Singapore Real Estate Market Report by Property (Residential, Commercial, Industrial, Land), Business (Sales, Rental), Mode (Online, Offline), and Region 2026-2034

Singapore Real Estate Market Summary:

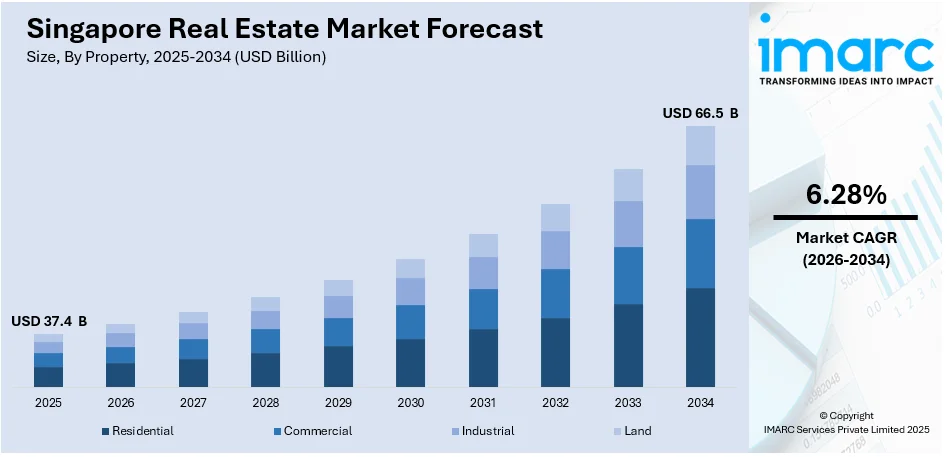

The Singapore real estate market size reached USD 37.4 Billion in 2025 and is projected to reach USD 66.5 Billion by 2034, growing at a CAGR of 6.28% during 2026-2034. The market growth is attributed to the thriving tourism and hospitality sector, considerable growth in the GDP, economic stability in the country, favorable government support initiatives for the real estate sector, rising infrastructure development, and technological advancements.

Market Insights:

- On the basis of property, the market has been categorized into residential, commercial, industrial, and land.

- On the basis of business, the market has been categorized into sales and rental.

- On the basis of mode, the market has been categorized into online and offline.

- On the basis of region, the market has been categorized into North-East, Central, West, East, and North.

Market Size and Forecast:

- 2025 Market Size: USD 37.4 Billion

- 2034 Projected Market Size: USD 66.5 Billion

- CAGR (2026-2034): 6.28%

Singapore Real Estate Market Trends:

Thriving Tourism and Hospitality Sector

As per an article published in 2024 on the official website of the Ministry of Education Singapore, the tourism and hospitality sector contribute 3-4% of Singapore’s annual gross domestic product (GDP). The influx of tourists and business travelers is contributing to the demand for hotel accommodations. As the number of tourists are rising, there is a corresponding need for more hotel rooms and hospitality services. This demand is driving investments in hotel properties, including new developments and renovations of existing establishments. Investors are seeking opportunities to capitalize on the growing tourism sector by investing in hotel real estate, which is one of the major Singapore real estate market trends. Additionally, tourists often engage in shopping, dining, and entertainment activities during their stay in Singapore. As a result, retail and entertainment establishments in tourist hotspots experience increasing foot traffic and individual spending. Property developers can capitalize on this demand by developing mixed-use developments that incorporate retail, dining, and entertainment offerings to cater to tourists and locals.

To get more information on this market Request Sample

Besides this, there are other types of retail stores, including souvenir shops, duty-free shops, and specialty shops that are prevalent in tourist-endearing places. These retail segments are targeted by property owners and developers to capture tourists’ spending and improve visitors’ experience.

Growth of Gross Domestic Product (GDP) at the Official Exchange Rate

An article published in 2024 on the website of the Central Intelligence Agency (CIA), the GDP at official exchange rate was $466.788 billion in 2022. A growing GDP typically correlates with economic expansion, leading to increased business activity, job creation, and income levels. As individuals and businesses experience higher incomes and greater confidence in the economy, they are more likely to invest in real estate, either for personal use or as part of their investment portfolio. Furthermore, a robust GDP growth rate can attract foreign investors seeking opportunities in a thriving economy. Singapore's status as a global financial hub makes it particularly attractive for foreign investors looking to diversify their portfolios or capitalize on growth opportunities, especially in the Singapore commercial real estate market. This influx of foreign investment is driving the demand for commercial and residential properties, leading to price appreciation.

In addition, the growing GDP helps businesses extend their activities and, consequently, require more office space, shopping centers, and production premises. This is pushing up rents and property prices particularly in central business locations and enhancing returns on investment for owners of commerce buildings. High economic growth rate enhances people’s confidence making individuals and families to invest in properties or upgrade to bigger houses. This is catalyzing the demand for residential real estate, leading to higher home prices and sales volumes.

Increased Demand for Smart Homes Coupled with Sustainable Developments

Another emerging trend in Singapore's real estate market is the growing demand for smart homes and eco-friendly, sustainable developments. As consumers become more tech-savvy and environmentally conscious, there is an increasing preference for properties that integrate smart technologies such as energy-efficient appliances, home automation, and IoT systems, which is creating a favorable Singapore real estate market outlook. Developers are responding by incorporating these features into new projects, attracting buyers who are willing to pay a premium for convenience and sustainability. Additionally, government incentives for green building practices and sustainability certifications are encouraging developers to prioritize eco-friendly construction. As the awareness around climate change and resource conservation grows, green buildings and eco-friendly developments are expected to dominate the market in the coming years, aligning with global trends toward sustainability. This shift is likely to drive long-term growth in the sector, with a greater emphasis on environmental responsibility and technological innovation in real estate.

Singapore Real Estate Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on property, business, and mode.

Property Insights:

- Residential

- Commercial

- Industrial

- Land

The report has provided a detailed breakup and analysis of the market based on the property. This includes residential, commercial, industrial, and land.

Business Insights:

Access the comprehensive market breakdown Request Sample

- Sales

- Rental

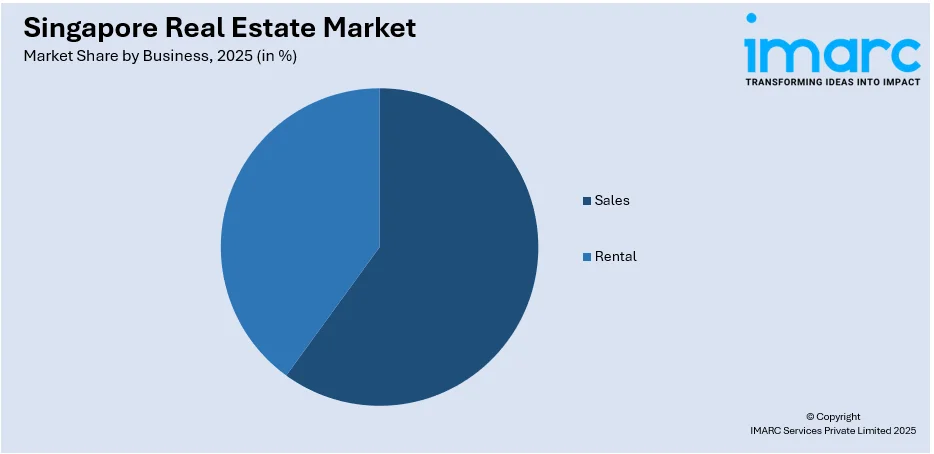

A detailed breakup and analysis of the market based on the business have also been provided in the report. This includes sales and rental.

Mode Insights:

- Online

- Offline

The report has provided a detailed breakup and analysis of the market based on the mode. This includes online and offline.

Regional Insights:

- North-East

- Central

- West

- East

- North

The report has also provided a comprehensive analysis of all the major regional markets, which include North-East, Central, West, East, and North.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Singapore Real Estate Market News:

- April 2025: 8M Real Estate announced the landmark off-market sale of 21 Carpenter, a heritage boutique hotel in Singapore, to Timemerchant Capital Pte. Ltd. This deal marks the largest shophouse hotel transaction by quantum in Singapore to date, reflecting the enduring investor appetite for rare, architecturally significant properties in the city-state’s hospitality market, underscoring a shift toward reinvesting capital into sustainable, community-driven projects.

- May 2025: Singapore-based start-up EXPIScore launched the world’s first star rating system for human-centric customer experience (CX) in buildings. Developed by EXPI Plus, the system assesses properties under LIVE and WORK categories, assigning scores out of 100 and star ratings from three to six. It aims to guide real estate developers in creating more user-focused, experience-driven spaces.

- May 30, 2024: Singapore-based Xander Group with the Government of Singapore Investment Corporation (GIC) acquired Waverock IT SEZ in Hyderabad for Rs 2,200 crore.

- June 5, 2024: Rajah & Tann Singapore represented the owners in the S$439 million ($326 million) collective sale via public tender of Delfi Orchard at 402 Orchard Road to CDL Draco, a subsidiary of City Developments Limited (CDL).

Singapore Real Estate Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Properties Covered | Residential, Commercial, Industrial, Land |

| Businesses Covered | Sales, Rental |

| Modes Covered | Online, Offline |

| Regions Covered | North-East, Central, West, East, North |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Singapore real estate market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Singapore real estate market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Singapore real estate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The real estate market in Singapore was valued at USD 37.4 Billion in 2025.

The Singapore real estate market is projected to exhibit a CAGR of 6.28% during 2026-2034, reaching a value of USD 66.5 Billion by 2034.

The market is driven by strong economic growth, political stability, and consistent foreign investment. Limited land availability supports high property values, while robust infrastructure and urban development enhance demand. Government policies, favorable tax structures, and a growing expatriate population further stimulate activity. Low interest rates and Singapore’s role as a financial hub attract both domestic and international buyers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)