Singapore Prepaid Card Market Size, Share, Trends and Forecast by Card Type, Purpose, Vertical, and Region, 2026-2034

Singapore Prepaid Card Market Overview:

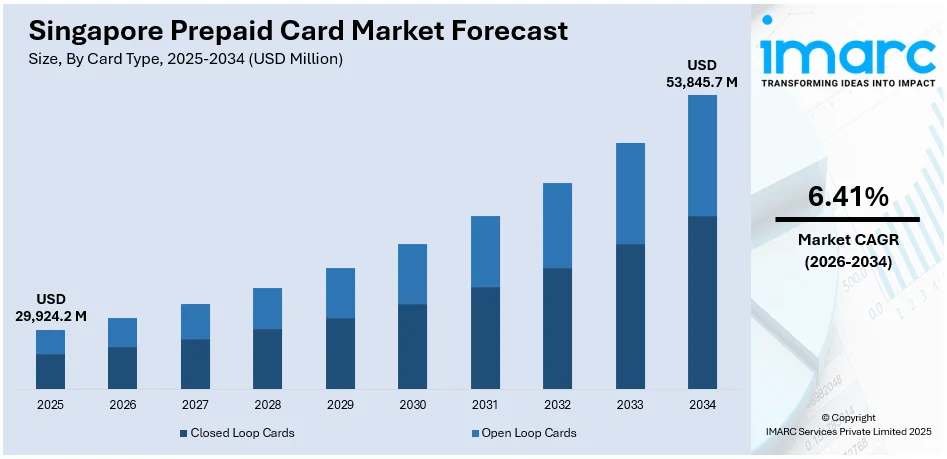

The Singapore prepaid card market size reached USD 29,924.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 53,845.7 Million by 2034, exhibiting a growth rate (CAGR) of 6.41% during 2026-2034. The increasing digital payment adoption, rise in e-commerce transactions, supportive financial inclusion initiatives, ongoing technological advancements, rising tourism, convenience of use, and consumer demand for budget management and security are some of the key factors strengthening the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 29,924.2 Million |

| Market Forecast in 2034 | USD 53,845.7 Million |

| Market Growth Rate (2026-2034) | 6.41% |

Singapore Prepaid Card Market Trends:

Increasing adoption of digital payments

The nation's digital transformation agenda and the government's Smart Nation initiative have spurred the shift towards a cashless society. Prepaid cards offer a convenient, secure, and efficient alternative to cash, appealing to both consumers and businesses. This change has made it easier for people to use prepaid cards for regular transactions by the boosting use of smartphones and mobile payment systems. In line with this, ongoing advancements in fintech have enabled the seamless integration of prepaid cards with digital wallets and mobile banking apps, enhancing their functionality and user experience. Furthermore, the COVID-19 pandemic has also played a crucial role in boosting digital payment adoption, as people have become more cautious about handling cash and increasingly preferred contactless payment methods.

To get more information on this market Request Sample

Rise of e-commerce

According to a survey conducted in 2022, Singapore had a total of 3.51 million e-commerce users. Among these, the majority of cross-border online shoppers belong to the 55 to 64 age group, making up 24% of the total, while the younger demographic aged between 18 and 24 accounted for 13% of the buyers. With the rapid growth of online shopping, prepaid cards offer a secure and convenient payment solution for e-commerce transactions. In confluence with this, the flexibility and ease of use of prepaid cards make them ideal for online purchases, subscription services, and digital content. Moreover, many e-commerce platforms and retailers are now offering prepaid card options to cater to the diverse payment preferences of their customers.

Push for financial inclusion

Financial institutions and fintech companies are focusing on providing accessible and affordable financial services to underserved and unbanked populations. Prepaid cards are a useful instrument for encouraging financial inclusion as they provide facilities to those without traditional bank accounts. They provide a secure and manageable way for people to receive payments, make purchases, and manage their finances. Government initiatives and regulatory support aimed at enhancing financial literacy and inclusion have further bolstered the adoption of prepaid cards. Prepaid cards are being used by programs for low-income households, students, and migrant workers to enable secure and effective financial transactions. Furthermore, the corporate and payroll prepaid cards provide an easy way for employers to pay employees and provide benefits, especially to temporary or part-time employees, which further bolsters the market growth.

Singapore Prepaid Card Market News:

- In April 2023, Grab announced that it would discontinue its GrabPay card starting in June of the same year. Launched with Mastercard, the GrabPay card was Asia’s first numberless physical card, offering enhanced security. The move signals a shift in Grab's financial strategy, impacting users who rely on this feature.

Singapore Prepaid Card Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on card type, purpose, and vertical.

Card Type Insights:

- Closed Loop Cards

- Open Loop Cards

The report has provided a detailed breakup and analysis of the market based on the card type. This includes closed loop cards and open loop cards.

Purpose Insights:

- Payroll/Incentive Cards

- Travel Cards

- General Purpose Reloadable (GPR) Cards

- Remittance Cards

- Others

A detailed breakup and analysis of the market based on the purpose have also been provided in the report. This includes payroll/incentive cards, travel cards, general purpose reloadable (GPR) cards, remittance cards, and others.

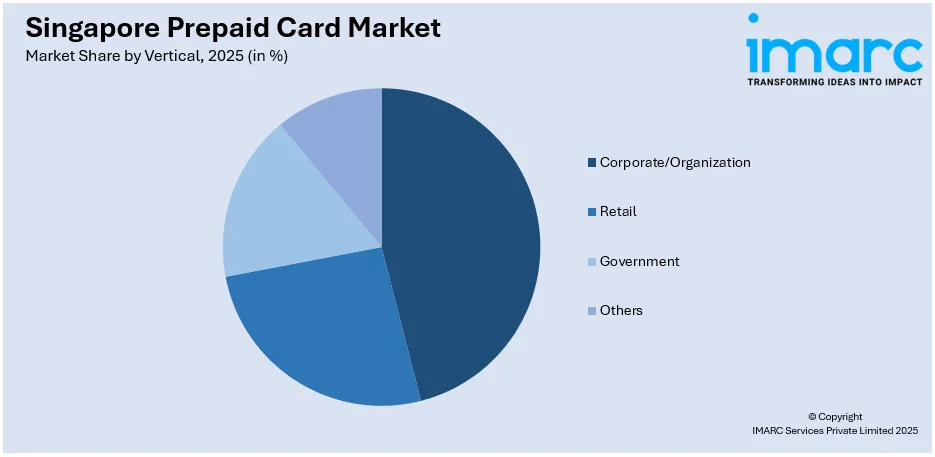

Vertical Insights:

Access the comprehensive market breakdown Request Sample

- Corporate/Organization

- Retail

- Government

- Others

The report has provided a detailed breakup and analysis of the market based on the vertical. This includes corporate/organization, retail, government, and others.

Region Insights:

- North-East

- Central

- West

- East

- North

The report has also provided a comprehensive analysis of all the major regional markets, which include North-East, Central, West, East, and North.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Singapore Prepaid Card Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Card Types Covered | Closed Loop Cards, Open Loop Cards |

| Purposes Covered | Payroll/Incentive Cards, Travel Cards, General Purpose Reloadable (GPR) Cards, Remittance Cards, Others |

| Verticals Covered | Corporate/Organization, Retail, Government, Others |

| Regions Covered | North-East, Central, West, East, North |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Singapore prepaid card market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Singapore prepaid card market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Singapore prepaid card industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The prepaid card market in Singapore was valued at USD 29,924.2 Million in 2025.

The Singapore prepaid card market is projected to exhibit a CAGR of 6.41% during 2026-2034, reaching a value of USD 53,845.7 Million by 2034.

Key factors driving the Singapore prepaid card market include rising smartphone penetration, increasing demand for cashless transactions, government initiatives promoting digital payments, and growing adoption of fintech solutions. Additionally, the expanding e-commerce platforms and increasing preference for secure, convenient payment methods are contributing to the market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)