SLI Battery Market Size, Share, Trends and Forecast by Type, Sales Channel, Application, and Region, 2025-2033

SLI Battery Market Size and Share:

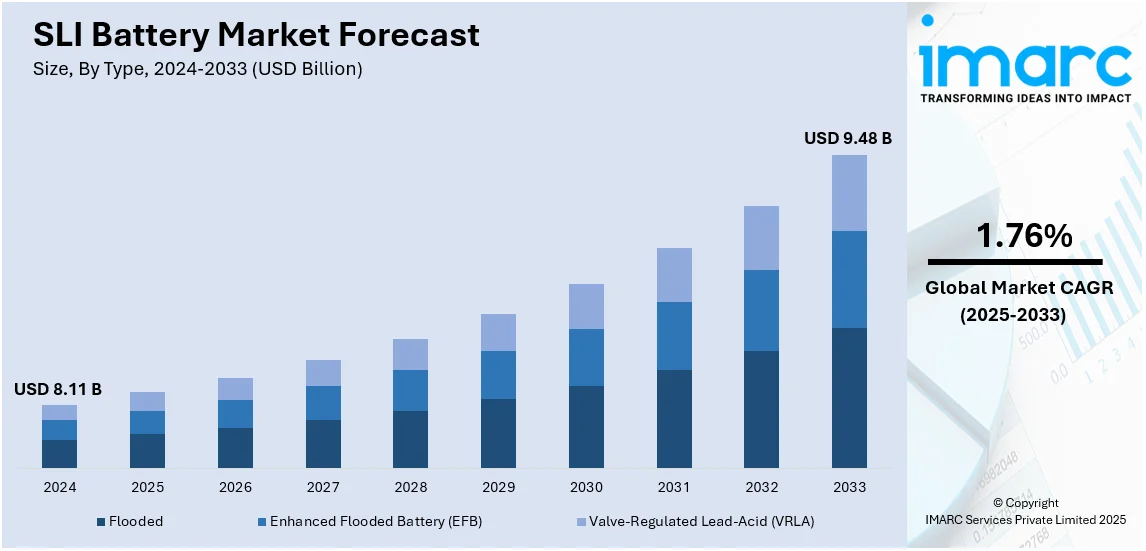

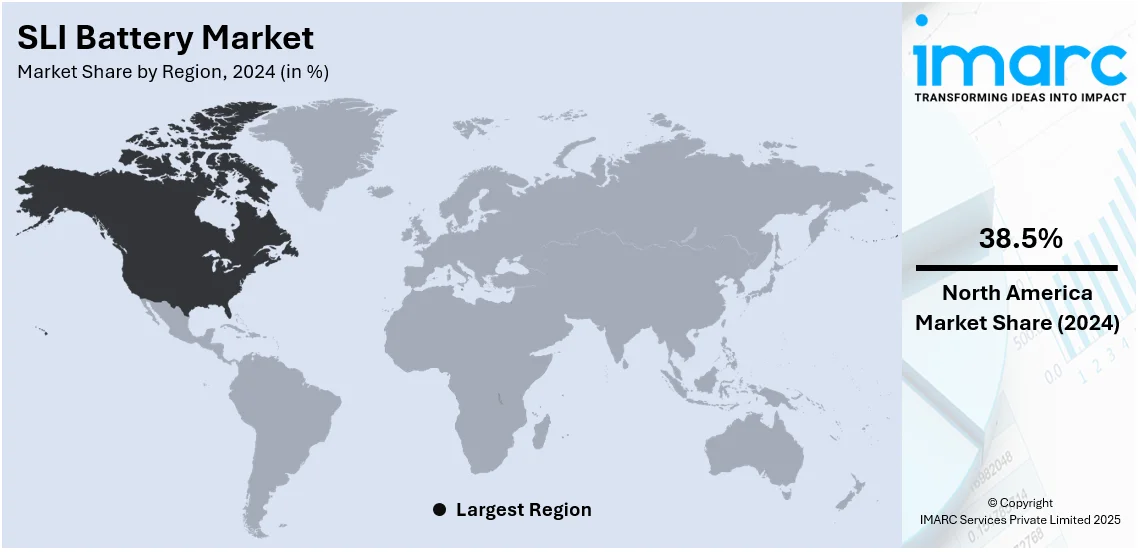

The global SLI battery market size was valued at USD 8.11 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 9.48 Billion by 2033, exhibiting a CAGR of 1.76% from 2025-2033. North America currently dominates the market, holding a market share of over 38.5% in 2024. The SLI battery market share is expanding, driven by increasing sales of commercial and passenger vehicles, favorable government initiatives to control carbon emissions, and the escalating demand for cost-effective and lightweight battery solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 8.11 Billion |

| Market Forecast in 2033 | USD 9.48 Billion |

| Market Growth Rate 2025-2033 | 1.76% |

The rising vehicle production is driving the demand for reliable power sources like SLI batteries in engine starting, lighting, and ignition systems. Besides this, the increasing user preference for feature-rich vehicles with advanced infotainment, navigation, and safety systems is creating the need for stable battery performance. The expanding automotive aftermarket is also contributing to the market growth, as vehicle owners are replacing aging batteries to ensure optimal performance. Apart from this, advancements in battery technology, such as improved recharge capabilities, are enhancing battery reliability. Additionally, the growing adoption of hybrid vehicles, which rely on auxiliary batteries for non-propulsion functions, is supporting the market growth.

The United States has emerged as a major region in the SLI battery market owing to many factors. The increasing demand for reliable power sources in passenger cars, commercial vehicles, and off-road machinery is fueling the SLI battery market growth. The country's large automotive sector, coupled with frequent battery replacements in older vehicles, drives consistent demand. According to the information published by the US Energy Information Administration, the sales of battery electric vehicles (BEVs) increased from 7.4% of the US light duty vehicle (LDV) market in Q2 2024 to 8.9% in Q3 2024. The proportion of hybrid vehicle (HV) sales rose as well, accounting for 10.6% of the US LDV market during the third quarter of 2024. Besides this, advancements in battery technology like enhanced cold-cranking performance are impelling the market growth. Additionally, the logistics and transportation industry in the US is employing fleet vehicles that require regular battery replacements.

SLI Battery Market Trends:

Increasing vehicle production

The rising vehicle production is propelling the market growth. For instance, worldwide passenger vehicle sales reached 65.3 Million in 2023, up from 64.8 Million in 2019, exceeding pre-COVID figures. As automakers are expanding production to meet the increasing user demand, the need for SLI batteries is rising to support engine ignition, lighting systems, and electronic features. Modern vehicles equipped with advanced infotainment, navigation, and safety technologies require stable power sources, further encouraging SLI battery adoption. Additionally, the manufacturing of electric vehicles (EVs), which often rely on auxiliary batteries for non-propulsion functions, adds to the demand. With expanding automotive manufacturing hubs, battery suppliers are experiencing consistent growth opportunities. As automakers continue to introduce new models and upgrade vehicle technologies, the need for efficient and durable SLI batteries remains strong.

Growing demand for golf carts

The rising demand for golf carts is positively influencing the market. For instance, since 2012, participation in both nine and 18-hole golf increased, especially by 62% in 2022 compared to 2020, comprising 16,000 registered in the Middle East. Golf carts rely on SLI batteries to start engines, power lighting systems, and support additional electrical components like global positioning system (GPS) devices and entertainment systems. As golf courses expand and recreational facilities grow, the need for golf carts equipped with reliable batteries rises. Additionally, golf carts are employed in airports, resorts, and gated communities for convenient transportation, further driving the SLI battery demand. With golf carts being widely utilized for both leisure and commercial purposes, the demand for stable and long-lasting SLI batteries is increasing.

Rising need for construction equipment

The growing requirement for construction equipment is offering a favorable SLI battery market outlook. Construction machinery, such as excavators, loaders, and bulldozers, rely on SLI batteries for starting engines, powering lighting systems, and supporting essential electronic controls. As infrastructure projects expand worldwide, the demand for such equipment grows, directly encouraging the adoption of SLI batteries. Additionally, construction machinery often operates in demanding environments, requiring durable and high-performance batteries with improved cold-cranking capabilities and resistance to vibrations. The increasing employment of technologically advanced construction equipment equipped with GPS, monitoring systems, and automated controls further creates the need for stable power sources. With high investments in infrastructure development and commercial construction activities, the demand for SLI batteries in the burgeoning construction equipment sector is rising. According to the IMARC group, the global construction equipment market is set to reach USD 349.91 Billion by 2033, showing a CAGR of 3.42% from 2025-2033.

SLI Battery Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global SLI battery market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, sales channel, and application.

Analysis by Type:

- Flooded

- Enhanced Flooded Battery (EFB)

- Valve-Regulated Lead-Acid (VRLA)

Flooded held 43.6% of the market share in 2024. These batteries are known for their simple design, making them easier to produce at a lower cost, which appeals to budget-conscious users and automakers. Flooded batteries are highly effective in handling the frequent charge and discharge cycles required in vehicles for engine starting, lighting, and ignition systems. Their robust construction allows them to perform well in various climate conditions, especially in regions with moderate weather. Additionally, flooded batteries are widely available in both original equipment manufacturer (OEM) and aftermarket sectors, ensuring easy replacements for older vehicles. Their long-standing utilization in conventional internal combustion engine vehicles further strengthens their dominance. As automakers continue to manufacture high volumes of entry-level and budget-friendly vehicles, the demand for reliable and affordable flooded batteries remains strong, keeping them at the forefront of the market.

Analysis by Sales Channel:

- OEM

- Aftermarket

OEM accounts for 62.0% of the market share. Automakers rely on OEM suppliers to provide batteries that meet precise technical specifications, ensuring compatibility with vehicle models. As vehicle production increases, especially with the growing adoption of passenger cars, commercial vehicles, and electric hybrids, the demand for OEM-installed batteries rises. OEM batteries are preferred by automakers for their consistent quality, reliability, and longer lifespan, reducing the risk of performance issues in new vehicles. Additionally, OEM suppliers maintain strong partnerships with automotive companies, ensuring a steady battery supply directly to vehicle production lines. The integration of advanced electronics, safety features, and comfort systems in modern vehicles further creates the need for reliable power sources. As automotive manufacturing expands and vehicle designs become more complex, OEM batteries continue to dominate the sales channel in the market.

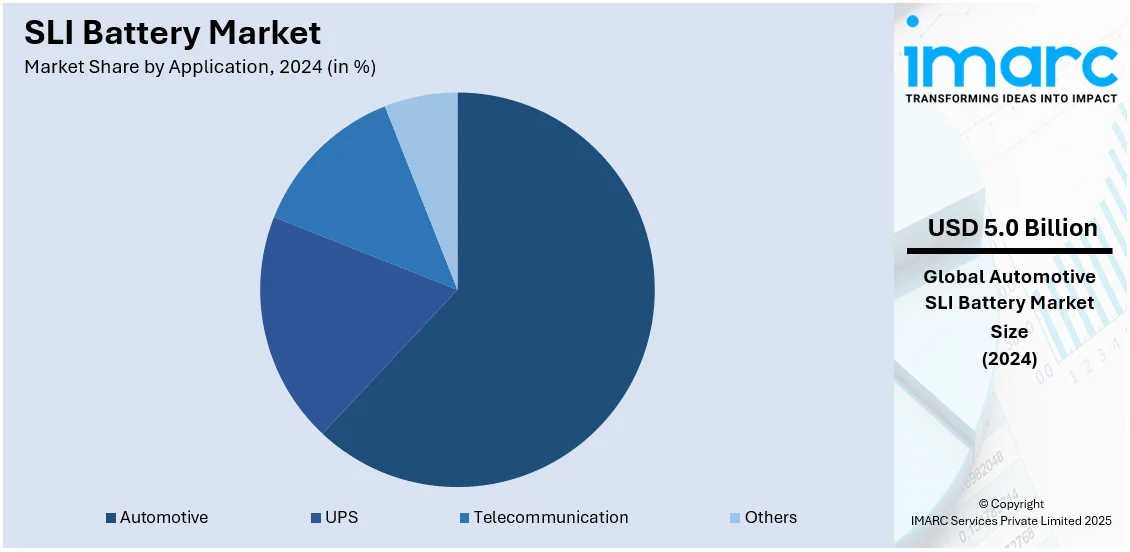

Analysis by Application:

- Automotive

- UPS

- Telecommunication

- Others

Automotive holds 62.2% of the market share, owing to the high demand for SLI batteries in passenger cars, commercial vehicles, and off-road machinery. SLI batteries are essential for powering engine ignition, vehicle lighting systems, and electronic features, making them a crucial component in automobiles. Rising vehicle production, particularly in developing regions, is creating the need for these batteries. Additionally, modern vehicles with advanced infotainment, GPS, and safety systems require stable power sources, further driving the demand for SLI batteries. The growing popularity of EVs, which often use auxiliary SLI batteries for non-propulsion functions, is also supporting the market growth. The increasing focus on vehicle maintenance and the replacement of aging batteries in existing vehicles is further catalyzing the demand in the automotive sector. As vehicle ownership continues to rise and automotive technology advances, the need for efficient and reliable SLI batteries remains prominent, ensuring the automotive segment’s dominance in the market.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America, accounting for 38.5%, enjoys the leading position in the market. The region is noted due to its well-established automotive industrial base, which drives consistent demand for reliable battery solutions. According to the Statistics Canada, in December 2024, the total number of new motor vehicles sold in Canada was 135,511. The region’s high vehicle ownership rate, including a significant number of older vehicles requiring frequent battery replacements, fuels the market growth. Harsh winter conditions in parts of North America further catalyze the demand for SLI batteries with enhanced cold-cranking performance to ensure smooth vehicle starting. Additionally, the strong presence of major automotive manufacturers and aftermarket service providers supports steady battery sales. Advancements in vehicle technologies, such as GPS systems, entertainment units, and enhanced lighting features, create the need for durable and efficient SLI batteries. Rising investments in fleet expansion and commercial vehicle operations also contribute to demand. With key players wagering on regional manufacturing facilities and efficient supply chains, North America continues to maintain its leadership in the market, driven by strong automotive requirements and technological advancements.

Key Regional Takeaways:

United States SLI Battery Market Analysis

The United States holds 87.2% of the market share in North America. The increasing utilization of SLI batteries in golf carts, aligning with the growing trend of golf, is impelling the market growth. For instance, in 2023, golfers aged 18 to 34 in the US represented the largest segment of on-course players, estimated at 6.3 Million. The burgeoning golf industry is driving the demand for golf carts, creating the need for SLI batteries to support a consistent power supply. The integration of advanced battery technology enhances vehicle performance, reinforcing the rising utilization of SLI batteries in golf carts. Additionally, the growing trend of golf has led to infrastructural developments, creating opportunities for SLI battery manufacturers. The high number of golf courses is catalyzing the demand for golf carts, promoting SLI battery adoption. With increasing user participation in golf, there is a continuous expansion of golf facilities, further emphasizing the growing utilization of SLI batteries in golf carts. The demand for energy-efficient solutions in golf transportation is enhancing the market potential for SLI batteries.

Asia-Pacific SLI Battery Market Analysis

The rising SLI battery adoption is attributed to the growing foreign direct investment (FDI) in the automotive sector, contributing to industry expansion. According to the India Brand Equity Foundation, the automobile sector attracted a total equity FDI inflow of around USD 35.65 Billion between April 2000 and December 2023. The increasing capital inflows have led to advancements in manufacturing capabilities, encouraging the usage of SLI batteries. Enhanced automotive production has also amplified the integration of battery technologies. Market players are leveraging FDIs to optimize production efficiency, reinforcing the employment of SLI batteries. Apart from this, the rising FDI in automotives has enabled the establishment of new production facilities, promoting innovations in battery technology. Moreover, the broadening automotive infrastructure and increasing production capacities are impelling the market growth. With continuous spending on the automotive sector, market players are capitalizing on evolving opportunities, strengthening the market growth.

Europe SLI Battery Market Analysis

The market in Europe is experiencing growth, driven by the increasing implementation of government initiatives to control carbon emissions, encouraging the transition towards efficient power solutions. For instance, the EU aims for a specific goal of achieving a 55% net decrease in greenhouse gas emissions by 2030. Regulatory frameworks emphasizing emission control have accelerated the shift towards advanced battery technologies, promoting SLI battery adoption. The rising execution of government initiatives to reduce carbon emissions is leading to innovations in energy-efficient mobility, increasing the relevance of SLI batteries. Policy-driven incentives for sustainable automotive solutions reinforce the usage of SLI batteries. The implementation of stringent emission regulations is enabling technological advancements, thereby fueling the market growth. Automotive manufacturers are investing in low-emission technologies, highlighting the importance of SLI batteries in meeting environmental goals. Market participants are prioritizing compliance with emission norms, which is propelling the market growth.

Latin America SLI Battery Market Analysis

The market in Latin America is witnessing growth due to the rising sales of commercial and passenger vehicles, coupled with increasing disposable incomes. According to reports, Latin America's total disposable income is expected to grow by nearly 60% from 2021 to 2040. The expanding vehicle market is creating the need for reliable battery solutions, encouraging SLI battery adoption. The burgeoning residential sector is contributing to infrastructure expansion, further driving the demand for automotive batteries. Additionally, the broadening of commercial fleets in sectors like logistics and agriculture is catalyzing the demand for durable batteries. The area's aging vehicle fleet further creates the need for aftermarket batteries since older cars require regular battery changes.

Middle East and Africa SLI Battery Market Analysis

The increasing demand for packaging solutions due to growing investments in telecommunication is fueling the market growth. For instance, overall expenditure on information and communications technology (ICT) across the Middle East, Türkiye, and Africa (META) was anticipated to attain USD 238 Billion in 2024, with a rise of 4.5% over 2023. The expansion of telecommunication infrastructure has amplified the requirement for energy-efficient packaging solutions, supporting the growing SLI battery adoption. The high demand for packaging solutions has influenced the development of battery technologies, ensuring optimal performance. Investments in telecommunication continue to enhance packaging innovations, reinforcing the usage of SLI batteries. Moreover, modern vehicles with infotainment systems, navigation tools, and safety features need efficient power sources like SLI batteries.

Competitive Landscape:

Key players work on developing modern solutions to meet the high SLI battery market demand. They are wagering on advanced technologies, improving product performance, and expanding their distribution networks. Leading manufacturers focus on developing batteries with enhanced durability, faster charging, and better cold-cranking capabilities. Companies are also introducing maintenance-free and spill-proof designs to attract users seeking convenience. Strategic partnerships with automakers help key players to supply original equipment batteries directly to vehicle manufacturers, strengthening their market presence. Additionally, investments in eco-friendly battery recycling programs align with environmental regulations, enhancing brand reputation. Key players are also broadening their production capacities and establishing regional distribution centers to ensure efficient supply chain management. By offering diverse product ranges for modern vehicles, these companies effectively cater to both original equipment and aftermarket demand. For instance, in April 2024, Clarios obtained a significant deal to provide its well-known 12V AGM battery to a top automaker. This battery could enhance fuel efficiency and lower CO2 emissions in vehicles equipped with start-stop systems. Its durability and minimal upkeep aimed to fulfill essential sustainability criteria. The agreement strengthened Clarios’s leadership in environment friendly lead-acid battery technologies.

The report provides a comprehensive analysis of the competitive landscape in the SLI battery market with detailed profiles of all major companies, including:

- Acumuladores Moura SA

- C&D Technologies Inc.

- Crown Battery Manufacturing Company

- East Penn Manufacturing Co.

- EnerSys

- Exide Technologies

- GS Yuasa International Ltd.

- Hankook & Company Co. Ltd.

- iQ International AG

- Leoch International Technology Limited

- Power Sonic Corporation

Latest News and Developments:

- December 2024: Hyundai Motor aimed to incorporate Amaron's made-in-India AGM battery technology as an SLI battery in its local range. Obtained via Amara Raja Energy & Mobility, these batteries were manufactured to improve vehicle performance. Hyundai intended to install locally produced AGM batteries in its vehicles during the fourth quarter of the fiscal year 2024-2025. This action strengthened Hyundai’s dedication to localization and creative solutions for Indian users.

- November 2024: Exide Technologies broadened its AGM battery range with the introduction of the EK454 and EK457 models. These batteries were made for hybrid and start-stop vehicles, providing improved cycling and quick recharging. Their cutting-edge technology could reduce fuel usage, in line with worldwide energy efficiency trends. This action strengthened Exide’s dedication to innovation and competitiveness in the rechargeable battery industry.

- September 2024: VARTA® Automotive introduced an updated range of products at Automechanika 2024, showcasing color-coded battery classifications for more straightforward selection. The portfolio featured SLI batteries marked with a blue label, in addition to new EFB and AGM choices to assist hybrid and electric vehicles (HEVs). Innovations supported by Clarios sought to simplify the IAM selection process and improve workshop productivity. The broader assortment also launched Li-Ion options for recreational vehicles, strengthening VARTA’s market position.

- July 2024: Exide Industries Ltd planned to unveil a cutting-edge SLI-AGM battery, addressing the increasing need for high-performance automotive power options. AGM technology could improve starting ability, longevity, and endurance in comparison to conventional lead-acid batteries. As certain OEMs transition to AGM batteries, Exide neared the completion of launching these for both the domestic and international markets. This action corresponded with the industry's drive for advanced battery technology.

SLI Battery Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Flooded , Enhanced Flooded Battery (EFB), Valve-Regulated Lead-Acid (VRLA) |

| Sales Channels Covered | OEM, Aftermarket |

| Applications Covered | Automotive, UPS, Telecommunication, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Acumuladores Moura SA, C&D Technologies Inc., Crown Battery Manufacturing Company, East Penn Manufacturing Co., EnerSys, Exide Technologies, GS Yuasa International Ltd., Hankook & Company Co. Ltd., iQ International AG, Leoch International Technology Limited, Power Sonic Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the SLI battery market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global SLI battery market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the SLI battery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The SLI battery market was valued at USD 8.11 Billion in 2024.

The SLI battery market is projected to exhibit a CAGR of 1.76% during 2025-2033, reaching a value of USD 9.48 Billion by 2033.

The increasing demand for commercial and passenger vehicles is creating the need for SLI batteries, which are essential for starting engines, powering vehicle lighting systems, and supporting electronic features. Additionally, advancements in battery technology, such as improved durability, enhanced cold-cranking performance, and better recharge capabilities, are fueling the market growth. The rising integration of electronic components in modern vehicles, including infotainment systems, navigation tools, and safety features, is further catalyzing the demand for stable power sources like SLI batteries.

North America currently dominates the SLI battery market, accounting for a share of 38.5% in 2024, driven by its large automotive sector, high vehicle ownership rates, and frequent battery replacements. Harsh winter conditions and increasing demand for advanced vehicle electronics further create the need for efficient SLI batteries.

Some of the major players in the SLI battery market include Acumuladores Moura SA, C&D Technologies Inc., Crown Battery Manufacturing Company, East Penn Manufacturing Co., EnerSys, Exide Technologies, GS Yuasa International Ltd., Hankook & Company Co. Ltd., iQ International AG, Leoch International Technology Limited, Power Sonic Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)