or growth stimulants. It improves germination, protects against pests and diseases, and ensures efficient planting by making seeds uniform and easier to handle. It is used in agriculture, as it supports higher crop yields, reduces seed waste, and promotes healthier early-stage growth.

The seed coating market was valued at USD 3.0 Billion in 2025.

IMARC estimates the global seed coating market to exhibit a CAGR of 6.63% during 2026-2034.

The global seed coating market is driven by increasing demand for high-yield crops, advancements in agricultural technologies, and the growing awareness about sustainable farming practices. Additionally, the rising use of eco-friendly and biodegradable coating materials, along with supportive government initiatives, is contributing to the market growth.

In 2025, polymers represented the largest segment by additive type, driven by their superior film-forming properties, enhanced seed protection, and ability to improve seed flowability and sowing precision.

Film coating leads the market by process owing to its ability to provide uniform coverage, improved seed appearance, and enhanced protection against pests.

Cereals and grains are the leading segment by crop type due to their global dietary significance, rising demand for high-yield varieties, and the widespread adoption of seed coating to enhance germination and crop protection.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global market include BASF SE, Brett-Young Seeds Limited, Centor Oceania, Chromatech Incorporated, Cistronics, Innovations Pvt. Ltd., Croda International plc, Germains Seed Technology, Precision Laboratories LLC, Sensient Colors LLC (Sensient Technologies Corporation), and Solvay, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)