Singapore CCTV Camera Market Size, Share, Trends and Forecast by Type, End User Vertical, and Region, 2025-2033

Singapore CCTV Camera Market Overview:

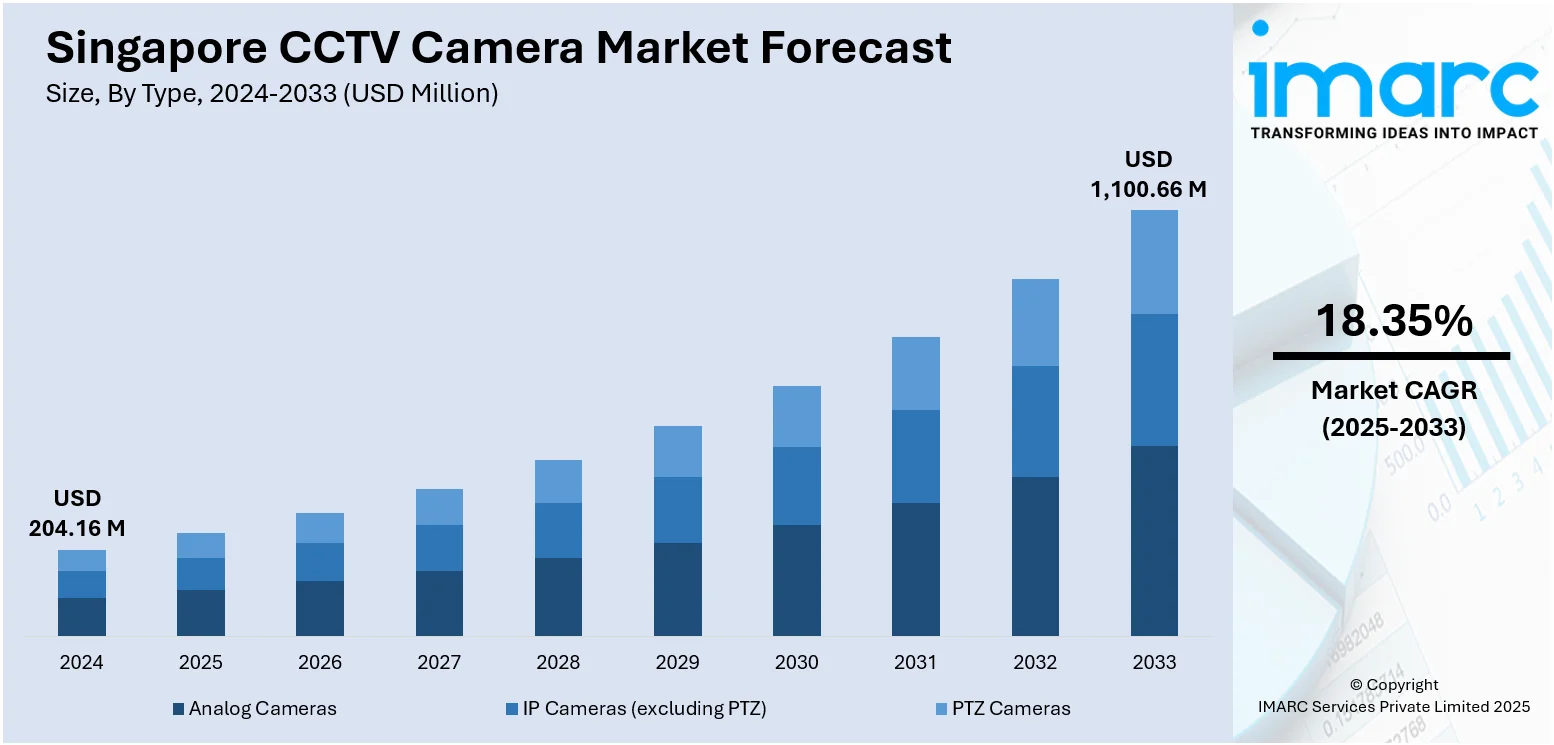

The Singapore CCTV camera market size reached USD 204.16 Million in 2024. Looking forward, the market is expected to reach USD 1,100.66 Million by 2033, exhibiting a growth rate (CAGR) of 18.35% during 2025-2033. The market is witnessing steady growth due to rising security concerns, increasing smart city initiatives, and widespread adoption in residential and commercial sectors. Technological advancements, such as AI integration and remote monitoring, are further enhancing demand. Government regulations supporting surveillance infrastructure also play a crucial role in in positively influencing the Singapore CCTV camera market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 204.16 Million |

| Market Forecast in 2033 | USD 1,100.66 Million |

| Market Growth Rate 2025-2033 | 18.35% |

Singapore CCTV Camera Market Trends:

Rising Demand for Public and Private Security

Singapore's increasing focus on public safety and crime prevention is significantly driving demand for CCTV cameras. Large-scale implementation of modern monitoring systems is encouraged by government projects to increase surveillance of the transport hubs, city infrastructure, and streets where there is a lot of traffic. Business and homeowners in the private sector are deploying CCTV to secure properties, prevent intrusion, and oversee daily activities. With incessant urbanization, there is also an increasing demand for real-time surveillance and crime prevention in residential buildings, schools, and commercial centers. This strong emphasis on safety across sectors reinforces the sustained demand for CCTV systems, making security concerns a key driver of the Singapore CCTV camera market growth.

To get more information on this market, Request Sample

Integration of Advanced Technologies

The adoption of cutting-edge technologies such as artificial intelligence (AI), facial recognition, cloud storage, and analytics is transforming the CCTV camera landscape in Singapore. These innovations enhance the capabilities of traditional surveillance systems by enabling features like real-time alerts, object detection, behavioral analysis, and remote access via mobile devices. Businesses and authorities are shifting towards smart surveillance solutions that offer more accurate threat detection and faster response times. Cloud-based platforms further facilitate centralized monitoring and easier data management. This technological evolution not only improves efficiency and scalability but also adds value to end-users, driving upgrades and increasing the adoption of next-generation CCTV systems across the country.

Government Support and Smart Nation Initiatives

Singapore’s government plays a pivotal role in promoting surveillance infrastructure as part of its broader Smart Nation initiative. Programs such as the Safe City Test Bed and various urban planning strategies emphasize the use of smart technologies to enhance public safety and urban management. Authorities also provide funding and policy support for integrating CCTV cameras into city infrastructure and traffic systems. Moreover, regulatory frameworks ensure data privacy and ethical use, fostering public trust in surveillance solutions. These government-backed efforts encourage innovation, create procurement opportunities, and accelerate the deployment of surveillance systems in both public and private sectors, making institutional support a crucial growth catalyst for the CCTV camera market in Singapore.

Singapore CCTV Camera Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and end user vertical.

Type Insights:

- Analog Cameras

- IP Cameras (excluding PTZ)

- PTZ Cameras

The report has provided a detailed breakup and analysis of the market based on the type. This includes analog cameras, IP cameras (excluding PTZ), and PTZ cameras.

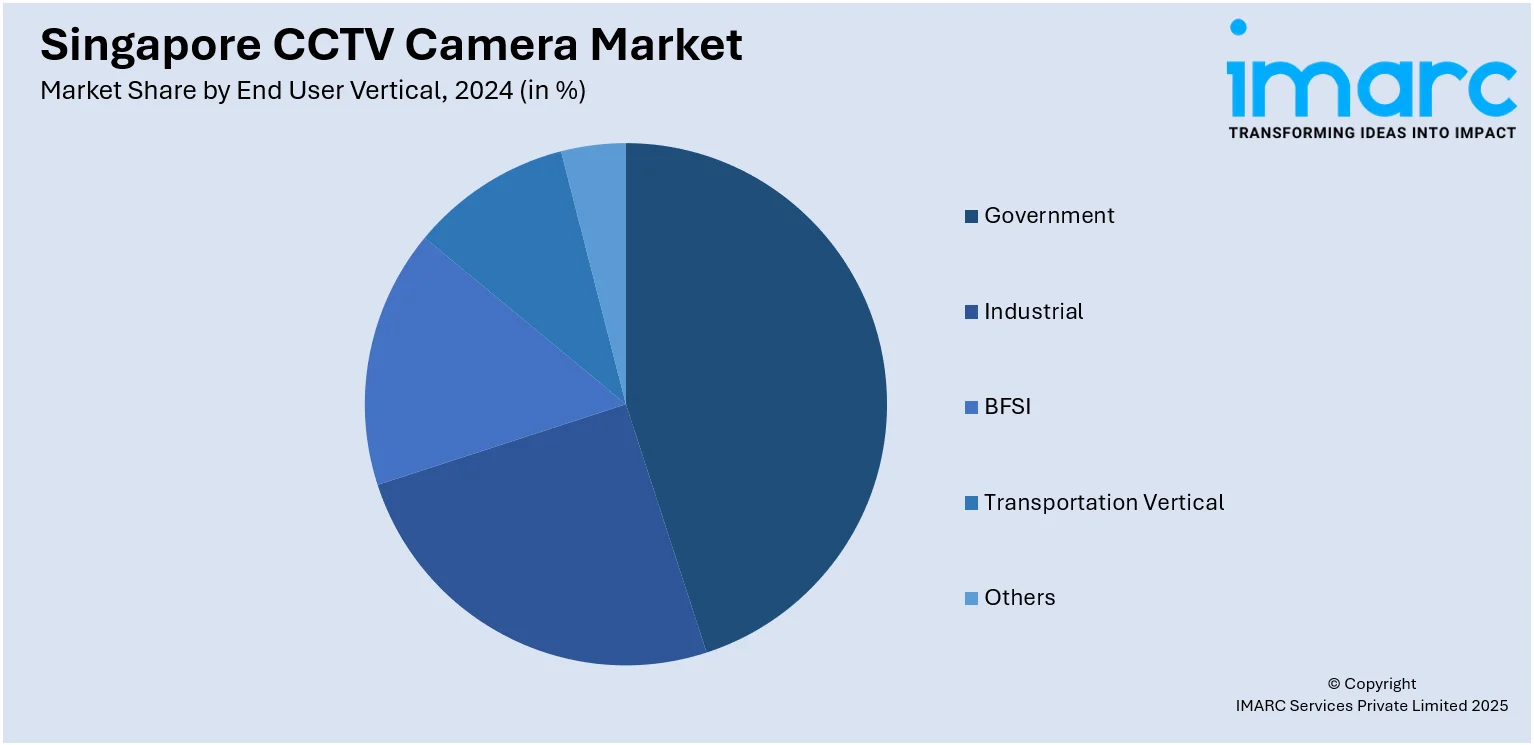

End User Vertical Insights:

- Government

- Industrial

- BFSI

- Transportation Vertical

- Others

A detailed breakup and analysis of the market based on the end user vertical have also been provided in the report. This includes government, industrial, BFSI, transportation vertical, and others.

Regional Insights:

- North-East

- Central

- West

- East

- North

The report has also provided a comprehensive analysis of all the major regional markets, which include North-East, Central, West, East, and North.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Singapore CCTV Camera Market News:

- In October 2024, Hitachi Rail, in partnership with Strides Engineering, secured a contract from Singapore’s Land Transport Authority (LTA) to carry out a full-scale upgrade of the CCTV system along the North–South and East–West Lines (NSEWL). Spanning over 50 stations, the initiative focuses on improving surveillance infrastructure and increasing camera capacity across the country’s oldest and most intensively used metro routes.

- In October 2023, the Singapore Police Force (SPF) issued a tender seeking to expand the nationwide deployment of police cameras, aiming to double their current number. This initiative is partly intended to enhance surveillance coverage in newly developed housing areas and infrastructure, which have emerged since the introduction of these cameras in 2012.

Singapore CCTV Camera Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Analog Cameras, IP Cameras (excluding PTZ), PTZ Cameras |

| End User Verticals Covered | Government, Industrial, BFSI, Transportation Vertical, Others |

| Regions Covered | North-East, Central, West, East, North |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Singapore CCTV camera market performed so far and how will it perform in the coming years?

- What is the breakup of the Singapore CCTV camera market on the basis of type?

- What is the breakup of the Singapore CCTV camera market on the basis of end user vertical?

- What is the breakup of the Singapore CCTV camera market on the basis of region?

- What are the various stages in the value chain of the Singapore CCTV camera market?

- What are the key driving factors and challenges in the Singapore CCTV camera market?

- What is the structure of the Singapore CCTV camera market and who are the key players?

- What is the degree of competition in the Singapore CCTV camera market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Singapore CCTV camera market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Singapore CCTV camera market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Singapore CCTV camera industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)