Smart Electric Meter Market Size, Share, Trends and Forecast by Type, Phase, End User, and Region, 2025-2033

Smart Electric Meter Market Size and Share:

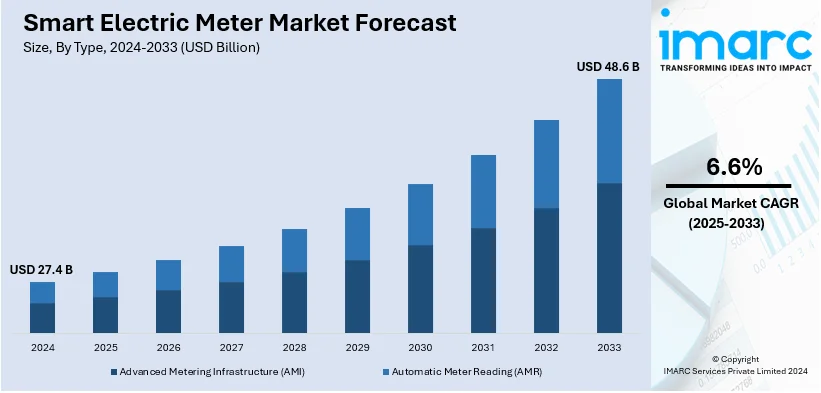

The global smart electric meter market size reached USD 27.4 Billion in 2024. Looking forward, the market is forecasted to reach USD 48.6 Billion by 2033, exhibiting a growth rate (CAGR) of 6.6% during 2025-2033. Asia Pacific currently dominates the market, holding a significant market share of over 40.9% in 2024. The increasing investments in smart grid infrastructure, government initiatives for energy efficiency, rising urbanization, regulatory mandates, renewable energy integration, and advancements in IoT-enabled technologies for real-time energy management are propelling the market across the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 27.4 Billion |

| Market Forecast in 2033 | USD 48.6 Billion |

| Market Growth Rate (2025-2033) | 6.6% |

The global smart electric meter market is growing fast, mainly on account of growing investments in smart grid infrastructure as well as increasing government initiatives meant to increase energy efficiency. Utilities are implementing smart meters to enhance operational efficiencies, reduce energy loss, and introduce renewable energy sources into the grid seamlessly. Additionally rising urbanization, as well as advanced metering technologies, is enhancing the demand for precise data of energy consumption, which allows dynamic pricing models and better management of energy. As per the United Nations, 68% of the global population is expected to reside in urban areas by 2050. Regulatory mandates for the installation of smart meters in residential, commercial, and industrial sectors also augment the growth of the market. In addition, increasing demands for electricity and efforts to minimize carbon emissions are forcing the energy providers to adopt such technologies. With the integration of IoT and advanced communication systems with smart meters, the market is also enabled to have real-time monitoring, consumer awareness, and improved billing clarity, which ultimately drive market expansion globally.

The United States has emerged as a key regional market for smart electric meters. The market is boosted by increased investments in modernizing the national grid and enhancing energy efficiency. There are federal and state-level initiatives, including plans on the development of advanced metering infrastructure, that have encouraged widespread adoption of smart meters in residential, commercial, and industrial sectors. This rising focus on renewable energy integration and reducing carbon emissions aligns well with smart meters' ability to handle distributed energy resources in an effective manner. Moreover, consumer demand for transparency over their energy usage and the right bill is rising, as such devices would provide them with real-time consumption data and support the time-of-use pricing model. In addition, utility companies use smart meters to decrease energy losses, increase the reliability of grids, and decrease operational costs.

Smart Electric Meter Market Trends:

Favourable Regulatory Support

The implementation of various regulations by government bodies that mandate the installation of smart meters to meet sustainability objective and modernize grid infrastructures is strengthening the market. Implementation of various regulations by the government bodies, mandating the installation of smart meters to meet sustainability objective as well as to modernize grid infrastructures is, therefore, strengthening the market. As of December 2022, according to the National Smart Grid Mission (NSGM) dashboard, a total of 222 million smart meters were sanctioned in India, with 7.9 million already installed. Apart from that, regulatory bodies also provide different financial incentives like grants and tax breaks to promote this smart meter technology faster. This, subsequently, is driving the market demand for smart electric meters. For example, in June 2022, Ministry of Power in India presented the Revamped Distribution Sector Scheme (RDSS). The RDSS scheme, as stated earlier, will increase the operational efficiency and finance sustainability of discoms. It covers all projects sanctioned under the programs, such as the Deendayal Upadhyay Gram Jyoti Yojana, the Integrated Power Development Scheme, the Prime Minister's Development Package 2015, etc. Further, the larger goals of smart metering program under the RDSS are a reduction of AT&C loss to 12 to 15 percent, reducing an average cost of supply average revenue realised gap to a zero gap by the fiscal year 2024-25, improvement in the supply of power to consumers, reliability, quality, affordability, creating a financially sustainable distribution sector with operationally and commercially sound operational efficiency, etc. In line with this, they are also engaging with utility companies to spearhead large-scale rollouts of smart meters, replacing old meters with smart meters. For example, in September 2023, the Union Minister for Power and New & Renewable Energy in India stated that the RDSS guidelines had mandated the rollout of smart meters through public-private partnership (PPP) on total expenditure (TOTEX) mode to provide support to DISCOMS and avoid post-implementation operational issues. In addition, in June of 2023, the ministry launched a pilot program through the United Nations Development Program to install smart meters with support to measure electricity use in Moldova, in Europe.

Continuous Technological Advancements

The increasing integration of ML algorithms and IoT technology in smart electric meters to improve their capabilities and reliability is positively influencing the outlook for the smart electric meter market. Additionally, these innovations offer predictive maintenance, provide real-time data analytics, even adapt to changing usage patterns, etc., which is acting as another significant growth-inducing factor. For example, in July 2023, Bern-based BKW announced the deployment of a meter data management platform across their meter network in Switzerland. Besides this, the introduction of comprehensive energy management systems is also contributing to the market growth. For example, in December 2023, Vector Technology Solutions (VTS) and Amazon Web Services (AWS) designed the platform called Diverge that optimizes high-frequency data from smart electricity and gas meters in businesses and homes and helps energy companies manage renewable power sources. Moreover, the increasing adoption of wireless communication technologies has made the operation and deployment of smart meters more feasible and cost-effective, which is driving the market. For instance, last December 2023, one of the telecom operators, Bharti Airtel, agreed to a strategic partnership with IntelliSmart Infrastructure to connect as many as 2 crore smart meters with Internet of Things technology.

Need for Real-Time Data

The growing consumer need for transparency in billing has been driving the smart electric meter market revenue. Beyond this, these meters present customers with detailed insights about their energy consumption patterns; this encourages them to take well-informed decisions. For example, in March 2024, distribution company Scottish and Southern Electricity Networks (SSEN), a part of GB distribution, made its full half-hourly consumption datasets available in open access. Apart from this, SSEN emerged as one of the first network operators in Britain to publish such data, having pioneered the development of an open data portal for the distribution of data in the country. In line with this, the key players are paying attention to enhance consumer satisfaction by extensively investing in smart electric meter technology, leading to a price rise of the product. This would, for instance, involve such examples as in October 2023, DCC and the UK's Energy Systems Catapult fast tracked access to smart meter data for greater transparency. This inflating demand for mutual benefits between customers and utility providers through data-driven insights is also expected to take the market forward in coming years. For example, in February 2024, GE Vernova announced GridOS Data Fabric, tailored to assist utilities in managing smart grids.

Smart Electric Meter Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with the smart electric meter market forecast at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on the type, phase, and end user.

Analysis by Type:

- Advanced Metering Infrastructure (AMI)

- Automatic Meter Reading (AMR)

Advanced metering infrastructure (AMI) leads the market with around 57.8% of market share in 2024. Advanced metering infrastructure (AMI) is dominating the market as it allows real-time data collection, thereby providing immediate insights into energy consumption patterns. In addition, AMI systems help reduce the probability of billing errors and disputes. Other than that, they enable two-way communication between the central system and the meter, which thus supports remote monitoring and even firmware updates. In addition to that, advanced metering infrastructure helps detect and isolate outages faster, thus enhancing the entire electric grid's reliability and efficiency. This is why it is widely adopted globally. For instance, in November 2023, Trilliant, one of the major overseas providers of advanced metering infrastructure (AMI), entered into a collaboration with IntelliSmart Infrastructure Private Limited, one of the major digital solutions providers in India, as one of its software partners for its Head-end System (HES) cellular implementations.

Analysis by Phase:

- Single Phase

- Three Phase

Single phase leads the market with around 62.3% of market share in 2024. Single-phase smart electric meters are majorly installed in residential buildings. Following this, the operating mechanisms of single-phase meters are relatively simple, and they are easier to maintain, use. Three-phase smart electric meters are widely utilized in commercial and industrial sites that have higher power demand requirements. In addition to that, they ensure more efficient and balanced power distribution in places with variable loads or heavy machinery, making them preferred for industries.

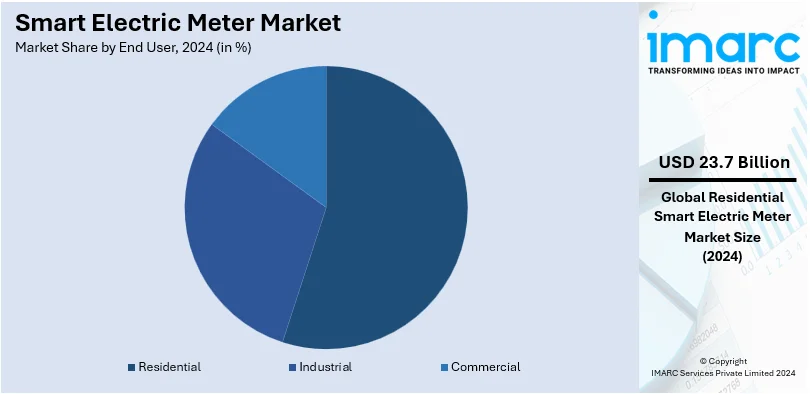

Analysis by End User:

- Industrial

- Commercial

- Residential

Residential lead the market with around 86.7% of market share in 2024. The increasing demand for real-time information on electricity consumption, which enabled consumers to better understand patterns of consumption and take necessary steps to reduce wastage, is driving growth in this segmentation. In addition, the automated nature of smart meters eliminates the need for a manual meter reading, and thus the billing process becomes more efficient and accurate. For instance, Eversource installed smart meters for more than 1.2 million residential and small business consumers in Connecticut, United States, during October 2023. In addition, in December 2023, Xylem launched a new residential electric meter featuring advanced grid edge capabilities.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 40.9%. Recent opportunities for the smart electric meter market include rising investments by utility companies in novel smart meter infrastructures. For example, Salzer set up a smart meter manufacturing company in India, which is going to produce 4 million smart energy meters per annum, as of February 2024. As a result of that, in February 2024, IGL Genesis Technologies agreed to terms to purchase smart meter manufacturing technology from China-based Hangzhou Beta Meter for close to Rs 20 Crore to strengthen the energy structure in India with a much-needed advanced metering system. Apart from this, the growing number of tech hubs that provide a robust platform for the development and adaptation of advanced technologies, such as smart electric meters, will continue to propel the market in the forecast period. For example, in March 2023, one of the leading Internet of Things solution providers, JioThings, joined forces with an electric utility firm in France, EDF, and Energy Efficiency Services Limited (EESL), to implement one million smart prepaid meters in the state of Bihar. Correspondingly, in September 2023, HPL Electric and Power Ltd entered a strategic alliance with Wirepas Oy for the initiation of smart metering projects in India.

Key Regional Takeaways:

United States Smart Electric Meter Market Analysis

In 2024, the United States accounts for over 93.90% of the smart electric meter market in North America. The modernisation of energy infrastructure and government-led programs encouraging energy saving have made the US a prominent market for smart electric meters. To modernise the electric grid, improve cybersecurity, increase interoperability, and gather an unprecedented amount of data on smart grid operations and benefits, DOE and the electricity industry have jointly invested USD 8 Billion in 99 cost-shared projects involving more than 200 participating electric utilities and other organisations under the largest program, the Smart Grid Investment Grant (SGIG). As a result, the U.S. Energy Information Administration reports that in 2022, electric utilities had approximately 119 million advanced (smart) metering infrastructure (AMI) installations, or about 72% of all electric meter installations. By switching to Advanced Metering Infrastructure (AMI), energy theft is decreased, grid dependability is increased, and real-time monitoring of energy consumption is made easier.

In order to assist distributed energy resources (DERs) such as solar panels and electric vehicles (EVs), utilities are implementing smart meters. States with high aspirations for integrating renewable energy, like California and Texas, are at the forefront of smart meter deployment. Adoption is further aided by growing consumer knowledge of demand response initiatives and energy savings. Other significant factors influencing the adoption of smart electric meters in the residential, commercial, and industrial sectors include integration with IoT devices, improvements in communication technology, and growing interest in time-of-use rates.

Europe Smart Electric Meter Market Analysis

Strict laws and aggressive energy efficiency goals are driving the market for smart electric meters in Europe. By 2020, 80% of electricity consumers in the member states were expected to have smart meters installed, as required by the European Union's Clean Energy Package.

Sweden was an early leader, implementing automated "smart" meters as early as 2003 and achieving 100% coverage. Since 2014, homeowners in Finland have been receiving their electricity bills based on actual meter readings, achieving a 100% implementation. In 2018, Spain became the first country in the EU to attain 100% installation, followed by Estonia in 2017 with 98%, and Denmark in 2019 with approximately 80% coverage. Nonetheless, several EU nations continue to lag behind their goals. At first, Germany chose not to implement smart meters. The German government then approved a draft law last year to start the smart meter rollout nationwide. Rollouts will be mandatory in Germany starting in 2025, with legally enforceable timelines to reach 100% coverage by 2030.

The market gains from the growing use of renewable energy sources and the requirement for effective grid management. In order to assist Europe's objective of becoming carbon neutral by 2050, smart meters are essential for enabling time-of-use rates and lowering energy waste. Large-scale deployment projects have been led by utilities like Enel and E.ON, frequently with government funding.

Asia Pacific Smart Electric Meter market Analysis

Urbanisation, rising power demand, and government-led initiatives are all contributing to the Asia-Pacific smart electric meter market's explosive rise. Large-scale installations are being driven by a national smart grid project in China, which is leading the region. With its Smart Meter National Program (SMNP), which aims to install 250 Million smart meters by 2025, India is a close follower. Taiwan is the least developed market across East Asia with merely 2.8 million smart meters installed.

Advanced metering technologies are required for effective energy management due to the growing use of renewable energy in nations like Australia and Japan. Adoption of smart meters is further aided by the region's growing IoT ecosystem and thriving industrial sector. The market is dominated by businesses that offer cutting-edge and reasonably priced solutions, such as Wasion Group and Toshiba Corporation. Prepaid smart meters, particularly in developing nations, give customers more control over how much energy they use while lowering utility collection losses, which further drives market growth.

Latin America Smart Electric Meter market Analysis

The demand for energy efficiency and grid modernisation is driving the market for smart electric meters in Latin America. Leading the region in smart metering initiatives to combat energy theft and system instability are Brazil, Mexico, and Argentina. Demand for sophisticated metering systems has increased because of Brazil's ProGD program, which encourages distributed generation. AMI is being used more and more by utility companies to cut down on non-technical losses, which in certain nations can make up as much as 15% of energy distribution losses. The need for smart meters is increased by the increased emphasis on renewable energy, especially solar. Collaborations with multinational firms, such as Siemens and GE, guarantee access to cutting-edge technologies, hastening deployment.

Middle East and Africa Smart Electric Meter market Analysis

The Middle East and Africa (MEA) smart electric meter market is developing due to increasing investments in renewable energy initiatives and energy infrastructure. According to an industrial report, between Q1 2020 and Q3 2023, approximately USD 128 Billion was financed into the energy sector by investors in the GCC countries. Leading the region in incorporating smart meters into their Vision 2030 sustainable development programs are the United Arab Emirates and Saudi Arabia. The use of smart meters in Africa is fuelled by electrification initiatives and initiatives to lower energy theft. The introduction of prepaid smart meters in South Africa demonstrates how they can help with billing issues and enhance energy accessibility. Collaborations with multinational producers provide consistent technological progress, bolstering regional market expansion.

Competitive Landscape:

Leading companies are using real-time tracking and advanced analytics that improve features, reliability, and efficiency in smart electric meters. The companies are increasing their reach geographically and adapting the products to match local regulations and consumer demands. Many key players are in strategic alliances with utility firms, technology companies, and local administrations to speed the adoption of smart meters. Apart from this, smart electric meter market companies are investing in secure data encryptions to protect user data from unauthorized access. Moreover, they are following international and local regulations, including energy efficiency standards and data protection laws, to ensure that their products meet or exceed those standards. In addition, key industry players have been working towards developing friendly interfaces and mobile applications that allow consumers to monitor their energy consumption in real time, increasing responsible energy usage.

The report provides a comprehensive analysis of the competitive landscape in the smart electric meter market with detailed profiles of all major companies, including:

- ABB Ltd.

- Aclara Technologies LLC (Hubbell Incorporated)

- Genus Power Infrastructures Ltd.

- Holley Technology Ltd.

- Honeywell International Inc.

- Iskraemeco Group

- Itron Inc.

- Jiangsu Linyang Energy Co. Ltd.

- Landis+Gyr

- Microchip Technology Inc.

- Schneider Electric SE

- Wasion Group

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News and Developments:

- December 2024: Australia's National Electricity Market (NEM) has finalized rules for a nationwide smart meter rollout, targeting installation in all households and small businesses by 2030. The initiative aims to enhance energy efficiency, enable better grid management, and support the transition to renewable energy. Smart meters will provide real-time usage data, fostering informed energy decisions and promoting innovation in energy services.

- December 2024: EQT Active Core Infrastructure fund ("EQT") and GIC, a prominent international investor, have reached a deal to jointly purchase a majority investment in Calisen Group, a top independent smart metering company in the United Kingdom.

- May 2024: Oakter, one of the leading consumer electronics brands, introduced Oakmeter, which is a smart energy meter with real-time data and Internet of Things capabilities.

- March 2024: The Maharashtra State Electricity Distribution Company Limited, known as MSEDCL, deployed pre-paid smart electricity meters in Nagpur as a part of the revamped RDSS.

- January 2024: Private transmission and distribution company Adani Energy Solutions Limited (AESL) merged with Esyasoft Holdings to form a joint venture to implement smart metering projects in India and other countries.

Smart Electric Meter Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Advanced Metering Infrastructure (AMI), Automatic Meter Reading (AMR) |

| Phases Covered | Single Phase, Three Phase |

| End Users Covered | Industrial, Commercial, Residential |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ABB Ltd., Aclara Technologies LLC (Hubbell Incorporated), Genus Power Infrastructures Ltd., Holley Technology Ltd., Honeywell International Inc., Iskraemeco Group, Itron Inc., Jiangsu Linyang Energy Co. Ltd., Landis+Gyr, Microchip Technology Inc., Schneider Electric SE, Wasion Group, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the smart electric meter market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global smart electric meter market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the smart electric meter industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

A smart electric meter is an advanced energy monitoring device that records electricity consumption in real-time and communicates data to utilities and consumers. Equipped with digital technology and two-way communication, it enables accurate billing, energy management, and integration of renewable sources, enhancing grid efficiency and promoting sustainable energy usage.

The smart electric meter market was valued at USD 27.4 Billion in 2024.

IMARC estimates the global smart electric meter market to exhibit a CAGR of 6.6% during 2025-2033.

The residential segment accounted for the largest smart electricity meter market share of approximately 86.7% by end user.

The global smart electric meter market is driven by the increasing investments in smart grid infrastructure, government initiatives for energy efficiency, rising urbanization, regulatory mandates, renewable energy integration, and advancements in IoT-enabled technologies for real-time energy management.

According to the report, advanced metering infrastructure (AMI) represented the largest segment by type, driven by its ability to provide real-time data, enable two-way communication, and support efficient energy management, making it essential for modernizing grids and optimizing energy usage.

Single phase leads the market by phase owing to their widespread use in residential and small commercial applications, where lower power requirements make them the most cost-effective and practical choice.

Residential is the leading segment by end user, driven by the widespread adoption of smart electric meters for accurate billing, energy consumption monitoring, and support for energy-saving initiatives in households.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global Smart Electric Meter market include ABB Ltd., Aclara Technologies LLC (Hubbell Incorporated), Genus Power Infrastructures Ltd., Holley Technology Ltd., Honeywell International Inc., Iskraemeco Group, Itron Inc., Jiangsu Linyang Energy Co. Ltd., Landis+Gyr, Microchip Technology Inc., Schneider Electric SE, Wasion Group, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)