Singapore Corrugated Packaging Market Size, Share, Trends and Forecast by Product Type, Packaging Type, Material Type, End Use, and Region, 2026-2034

Singapore Corrugated Packaging Market Overview:

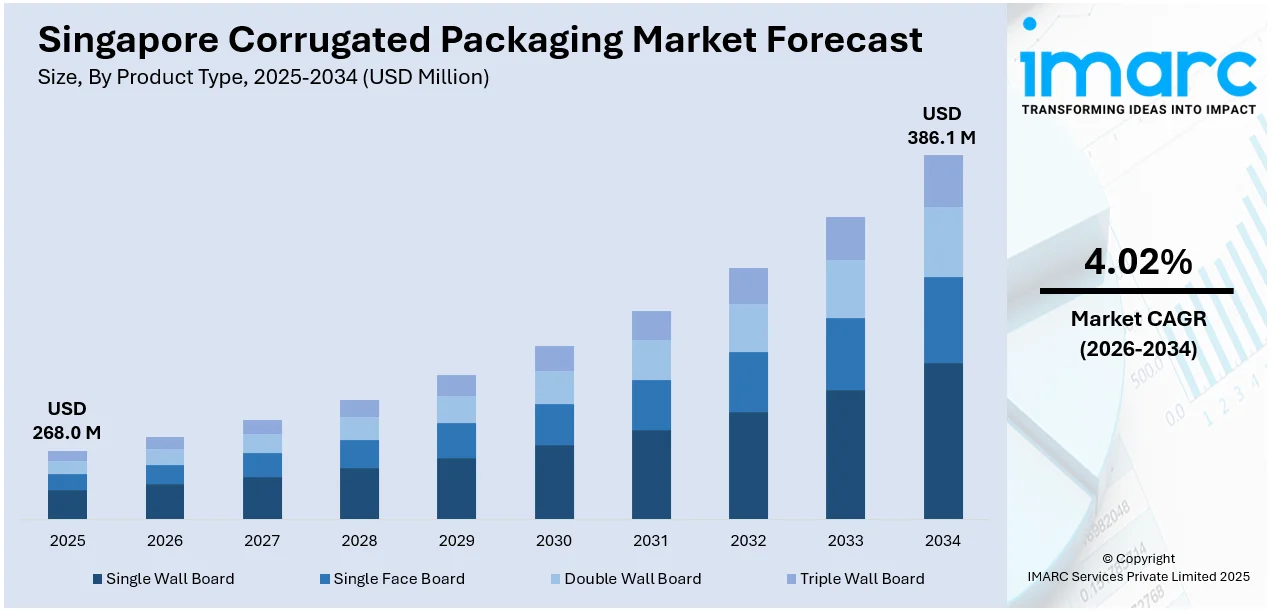

The Singapore corrugated packaging market size reached USD 268.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 386.1 Million by 2034, exhibiting a growth rate (CAGR) of 4.02% during 2026-2034. Rapid growth of e-commerce sector, the emphasis on sustainability, expansion in the food and beverage (F&B) industry, industrialization, tourism, the implementation of government regulations favoring recyclable materials, branding and customization trends, technological advancements, and the country's role as a regional logistics hub are factors fostering the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 268.0 Million |

|

Market Forecast in 2034

|

USD 386.1 Million |

| Market Growth Rate 2026-2034 | 4.02% |

Singapore Corrugated Packaging Market Trends:

E-commerce Growth and Corrugated Packaging Demand: The growing e-commerce sector in Singapore is one of the major factors that drives the growth of the corrugated packaging market. According to available statistics, Singapore is the 34th biggest eCommerce market with a forecasted turnover of US$ 9,901.5 million in 2024. The revenue is expected to exhibit a CAGR (2024-2028) of 12.0%. Moreover, with rising inclination towards online shopping, businesses need secure packaging solutions to protect products during logistics, which in turn is propelling the product demand. Additionally, the COVID-19 outbreak has a been a catalyst to the growing move towards online shopping, boosting the market growth.

To get more information on this market Request Sample

Sustainability Drive and Adoption of Corrugated Packaging: The commitment of sustainability and environment conservation by Singapore is forwarding the adoption of corrugated packaging materials. Consumers are turning increasingly environment conscious and as a result, businesses are being forced to adopt eco-friendly packaging solutions. Tapping into the growing push towards sustainability, the use of recycled materials, and a focus on its biodegradable properties, the corrugated packaging projects itself as a viable solution to the packaging options that are currently available in the market in Singapore, as more companies continue to adapt to the green trends. Additionally, with government regulation to encourage businesses to switch to recyclable packaging, it ensures more conversion to corrugated packaging. Additionally, lower packaging weight helps in reducing transportation costs and carbon dioxide (CO2) emissions; making this material an economical and sustainable option for businesses that plan to reduce their impact on the environment.

Food and Beverage Industry Expansion and Packaging Needs: The growth in Singapore's food industry, along with the addictiveness of local eateries is expected to keep fueling the need for effective packaging solutions that will maintain the quality and freshness of products. With the help of this corrugated packaging, the flavor of food and beverage (F&B) products is still fresh during storage and transportation. Given growing consumer preference for convenient food choices and on-the-go consumption, packaging has the added responsibility of protecting food while ensuring that it looks its best. Corrugated packaging is designed with flexibility for the construction, to be able to provide a customized packaging solutions that meets the specific needs of each food product. The COVID will propel the already boosted food delivery and takeaway trends, boosting the demand for corrugated packaging, as restaurants and food service providers look for ways to pack away their meals hygienically and efficiently.

Singapore Corrugated Packaging Market News:

- In 2023, Rengo Co., Ltd., announced a significant development with its subsidiary TRICOR Packaging & Logistics. They decided to construct a new plant in North Rhine-Westphalia, Germany, with an investment of approximately 170 million euros. This state-of-the-art plant, scheduled for completion by July 2025, will focus on industrial and heavy-duty corrugated packaging, incorporating advanced automation technologies. The new facility aligns with global sustainability goals, aiming for carbon neutrality by 2050.

- Rengo Japan and Velvin Group of India formed a strategic joint venture to establish a new corrugation unit in Cheyyar, Tamil Nadu. This collaboration leverages Rengo's extensive experience in paper and corrugated box manufacturing and Velvin's deep understanding of the Indian market. The joint venture, Velvin Rengo Containers, will begin partial operations in March 2024.

Singapore Corrugated Packaging Market Segmentation:

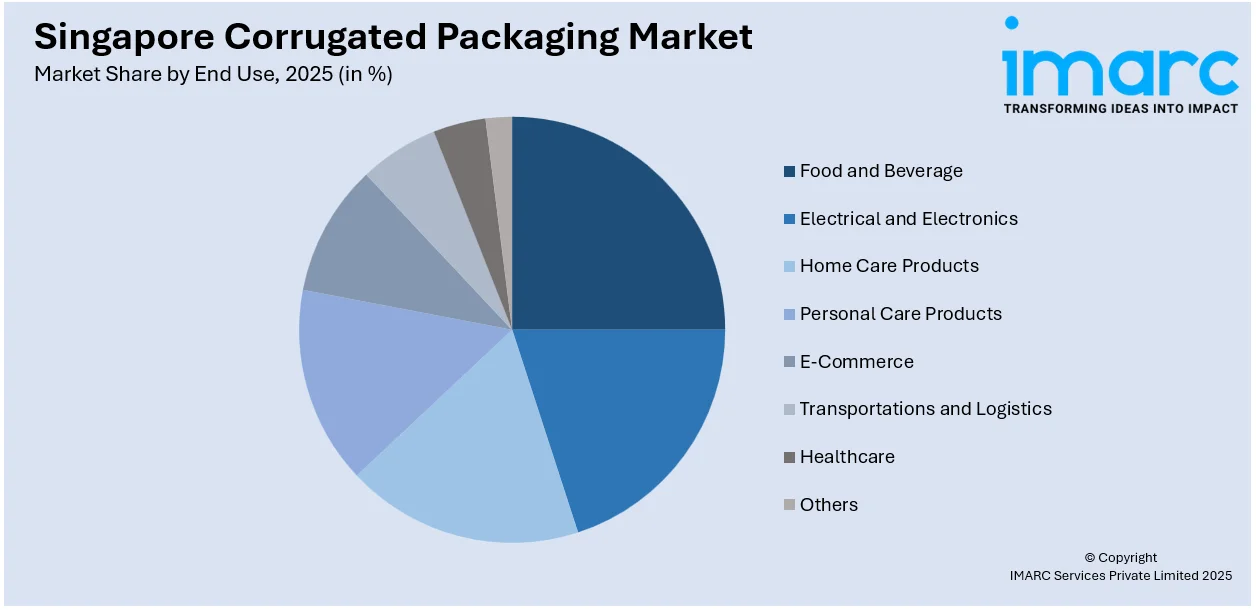

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on product type, packaging type, material type, and end use.

Product Type Insights:

- Single Wall Board

- Single Face Board

- Double Wall Board

- Triple Wall Board

The report has provided a detailed breakup and analysis of the market based on the product type. This includes single wall board, single face board, double wall board, and triple wall board.

Packaging Type Insights:

- Box

- Slotted Box

- Folder Box

- Telescope Box

- Diet Cut Box

- Crates

- Trays

- Octabin

- Pallet

- Others

A detailed breakup and analysis of the market based on the packaging type have also been provided in the report. This includes box (slotted box, folder box, telescope box, and diet cut box), crates, trays, octabin, pallet, and others.

Material Type Insights:

- Linerboard

- Fluting Medium

The report has provided a detailed breakup and analysis of the market based on the material type. This includes linerboard and fluting medium.

End Use Insights:

Access the comprehensive market breakdown Request Sample

- Food and Beverage

- Electrical and Electronics

- Home Care Products

- Personal Care Products

- E-Commerce

- Transportations and Logistics

- Healthcare

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes food and beverage, electrical and electronics, home care products, personal care products, e-commerce, transportations and logistics, healthcare, and others.

Regional Insights:

- North-East

- Central

- West

- East

- North

The report has also provided a comprehensive analysis of all the major regional markets, which include North-East, Central, West, East, and North.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Singapore Corrugated Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Single Wall Board, Single Face Board, Double Wall Board, Triple Wall Board |

| Packaging Types Covered |

|

| Material Types Covered | Linerboard, Fluting Medium |

| End Uses Covered | Food and Beverage, Electrical and Electronics, Home Care Products, Personal Care Products, E-Commerce, Transportations and Logistics, Healthcare, Others |

| Regions Covered | North-East, Central, West, East, North |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Singapore corrugated packaging market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Singapore corrugated packaging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Singapore corrugated packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The corrugated packaging market in Singapore was valued at USD 268.0 Million in 2025.

The Singapore corrugated packaging market is projected to exhibit a CAGR of 4.02% during 2026-2034, reaching a value of USD 386.1 Million by 2034.

Singapore’s corrugated packaging market is driven by the growth of e-commerce and logistics, rising demand for sustainable and recyclable materials supported by government green initiatives, and the needs of high-value manufacturing industries. These factors collectively boost the adoption of durable, eco-friendly packaging solutions tailored to meet evolving business and consumer expectations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)