Singapore Vegan Cosmetics Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

Singapore Vegan Cosmetics Market Overview:

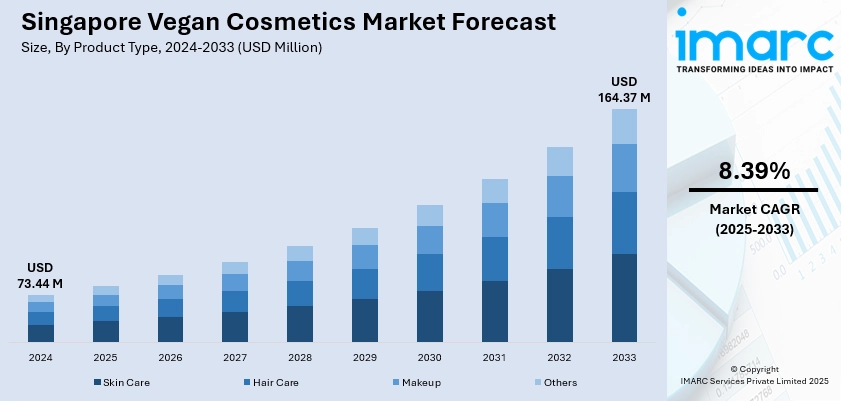

The Singapore vegan cosmetics market size reached USD 73.44 Million in 2024. Looking forward, the market is expected to reach USD 164.37 Million by 2033, exhibiting a growth rate (CAGR) of 8.39% during 2025-2033. The market is propelled by the increasing awareness about animal welfare, eco-friendliness, and plant-based wellness. More consumers look for cruelty-free, allergen-friendly formulas and ethically derived ingredients that resonate with Singapore's health-conscious and eco-friendly lifestyle. Singapore as a regional beauty hub also welcomes several international vegan brands expanding into Southeast Asia, playing a significant role in growing the Singapore vegan cosmetics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 73.44 Million |

| Market Forecast in 2033 | USD 164.37 Million |

| Market Growth Rate 2025-2033 | 8.39% |

Singapore Vegan Cosmetics Market Trends:

Tropical Botanicals and Climate‑Adapted Vegan Formulations

One of the primary trends in the Singapore vegan cosmetics market is the formulation of products that tailor vegan ethics to tropical climate and botanical tradition of the region. Companies doing business in the country are highlighting lighter textures, cooling gels, and oil‑control serums with locally applicable tropical plant extracts such as pandan leaf, mangosteen rind, aloe vera, and green tea. These vegan products are formulated to quickly absorb in hot and humid environments, hydrating without the oiliness, which appeals to the Singaporean consumer. Many local startups are also capitalizing on native Southeast Asian flora known for soothing and cooling effects like calamansi fruit, coconut water, or rice flower extract, packaged in cruelty-free and vegan‑friendly formats. This vegan certification along with climate‑adapted formulation represents the singular convergence of ethical beauty ideals and Singapore's urban subtropical living, forging a particular trend contributing to the overall Singapore vegan cosmetics market growth.

To get more information on this market, Request Sample

Clean Labeling, Eco‑Innovations, and Regulatory Confluence

The second key trend influencing Singapore vegan cosmetics is the sheer visibility of clean-label and green product positioning backed by Singapore's environmental and regulatory landscape. Vegan beauty firms in Singapore increasingly market allergen-free, fragrance-free, and sustainable-packaging products, reflecting on the part of consumers both health-aware individuals and advanced regulation favoring naturals or botanicals. The stringent food and cosmetics safety regulation in Singapore compels manufacturers to be open to ingredient provenance, allowing vegan certifications, cruelty-free symbols, and traceable sourcing to be trusted purchases by discerning consumers. Sustainable packaging innovations such as refill systems in green beauty shops, to recycled plastic applied in high-end vegan ranges, are picking up pace and supporting the circular‑economy thinking that pervades Singapore. The eco-innovative approaches are well in line with vegan principles and raise consumer confidence, thus making clean-label and eco-friendly credentials ever more compelling purchase drivers in the highly competitive local vegan beauty market.

Digital Wellness Culture and Influencer‑Driven Vegan Advocacy

Singapore's technology-literate consumer base, especially among youths and urban professionals, is assisting in driving the vegan beauty trend online by means of active social media participation and health-oriented content on socials. Beauty influencers, health bloggers, and micro-influencers often emphasize vegan skincare regimens, ingredient transparency, and cruelty-free product interchange in city-focused content communities such as Instagram, TikTok, and wellness websites. These voices tend to sell minimalist habits like multi-purpose serums, aloe toners, eco-friendly sheet masks, which are in line with Singapore's urban, high-speed lifestyle and moral standards. Vegan companies are reacting by sharing rich digital content in terms of ingredient procurement, performance, and sustainability through QR-coded packaging or e-commerce narratives. High digital literacy, health consciousness, and ethicalness combine to create demand for effective yet ethical vegan cosmetic solutions. This trend is particularly strong among cosmopolitan neighborhoods such as Orchard, Tiong Bahru, and Holland Village, where pop-up experiences and boutique vegan beauty shops further accentuate the digital‑wellness look associated with veganism.

Singapore Vegan Cosmetics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Skin Care

- Hair Care

- Makeup

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes skin care, hair care, makeup, and others.

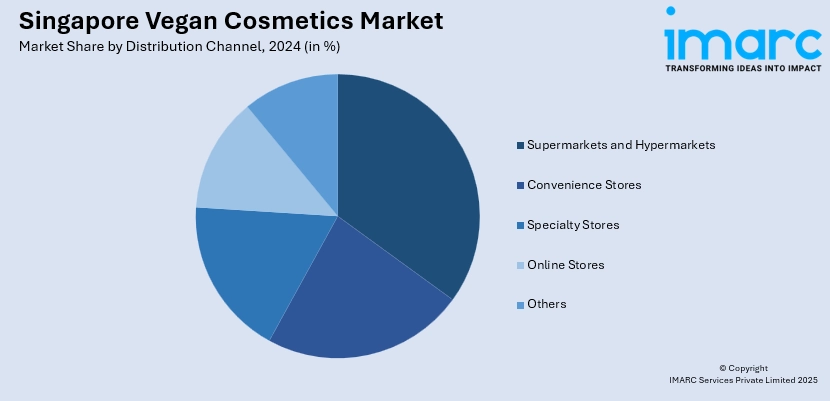

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel has also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, specialty stores, online stores, and others.

Regional Insights:

- North-East

- Central

- West

- East

- North

The report has also provided a comprehensive analysis of all the major regional markets, which include North-East, Central, West, East, and North.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Singapore Vegan Cosmetics Market News:

- In May 2025, Sephora introduced Haus Labs by Lady Gaga across seven Asia Pacific markets, broadening its exclusive brand selection with a complete array of 125 cosmetic items. Customers in New Zealand, Australia, Malaysia, Singapore, Thailand, the Philippines, and Hong Kong SAR can now find Haus Labs available in Sephora’s retail locations and digital platforms. Recognized for its pure, vegan, and skincare-enhanced formulas, the brand offers key items such as the Triclone Skin Tech Foundation in 51 shades, the PhD Hybrid Lip Oil and Plumping Lip Glaze, along with the Color Fuse Blush Powder. With this launch, Sephora’s premium beauty collection in the area expands to almost 250 brands. It also indicates increasing demand in the area for cosmetic items that offer skincare advantages alongside diverse shade options.

Singapore Vegan Cosmetics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Skin Care, Hair Care, Makeup, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, Others |

| Regions Covered | North-East, Central, West, East, North |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Singapore vegan cosmetics market performed so far and how will it perform in the coming years?

- What is the breakup of the Singapore vegan cosmetics market on the basis of product type?

- What is the breakup of the Singapore vegan cosmetics market on the basis of distribution channel?

- What is the breakup of the Singapore vegan cosmetics market on the basis of region?

- What are the various stages in the value chain of the Singapore vegan cosmetics market?

- What are the key driving factors and challenges in the Singapore vegan cosmetics market?

- What is the structure of the Singapore vegan cosmetics market and who are the key players?

- What is the degree of competition in the Singapore vegan cosmetics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Singapore vegan cosmetics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Singapore vegan cosmetics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Singapore vegan cosmetics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)