Singapore Commercial Insurance Market Size, Share, Trends and Forecast by Type, Enterprise Size, Distribution Channel, Industry Vertical, and Region, 2025-2033

Singapore Commercial Insurance Market Overview:

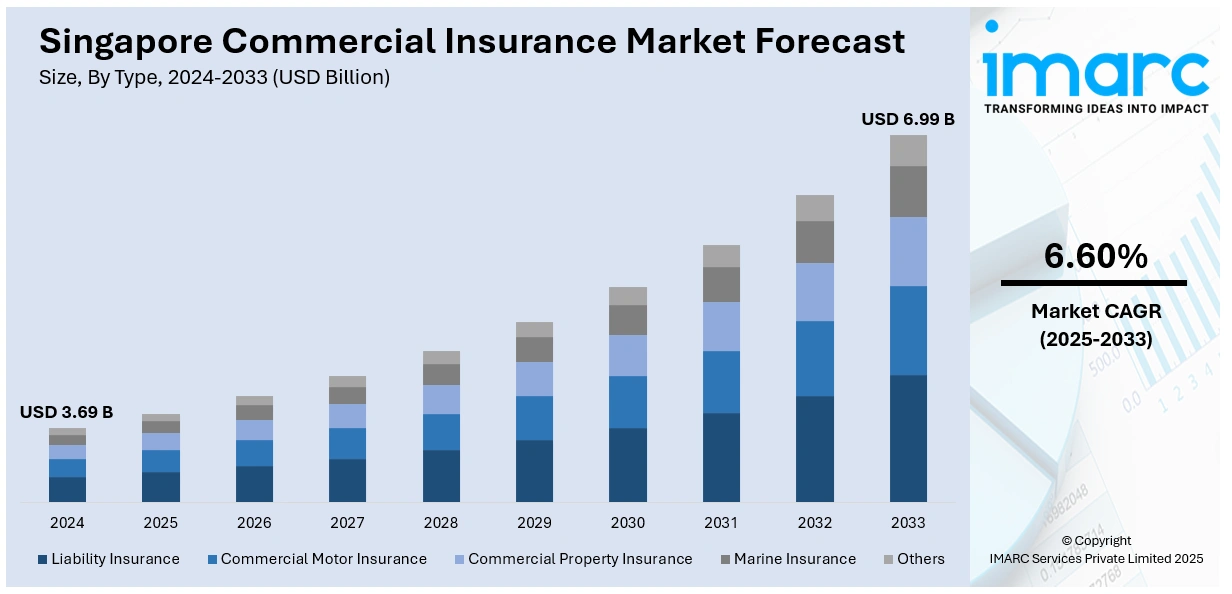

The Singapore commercial insurance market size reached USD 3.69 Billion in 2024. The market is projected to reach USD 6.99 Billion by 2033, exhibiting a growth rate (CAGR) of 6.60% during 2025-2033. The market is expanding through digital adoption, new entrants, and regional product diversification. Growing focus on cloud platforms, insurtech partnerships, and flexible motor and marine coverage continues to support Singapore commercial insurance market share, strengthening competitiveness and improving service standards across the country’s commercial insurance sector.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.69 Billion |

| Market Forecast in 2033 | USD 6.99 Billion |

| Market Growth Rate 2025-2033 | 6.60% |

Singapore Commercial Insurance Market Trends:

Technology Adoption Driving Market Modernization

The Singapore commercial insurance market growth has been supported by a steady shift toward technology-led solutions in underwriting, claims, and customer engagement. Insurers are adopting cloud platforms, advanced analytics, and digital tools to reduce costs while improving accuracy in assessing complex risks. Businesses increasingly expect policies that can be tailored to their needs, which pushes insurers to rely more on data-driven models and automated systems. This has made innovation not just optional, but necessary to remain competitive. In January 2025, The Hartford expanded operations in Singapore through a new service company under Lloyd’s Syndicate 1221, focusing on Financial Lines, Credit, and Political Risks. The move reflected the growing use of technical expertise and digital platforms to strengthen commercial insurance offerings. In June 2025, Allianz Commercial Singapore appointed Hydor as a managing general agent, broadening marine liability insurance services and improving service delivery. These developments show how digital adoption and specialist collaboration are driving market efficiency. The use of technology is helping insurers create faster, more reliable, and flexible solutions, which in turn supports long-term stability and positions Singapore as a hub for innovative commercial insurance services.

To get more information on this market, Request Sample

Competition and Expansion Reshaping the Market

Singapore’s commercial insurance sector has been marked by stronger competition and regional expansion as insurers work to meet rising demand for diverse coverage. Global players and local providers are introducing specialized products to respond to evolving risks, while also competing to deliver better value and service quality. This heightened activity has resulted in businesses having more choice, as insurers adapt to changing needs with flexible and innovative coverage options. In March 2025, Allianz Commercial authorized Hydor to operate as a managing general agent, expanding the scope of marine liability coverage across the Asia-Pacific region. By June 2025, Grab had taken steps toward launching motor insurance in Singapore after securing regulatory approval, signaling a new level of disruption in a space traditionally dominated by established insurers. With its access to mobility data and large driver network, Grab is preparing to design usage-based policies that could appeal to private-hire operators. These changes illustrate how fresh entrants and international expansions are reshaping the balance of competition. The market is becoming more dynamic and customer-focused, with insurers under pressure to innovate, refine their pricing strategies, and expand service quality to protect their market positions.

Singapore Commercial Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on type, enterprise size, distribution channel, and industry vertical.

Type Insights:

- Liability Insurance

- Commercial Motor Insurance

- Commercial Property Insurance

- Marine Insurance

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes liability insurance, commercial motor insurance, commercial property insurance, marine insurance, and others.

Enterprise Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

The report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes large enterprises and small and medium-sized enterprises.

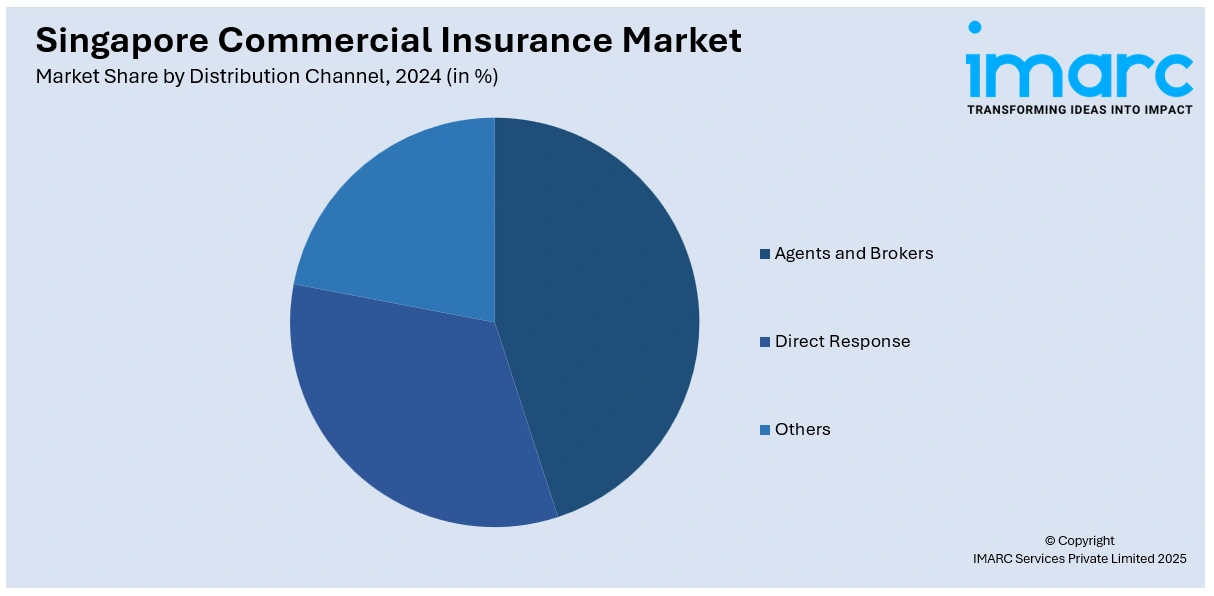

Distribution Channel Insights:

- Agents and Brokers

- Direct Response

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes agents and brokers, direct response, and others.

Industry Vertical Insights:

- Transportation and Logistics

- Manufacturing

- Construction

- IT and Telecom

- Healthcare

- Energy and Utilities

- Others

The report has provided a detailed breakup and analysis of the market based on the industry vertical. This includes transportation and logistics, manufacturing, construction, it and telecom, healthcare, energy and utilities, and others.

Regional Insights:

- North-East

- Central

- West

- East

- North

The report has also provided a comprehensive analysis of all the major regional markets, which include North-East, Central, West, East and North.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Singapore Commercial Insurance Market News:

- June 2025: Allianz Commercial Singapore appointed Hydor as a managing general agent for marine insurance, authorizing it to quote and bind liability policies. This development strengthened Singapore’s commercial insurance market by expanding specialized marine coverage, improving service delivery, and enhancing tailored solutions across the Asia-Pacific region.

- June 2025: Grab prepared to launch motor insurance in Singapore after securing a general insurer license from MAS and joining the General Insurance Association. This move disrupted the commercial insurance market by introducing data-driven, flexible coverage, intensifying competition against established motor insurers.

Singapore Commercial Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Liability Insurance, Commercial Motor Insurance, Commercial Property Insurance, Marine Insurance, Others |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium-Sized Enterprises |

| Distribution Channels Covered | Agents and Brokers, Direct Response, Others |

| Industry Verticals Covered | Transportation and Logistics, Manufacturing, Construction, IT and Telecom, Healthcare, Energy and Utilities, Others |

| Regions Covered | North-East, Central, West, East, North |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Singapore commercial insurance market performed so far and how will it perform in the coming years?

- What is the breakup of the Singapore commercial insurance market on the basis of type?

- What is the breakup of the Singapore commercial insurance market on the basis of enterprise size?

- What is the breakup of the Singapore commercial insurance market on the basis of distribution channel?

- What is the breakup of the Singapore commercial insurance market on the basis of industry vertical?

- What is the breakup of the Singapore commercial insurance market on the basis of region?

- What are the various stages in the value chain of the Singapore commercial insurance market?

- What are the key driving factors and challenges in the Singapore commercial insurance market?

- What is the structure of the Singapore commercial insurance market and who are the key players?

- What is the degree of competition in the Singapore commercial insurance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Singapore commercial insurance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Singapore commercial insurance market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Singapore commercial insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)