Singapore Cryptocurrency Market Size, Share, Trends and Forecast by Type, Component, Process, Application, and Region, 2025-2033

Singapore Cryptocurrency Market Overview:

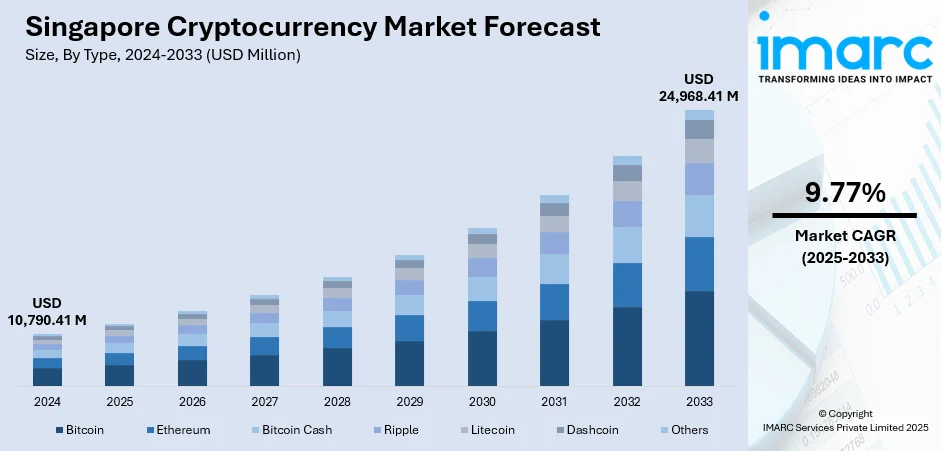

The Singapore cryptocurrency market size reached USD 10,790.41 Million in 2024. The market is projected to reach USD 24,968.41 Million by 2033, exhibiting a growth rate (CAGR) of 9.77% during 2025-2033. Rising awareness about digital assets is driving crypto adoption in Singapore through increased public understanding, regulatory clarity, and fintech innovation. Besides this, the broadening of retail outlets, which is making cryptocurrency more accessible via user-friendly platforms, payment integrations, and user-focused services, is contributing to the expansion of the Singapore cryptocurrency market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 10,790.41 Million |

| Market Forecast in 2033 | USD 24,968.41 Million |

| Market Growth Rate 2025-2033 | 9.77% |

Singapore Cryptocurrency Market Trends:

Growing awareness about digital assets

Increasing awareness about digital assets in Singapore is encouraging more investment, engagement, and acceptance from a variety of societal groups. Confidence in the use and validity of cryptocurrencies is growing as more people, companies, and institutional investors are learning about blockchain technology, decentralized finance (DeFi), and the possible advantages of cryptocurrencies. As per industry reports, in 2024, Singapore achieved a record level of public awareness, with 94% of participants indicating they recognized at least one cryptocurrency. This heightened understanding is encouraging wider adoption of crypto wallets, trading platforms, and blockchain-based financial services. In Singapore, a tech-savvy population, strong government support for innovations, and clear regulatory frameworks have created an environment where digital assets are increasingly seen as a viable investment class and tool for financial inclusion. Educational initiatives, fintech events, and public discourse are demystifying complex crypto concepts, enabling more people to engage with digital assets responsibly. Startups and financial institutions are also responding to this trend by launching user-friendly platforms and services tailored to both novice and experienced users. Furthermore, rising consciousness is catalyzing the demand for regulatory clarity and investor protection, leading to proactive engagement between regulators and industry players. This cycle of education, trust, and innovation is strengthening Singapore’s position as a leading crypto hub.

To get more information on this market, Request Sample

Broadening of retail channels

The expansion of retail outlets is impelling the Singapore cryptocurrency market growth. According to IMARC Group, the Singapore retail market size reached USD 139.1 Billion in 2024. As retail investors are exploring alternative investment avenues, cryptocurrencies are emerging as a popular choice due to their accessibility, high return potential, and decentralization. In Singapore, the rise of user-friendly crypto exchanges, mobile apps, and digital wallets has lowered entry barriers for the general public, enabling more individuals to participate in the crypto ecosystem. Retail-driven demand is also motivating fintech firms and traditional retailers to accept crypto payments, offer blockchain loyalty programs, and explore non-fungible token (NFT)-based user engagement. This convergence of retail and crypto is transforming the market from a niche financial segment into a more mainstream asset class. The involvement of retail investors is also leading to increased market liquidity, price activity, and innovations in product offerings. As a result, the growing presence and influence of retail participants are not only boosting adoption but also encouraging further institutional interest and regulatory attention in Singapore.

Singapore Cryptocurrency Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, component, process, and application.

Type Insights:

- Bitcoin

- Ethereum

- Bitcoin Cash

- Ripple

- Litecoin

- Dashcoin

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes bitcoin, ethereum, bitcoin cash, ripple, litecoin, dashcoin, and others.

Component Insights:

- Hardware

- Software

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes hardware and software.

Process Insights:

- Mining

- Transaction

The report has provided a detailed breakup and analysis of the market based on the process. This includes mining and transaction.

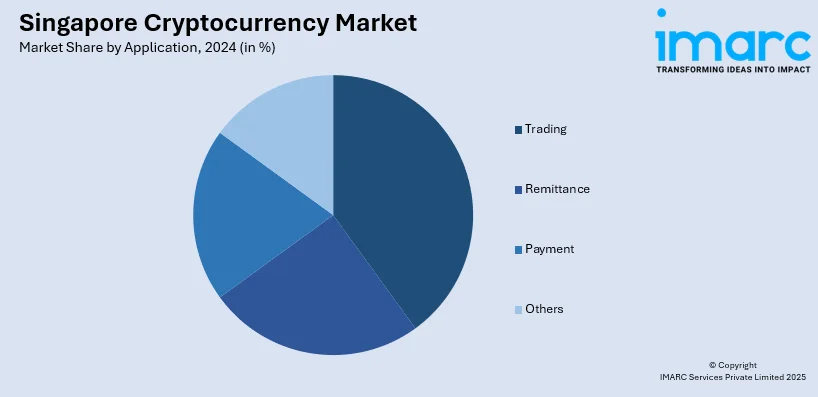

Application Insights:

- Trading

- Remittance

- Payment

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes trading, remittance, payment, and others.

Regional Insights:

- North-East

- Central

- West

- East

- North

The report has also provided a comprehensive analysis of all the major regional markets, which include North-East, Central, West, East, and North.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Singapore Cryptocurrency Market News:

- In April 2025, Sony Electronics announced that it started accepting the USDC stablecoin for payments in Singapore. The firm partnered with Crypto.com to enable USDC transactions in its online shop. The company also revealed its intention to add more cryptocurrencies to its accepted tokens list.

Singapore Cryptocurrency Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Bitcoin, Ethereum, Bitcoin Cash, Ripple, Litecoin, Dashcoin, Others |

| Components Covered | Hardware, Software |

| Processes Covered | Mining, Transaction |

| Applications Covered | Trading, Remittance, Payment, Others |

| Regions Covered | North-East, Central, West, East, North |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Singapore cryptocurrency market performed so far and how will it perform in the coming years?

- What is the breakup of the Singapore cryptocurrency market on the basis of type?

- What is the breakup of the Singapore cryptocurrency market on the basis of component?

- What is the breakup of the Singapore cryptocurrency market on the basis of process?

- What is the breakup of the Singapore cryptocurrency market on the basis of application?

- What is the breakup of the Singapore cryptocurrency market on the basis of region?

- What are the various stages in the value chain of the Singapore cryptocurrency market?

- What are the key driving factors and challenges in the Singapore cryptocurrency market?

- What is the structure of the Singapore cryptocurrency market and who are the key players?

- What is the degree of competition in the Singapore cryptocurrency market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Singapore cryptocurrency market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Singapore cryptocurrency market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Singapore cryptocurrency industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)