Singapore Pharmaceutical Market Size, Share, Trends and Forecast by Type, Nature, and Region, 2026-2034

Singapore Pharmaceutical Market Size and Share:

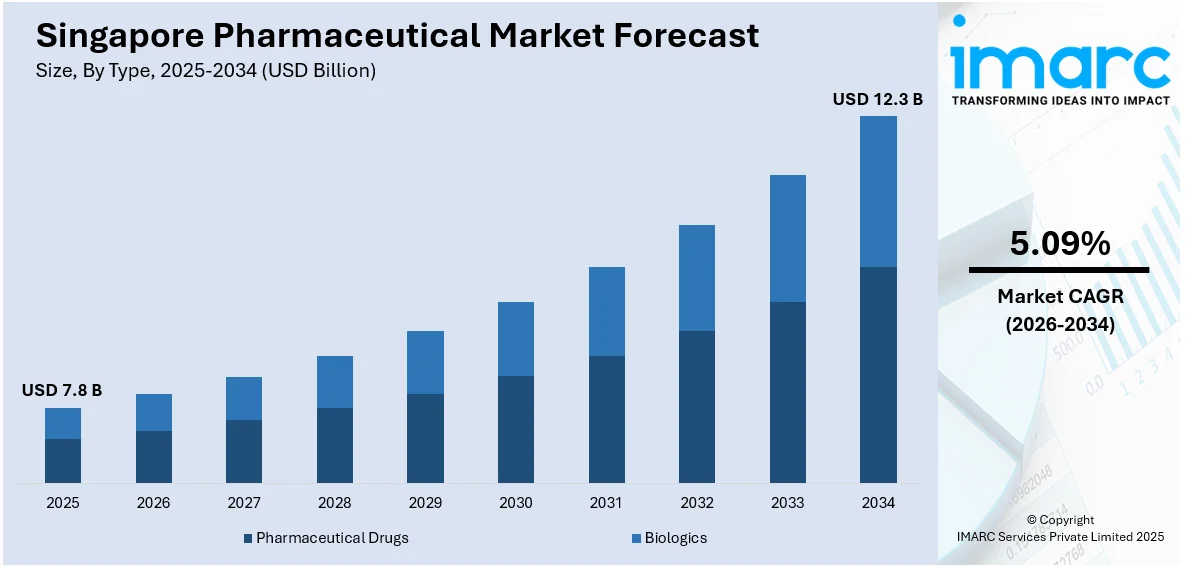

The Singapore pharmaceutical market size was valued at USD 7.8 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 12.3 Billion by 2034, exhibiting a CAGR of 5.09% from 2026-2034. West region currently dominates the market due to its robust regulatory framework, strategic geographical location, and strong government support. A skilled workforce and rising healthcare demand fuel industry growth, while technological advancements and strategic partnerships boost innovation. Significant biotech investments highlight its research and development (R&D) focus. The nation's commitment to sustainability enhances global appeal, and its role as a gateway ensures expanding market access, making it a prime hub for business, research, and regional expansion across diverse sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034 |

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 7.8 Billion |

| Market Forecast in 2034 | USD 12.3 Billion |

| Market Growth Rate (2026-2034) | 5.09% |

Singapore’s government plays a crucial role in shaping the pharmaceutical market through strong support and pro-business policies. The S$25 billion investment made under the Research, Innovation, and Enterprise 2025 strategy, which focuses on areas like human health, demonstrates this dedication. Agencies such as the Economic Development Board (EDB) and Health Sciences Authority (HSA) actively foster innovation, streamline regulatory approvals, and attract global pharmaceutical leaders. Generous tax incentives, funding grants, and public-private partnerships further stimulate R&D and advanced manufacturing. Singapore’s transparent legal framework, strong intellectual property protection, and efficient infrastructure create a stable environment for long-term investments. These comprehensive government efforts position Singapore as a trusted, innovation-driven hub for pharmaceutical companies seeking to expand in Asia, making government support a key driver of sustained industry growth.

To get more information on this market Request Sample

Singapore has unparalleled access to the rapidly expanding Asia-Pacific pharmaceutical market owing to its advantageous location in Southeast Asia. With its world-class port and Changi Airport, which has around 30,000 square meters of temperature-controlled warehouse space within the Airport Free Trade Zone, it provides exceptional connection as a gateway between the East and the West. This infrastructure ensures 24/7 access and stringent security, enabling efficient distribution and supply chain management for pharmaceutical companies. Strong trade agreements and alignment with international standards further enhance export potential and facilitate cross-border collaborations. With increasing healthcare demand in neighbouring countries like Indonesia, Malaysia, and Vietnam, Singapore-based firms are ideally positioned to serve regional markets, making its location a critical driver of growth and competitiveness in the pharmaceutical sector.

Singapore Pharmaceutical Market Trends:

Focus on Sustainability and Green Manufacturing

The rising focus towards sustainable manufacturing and environmentally sustainable products is supporting the market. As such, in 2024, AstraZeneca announced a USD 1.5 Billion antibody drug conjugates (ADCs) manufacturing facility in Singapore, operational by 2029. The zero-emission site will boost sustainable cancer drug production, support local talent, and mark AstraZeneca’s first fully integrated ADC manufacturing investment globally. Environmental factors are increasingly being given attention, especially by the pharmaceutical industries due to new laws and customer demands. Singapore is one of the leaders in sustainable development initiatives for the pharmaceutical manufacturing sector and has embedded policies and strategies towards sustainability. These organizations are sourcing and manufacturing their products in ways that are less detrimental to the environment, and they are reducing waste and emissions. There is an increasing tendency of using renewable energy sources in the pharmaceutical industries, driven by incentives from authorities and the implementation of requirements on sustainable material. This emphasis on sustainability complement international environmental objectives and adds more value and status to Singapore pharma market. The integration of sustainable developments practices is meant to facilitate sustainable improvement with emphasis on the sustainability aspect by the pharma industry in Singapore.

Expanding Market Access in Asia-Pacific

The increase in access to the market is one of the chief forces for the Singapore pharmaceutical market in the Asia-Pacific region. Singapore being a location that serves as an entry point to the Asia market enable pharma firms to tap into a large and expanding market of consumers. The larger population base and growing healthcare requirements in the Asia-Pacific region make for a larger future market for pharmaceuticals. According to the United Nations Economic and Social Commission for Asia and the Pacific (ESCAP), about 60% of the world’s population lives in the Asia-Pacific region, making it the most populous region globally. Singapore enjoys long-standing trade relations and business links with countries in the region which make it easy for pharmaceuticals products and services to be imported or exported from the region. Also, the legal framework is friendly to business and the protection of intellectual property rights is well developed, which makes many multinational pharmaceuticals interested in opening their regional headquarters and distribution centers of the country.

Continual Technological Advancements and Digital Transformation

The adoption of cutting-edge technologies such as artificial intelligence (AI), machine learning, big data analytics, and blockchain is revolutionizing drug discovery, clinical trials, and supply chain management. Singapore’s robust digital infrastructure and strong emphasis on technological innovation provide a conducive environment for the integration of these technologies into pharmaceutical processes. AI and machine learning algorithms are being utilized to accelerate the identification of potential drug candidates and predict clinical outcomes, significantly reducing the time and cost of drug development. Digital health solutions, including telemedicine and wearable health devices, are enhancing patient care and monitoring, creating new opportunities for pharmaceutical companies to develop personalized and targeted therapies. The digital transformation of the pharmaceutical industry in Singapore is supporting efficiency, innovation, and improved patient outcomes, positioning the market at the forefront of the global pharmaceutical landscape. Accordingly, in 2024, Singapore’s MOH pledged SGD 200 million over five years to augment AI and genomics in healthcare. Key initiatives include nationwide genetic testing and AI screenings by 2025, plus new legislation to regulate genetic data and prevent misuse.

Investment in Biotechnology and Biopharmaceuticals

Development of Singapore as a hub for biotechnology and production of biopharmaceuticals is one of the major factors that has propelled pharma mart in Singapore. Large funding and assistance from the government towards the growth of biotechnology has had a strategic emphasis on the biopharmaceutical industry. The Singaporean government supports biotech and MedTech growth through RIE2025, a strategic plan allocating SGD 25 billion to enhance research infrastructure and innovation in key sectors. This investment has led to the creation of intensive biotechnology research and development facilities and biotech parks that provides escalating host to brighter biotech organizations. Biopharmaceuticals, specifically biologic and biosimilar products, are part of the expanding industry of advanced therapeutic and targeted medicinal approaches. These include Biopolis research complex that was launched to support the growth of the biopharmaceutical industry through fostering biomedical research and development. These coordinated efforts in biotechnology and biopharmaceuticals strengthen Singapore’s competencies in generating new technologies for the advancement for innovative medicines and to firmly establish Singapore within the intensifying global biopharmaceutical industry.

Singapore Pharmaceutical Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Singapore pharmaceutical market, along with forecast at the regional, and country levels from 2026-2034. The market has been categorized based on type and nature.

Analysis by Type:

- Pharmaceutical Drugs

- Cardiovascular Drugs

- Dermatology Drugs

- Gastrointestinal Drugs

- Genito-Urinary Drugs

- Hematology Drugs

- Anti-Infective Drugs

- Metabolic Disorder Drugs

- Musculoskeletal Disorder Drugs

- Central Nervous System Drugs

- Oncology Drugs

- Ophthalmology Drugs

- Respiratory Diseases Drugs

- Biologics

- Monoclonal Antibodies (MAbS)

- Therapeutic Proteins

- Vaccines

Pharmaceutical drugs account for the majority market share of 69.8% in Singapore, owing to their critical role in treating a wide range of health conditions, from chronic diseases to acute illnesses. Their dominance is supported by high demand in both public and private healthcare sectors, as well as widespread use in hospitals, clinics, and pharmacies. Government healthcare policies, insurance coverage, and subsidies further promote accessibility and affordability of these drugs. In addition, Singapore’s aging population and rising prevalence of lifestyle-related conditions drive continuous demand. A well-established supply chain, regulatory clarity, and consistent quality standards also support the growth of pharmaceutical drugs. Their proven safety, effectiveness, and familiarity among healthcare professionals make them the preferred choice over newer or more complex therapies.

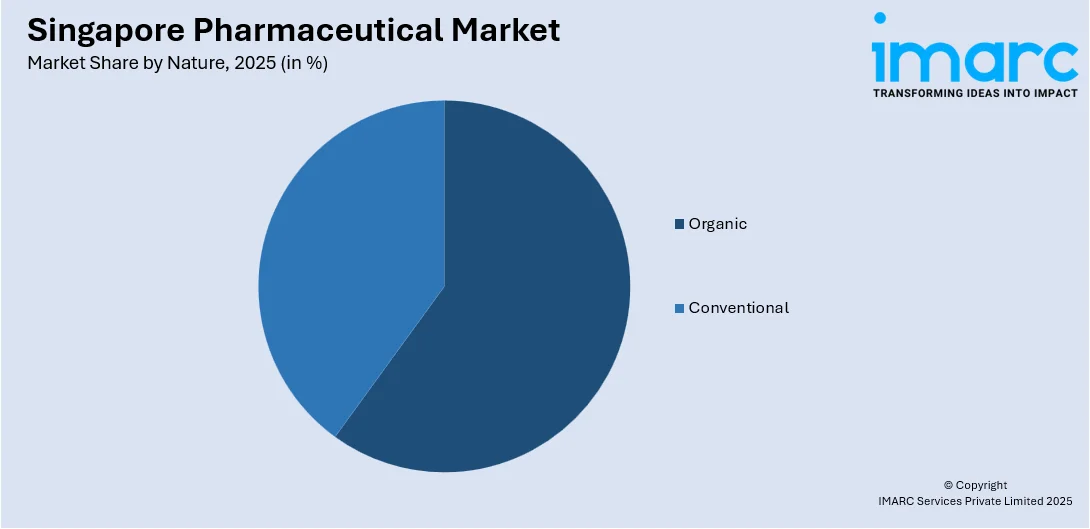

Analysis by Nature:

Access the comprehensive market breakdown Request Sample

- Organic

- Conventional

Conventional pharmaceuticals hold the largest market share of 85.0% in Singapore, driven by established treatment protocols, widespread availability, and strong demand for generic and branded drugs. These medications are integral to managing chronic diseases, infections, and other common health conditions, making them essential to the healthcare system. Their affordability, proven efficacy, and inclusion in national healthcare programs further boost adoption. Additionally, a well-developed manufacturing infrastructure and regulatory support facilitate consistent production and supply. The familiarity and trust built around conventional drugs among healthcare providers and patients also contribute to their dominance. While biologics and advanced therapies are growing, conventional pharmaceuticals remain the backbone of Singapore’s pharmaceutical market due to their accessibility, cost-effectiveness, and broad therapeutic coverage.

Regional Analysis:

- North-East

- Central

- West

- East

- North

The West Region is the leading hub of Singapore’s pharmaceutical market, driven by its concentration of industrial estates, research centers, and advanced manufacturing facilities. It houses key biomedical and pharmaceutical clusters supported by government initiatives aimed at fostering innovation and high-value production. The presence of cutting-edge infrastructure, such as Biopolis and Tuas Biomedical Park, enhances its appeal for global and regional pharmaceutical operations. Its strategic location near major ports and logistics hubs facilitates efficient supply chain management and international distribution. The region also benefits from close collaboration between academia, research institutions, and industry players, fostering a strong innovation ecosystem. These factors collectively position the West Region as a powerhouse for pharmaceutical development, manufacturing, and export within Singapore and the wider Asia-Pacific region.

Competitive Landscape:

Singapore’s pharmaceutical market features a highly competitive landscape driven by innovation, quality standards, and regional demand. The environment is shaped by a mix of global manufacturers, regional players, and local startups focused on R\&D, biologics, and specialty medicines. Competition centers around advanced manufacturing capabilities, cost efficiency, regulatory compliance, and speed-to-market. Strong government support, IP protection, and a skilled talent pool encourage new entrants and sustained investment. Companies compete by forming strategic partnerships, leveraging cutting-edge technology, and expanding their footprint across the Asia-Pacific region. With increasing demand for personalized medicine and biologics, firms are focusing on differentiation through innovation, operational excellence, and agility to adapt to evolving healthcare needs, positioning Singapore as a leading pharmaceutical hub in the region.

The report provides a comprehensive analysis of the competitive landscape in the Singapore pharmaceutical market with detailed profiles of all major companies.

Latest News and Developments:

- April 2025: DHL Supply Chain launched an EUR 10 million pharma hub in Singapore to support the growing Life Sciences and Healthcare sector. The facility features specialized temperature-controlled zones, is GMP-compliant, and offers efficient regional and global distribution. It is part of DHL’s EUR 500 million investment in the Asia Pacific healthcare sector.

- March 2025: Callio Therapeutics, headquartered in Singapore and Seattle, launched with a USD 187 million Series A funding round led by Frazier Life Sciences. The company, focused on multi-payload antibody-drug conjugates (ADCs) for cancer therapy, plans to use the funds to advance clinical proof-of-concept and has secured a licensing deal with Hummingbird Bioscience.

- March 2025: Temasek-backed 65 Equity Partners facilitated Healthcare Advanced Synthesis' acquisition of Swiss pharma company Cerbios-Pharma. 65 Equity will hold a 40% stake in the merged entity, valued at USD 380 million. The firm, based in Singapore, supports industrial consolidation in the CDMO sector.

- November 2024: Sanofi opened a USD 595 million modular vaccine facility, Modulus, in Singapore. The plant can quickly switch between producing different vaccines or treatments, enhancing pandemic preparedness. This facility is part of Sanofi's EUR 900 million investment in two global facilities, with the Singapore plant expected to be operational by mid-2026.

- July 2024: Pfizer opened a USD 1 billion active pharmaceutical ingredient plant in Singapore's Tuas Biomedical Park. The 429,000 sq ft facility will produce ingredients for cancer, pain, and antibiotic medications, creating 250 jobs.

- June 2024: Firebrick Pharma launched Nasodine Nasal Spray in Singapore. Approved by Singapore’s HSA for advertising, it is promoted as a germ-killing antiseptic. Nasodine is reportedly the first PVP-I nasal spray in Singapore, targeting daily germ exposure in public settings.

Singapore Pharmaceutical Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Natures Covered | Organic, Conventional |

| Regions Covered | North-East, Central, West, East, North |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Singapore pharmaceutical market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Singapore pharmaceutical market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Singapore pharmaceutical industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Singapore pharmaceutical market was valued at USD 7.8 Billion in 2025.

The Singapore pharmaceutical market is projected to exhibit a CAGR of 5.09% during 2026-2034, reaching a value of USD 12.3 Billion by 2034.

Key factors driving Singapore’s pharmaceutical market include strong government support, a robust regulatory framework, strategic regional location, advanced infrastructure, and a skilled workforce. Additionally, rising healthcare demand, significant R&D investment, technological innovation, and regional market access through trade agreements position Singapore as a leading hub for pharmaceutical growth in Asia.

West Region currently dominates the Singapore pharmaceutical market, accounting for a share of XX due to its concentration of advanced manufacturing facilities, research hubs, and biomedical parks. Strong infrastructure, government-backed industrial clusters, and proximity to logistics networks make it a strategic base for pharmaceutical operations and exports.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)