Singapore Duty-Free and Travel Retail Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

Singapore Duty-Free and Travel Retail Market Overview:

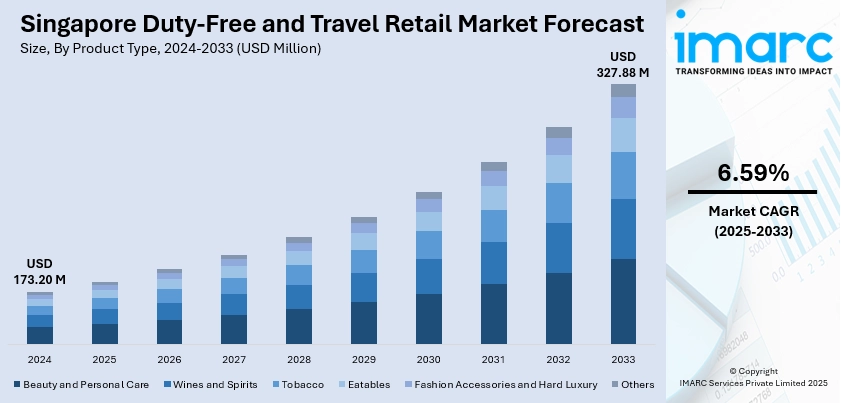

The Singapore duty-free and travel retail market size reached USD 173.20 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 327.88 Million by 2033, exhibiting a growth rate (CAGR) of 6.59% during 2025-2033. Rising tourist arrivals, strong airport infrastructure, premium brand availability, growing middle-class spending, strategic Changi Airport expansions, increased regional air connectivity, digitalization of retail experiences, exclusive duty-free promotions, government support for tourism, and a focus on personalized luxury products are some of the factors contributing to the Singapore duty-free and travel retail market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 173.20 Million |

| Market Forecast in 2033 | USD 327.88 Million |

| Market Growth Rate 2025-2033 | 6.59% |

Singapore Duty-Free and Travel Retail Market Trends:

Upscale Retail Focus in Travel Hubs

High-end retail is gaining traction in airport environments, with a noticeable emphasis on premium offerings, exclusive products, and elevated store design. At major international gateways like Changi Airport, the focus is shifting toward creating a more immersive luxury shopping experience that appeals to global travelers. Enhanced store layouts, curated brand selections, and refined aesthetics are being prioritized to attract shoppers in transit. This approach supports the growing role of travel locations as key shopping destinations, especially in markets with strong tourist flows. The demand for refined, airport-based retail reflects broader shifts in consumer behavior, where convenience, exclusivity, and experience are driving spending habits in transit spaces. These factors are intensifying the Singapore duty-free and travel retail market growth. For example, in January 2024, LOTTE DUTY FREE Singapore completed the launch of all 19 stores at Changi Airport with the grand reopening of its Terminal 3 Departure Central Duplex Store. The revamped space brings new features, exclusive products, and a focus on high-end retail, reinforcing Singapore’s status as a key hub for luxury travel shopping and marking a significant step in LOTTE’s expansion in the region.

To get more information on this market, Request Sample

Immersive Beauty Experiences in Airport Retail

Airport beauty retail is moving toward interactive, multi-sensory formats that combine product discovery with entertainment and personalization. New concepts are focusing on creating immersive environments where travelers engage with brands through digital touchpoints, lounge-style settings, and experiential zones. These spaces are no longer just for shopping; they’re becoming curated destinations aimed at offering moments of exploration and connection during travel. With partnerships across airports and retailers, major beauty groups are using key markets like Singapore to test new ways of blending innovation, luxury, and engagement. This direction reflects how beauty retail is evolving to match the expectations of travelers who value experience as much as product. For instance, in May 2025, L’Oréal Travel Retail Asia Pacific unveiled its 510 sqm “Beauty Shopper-tainment of the Future” concept at TFWA 2025, blending beauty, entertainment, and innovation in airport retail. Partnering with Changi Airport Group, Shilla Duty Free Singapore, and others, it introduces multi-sensory lounges and immersive touchpoints. Featuring 22 luxury brands, including Lancôme and YSL Beauty, the showcase reimagines the airport beauty experience for modern travelers in key markets like Singapore.

Singapore Duty-Free and Travel Retail Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Beauty and Personal Care

- Wines and Spirits

- Tobacco

- Eatables

- Fashion Accessories and Hard Luxury

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes beauty and personal care, wines and spirits, tobacco, eatables, fashion accessories and hard luxury, and others.

Distribution Channel Insights:

- Airports

- Airlines

- Ferries

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes airports, airlines, ferries, and others.

Region Insights:

- North-East

- Central

- West

- East

- North

The report has also provided a comprehensive analysis of all the major regional markets, which include North-East, Central, West, East, and North.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Singapore Duty-Free and Travel Retail Market News:

- In May 2025, Lagardère Travel Retail secured the Master Duty-Free & General Merchandise Concession at Singapore Cruise Centre’s HarbourFront and Tanah Merah terminals. This strengthens its footprint in Asia, offering full-service operations in duty-free travel essentials and dining. The partnership with SCC, which runs three ferry terminals and one international cruise terminal, supports Lagardère’s growth strategy and aims to enhance the travel retail experience in Singapore.

Singapore Duty-Free and Travel Retail Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Beauty and Personal Care, Wines and Spirits, Tobacco, Eatables, Fashion Accessories and Hard Luxury, Others |

| Distribution Channels Covered | Airports, Airlines, Ferries, Others |

| Regions Covered | North-East, Central, West, East, North |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Singapore duty-free and travel retail market performed so far and how will it perform in the coming years?

- What is the breakup of the Singapore duty-free and travel retail market on the basis of product type?

- What is the breakup of the Singapore duty-free and travel retail market on the basis of distribution channel?

- What is the breakup of the Singapore duty-free and travel retail market on the basis of region?

- What are the various stages in the value chain of the Singapore duty-free and travel retail market?

- What are the key driving factors and challenges in the Singapore duty-free and travel retail market?

- What is the structure of the Singapore duty-free and travel retail market and who are the key players?

- What is the degree of competition in the Singapore duty-free and travel retail market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Singapore duty-free and travel retail market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Singapore duty-free and travel retail market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Singapore duty-free and travel retail industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)