Singapore Retail Market Size, Share, Trends and Forecast by Product, Distribution Channel, and Region, 2026-2034

Singapore Retail Market Summary:

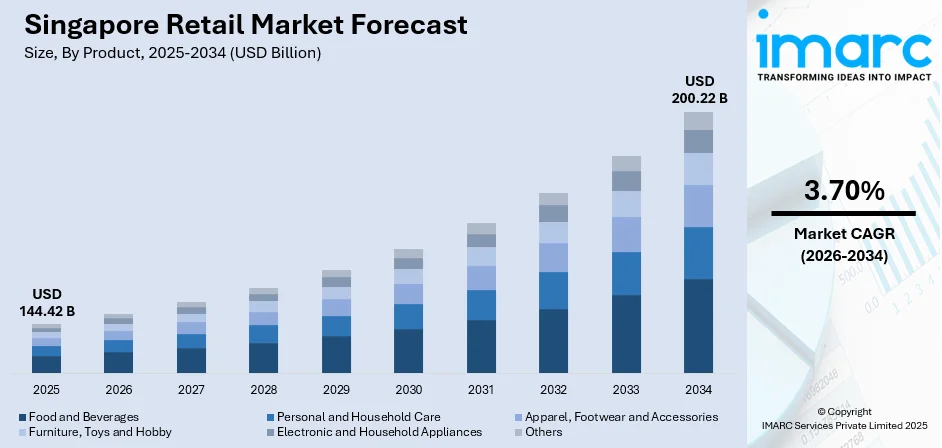

The Singapore retail market size was valued at USD 144.42 Billion in 2025 and is projected to reach USD 200.22 Billion by 2034, growing at a compound annual growth rate of 3.70% from 2026-2034.

The Singapore retail market demonstrates robust expansion, driven by the nation's high consumer affluence, strategic positioning as a regional commercial hub, and the seamless integration of digital and physical retail channels. Rising disposable incomes, coupled with surging tourism activities, continue to fuel consumer spending across diverse product categories. The market gains from from advanced retail infrastructure, high adoption of digital payment systems, and a tech-savvy population that increasingly embraces omnichannel shopping experiences.

Key Takeaways and Insights:

-

By Product: Food and beverages dominate the market with a share of 28% in 2025, owing to the nation's diverse culinary culture, strong demand for fresh and packaged food products, and the essential nature of grocery purchases. Rising health consciousness and premium food preferences further drive segment expansion.

-

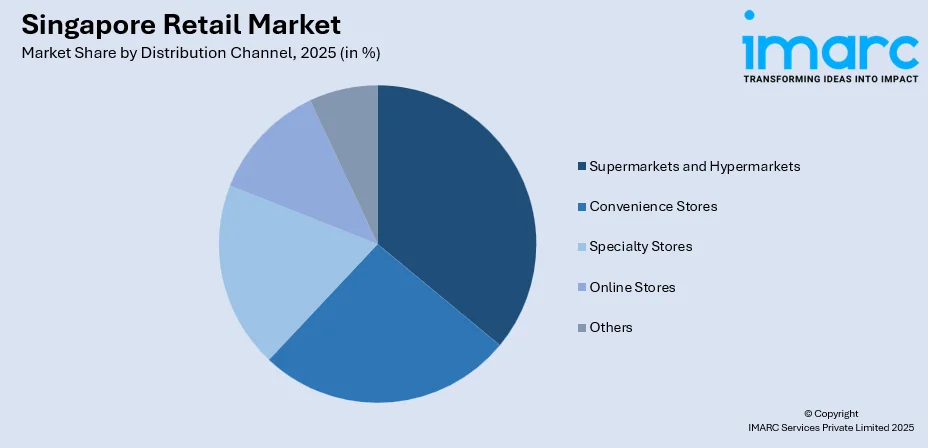

By Distribution Channel: Supermarkets and hypermarkets lead the market with a share of 36% in 2025. This dominance is driven by the convenience of one-stop shopping, competitive pricing strategies, extensive product assortments, and the integration of digital services, including online ordering and home delivery options.

-

By Region: North-East represents the largest region with 29% share in 2025, driven by rapid residential development in Punggol and Sengkang, growing population density, new retail infrastructure investments, and integrated transport hubs enhancing accessibility to shopping destinations.

-

Key Players: Key players drive the Singapore retail market by expanding store networks, investing in omnichannel capabilities, and enhancing customer loyalty programs. Their focus on private-label development, technology integration, and sustainable practices strengthens competitive positioning and ensures consistent product availability across diverse consumer segments.

To get more information on this market Request Sample

The Singapore retail landscape continues to evolve rapidly, characterized by the convergence of traditional retail excellence and digital innovation. The nation's position as a premier shopping destination attracts millions of international visitors annually, with tourism receipts reaching USD 29.8 Billion in 2024, directly stimulating fashion, luxury, and food service categories. Consumer preferences increasingly favor retailers offering seamless omnichannel experiences, personalized services, and sustainable product options. The proliferation of e-commerce platforms has transformed purchasing behaviors. Government initiatives supporting digital transformation, combined with robust logistics infrastructure and high smartphone penetration rates, create favorable conditions for continued market expansion across both physical and virtual retail channels. Additionally, rising disposable incomes and a strong culture of premium consumption support demand for high-quality and experiential retail formats.

Singapore Retail Market Trends:

Rising Adoption of Omnichannel Retail Strategies

Singapore retailers are increasingly embracing omnichannel approaches that seamlessly integrate online and offline shopping experiences. Consumers expect unified purchasing journeys where they can browse products digitally, compare prices across platforms, and choose between home delivery or in-store pickup options. Major retailers are investing significantly in mobile applications, digital payment integration, and inventory synchronization systems to meet these evolving expectations. In 2024, Singapore's digital payment adoption stood at 57%, making it the leader among Southeast Asian countries, with transaction values exceeding USD 39.37 Billion. This trend reflects the sophisticated shopping preferences of Singapore's tech-savvy population and the growing importance of convenience-driven retail solutions.

Growing Consumer Focus on Sustainability and Ethical Consumption

Sustainability has emerged as a defining consideration in Singaporean consumer purchasing decisions, particularly among younger demographics. Retailers are responding by implementing eco-friendly practices, including sustainable sourcing, reduced packaging waste, and recyclable materials. The demand for organic products, locally sourced goods, and circular economy offerings continues to accelerate across the country. Retail establishments are also prioritizing energy-efficient operations and transparent supply chain practices to align with growing environmental consciousness among consumers.

Expansion of Experiential and Pop-Up Retail Formats

The retail sector is witnessing significant growth in experiential shopping concepts that prioritize customer engagement and brand immersion over traditional transactional models. Pop-up stores, interactive product demonstrations, and themed retail experiences are becoming increasingly prevalent across shopping districts. In December 2025, the inaugural MINISO x Mofusand pop-up store was opened in Singapore. The collection featured full-sized ‘ice cream truck’, unique plushies, and complimentary stickers. Retailers recognize that memorable in-store experiences differentiate physical locations from online alternatives, driving foot traffic and fostering brand loyalty. This trend is particularly evident in fashion, beauty, and lifestyle segments where sensory engagement influences purchasing decisions.

Market Outlook 2026-2034:

The Singapore retail market outlook remains optimistic through the forecast period, supported by sustained economic growth, rising consumer confidence, and increasing tourism activities. The market generated a revenue of USD 144.42 Billion in 2025 and is projected to reach a revenue of USD 200.22 Billion by 2034, growing at a compound annual growth rate of 3.70% from 2026-2034. Digital transformation initiatives, infrastructure developments in emerging residential districts, and the anticipated launch of new retail destinations will drive sector expansion. The integration of artificial intelligence (AI) in retail operations, expansion of social commerce platforms, and growing demand for premium and personalized shopping experiences are expected to shape market dynamics throughout the forecast period.

Singapore Retail Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product | Food and Beverages | 28% |

| Distribution Channel | Supermarkets and Hypermarkets | 36% |

| Region | North-East | 29% |

Product Insights:

- Food and Beverages

- Personal and Household Care

- Apparel, Footwear and Accessories

- Furniture, Toys and Hobby

- Electronic and Household Appliances

- Others

Food and beverages dominate with a market share of 28% of the total Singapore retail market in 2025.

The food and beverages segment maintains commanding leadership in Singapore's retail landscape, driven by the nation's vibrant culinary culture and the essential nature of grocery purchases. Singapore's multicultural population generates diverse demand for international cuisines, specialty ingredients, and premium food products. The segment benefits from extensive supermarket networks, wet markets, and specialty food retailers that collectively ensure broad product accessibility across residential areas. Health-conscious consumption patterns are accelerating demand for organic, plant-based, and functional food products.

Government food security initiatives, including the '30 by 30' goal to produce 30% of nutritional needs locally by 2030, are stimulating innovations in local food production and distribution. Premium grocery retailers and specialty food stores continue to expand their presence in affluent residential districts. Food retail sales consistently demonstrate resilience, supported by the nation's high dining frequency and strong household spending on quality food products, further reinforcing segment dominance.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Stores

- Others

Supermarkets and hypermarkets lead with a share of 36% of the total Singapore retail market in 2025.

Supermarkets and hypermarkets maintain dominant positioning in Singapore's distribution landscape, offering consumers comprehensive one-stop shopping solutions with competitive pricing and extensive product variety. Major chains have established extensive store networks across residential heartlands, ensuring convenient access for households. These retailers leverage economies of scale, advanced supply chain management, and strategic promotional activities to deliver value-driven shopping experiences.

Leading supermarket operator, Sheng Siong Group, forecasts opening ten new stores in 2025, reflecting aggressive network expansion across emerging residential areas. The segment increasingly integrates digital capabilities with physical operations, offering online ordering, home delivery services, and loyalty programs that enhance customer retention. Self-checkout systems, mobile payment acceptance, and real-time inventory management represent ongoing investments that strengthen operational efficiency and shopping convenience.

Regional Insights:

- North-East

- Central

- West

- East

- North

North-East exhibits a clear dominance with a 29% share of the total Singapore retail market in 2025.

North-East commands the largest regional share, driven by substantial population growth in Punggol and Sengkang new towns and significant retail infrastructure investments. As per industry reports, the projected population of Punggol is 204,150 in 2025. These rapidly developing residential areas feature young family demographics with strong purchasing power and diverse consumption needs. The region benefits from integrated transport hubs connecting retail destinations with residential neighborhoods, enhancing shopper accessibility and driving consistent foot traffic to commercial establishments.

The presence of modern suburban malls, neighborhood retail clusters, and community-centric shopping formats in North-East supports frequent, convenience-driven purchases across daily essentials, lifestyle products, and food services. Retailers benefit from lower rental costs compared to central districts, encouraging wider tenant diversity and competitive pricing. Ongoing public housing development, educational institutions, and recreational facilities further strengthen local demand. Additionally, strong digital adoption among residents supports omnichannel retail strategies, enabling retailers to integrate online platforms with physical stores and sustain steady sales growth in the area.

Market Dynamics:

Growth Drivers:

Why is the Singapore Retail Market Growing?

Increasing Tourism Activities

Rising tourism activities are strongly fueling the market growth in Singapore by expanding consumer footfall and increasing discretionary spending across key retail categories. From January to May 2025, Singapore drew around 7.09 Million tourists, an increase of 2.3% compared to the corresponding period in 2024. International visitors contribute significantly to demand for luxury goods, fashion, cosmetics, electronics, and souvenirs, particularly in prime shopping districts and airport retail zones. Tourist spending supports premium pricing strategies and higher sales volumes, improving retailer profitability. Seasonal travel peaks and large-scale events stimulate short-term sales surges, encouraging retailers to launch exclusive collections and limited-edition products. Duty-free shopping and tax refund schemes further enhance Singapore’s appeal as a shopping destination. Retailers also adapt merchandising and service offerings to cater to diverse cultural preferences, strengthening conversion rates. Increased hotel development and cruise tourism extend visitor stays, boosting repeat shopping visits.

Expansion of Flagship Stores

The broadening of flagship stores is driving the market expansion in Singapore by enhancing brand visibility, customer engagement, and experiential shopping appeal. Global and regional brands are expanding flagship formats to showcase full product portfolios, immersive store designs, and interactive digital features. In September 2024, Jaipur Rugs opened its first flagship store, located on Amoy Street, in Singapore, signifying the brand's fourth global retail location after launches in London, Dubai, and Milan. These stores function as brand experience centers rather than purely transactional spaces, encouraging longer dwell times and stronger emotional connections with consumers. Flagship outlets often integrate personalization services, in-store events, and exclusive launches that attract both local shoppers and tourists. Their presence strengthens retail destinations by acting as anchor tenants that draw consistent foot traffic. Additionally, flagship stores support omnichannel strategies by serving as fulfillment hubs for online orders and click-and-collect services. This integration improves inventory efficiency and customer convenience.

Omnichannel Retail Expansion and Digital Adoption

Rapid digital adoption is propelling the market expansion in Singapore through the integration of physical and online channels. Consumers increasingly expect seamless shopping experiences that combine in-store engagement with online convenience. Retailers invest in e-commerce platforms, mobile apps, data analytics, and digital payment systems to enhance personalization and operational efficiency. Click-and-collect, same-day delivery, and easy returns improve customer satisfaction and loyalty. High smartphone and internet penetration and strong logistics infrastructure enable efficient fulfillment and real-time inventory management. As per DataReportal, at the beginning of 2024, Singapore had 5.79 Million internet users, with internet penetration at 96.0%. Digital marketing and social commerce platforms expand brand reach and influence purchasing decisions. Retailers also leverage technology to optimize pricing, promotions, and customer engagement. This omnichannel transformation allows retailers to reach wider audiences, improve cost efficiency, and adapt quickly to changing consumer behaviors, strengthening long-term market competitiveness.

Market Restraints:

What Challenges the Singapore Retail Market is Facing?

Elevated Rental and Operating Costs

Singapore's limited land availability and strong property market fundamentals result in persistently high retail rental rates, particularly in prime commercial locations along Orchard Road and within central business districts. These elevated occupancy costs compress profit margins, challenging smaller retailers and emerging brands seeking physical store presence. Operating expenses, including utilities, maintenance, and regulatory compliance further increase cost burdens.

Labor Market Constraints and Rising Wage Pressures

Labor market constraints and rising wage pressures are challenging the Singapore retail market by increasing operating costs and squeezing profit margins. Retailers face difficulties hiring frontline staff due to manpower shortages and competition from other service sectors. Higher minimum wages and compliance with progressive wage models raise payroll expenses. Smaller retailers struggle to absorb costs, leading to price adjustments, reduced operating hours, or greater reliance on automation and self-service technologies.

Intense Competitive Environment and Market Saturation

Singapore's retail landscape features intensive competition among established local operators, regional chains, and aggressive international entrants across both physical and digital channels. Market saturation in certain product categories and geographic areas limits expansion opportunities for existing players. Price competition from e-commerce platforms and cross-border shopping alternatives further pressures traditional retailers to continuously differentiate offerings.

Competitive Landscape:

The Singapore retail market exhibits a highly competitive structure, characterized by the presence of established domestic players, regional retail groups, and international brand entrants across diverse product categories and distribution formats. Leading supermarket chains maintain significant market positions through extensive store networks, competitive pricing strategies, and integrated digital services. Specialty retailers compete through curated product assortments, premium customer experiences, and targeted marketing approaches. E-commerce platforms continue to gain market share, intensifying competition with traditional brick-and-mortar operators. Strategic investments in omnichannel capabilities, private-label development, and sustainable business practices differentiate market leaders from competitors.

Recent Developments:

-

In May 2025, Chinese lifestyle retailer KKV commenced its Singapore expansion with the opening of its first store at Tiong Bahru Plaza, announcing plans to establish ten locations across the city-state through partnerships with CapitaLand and Frasers Property. The retailer offered over 20,000 items across categories, including toys, homeware, daily essentials, and cosmetics.

-

In March 2025, Punggol Coast Mall opened in Singapore, featuring over 120 retail, dining, and entertainment establishments in the Punggol Digital District. The development included diverse food and beverage (F&B) options, lifestyle stores, and community spaces serving residents in the North-East.

Singapore Retail Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Food and Beverages, Personal and Household Care, Apparel, Footwear and Accessories, Furniture, Toys and Hobby, Electronic and Household Appliances, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, Others |

| Regions Covered | North-East, Central, West, East, North |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Singapore retail market size was valued at USD 144.42 Billion in 2025.

The Singapore retail market is expected to grow at a compound annual growth rate of 3.70% from 2026-2034 to reach USD 200.22 Billion by 2034.

Food and beverages dominated the market with a share of 28%, driven by the nation's diverse culinary culture, essential grocery purchasing patterns, and growing demand for premium and health-conscious food products.

Key factors driving the Singapore retail market include strong tourism recovery and international visitor spending, high consumer affluence and rising disposable incomes, digital transformation and e-commerce expansion, and robust retail infrastructure development.

Major challenges include elevated rental and operating costs, labor market constraints and rising wage pressures, intense competitive environment and market saturation, and supply chain dependencies on imported goods.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)