Singapore E-commerce Market Size, Share, Trends and Forecast by Type, Transaction, and Region, 2026-2034

Singapore E-commerce Market Summary:

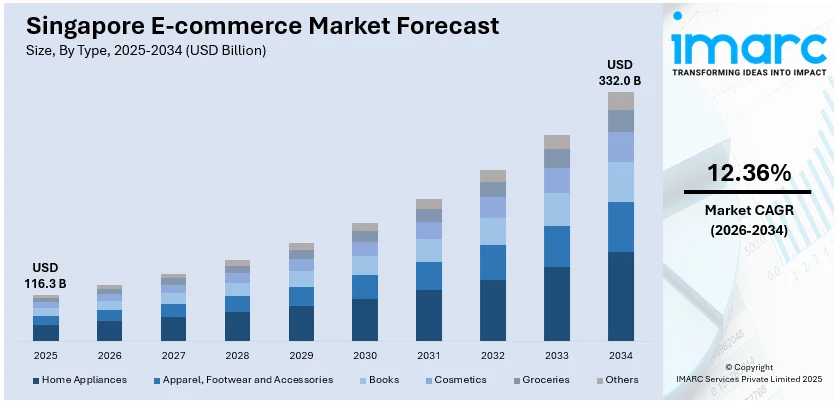

The Singapore e-commerce market size reached USD 116.3 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 332.0 Billion by 2034, exhibiting a growth rate (CAGR) of 12.36% during 2026-2034. The market growth is attributed to high internet penetration, rising smartphone usage, particularly among the younger population, advanced logistics infrastructure, favorable government policies, and a growing preference for online shopping.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 116.3 Billion |

|

Market Forecast in 2034

|

USD 332.0 Billion |

| Market Growth Rate 2026-2034 | 12.36% |

Singapore E-commerce Market Trends:

High Internet Penetration

The widespread access to the internet facilitates online shopping and digital engagement is driving the growth of the market. According to a report by the datareportal, there were 5.79 million internet users in Singapore at the start of 2024 when internet penetration stood at 96.0%. Singapore was home to 5.13 million social media users in January 2024, equating to 85.0 percent of the total population. A total of 9.78 million cellular mobile connections were active in Singapore in early 2024, with this figure equivalent to 162.2% of the total population. There were 5.79 million internet users in Singapore in January 2024. Singapore’s internet penetration rate stood at 96.0% of the total population at the start of 2024. Kepios analysis indicates that internet users in Singapore increased by 37 thousand (+0.6%) between January 2023 and January 2024. For perspective, these user figures reveal that 244.1 thousand people in Singapore did not use the internet at the start of 2024, suggesting that 4.0% of the population remained offline at the beginning of the year. Median mobile internet connection speed via cellular networks: 95.18 Mbps. Median fixed internet connection speed: 263.51 Mbps. Ookla’s data reveals that the median mobile internet connection speed in Singapore increased by 23.00 Mbps (+31.9 percent) in the twelve months to the start of 2024.

To get more information on this market Request Sample

Significant Advancements in Logistics Infrastructure

Efficient delivery systems and reliable logistics support fast and convenient e-commerce transactions. According to the Singapore Economic Development Board (EDB), Singapore is a prime location for major logistics firms, with most of the top 25 global players conducting operations here. Most of them, like DHL and Schenker, have set up regional or global HQ functions here. Leading manufacturers like Henkel and Infineon base their SCM hubs and Distribution Centres in Singapore to orchestrate their regional and global supply chains. They enjoy strong support from our vibrant ecosystem of leading shippers and third-party logistics providers (3PLs), many of whom have innovation hubs here. We also offer a professional talent pool and a robust R&D ecosystem. the world’s busiest transshipment seaport, and Changi Airport, one of Asia’s largest cargo airports, Singapore helps companies drive speed to the global market through our excellent infrastructure and connectivity. We also offer business connectivity through Asia’s most extensive network of Free Trade Areas, covering 85% of the world’s GDP.

Rise of Digital Payments and BNPL Services

The surge of digital payment platforms is transforming Singapore’s e-commerce ecosystem, creating a frictionless experience for both consumers and retailers. Mobile wallets such as GrabPay, PayNow, and ShopeePay are increasingly integrated into online platforms, enabling quick, secure, and hassle-free transactions, and forming a major part of the overall Singapore e-commerce market share. This trend is reinforced by the growing popularity of Buy Now Pay Later (BNPL) services, which offer flexible payment options and appeal strongly to younger, tech-savvy shoppers who prefer budgeting convenience over traditional credit cards. Retailers are also leveraging these payment systems to build customer loyalty by pairing them with rewards and cashback programs. As per E-commerce in Singapore statistics and trends, strong cybersecurity measures and high consumer trust in digital banking are enabling seamless checkout experiences, which are driving higher online spending and expanding e-commerce penetration across diverse product categories. Additionally, partnerships between fintech firms and major e-commerce players are leading to innovative financial solutions like micro-lending. These developments are also boosting small and mid-sized businesses by simplifying payment processing. As digital payments evolve, they are expected to remain at the heart of Singapore’s online retail growth strategy.

Singapore E-commerce Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type and transaction.

Type Insights:

- Home Appliances

- Apparel, Footwear and Accessories

- Books

- Cosmetics

- Groceries

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes home appliances, apparel, footwear and accessories, books, cosmetics, groceries, and others.

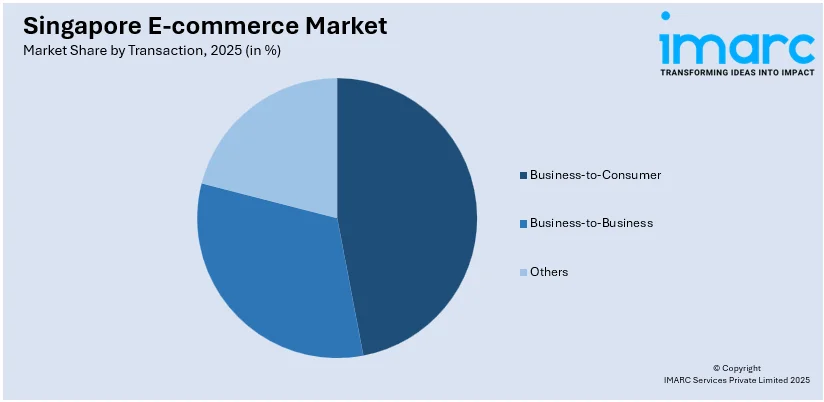

Transaction Insights:

Access the comprehensive market breakdown Request Sample

- Business-to-Consumer

- Business-to-Business

- Others

A detailed breakup and analysis of the market based on the transaction have also been provided in the report. This includes business-to-consumer, business-to-business, and others.

Regional Insights:

- North-East

- Central

- West

- East

- North

The report has also provided a comprehensive analysis of all the major regional markets, which include North-East, Central, West, East, and North.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Singapore E-commerce Market News:

- In May 2025, Shopee showcased the manner content-led strategies, AI-driven personalization, and fast fulfilment are transforming e-commerce in Singapore, with Shopee Live achieving 3.5 times year-on-year GMV growth. The platform reported a 13-fold surge in next-day fulfilment demand, with 51% of shoppers expecting deliveries within two days, supported by its Fulfilled by Shopee logistics solution.

- In February 2025, Shopee announced that over 8,000 local sellers in Singapore have joined its pilot programme, enabling them to reach markets such as Malaysia, Thailand, and the Philippines at no extra cost. The programme, launched in September 2024, has resulted in an eightfold increase in orders and gross merchandise value (GMV) for participating sellers.

- In November 2024, Lazada partnered with Alibaba's Taobao to launch a dedicated Taobao Fashion channel in Singapore and Malaysia, featuring over 6 million fashion products and exclusive promotions. The platform offers discounts up to 70%, “Buy 3, Get 20% Off” deals, and free international air shipping with deliveries as fast as 5 working days.

- In June 2024, Webuy Global Ltd entered the nutraceutical and longevity sectors with the launch of NEONE, a premium supplement brand aimed at enhancing cellular energy, optimizing mitochondrial function, and supporting longevity. Since its launch in May 2024, NEONE has gained rapid consumer traction across Southeast Asia, supported by celebrity endorsements and leveraging Webuy’s community-driven e-commerce model.

- In March 2024, TikTok’s e-commerce platform TikTok Shop launched TikTok Shop Mall in Singapore, a by-invite-only channel exclusively for brands’ flagship stores and authorized online retail outlets.

- In May 2024, Singapore Post (SingPost), a leading postal and e-commerce logistics provider in Asia Pacific, and Qazpost, the national postal operator of the Republic of Kazakhstan, announced a strategic cooperation agreement aimed at boosting e-commerce and logistics and bolstering development in both countries.

Singapore E-commerce Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Home Appliances, Apparel, Footwear and Accessories, Books, Cosmetics, Groceries, Others |

| Transactions Covered | Business-to-Consumer, Business-to-Business, Others |

| Regions Covered | North-East, Central, West, East, North |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Singapore e-commerce market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Singapore e-commerce market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Singapore e-commerce industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Singapore e-commerce market was valued at USD 116.3 Billion in 2025.

The Singapore e-commerce market is projected to exhibit a CAGR of 12.36% during 2026-2034, reaching a value of USD 332.0 Billion by 2034.

The Singapore e-commerce market is driven by high internet penetration, a tech-savvy population, and strong logistics infrastructure. Government support, secure digital payment systems, and growing mobile commerce also contribute to market growth. Rising consumer demand for convenience and international brands further fuels growth, making Singapore a regional e-commerce hub in Southeast Asia.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)