Silicon Fertilizer Market Report by Type (Synthetic, Natural), Form (Liquid, Solid), Application (Field Crops, Horticultural Crops, Hydroponics, Floriculture), and Region 2026-2034

Market Overview:

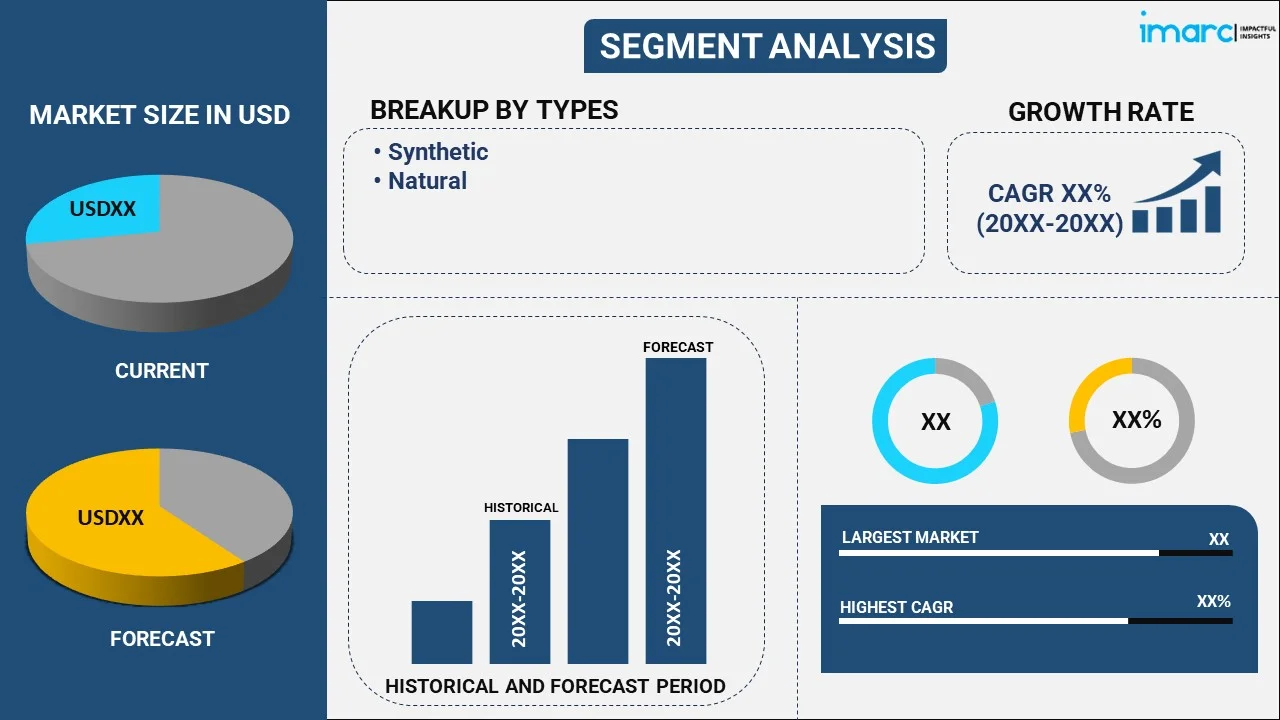

The global silicon fertilizer market size reached USD 114.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 147.7 Million by 2034, exhibiting a growth rate (CAGR) of 2.83% during 2026-2034. The growing adoption in silicon-accumulating crops, including rice, rising employment in water-stressed areas to improve water-use efficiency in crops, and increasing advancements in fertilizer delivery systems, such as slow-release and controlled-release technologies, are some of the factors impelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 114.0 Million |

|

Market Forecast in 2034

|

USD 147.7 Million |

| Market Growth Rate 2026-2034 | 2.83% |

Silicon fertilizer refers to a chemical or natural substance that involves the deposition of silicon in soil, land, or plant epidermal tissue to improve crop growth and yield. Calcium, sodium and potassium silicate are some of the commonly available types of silicon fertilizers usually consisting of silicic acid, or silicon acid, silicon conditioners, and other products. Silicon fertilizers are widely used in field, hydroponics, floriculture and horticulture crops, such as cereals, soybean, wheat, and vegetable sugarcane. They assist in strengthening cell walls, providing resistance against bacterial and fungal diseases, preventing lodging, and decreasing biotic and abiotic stress, thus enhancing the growth and yield of all annual and vegetable crops. The silicon fertilizer market share is expected to grow due to increasing demand for enhanced crop yield and resistance to pests, as well as rising awareness about the benefits of silicon in improving soil health and plant development.

To get more information on this market Request Sample

Silicon Fertilizer Market Trends:

Rising Adoption in Rice Cultivation

Rice is one of the most silicon-accumulating crops, and its cultivation benefits highly from silicon fertilizers. Silicon plays a vital role in boosting the plant's ability to withstand both biotic stresses, like diseases and pests, and abiotic stresses, such as droughts, floods, and other extreme weather conditions. The presence of silicon in rice plants improves cell wall strength, making them more robust and capable of withstanding adverse environmental factors. Additionally, silicon enhances nutrient absorption, which supports plant growth and development under stress conditions. The growing demand for higher rice yields to feed the increasing population is encouraging farmers to turn to silicon fertilizers. In 2024, the Ministry of Agriculture and Farmers Welfare in India announced that total rice production for 2023-24 was estimated at 1367.00 LMT (Lakh Metric Tons), an increase of 9.45 LMT compared to the previous year's production of 1357.55 LMT. This rise in production highlights the growing need for higher rice yields, driven by food demand. Silicon fertilizers assist in this process by increasing yields and decreasing reliance on chemical interventions.

Enhancing Water Efficiency in Agriculture

Water scarcity is an ongoing concern in many agricultural regions, and silicon fertilizers are being used to improve water-use efficiency in crops. Silicon helps plants retain water, allowing them to thrive in drought-prone areas or regions with limited irrigation options. By enhancing the ability of the plant to manage water effectively, silicon fertilizers reduce the need for excessive watering and contribute to more sustainable agricultural practices. This water-saving benefit is attracting attention from farmers and policymakers alike, encouraging adoption in water-stressed areas. As per the UN Environment Programme's report in 2024, approximately 2.4 billion people live in countries facing water stress, where 25% or more of their renewable freshwater resources are used to meet water demands. Moreover, it is projected that by 2025, approximately 1.8 billion people will face absolute water scarcity as defined by the Food and Agriculture Organization (FAO), with two-thirds of the global population expected to experience water stress.

Technological Advancements in Fertilizer Delivery Systems

Advancements in fertilizer delivery systems, such as slow-release and controlled-release technologies, are improving the effectiveness of silicon fertilizers. These innovations allow for the gradual and sustained release of silicon into the soil, which ensures a more consistent uptake by plants over time. This not only improves the efficiency of silicon utilization but also minimizes nutrient loss due to leaching or volatilization. Therefore, farmers can improve crop performance using fewer applications, reducing labor and material expenses. Moreover, these enhanced delivery methods encourage a greener approach by reducing the chances of excessive fertilization and decreasing waste. By enhancing the efficiency and affordability of silicon fertilizers, these technologies are promoting their use in various crops and farming systems, including those requiring precise nutrient management. In 2023, Lucent Bio unveiled a new smart fertilizer system that is biodegradable and utilizes water-insoluble biopolymers to provide sustainable crop nutrition. This technology advanced environment-friendly farming by lessening environmental impact, while enhancing crop yields and soil health.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global silicon fertilizer market report, along with forecasts at the global, regional and country levels from 2026-2034. Our report has categorized the market based on type, form and application.

Breakup by Type:

To get detailed segment analysis of this market Request Sample

- Synthetic

- Natural

Breakup by Form:

- Liquid

- Solid

Breakup by Application:

- Field Crops

- Horticultural Crops

- Hydroponics

- Floriculture

Breakup by Region:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the global silicon fertilizer market. Detailed profiles of all major companies have also been provided. Some of the companies covered include:

- Agripower Australia Ltd.

- Jaipur Bio Fertilizers

- Khandelwal Biofertilizer

- MaxSil Pty Ltd.

- Plant Tuff

- Redox Pty Ltd.

- Satpura Bio Fertiliser India Private Limited

- Sigma AgriScience LLC

- Vedant Agrotech

Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.

Silicon Fertilizer Market News:

- October 2024: Evonik has revealed plans to grow its Charleston facility in South Carolina, boosting precipitated silica output by 50% to cater to the rising need for eco-friendly tires in the U.S. This decision reflects Evonik's dedication to sustainability and enhancing its footprint in North America. Local authorities support the expansion to improve supply chains for manufacturing fuel-efficient tires.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Segment Coverage | Type, Form, Application, Region |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Agripower Australia Ltd., Jaipur Bio Fertilizers, Khandelwal Biofertilizer, MaxSil Pty Ltd., Plant Tuff, Redox Pty Ltd., Satpura Bio Fertiliser India Private Limited, Sigma AgriScience LLC and Vedant Agrotech. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global silicon fertilizer market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the global silicon fertilizer market?

- What are the key regional markets?

- What is the breakup of the market based on the type?

- What is the breakup of the market based on the form?

- What is the breakup of the market based on the application?

- What are the various stages in the value chain of the industry?

- What are the key driving factors and challenges in the industry?

- What is the structure of the global silicon fertilizer market and who are the key players?

- What is the degree of competition in the industry?

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)