Singapore Family Offices Market Size, Share, Trends and Forecast by Type, Office Type, Asset Class, Service Type, and Region, 2025-2033

Singapore Family Offices Market Overview:

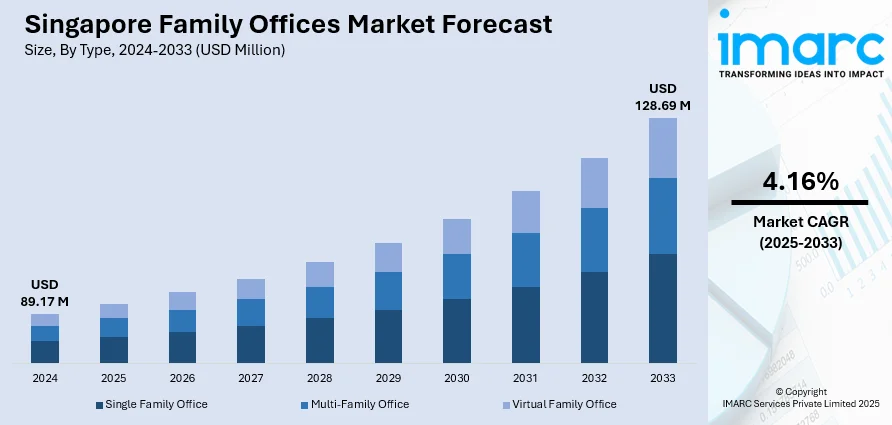

The Singapore family offices market size reached USD 89.17 Million in 2024. The market is projected to reach USD 128.69 Million by 2033, exhibiting a growth rate (CAGR) of 4.16% during 2025-2033. The market is fueled by growth in wealth accumulation and heightened appetite for high-end wealth management services. Strengthened regulatory environments and thoughtful government policies are further supporting the ecosystem, drawing ultra-high-net-worth families looking for regional and international investment opportunities. Greater adoption of sustainable investing, holistic financial solutions, and technology underscores this upward trend. These drivers together enhance Singapore's position in wealth management as expressed in the growing Singapore family offices market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 89.17 Million |

| Market Forecast in 2033 | USD 128.69 Million |

| Market Growth Rate 2025-2033 | 4.16% |

Singapore Family Offices Market Trends:

Growing Use of Integrated Wealth Management Solutions

Singapore family offices are increasingly adopting integrated wealth management solutions to offer comprehensive services that cover investment management, estate planning, tax advisory, and philanthropy. This holistic strategy ensures maximized asset growth and preservation and helps in managing intricate family relationships and succession planning. Adopting advanced technological platforms allows for easy portfolio tracking and reporting, optimizing decision-making effectiveness. In addition, the need for customized and tailored financial solutions remains on the increase, mirroring the changing aspirations of ultra-high-net-worth families. Such innovations play an important role in market expansion, with companies diversifying their service portfolios to stay ahead. Reflecting this trend, the number of single-family offices in Singapore surged past 2,000 by the end of 2024—a growth of over 40 percent since 2023—highlighting rising demand for more integrated and sophisticated wealth services in the city-state. The trend reflects a wider movement in Singapore family offices market trends toward total wealth stewardship that balances risk management with legacy creation.

To get more information on this market, Request Sample

Focus on Sustainable and Impact Investing

Sustainability and impact investing are also among the key themes in Singapore family offices, with wealthy families becoming increasingly aware of environmental, social, and governance (ESG) considerations. Family offices are increasingly putting capital into investments that have positive social and environmental impacts as well as financial returns. The driver behind this shift is aligning portfolios with family values and long-term global sustainability objectives. The increase in ESG-oriented investment mandates is expressed through increased due diligence activities and the inclusion of non-financial data in performance evaluation. This emphasis on responsible investing is a central part of market trends and a key driver of enhancing Singapore family offices market growth as families want to blend purpose and profit into their investment strategies.

Increased Use of Technology and Data Analytics

The adoption of cutting-edge technology and data analysis is revolutionizing the working environment of Singapore family offices. Utilizing artificial intelligence, big data, and cloud-based platforms helps family offices augment investment research, risk analysis, and portfolio management. Automation of routine administrative work frees wealth managers to concentrate on strategic advisory and personalized client interactions. In addition, digital tools allow for real-time reporting and secure communication, strengthening transparency and governance. This technological convergence enables faster and better-informed decision-making, which is crucial for turbulent world markets. According to reports, it is found that although many family offices still rely on legacy tools like Excel and email, approximately 49 % of respondents are now developing or launching digitization strategies, while 89 % feel under-invested in their tech infrastructure, underscoring substantial opportunity for modernization. Such innovations form a critical component of market trends and directly contribute to the long-term growth of the market through accelerating operational efficiency and raising the standards of client service.

Singapore Family Offices Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, office type, asset class, and service type.

Type Insights:

- Single Family Office

- Multi-Family Office

- Virtual Family Office

The report has provided a detailed breakup and analysis of the market based on the type. This includes single family office, multi-family office, and virtual family office.

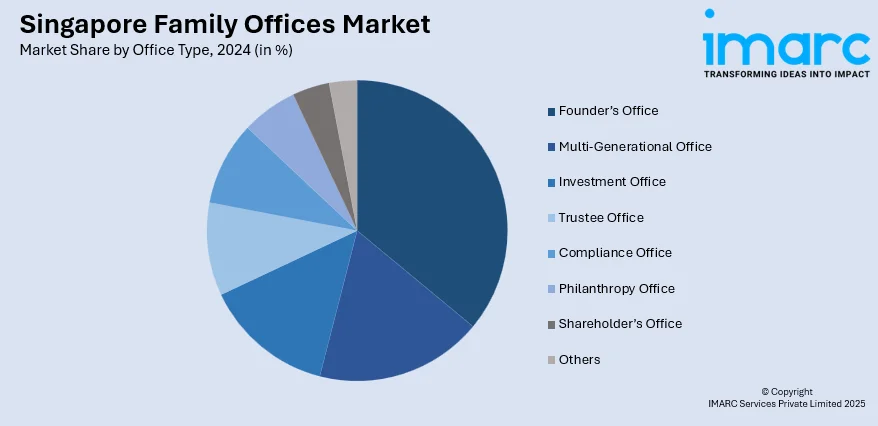

Office Type Insights:

- Founder’s Office

- Multi-Generational Office

- Investment Office

- Trustee Office

- Compliance Office

- Philanthropy Office

- Shareholder’s Office

- Others

A detailed breakup and analysis of the market based on the office type have also been provided in the report. This includes founder’s office, multi-generational office, investment office, trustee office, compliance office, philanthropy office, shareholder’s office, and others.

Asset Class Insights:

- Bonds

- Equalities

- Alternatives Investments

- Commodities

- Cash or Cash Equivalents

The report has provided a detailed breakup and analysis of the market based on the asset class. This includes bonds, equalities, alternatives investments, commodities, and cash or cash equivalents.

Service Type Insights:

- Financial Planning

- Strategy

- Governance

- Advisory

- Others

A detailed breakup and analysis of the market based on the service type have also been provided in the report. This includes financial planning, strategy, governance, advisory, and others.

Regional Insights:

- North-East

- Central

- West

- East

- North

The report has also provided a comprehensive analysis of all the major regional markets, which include North-East, Central, West, East, and North.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided

Singapore Family Offices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Single Family Office, Multi-Family Office, Virtual Family Office |

| Office Types Covered | Founder’s Office, Multi-Generational Office, Investment Office, Trustee Office, Compliance Office, Philanthropy Office, Shareholder’s Office, Others |

| Asset Classes Covered | Bonds, Equalities, Alternatives Investments, Commodities, Cash or Cash Equivalents |

| Service Types Covered | Financial Planning, Strategy, Governance, Advisory, Others |

| Regions Covered | North-East, Central, West, East, North |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Singapore family offices market performed so far and how will it perform in the coming years?

- What is the breakup of the Singapore family offices market on the basis of type?

- What is the breakup of the Singapore family offices market on the basis of office type?

- What is the breakup of the Singapore family offices market on the basis of asset class?

- What is the breakup of the Singapore family offices market on the basis of service type?

- What is the breakup of the Singapore family offices market on the basis of region?

- What are the various stages in the value chain of the Singapore family offices market?

- What are the key driving factors and challenges in the Singapore family offices market?

- What is the structure of the Singapore family offices market and who are the key players?

- What is the degree of competition in the Singapore family offices market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Singapore family offices market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Singapore family offices market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Singapore family offices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)