Singapore Fintech Market Size, Share, Trends and Forecast by Deployment Mode, Technology, Application, End User, and Region, 2026-2034

Singapore Fintech Market Summary:

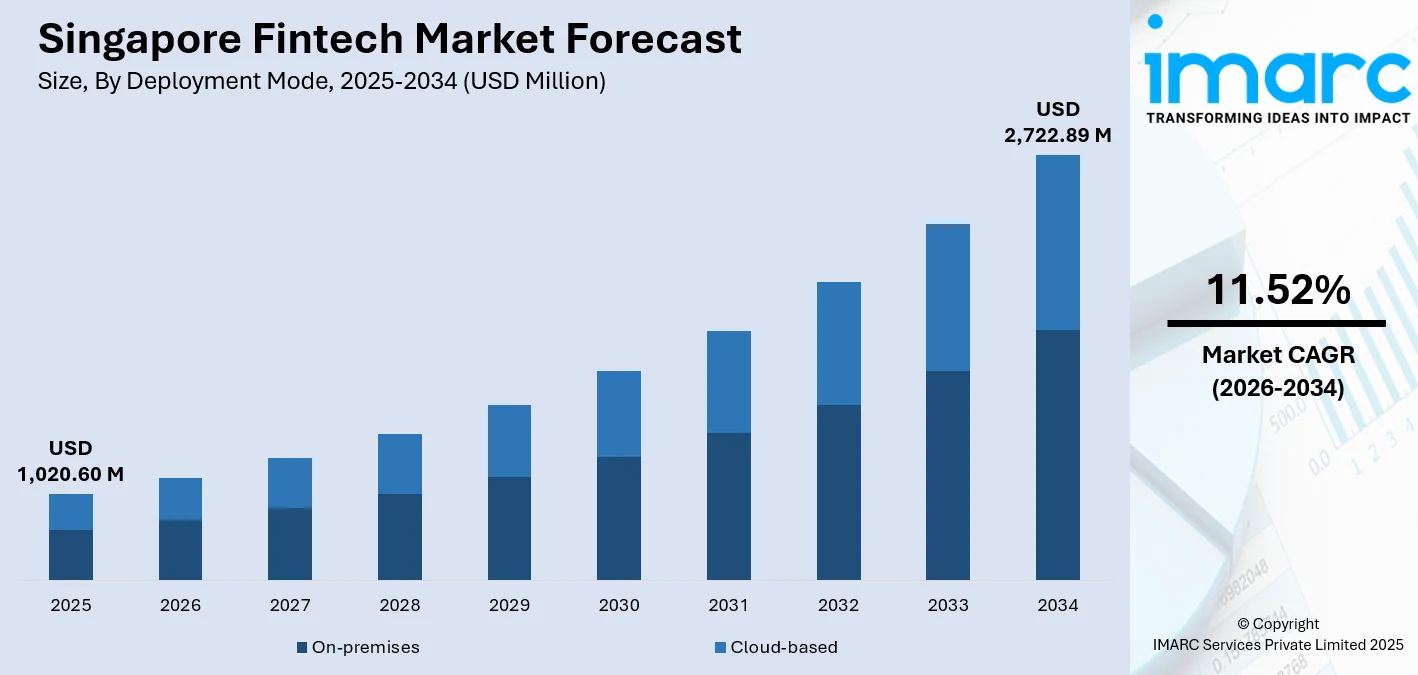

The Singapore fintech market size was valued at USD 1,020.60 Million in 2025 and is projected to reach USD 2,722.89 Million by 2034, growing at a compound annual growth rate of 11.52% from 2026-2034.

The Singapore fintech market is experiencing transformative growth driven by robust government initiatives, advanced digital infrastructure, and strong investment inflows. Progressive regulatory frameworks established by the Monetary Authority of Singapore continue fostering innovation while maintaining financial stability. The convergence of artificial intelligence (AI) adoption, expanding cross-border payment connectivity, and rising demand for digital financial services is fundamentally reshaping competitive dynamics and creating substantial opportunities across the value chain, positioning Singapore as a leading global fintech hub.

Key Takeaways and Insights:

- By Deployment Mode: On-premises dominate the market with a share of 35.08% in 2025, driven by established financial institutions prioritizing data security, regulatory compliance requirements, and integration with legacy banking systems.

- By Technology: Application programming interface leads the market with a share of 25.06% in 2025, reflecting strong open banking adoption, API Exchange platform utilization, and financial institutions leveraging APIs for seamless third-party integrations and collaborative innovation.

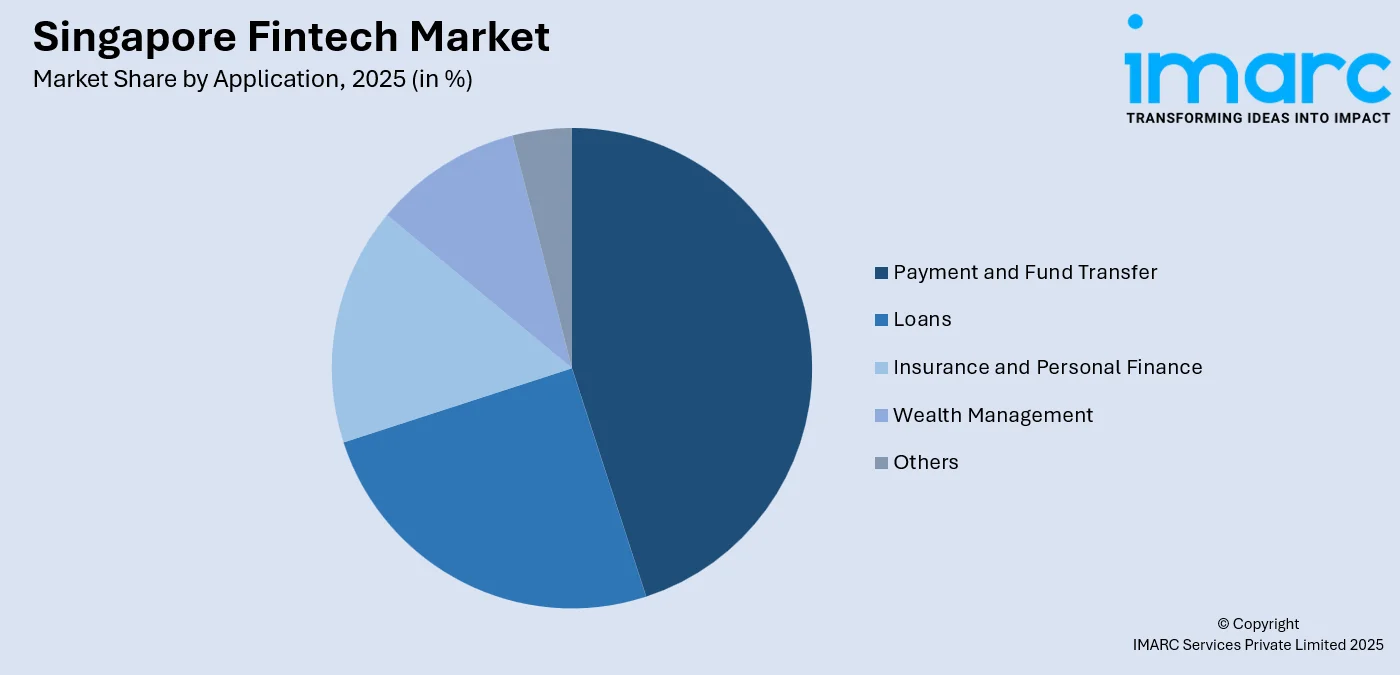

- By Application: Payment and fund transfer represents the largest segment with a market share of 45.05% in 2025. This dominance is because of widespread PayNow and SGQR adoption, expanding cross-border payment connectivity, and nearly universal digital payment usage across consumers and businesses.

- By End User: Banking dominate the market with a share of 50.13% in 2025, underscoring traditional financial institutions as primary adopters of fintech solutions for digital transformation, operational efficiency enhancement, and competitive positioning against digital-native challengers.

- Key Players: The Singapore fintech market exhibits dynamic competitive intensity, with established financial institutions, global technology providers, and innovative startups competing across various segments while collaborating through regulatory sandboxes and industry consortiums.

To get more information on this market Request Sample

The Singapore fintech market continues establishing itself as a premier global financial innovation hub, supported by comprehensive regulatory frameworks and advanced digital infrastructure. The Monetary Authority of Singapore has been instrumental in creating a conducive environment for fintech development through initiatives, such as the Financial Sector Technology and Innovation Scheme (FSTI 3.0), which committed an additional S$100 million in July 2024 to accelerate quantum and artificial intelligence (AI) technology adoption across financial services. This strategic investment demonstrates Singapore's commitment to maintaining technological leadership while ensuring financial system stability. Besides this, the market benefits from high smartphone penetration, widespread digital payment adoption, and strong venture capital inflows that collectively contribute to the Singapore fintech market growth. Cross-border payment initiatives and regional integration efforts further strengthen Singapore's position as the gateway for fintech expansion across Southeast Asia.

Singapore Fintech Market Trends:

Advanced Digital Infrastructure and Connectivity

Singapore’s robust digital infrastructure is a crucial factor influencing the market by enabling secure, efficient, and scalable delivery of financial services. High-speed connectivity, reliable cloud adoption, and widespread digital penetration allow real-time transactions, data analytics, and innovative fintech solutions to operate seamlessly. In 2024, the government announced plans to invest up to S$100 million to upgrade the nationwide broadband network to 10Gbps, with rollout beginning mid-2024 and expected completion by 2026, further enhancing digital capacity. This investment strengthens the foundation for fintech innovation, ensures consistent service quality, and positions Singapore to support increasingly sophisticated and high-demand financial technologies.

Expansion of Advanced Cross-Border Payment Solutions

As businesses increasingly operate across international markets, the need for seamless, multi-currency, and real-time payment capabilities is growing. This trend is reinforced by fintech firms expanding their offerings to address cost, speed, and operational complexity in cross-border transactions. In 2025, Razorpay’s expansion into Singapore highlighted this trend by introducing real-time payments, AI-powered financial tools, such as Agentic-AI and RAY, and multi-currency checkout solutions, aimed at reducing cross-border transaction fees by 30–40%. This advancement enhanced operational efficiency, improved financial intelligence, and enabled SMEs and e-commerce businesses in Singapore to scale globally, accelerating fintech adoption and overall market growth.

Unified Multi-Currency Platforms for Regional Scalability

The increasing need for unified, compliant, and efficient multi-currency payment platforms is propelling the fintech market growth in Singapore. As businesses expand across Southeast Asia, fragmented payment systems, currency complexities, and regulatory differences create operational challenges. Fintech solutions that consolidate these functions into a single platform significantly improve efficiency and scalability. Xendit Group’s launch of its Global Account at the Singapore FinTech Festival 2025 exemplified this trend by enabling businesses to manage multi-currency payments, automate currency conversions, and execute instant regional payouts through one integrated platform. By simplifying cross-border operations and ensuring multi-market compliance, such platforms empower SMEs and enterprises to scale regionally, reinforcing demand for advanced fintech solutions.

Market Outlook 2026-2034:

The Singapore fintech market demonstrates notable growth potential over the forecast period, supported by progressive regulatory frameworks, strong government backing, and rapid digital transformation across banking and financial services. High digital adoption, advanced payment infrastructure, and a strong startup ecosystem are accelerating innovation in payments, lending, wealth management, and regtech solutions. Continued investment and regulatory clarity are expected to sustain long-term market growth. The market generated a revenue of USD 1,020.60 Million in 2025 and is projected to reach a revenue of USD 2,722.89 Million by 2034, growing at a compound annual growth rate of 11.52% from 2026-2034.

Singapore Fintech Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Deployment Mode | On-Premises | 35.08% |

| Technology | Application Programming Interface | 25.06% |

| Application | Payment and Fund Transfer | 45.05% |

| End User | Banking | 50.13% |

Deployment Mode Insights:

- On-premises

- Cloud-based

On-premises dominates with a market share of 35.08% of the total Singapore fintech market in 2025.

On-premises leads the market due to stringent regulatory requirements, data sovereignty expectations, and strong emphasis on financial data security. Banks, payment institutions, and regulated fintech firms prefer on-premises systems to retain direct control over sensitive user information, transaction data, and core processing infrastructure. This deployment mode supports compliance with local supervisory guidelines, internal risk management policies, and audit requirements. On-premises environments also enable tighter customization of systems, integration with legacy banking platforms, and predictable performance for mission-critical financial operations across large institutions.

Large financial institutions and established fintech providers continue to invest in on-premises infrastructure to ensure operational resilience and business continuity. Control over infrastructure allows faster response to security incidents and regulatory inspections. On-premises deployment also supports high-volume transaction processing with minimal latency, which is essential for payments, trading, and core banking functions. While cloud adoption is rising, on-premises systems remain preferred for core workloads, supporting stability, compliance assurance, and long-term operational reliability within Singapore’s highly regulated financial ecosystem.

Technology Insights:

- Application Programming Interface

- Artificial Intelligence

- Blockchain

- Robotic Process Automation

- Data Analytics

- Others

Application programming interface leads with a market share of 25.06% of the total Singapore fintech market in 2025.

Application programming interface holds the biggest market share owing to its central role in enabling system interoperability, open banking, and rapid innovation across financial services. API allows seamless integration between banks, fintech platforms, payment gateways, and third-party service providers, supporting real-time data exchange and modular service development. This flexibility enables faster product launches, customization, and scalability while maintaining compliance with regulatory requirements. API also supports secure data sharing frameworks, enhancing collaboration across the financial ecosystem and improving user experience through connected financial solutions.

Strong regulatory support for open banking and digital payments further reinforces API adoption across Singapore’s fintech landscape. Financial institutions rely on API to enable account aggregation, instant payments, digital identity verification, and embedded finance solutions. APIs reduce development complexity and integration costs while supporting innovation in lending, wealth management, and payments. Its ability to support cross-platform connectivity and rapid innovation makes API the preferred technology foundation for Singapore’s advanced and highly interconnected fintech market.

Application Insights:

To get detailed segment analysis of this market Request Sample

- Payment and Fund Transfer

- Loans

- Insurance and Personal Finance

- Wealth Management

- Others

Payment and fund transfer exhibits a clear dominance with a 45.05% share of the total Singapore fintech market in 2025.

Payment and fund transfer represent the largest segment, attributed to the country’s highly digitalized economy and widespread adoption of cashless transactions. Individuals and businesses increasingly rely on real-time payments, mobile wallets, and digital transfer platforms for daily financial activities. Strong demand for speed, convenience, and security is driving continuous innovation in domestic and cross-border payment solutions. These applications support high transaction volumes, frequent usage, and recurring revenue streams, making payments the most commercially significant fintech segment.

Singapore’s status as a leading global financial and trade hub reinforces its dominance in payment and fund transfer services, driven by the growing need for efficient cross-border transactions, remittances, and corporate treasury operations. In 2025, TransferMate received approval from the Monetary Authority of Singapore (MAS) to expand its payment services under its Major Payment Institution license, including account issuance, domestic transfers, and e-money services. This enabled businesses across Asia to store funds locally, execute cross-border payments, manage currencies, and handle payroll or supplier payments via TransferMate’s centralized Singapore platform, solidifying the city-state’s role as a regulated, multi-currency financial hub and enhancing seamless regional financial operations.

End User Insights:

- Banking

- Insurance

- Securities

- Others

Banking dominates with a market share of 50.13% of the total Singapore fintech market in 2025.

Banking exhibits a clear dominance in the market, driven by its scale, regulatory obligations, and continuous drive for digital innovation. Banks increasingly adopt fintech solutions to enhance client experience, strengthen operational efficiency, and meet regulatory and risk management requirements. In 2026, Singapore’s Sea Ltd invested an additional S$75 million into MariBank, raising its paid-up capital to approximately US$639 million as the digital bank expands operations. This investment underscores the sector’s reliance on advanced platforms for digital payments, core banking, fraud detection, and data analytics.

Singapore’s position as a regional banking hub further reinforces this dominance. Local and international banks operate complex, high-value financial operations that require secure, resilient, and scalable technology infrastructure. Fintech solutions support real-time processing, regulatory reporting, cybersecurity, and product innovation. Collaboration between banks and fintech providers is common, enabling faster deployment of digital services. Continuous modernization of legacy systems and competition from digital banks are also driving higher fintech adoption, ensuring banks remain the leading end users in Singapore’s fintech market.

Regional Insights:

- North-East

- Central

- West

- East

- North

North-East supports fintech growth through its strong residential base and rising adoption of digital payments and mobile banking services. High smartphone penetration and digitally active individuals drive the demand for user-centric fintech applications, particularly in payments, personal finance management, and digital lending solutions.

Central dominates the fintech market due to its concentration of financial institutions, multinational corporations, regulators, and technology firms. The region hosts major banks, fintech startups, and innovation hubs, making it the primary center for fintech development, investment, and enterprise adoption nationwide.

West contributes to fintech adoption through industrial zones, business parks, and logistics hubs that require efficient digital payment, trade finance, and treasury management solutions. Fintech platforms supporting enterprise finance, supply chain payments, and automation are increasingly adopted by businesses operating in this region.

East benefits from strong commercial activity, transportation infrastructure, and cross-border connectivity. Demand for remittance services, travel-related payments, and digital wallets is high, supported by retail centers and proximity to transport hubs, reinforcing fintech usage in consumer and small business segments.

North supports fintech growth through expanding residential developments and small business activity. Increasing digital inclusion, adoption of cashless payments, and use of online banking services are driving fintech demand, particularly among households, retailers, and service-oriented enterprises in the region.

Market Dynamics:

Growth Drivers:

Why is the Singapore Fintech Market Growing?

Focus on Cybersecurity and Trust

Heightened emphasis on cybersecurity and trust is a crucial factor influencing the fintech market by fostering confidence in digital financial systems. Strong governance practices and security standards encourage greater adoption among both consumers and institutions. In response, fintech firms are integrating robust risk controls and secure architectures to meet rising expectations. Trust remains a critical enabler of digital finance, directly influencing user adoption and long-term engagement. As financial services become more digitized, security-focused solutions are gaining strategic importance. For instance, phishing attempts in Singapore increased by 49% to 6,100 cases in 2024, according to the Cyber Security Agency of Singapore's annual report, highlighting the growing need for secure fintech infrastructures.

Integration of AI and Automation

The integration of AI and automation is significantly accelerating fintech innovation, with financial institutions increasingly adopting intelligent systems to enhance decision-making, boost operational efficiency, and personalize services. These technologies enable fintech platforms to reduce manual intervention, increase processing speed, and ensure scalability while maintaining accuracy and control. As these intelligent solutions become more embedded in financial services, the demand for advanced fintech platforms continues to grow. A notable example is the 2025 launch of ALFIN, an AI-driven research platform by the Global Finance & Technology Network (GFTN) at the Singapore FinTech Festival, designed to provide trusted and verifiable intelligence for smarter financial decision-making.

Rise of Cash Management Solutions

The growing demand for efficient cash management and liquidity optimization is influencing the market, as businesses increasingly seek flexible, low‑risk solutions that allow them to earn returns on idle funds while maintaining easy access to capital. In 2025, Revolut Business Singapore responded to this need by launching Flexible Cash Funds, a product that enables companies to earn daily returns on idle balances through low‑risk money market funds. Supporting USD, GBP, and EUR, this feature offered instant access within two business days and had no investment limits, strengthening the appeal of digital treasury solutions in the market.

Market Restraints:

What Challenges the Singapore Fintech Market is Facing?

Rising Cybersecurity Threats and Digital Financial Scam Vulnerabilities

The increasing sophistication of cybercriminal activities poses significant challenges as digital financial transactions expand across platforms and channels. Financial institutions face mounting pressure to invest in advanced security infrastructure while maintaining seamless user experiences. The evolving threat landscape requires continuous adaptation of fraud detection systems, authentication mechanisms, and incident response capabilities that strain organizational resources and increase operational costs.

High Compliance Costs and Evolving Regulatory Requirements

Fintech companies must navigate complex and continuously evolving regulatory frameworks, ranging spanning anti-money laundering, data protection, consumer safeguards, to digital asset governance. Compliance spending has increased substantially as new requirements demand enhanced systems, specialized personnel, and ongoing audit capabilities. Smaller fintech startups face particular challenges meeting regulatory obligations while managing limited resources and competing against well-capitalized incumbents.

Talent Shortage in Specialized Fintech Roles

The rapid growth of Singapore's fintech sector has created acute demand for specialized talent in areas, including AI, cybersecurity, blockchain development, and regulatory compliance. Competition for skilled professionals intensifies as both established financial institutions and emerging startups seek similar expertise. Many companies struggle finding regional specialists in critical functions such as fraud prevention and risk modeling, potentially constraining innovation and expansion plans.

Competitive Landscape:

The Singapore fintech market exhibits dynamic competitive intensity characterized by established financial institutions, global technology providers, and innovative startups competing across payment, lending, wealth management, and insurance segments. Competition is driven by investments in AI capabilities, API infrastructure development, and digital user experience enhancement. Strategic partnerships between traditional banks and fintech companies are accelerating innovation while regulatory sandboxes enable collaborative experimentation. Market participants are focusing on cross-border expansion capabilities, sustainable finance offerings, and embedded financial solutions to differentiate positioning and capture emerging opportunities in the evolving digital finance landscape.

Recent Developments:

- December 2025: Singapore appointed DBS Bank as its second Renminbi (RMB) clearing bank and launched an e-CNY pilot for Singapore travelers, enabling digital yuan wallet top-ups for merchant payments in China. These initiatives supported cross-border trade, investment, bond market access, and secondary listings of Chinese A-share companies on the Singapore Exchange. The measures reinforce Singapore’s role as a regional financial gateway, enhancing connectivity with China and ASEAN through fintech, green finance, and cross-border financial services.

- November 2025: The Singapore FinTech Festival 2025, held from November 12–14, celebrated its 10th anniversary as a global platform for FinTech innovation, organized by MAS, GFTN, and Constellar. The event focused on AI, tokenization, quantum technologies, and financial inclusion, featuring over 800 speakers in 400+ sessions and showcasing innovations through exhibitions and immersive experiences.

Singapore Fintech Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Deployment Modes Covered | On-premises, Cloud-based |

| Technologies Covered | Application Programming Interface, Artificial Intelligence, Blockchain, Robotic Process Automation, Data Analytics, Others |

| Applications Covered | Payment and Fund Transfer, Loans, Insurance and Personal Finance, Wealth Management, Others |

| End Users Covered | Banking, Insurance, Securities, Others |

| Regions Covered | North-East, Central, West, East, North |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Singapore fintech market size was valued at USD 1,020.60 Million in 2025.

The Singapore fintech market is expected to grow at a compound annual growth rate of 11.52% from 2026-2034 to reach USD 2,722.89 Million by 2034.

On-premises dominates with a market share of 35.08% in 2025, due to stringent regulatory requirements, data sovereignty expectations, and strong emphasis on financial data security. Banks, payment institutions, and regulated fintech firms prefer on-premises systems to retain direct control over sensitive user information, transaction data, and core processing infrastructure.

Key factors driving the Singapore fintech market include advanced digital infrastructure that supports secure, efficient fintech services. For example, in 2024, the government committed S$100?million to upgrade broadband to 10?Gbps, enhancing connectivity, enabling real-time transactions, and fostering fintech innovation while ensuring reliable, scalable financial service delivery nationwide.

Major challenges include rising cybersecurity threats and sophisticated digital financial scams, high compliance costs amid evolving regulatory requirements, talent shortages in specialized roles including AI and fraud prevention, intensifying competition from regional markets, and elevated customer acquisition costs in saturated segments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)