Singapore Online Gaming Market Size, Share, Trends and Forecast by Device Type, Gaming Type, Age Group, Gender Demographics, Model, and Region, 2025-2033

Singapore Online Gaming Market Overview:

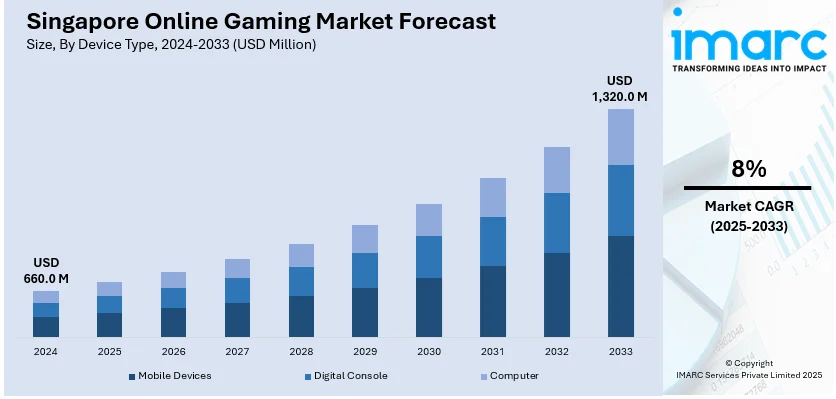

The Singapore online gaming market size reached USD 660.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,320.0 Million by 2033, exhibiting a growth rate (CAGR) of 8% during 2025-2033. The market is primarily driven by increasing internet penetration in Singapore, significant expansion of the e-sports industry, increased smartphone usage, technological advancements, and government regulations and esports events across the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 660.0 Million |

| Market Forecast in 2033 | USD 1,320.0 Million |

| Market Growth Rate (2025-2033) | 8% |

Singapore Online Gaming Market Trends:

High Internet Penetration in Singapore

Singapore's strong internet penetration rate is driving the growth of its online gaming business. According to the Infocomm Media Development Authority, Singapore Digital Society report 2023, Singapore has achieved significant digital accessibility, with almost all or 99% of resident homes having internet access and 90% owning computers by 2022. This connectivity enables smooth gameplay, which is critical for recreational and competitive players, and streaming and content production, which are vital components of the gaming community. In addition, smartphone ownership among people has hit a new high of 97%. Moreover, with the increasing internet connection, gaming businesses may reach a larger audience, encouraging the adoption of new games and the growth of mobile gaming apps. The solid digital infrastructure facilitates cloud gaming development, removing hardware limits for gamers and potentially expanding the market to individuals who do not possess high-end gaming equipment. Furthermore, high-speed internet improves the overall user experience by lowering latency, which can impede the growth of online gaming communities. These technological developments and excellent connections entice foreign gaming corporations to seek a stable market to launch new goods and motivate local developers to innovate, thus contributing to market growth.

To get more information on this market, Request Sample

Growing E-Sports Industry in Singapore

The e-sports industry in Singapore has shown significant growth, with the country holding numerous prominent e-sports championships that have attracted international notice. These tournaments draw foreign gamers and spectators while also developing local talent and excitement for competitive gaming. Major competitions, such as the Southeast Asian Majors and the Singapore Major, have large prize pools and are crucial to raising the city-state's status as an e-sports hotspot. According to the International Trade Administration, the Singapore gaming sector has tremendous potential for expansion. For instance, in 2019, Singapore gamers spent USD 327 million on games, establishing the country as a big contributor to the Southeast Asia games business. Approximately 46% of the online population, or 3.8 million gamers, engaged with video game content, and 21% followed e-sports. Additionally, 23% of the games played in Singapore are mobile games intended to fill time. The games and e-sports sector saw an estimated 15% growth from 2019 to 2020, with around 220 companies involved in game-related activities. Besides this, the expanding e-sports environment contributes to the broader online gaming market by increasing interest and participation in various gaming platforms across the region.

Singapore Online Gaming Market News:

- May 2023: The Singapore Tourism Board (STB) introduced Singapore Wanderland on Roblox, marking its debut on one of the most popular online gaming platforms globally. This new game offers a whimsical representation of Singapore and has attracted over two million visits since its beta version was released on May 11. Singapore Wanderland is a part of STB's initiative to engage new audiences through innovative methods, allowing users to explore and experience Singapore by completing various tasks in a virtual environment.

- June 2023: Finute Launches the MATA-verse for Singapore Police. The MATA-verse is a Roblox-based metaverse experience where players can immerse themselves in the life of a police officer. Players engage in activities such as pursuing and arresting criminals, identifying wanted persons, and patrolling the streets of Singapore to ensure safety through their in-game characters. The game feature’s multiple locations inspired by Ang Mo Kio North and the Home Team Academy. When the missions are completed, it allows players to unlock exclusive uniforms and vehicles while advancing in rank.

Singapore Online Gaming Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on device type, gaming type, age group, gender demographics, and model.

Device Type Insights:

- Mobile Devices

- Digital Console

- Computer

The report has provided a detailed breakup and analysis of the market based on the device type. This includes mobile devices, digital console, and computer.

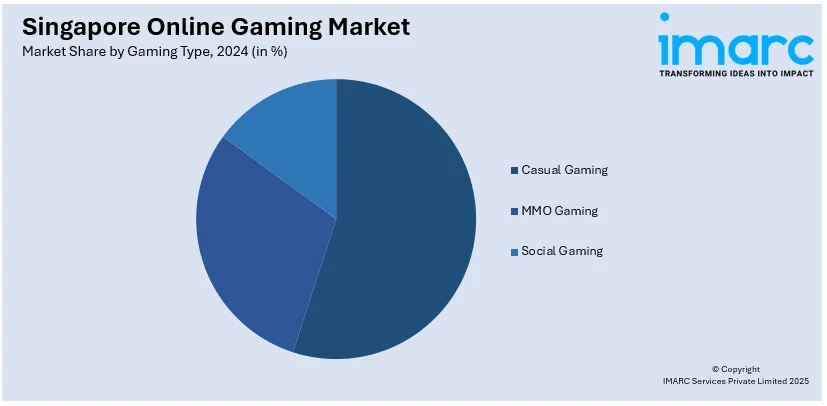

Gaming Type Insights:

- Casual Gaming

- MMO Gaming

- Social Gaming

A detailed breakup and analysis of the market based on the gaming type have also been provided in the report. This includes casual gaming, MMO gaming, and social gaming.

Age Group Insights:

- Below 18 Years

- 19-25 Years

- 26-35 Years

- 36-45 Years

- Over 46 Years

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes below 18 years, 19-25 years, 26-35 years, 36-45 years, and over 46 years.

Gender Demographics Insights:

- Male

- Female

A detailed breakup and analysis of the market based on the gender demographics have also been provided in the report. This includes male and female.

Model Insights:

- Free-to-play Games

- Pay-to-Play Games

A detailed breakup and analysis of the market based on the model have also been provided in the report. This includes free-to-play games and pay-to-play games.

Regional Insights:

- North-East

- Central

- West

- East

- North

The report has also provided a comprehensive analysis of all the major regional markets, which include North-East, Central, West, East, and North.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Singapore Online Gaming Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Device Types Covered | Mobile Devices, Digital Console, Computer |

| Gaming Types Covered | Casual Gaming, MMO Gaming, Social Gaming |

| Age Groups Covered | Below 18 Years, 19-25 Years, 26-35 Years, 36-45 Years, Over 46 Years |

| Gender Demographics Covered | Male, Female |

| Models Covered | Free-to-play Games, Pay-to-Play Games |

| Regions Covered | North-East, Central, West, East, North |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Singapore online gaming market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Singapore online gaming market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Singapore online gaming industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The online gaming market in Singapore was valued at USD 660.0 Million in 2024.

The Singapore online gaming market is projected to exhibit a CAGR of 8% during 2025-2033, reaching a value of USD 1,320.0 Million by 2033.

Singapore's online gaming market is propelled by widespread smartphone usage, rapid 5G rollout, a thriving esports ecosystem, and adoption of advanced technologies like cloud gaming, AR/VR, and blockchain, creating immersive experiences and boosting user engagement across competitive and casual gaming segments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)