Singapore Digital Wallet Market Size, Share, Trends and Forecast by Type, Deployment Type, Industry Vertical, and Region, 2026-2034

Singapore Digital Wallet Market Overview:

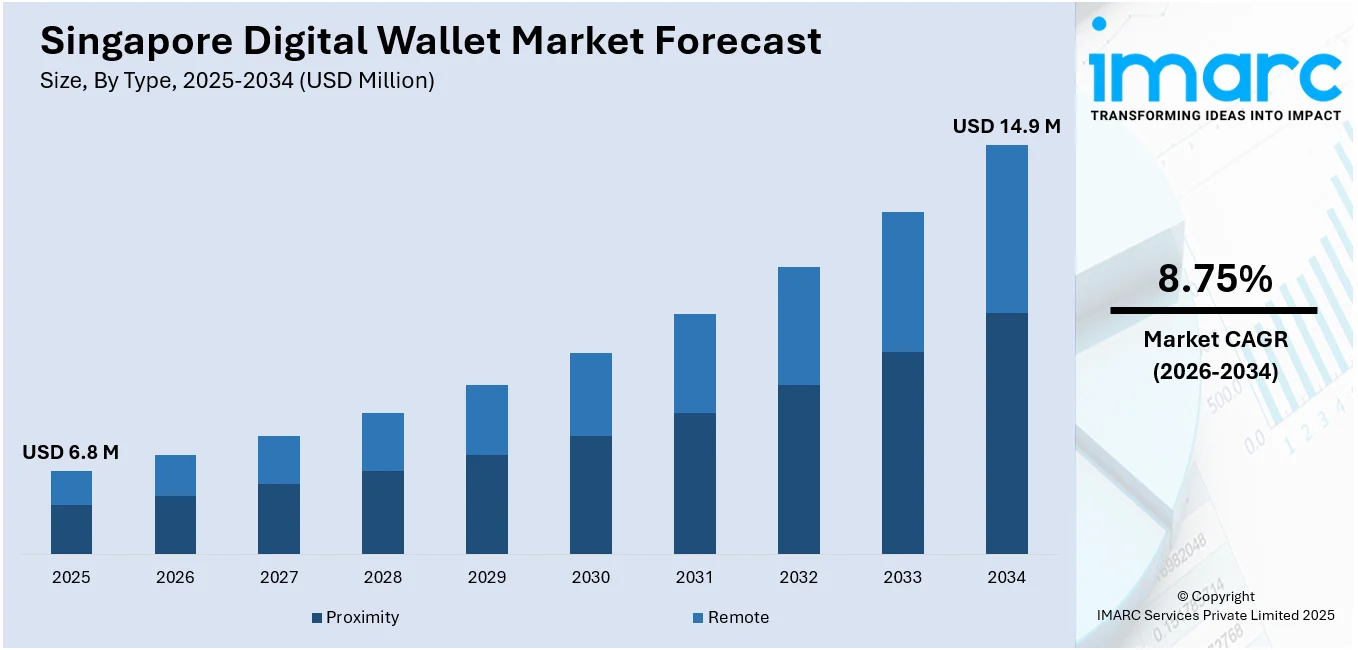

The Singapore digital wallet market size reached USD 6.8 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 14.9 Million by 2034, exhibiting a growth rate (CAGR) of 8.75% during 2026-2034. The heightened utilization of smartphones for making payments and accessing bank accounts, increased implementation of several favorable government policies associated with online transactions, and the rising number of e-commerce websites encouraging individuals to indulge in online shopping activities are some of the factors contributing to the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 6.8 Million |

| Market Forecast in 2034 | USD 14.9 Million |

| Market Growth Rate (2026-2034) | 8.75% |

Singapore Digital Wallet Market Trends:

Increasing Smartphone Penetration

As per a study conducted by Yahoo Singapore in 2024, 1500 respondents aged 18 and above, 57% of commuters utilize e-wallets or mobile apps for making payments. The broad adoption of smartphones is one of the main factors facilitating the use of digital wallet in Singapore. Singapore has one of the greatest rates of smartphone adoption worldwide, with a sizable percentage of the populace utilizing cutting-edge mobile gadgets. The adoption of digital wallets is aided by this high penetration rate since more customers have access to the technology required to support these applications. With digital wallets, consumers can easily manage their funds, conduct transactions, and purchase online, owing to the ease of smartphones. The strong telecommunications infrastructure in Singapore, which guarantees dependable and fast internet connectivity, a necessity for the seamless operation of digital wallets, further supports this trend. The combination of Near Field Communication (NFC), quick response (QR) codes, and biometric authentication in modern smartphones enhances the security and ease of use of digital wallets, making them an attractive option for the public looking for efficient and secure payment solutions.

To get more information on this market Request Sample

Government Initiatives and Regulatory Support

Governing agencies in Singapore are undertaking active measures to promote digital economy, implementing various initiatives and regulatory frameworks to foster the growth of digital payments, including digital wallets. The Smart Nation Initiative, started by governing agencies focuses on harnessing technology to enhance the quality of life, create better opportunities for the public, and build stronger communities as well. This initiative integrates the promotion of cashless transactions and the development of a digital payment ecosystem in Singapore. Regulatory bodies such as the Monetary Authority of Singapore (MAS) have introduced frameworks that make sure the security and efficiency of digital payment system is retained while encouraging innovation. The introduction of the Payment Service Act presents a comprehensive regulatory framework that maintains the safety and efficiency of digital payment systems. On April 2024, MAS further published its revised frequently asked questions (FAQs) on the Payment Services Act to clarify several queries among the public.

Rising E-commerce and Online Transactions

The rapid increment in e-commerce websites and online transactions in Singapore is another key factor driving the digital wallet market. With individuals increasingly turning to online platforms for shopping, bill payments, and other financial transactions, the requirement for convenient and secure payment methods has surged. Digital wallets offer a seamless solution for these online activities, allowing users to store multiple payment methods, track spending, and complete transactions quickly. E-commerce platforms and online retailers often collaborate with digital wallet providers to offer discounts, cashback, and other incentives, encouraging consumers to use these payment methods. Moreover, the integration of digital wallets with various online services, such as food delivery, ride-hailing, and subscription services, has expanded their utility, making them an integral part of the digital economy in Singapore. The convenience, security, and additional benefits provided by digital wallets make them a preferred choice for online consumers, thereby driving their market.

In 2023, Singapore’s e-commerce giant Sea increased its investments in online shopping business Shopee across all markets.

Singapore Digital Wallet Market News:

- February 2024: Revolut launched mobile wallets in Singapore to allow its users to send money abroad spontaneously. Individuals can send money to Bangladesh and Kenya straightway using their Revolut app.

- April 2024: Tranglo expanded its cross border payment network to enable transfers to more than 30 digital wallets and its direct to wallet transactions also eliminate the requirement for intermediaries.

Singapore Digital Wallet Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type, deployment type, and industry vertical.

Type Insights:

- Proximity

- Remote

The report has provided a detailed breakup and analysis of the market based on the type. This includes proximity and remote.

Deployment Type Insights:

- On-Premises

- Cloud

A detailed breakup and analysis of the market based on the deployment type have also been provided in the report. This includes on-premises and cloud.

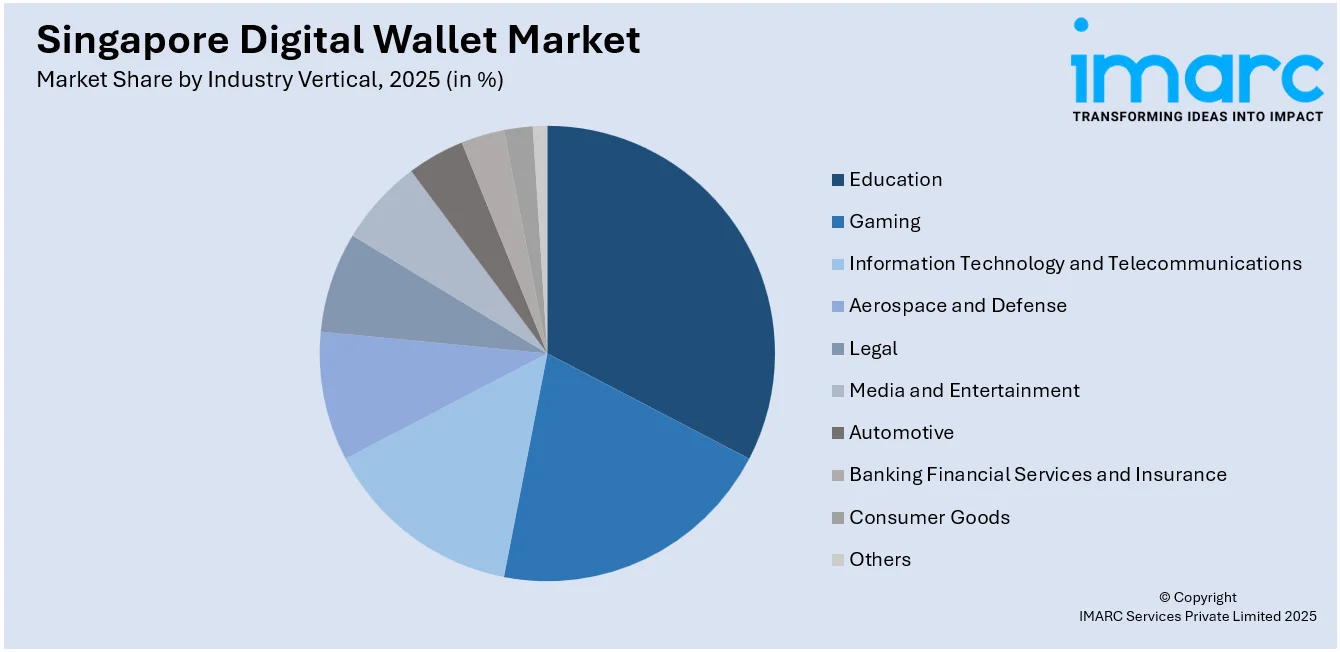

Industry Vertical Insights:

Access the comprehensive market breakdown Request Sample

- Education

- Gaming

- Information Technology and Telecommunications

- Aerospace and Defense

- Legal

- Media and Entertainment

- Automotive

- Banking Financial Services and Insurance

- Consumer Goods

- Others

The report has provided a detailed breakup and analysis of the market based on the industry vertical. This includes education, gaming, information technology and telecommunications, aerospace and defense, legal, media and entertainment, automotive, banking financial services and insurance, consumer goods, and others.

Regional Insights:

- North-East

- Central

- West

- East

- North

The report has also provided a comprehensive analysis of all the major regional markets, which include North-East, Central, West, East, and North.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Singapore Digital Wallet Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Proximity, Remote |

| Deployment Types Covered | On-Premises, Cloud |

| Industry Verticals Covered | Education, Gaming, Information Technology and Telecommunications, Aerospace and Defense, Legal, Media and Entertainment, Automotive, Banking Financial Services and Insurance, Consumer Goods, Others |

| Regions Covered | North-East, Central, West, East, North |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Singapore digital wallet market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Singapore digital wallet market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Singapore digital wallet industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Singapore digital wallet market was valued at USD 6.8 Million in 2025.

The Singapore digital wallet market is projected to exhibit a CAGR of 8.75% during 2026-2034, reaching a value of USD 14.9 Million by 2034.

The Singapore digital wallet market is driven by high smartphone penetration, a tech-savvy population, and strong government support for a cashless economy. Consumers favor convenience, speed, and security, while seamless integration with transport, retail, and banking services boosts usage. Growing fintech innovation further accelerates digital wallet adoption across the country.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)