Smart Homes Market Size, Share, Trends and Forecast by Component, Application, and Region, 2025-2033

Smart Homes Market Size:

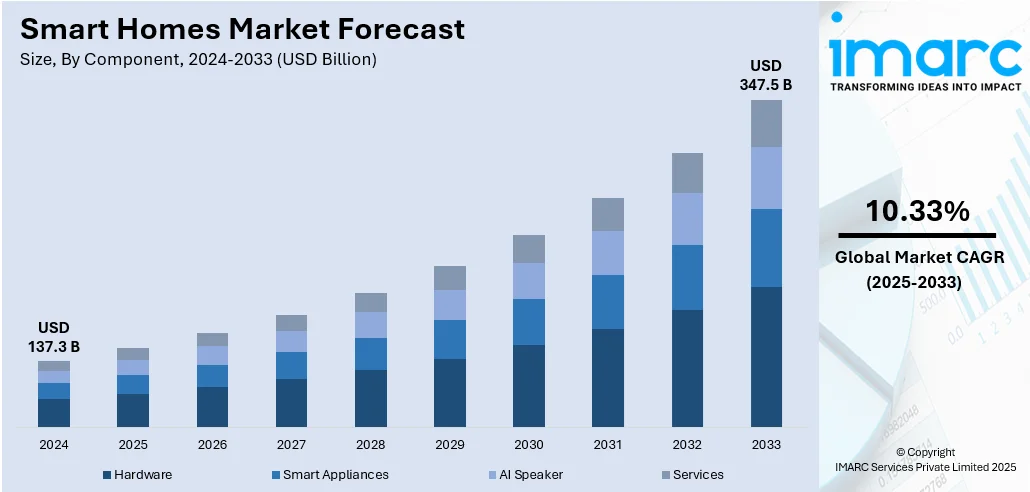

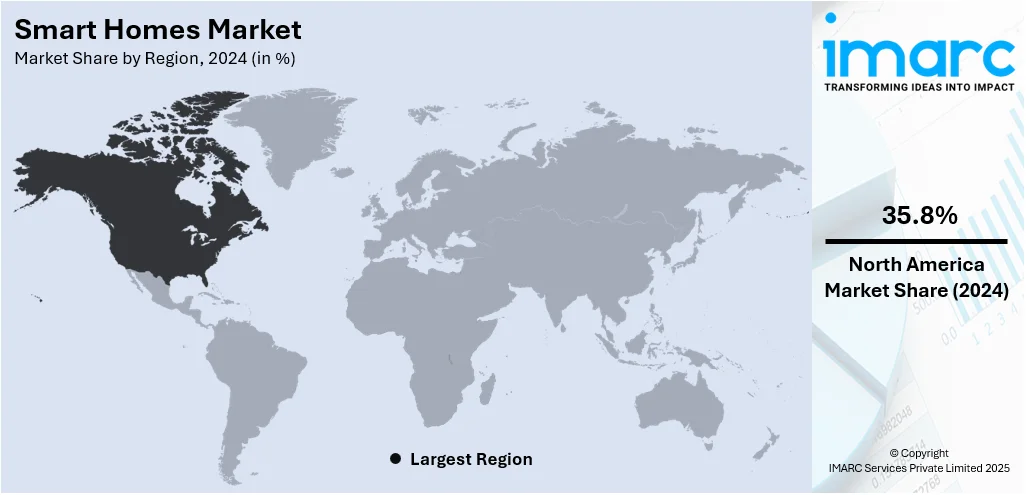

The global smart homes market size was valued at USD 137.3 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 347.5 Billion by 2033, exhibiting a CAGR of 10.33% from 2025-2033. North America currently dominates the market, holding a market share of 35.8% in 2024. Technological advancements in smart homes, which include the intersection of artificial intelligence (AI) and the Internet of Things (IoT), are driving the market. Moreover, the growing demand for fast internet is offering a favorable market outlook. Furthermore, the heightened focus on energy efficiency is expanding the smart homes market share.

Market Size & Forecasts:

- Smart homes market was valued at USD 137.3 Billion in 2024.

- The market is projected to reach USD 347.5 Billion by 2033, at a CAGR of 10.33% from 2025-2033.

Dominant Segments:

- Component: Hardware dominates the market as these devices form the physical infrastructure of a smart home and are essential for automation and control.

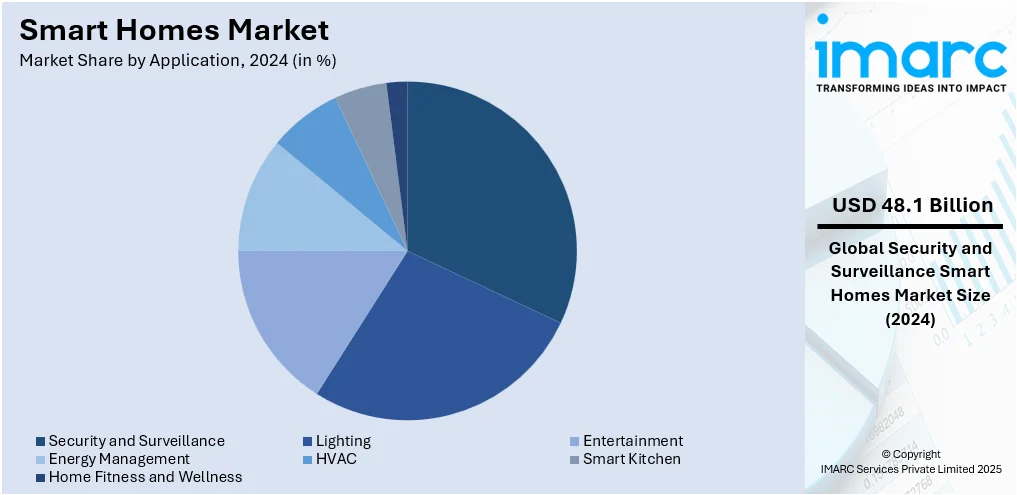

- Application: Security and surveillance hold the biggest market share. They focus on enhancing home security and providing homeowners with real-time monitoring and alerts.

- Region: North America leads the smart homes market as governing agencies of various countries are encouraging the adoption of energy efficient and sustainable smart home technologies.

Key Players:

- The leading companies in smart homes market include ABB Ltd, Amazon.com, Inc., Emerson Electric Co., Google LLC, Johnson Controls, Legrand S.A., LG Electronics Inc., Nice S.p.A., Panasonic Corporation, Resideo Technologies, Inc., Robert Bosch Smart Home GmbH, Schneider Electric SE, Siemens AG, etc.

Key Drivers of Market Growth:

- Energy Efficiency and Sustainability: Increasing awareness about energy conservation and the push to minimize carbon footprints are driving the uptake of smart home technologies that enhance energy usage and reduce utility expenses.

- Government Actions: Favorable policies and incentives designed to improve energy efficiency and deploy smart grids are motivating homeowners to invest in advanced home automation systems.

- Technological Progress: Ongoing advancements in Internet of Things (IoT) devices, artificial intelligence (AI), and wireless connections are enhancing the functionality, ease of use, and compatibility of smart home systems.

- Growing Security Issues: The heightened need for improved home safety and live surveillance is propelling the adoption of sophisticated security technologies like intelligent cameras, sensors, and access management systems.

- Increasing User Wealth and Lifestyle Shifts: Rising disposable incomes, along with a desire for contemporary, interconnected living environments, are driving notable expansion in the global smart home sector.

Future Outlook:

- Strong Growth Outlook: The smart homes market is projected to experience robust expansion, supported by continuous advancements in connected technologies, increasing demand for convenience and efficiency, and favorable regulatory frameworks promoting sustainable living.

- Market Evolution: The sector is expected to evolve from early adopters and high-end residential segments to mainstream integration across diverse housing types, driven by declining device costs, improved interoperability, and broader user awareness.

To get more information on this market, Request Sample

The market for smart homes is growing at a rapid pace, due to the increasing convergence of new-age technologies and increasing consumer appetite for convenience, security, and energy efficiency. Manufacturers and service providers are constantly launching new and innovative solutions, including (artificial intelligence) AI-based home assistants, Internet of Things (IoT)-based appliances, and automated climate control systems. These innovations are revolutionizing conventional residential spaces into networked environments that optimize user comfort and lifestyle. Users are increasingly using smart home devices because of the rising consciousness of energy saving and the advantages of remote access and control. The market is also experiencing an upsurge in the utilization of voice-operated systems, with operating systems becoming popular.

The United States smart home market is growing at a fast pace, driven by the demand for connected living and continuous innovation in home automation technologies. Smart devices are being embraced by homes across the nation as they provide improved convenience, security, and energy efficiency, with smart thermostats, lighting systems, and voice-controlled assistants gaining ground as common features in contemporary homes. Top technology firms are continually creating and improving platforms that enable easy integration and management of various smart home elements. Homeowners are focusing on energy management and cost reduction, which is driving increased adoption of smart HVAC systems and smart energy monitoring devices. As a result, companies are also launching various efficient products to cater to the needs of people. For instance, in 2024, LG Electronics (LG) showcased its latest heating, ventilation, and air conditioning (HVAC) solutions at AHR Expo 2024, which took place in Chicago, Illinois. LG's lineup of energy-efficient residential and commercial HVAC systems showcased at this year's event offers outstanding performance and highlights the company's unwavering dedication to environmental stewardship.

Smart Homes Market Trends:

Technological developments

Technological advancements in smart homes, which include the intersection of artificial intelligence (AI) and the Internet of Things (IoT), are driving the market. For example, in January 2025, Arlo Technologies, Inc., a smart home security solutions provider, formed an alliance with Origin AI to assist in the protection of customers through advanced AI-enabled smart home security technology. Under this collaboration, Arlo will have global exclusive rights to sell and distribute Origin AI's groundbreaking artificial intelligence (AI) technologies, specifically TruShield and Allos, that leverage radio frequency (RF) signals from already installed WiFi devices in homes or offices to identify Verified Human Presence. By enhancing precision and reducing false alarms, the feature provides two-way communication service providers and other solution companies with a simple yet powerful means of delivering smart home security to their customers. IoT is providing seamless communication between devices so that homeowners can remotely operate and monitor various household functionalities from central systems. AI-controlled systems, for example, voice-based assistants, are enhancing end-user experience through personalized solutions that react according to individual lifestyles. Further, the industry is shifting towards making user-friendly and cost-effective smart home devices, which is increasing availability and supporting the smart homes market growth. Incorporation of machine learning (ML) algorithms is allowing smart devices to learn and adapt to user habits and customize functionality accordingly, which is assisting in developing responsive and energy-efficient home environments. Advanced features such as facial recognition, threat detection through AI, and biometric authentication are also being employed to further enhance home security, which itself is driving market growth as families prioritize both safety and convenience. In 2025, Amazon's Ring video doorbell stated that it had made the decision to introduce AI-created alerts informing users of suspicious or unusual activity around their home.

Increased demand for high-speed internet

One of the major smart homes market trends includes the growing demand for fast internet. The extensive adoption of smartphones, coupled with the availability of reliable broadband and advanced fourth-generation (4G) and fifth-generation (5G) networks, is providing smart devices with the infrastructure they need to perform efficiently. For example, in April 2025, 5G network subscriptions in the world surpassed 2.25 Billion. As of late 2024, the United States and Canada had over 182 Million 5G connections, representing an impressive growth rate of 20% annually. Strong connectivity is making it easier for homeowners to manage smart systems remotely, enabling convenience and real-time management of security, climate levels, and home appliances via mobile apps. Such access is boosting peace of mind via instant monitoring and adjustments from nearly everywhere. High-speed internet connections ensure smart devices communicate rapidly and conveniently with one another, enabling real-time updates, notifications, and performance monitoring. The ability to achieve seamless connectivity is therefore enhancing customer trust and encouraging investment in smart home solutions. IMARC Group forecasts that the global 4G equipment market is expected to reach USD 497.8 Billion by 2033.

Increased emphasis on energy efficiency

The heightened focus on energy efficiency is offering a favorable smart homes market outlook. The increasing awareness about environmental sustainability and the need to reduce the cost of utility bills are making people switch to energy-efficient technologies. Smart thermostats, smart lighting, and energy-efficient appliances are allowing homeowners to optimize energy use by controlling settings based on occupancy, routine, or external climatic conditions. It is reported that motion-sensor switches have been found to cut energy usage by 35% to 45%. Such solutions lower carbon prints as well as offer tangible cost advantages in the long term. Governments are, in most instances, actively promoting energy efficiency through incentives, certifications, and enabling policy platforms, further stimulating the uptake of smart energy solutions. Smart energy monitoring technology is also empowering homeowners with real-time views of household energy use, allowing better decision-making and highlighting opportunities for ending unnecessary consumption. Samsung is poised to expand its range of Bespoke home appliances. The company has indicated that it will launch the new range of Bespoke AI digital products on June 25 in the country. The company revealed that the new range of home appliances will include smart displays, two-way natural conversations, Knox security, and SmartThings.

Smart Homes Market Growth Driver:

Increasing Emphasis on Energy Efficiency and Sustainability

Increasing energy prices and growing environmental issues are strongly catalyzing the demand for smart home technology that encourages effective energy consumption. For instance, in September 2024, ABB India launched the ABB-free@home, a smart home automation solution with advanced interoperability features. This state-of-the-art wireless home automation system aids in the development of green buildings and sustainable cities by optimizing energy consumption, which allows homeowners and building residents to lessen their carbon footprint. People are increasingly looking for solutions that offer real-time energy monitoring, automatic HVAC control, and smart lighting solutions to maximize consumption behavior. These systems allow homes to reduce energy loss by modulating settings according to occupancy, time, or weather, thereby achieving significant cost savings and minimizing carbon prints. This increased consciousness regarding sustainability is promoting investments in smart equipment that facilitates integration of renewable energy sources like solar panels and battery storage. The focus on developing green and energy-resilient homes is making smart technologies key instruments for the attainment of sustainability goals.

Growing Disposable Income

Growing disposable incomes globally, particularly in fast-developing parts of the world, are making it possible for increasing numbers of end-users to afford comfort, convenience, and contemporary living standards through the adoption of smart homes. According to the U.S. Energy Information Administration (EIA), in 2022, the global disposable income per capita reached USD 10,136. It is expected to reach USD 16,979 by 2050, representing a growth rate of 1.9%. Greater purchasing power makes homes able to invest in cutting-edge home automation systems, from voice-activated assistants to networked appliances and security systems. The trend is especially strong among younger, technology-oriented groups who appreciate having the latest cutting-edge technologies embedded in daily life. With improving affordability and ease of use, smart home devices become more attractive to middle-income households too. The spending power also reinforces demand for higher-end features and personalized smart home systems, fueling ongoing market growth and stimulating technological advances.

Government Incentives and Regulations

As per the smart homes market forecasts, the supportive government policies and regulations are facilitating the growth of smart home technology adoption. Governments across the globe are adopting policies that promote energy-efficient homes through tax credits, rebates, and subsidies for smart systems and devices. Green building certifications and guidelines such as LEED and BREEAM are motivating builders and homeowners to include advanced automation and energy management systems. These standards lower the environmental footprint and also enhance the modernization of residential infrastructure, serving national sustainability objectives. While governments strengthen energy requirements and invest in smart city initiatives, demand for linked, environmentally friendly homes is anticipated to grow significantly, fueling the market growth. For instance, in June 2015, the Government of India launched the Smart Cities Mission (SCM) to raise the standard of living across 100 cities in the country through effective services, smart infrastructure, and environmentally friendly solutions. As of December 2024, the initiative had successfully completed 7,380 out of 8,075 projects, with a total investment of Rs 1,47,704 Crore.

Smart Homes Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global smart homes market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on component and application.

Analysis by Component:

- Hardware

- Security

- Home Automation

- Home Entertainment

- Home Healthcare

- Smart Appliances

- AI Speaker

- Services

- Energy Consumption and Management Services

- Security Services

- Healthcare Services

- Entertainment Services

Hardware stands as the largest component in 2024, holding 57.6% of the market. It is playing a critical role in enabling core functionalities and driving adoption. Key hardware components include smart sensors, control devices, cameras, and actuators, all of which are essential for automating and monitoring home environments. Smart thermostats, lighting systems, and security equipment such as doorbell cameras and motion detectors are witnessing high demand due to their utility in energy management and home protection. Advancements in miniaturization and connectivity are allowing hardware devices to become more efficient, reliable, and user-friendly. Integration with AI and IoT technologies is further enhancing the performance and interoperability of these components. The proliferation of wireless communication standards, including Wi-Fi, Zigbee, and Z-Wave, is enabling seamless installation and operation across different platforms. As consumers prioritize convenience and safety, the demand for robust and compatible smart home hardware continues to grow, contributing significantly to market expansion.

Analysis by Application:

- Security and Surveillance

- Lighting

- Entertainment

- Energy Management

- HVAC

- Smart Kitchen

- Home Fitness and Wellness

Security and surveillance lead the market with 35.0% of market share in 2024. They represent a dominant application segment within the market, driven by increasing concerns over residential safety and the demand for real-time monitoring. This segment includes smart cameras, motion sensors, video doorbells, and smart locks, which are enabling homeowners to monitor and secure their properties remotely. Integration with mobile apps and cloud storage is allowing users to receive prompt alerts, access live video feeds, and manage devices from anywhere. Technological advancements are enhancing the capabilities of security systems through features such as facial recognition, night vision, and AI-driven threat detection. These innovations are improving the accuracy and responsiveness of surveillance solutions, making them more effective in preventing unauthorized access and responding to potential risks. In addition, user-friendly interfaces and compatibility with broader smart home ecosystems are making these systems more accessible to a wider consumer base. As a result, security and surveillance are a major driver of smart home adoption.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of 35.8%. The North American industry is observing steady growth, driven by the rapid adoption of networked devices and growing interest in automation and energy conservation. Homes throughout the region are adopting smart solutions like thermostats, lighting controls, and integrated security systems that provide convenience, cost benefits, and improved safety. Leading technology firms are aggressively making investments in research and development (R&D) to enhance device compatibility, user interface, and system smarts, which is driving the market. Shoppers are focusing on smart home products that offer remote monitoring, voice commands, and real-time notification capabilities, especially in applications for home security and energy management. The deployment of platforms is growing, facilitating effortless control over an increasing number of devices. Moreover, smart appliances and environmental sensors are becoming prevalent in new home builds and renovations.

Key Regional Takeaways:

United States Smart Homes Market Analysis

The United States smart home market holds 82.00% share in North America. The market is primarily driven by technological innovation, shifting consumer preferences, and supportive infrastructure. The rapid proliferation of the Internet of Things (IoT) devices and high-speed internet connectivity has enabled seamless integration of smart devices, making it easier for consumers to adopt automated systems. For instance, the number of IoT devices in use in the United States is expected to reach 75 Billion in 2025, according to the National Cybersecurity Center of Excellence (NCCOE). Rising awareness among homeowners about the benefits of smart thermostats and lighting, such as improved lifestyle comfort, has significantly heightened demand. Energy efficiency and sustainability initiatives are also increasing interest in programmable thermostats, smart meters, and connected appliances to reduce utility bills and carbon footprints. Moreover, growing concerns around safety and home monitoring are fueling demand for smart locks, security cameras, and sensors that offer real-time alerts and remote access. In 2024, home burglaries were estimated to have occurred approximately 2.5 million times in the US, resulting in total losses of around USD 3.4 billion. In addition to this, numerous manufacturers are increasingly embracing interoperability and open standards to simplify device integration and reduce platform fragmentation, making smart ecosystems more accessible to non-technical users. Other than this, real estate developers are also incorporating smart features in new constructions, appealing to tech-savvy buyers. As privacy and data security measures improve, consumer confidence is expected to rise, further propelling adoption.

Asia Pacific Smart Homes Market Analysis

The Asia Pacific market is expanding due to rising disposable incomes and increasing smartphone and internet penetration across emerging economies. For instance, 954.4 Million individuals in India had an Internet subscription in 2024. Of these, 556.05 Million were in urban areas and 398.35 Million in rural areas. Moreover, 660 Million individuals in the country owned a smartphone, equating to a robust 46.5% smartphone penetration rate. As more individuals move into cities and adopt modern lifestyles, there is growing demand for connected home solutions that offer convenience, energy efficiency, and enhanced security. Government-led smart city initiatives in countries such as China, India, and South Korea are also accelerating the development of smart infrastructure, which includes smart residential technologies. Additionally, a tech-savvy middle class is increasingly embracing home automation products such as smart lighting, security systems, and voice-controlled assistants, supporting industry expansion. Local manufacturers are also offering cost-effective smart home solutions, making the technology more accessible to a wider population.

Europe Smart Homes Market Analysis

The growth of the Europe market is largely fueled by a growing emphasis on energy efficiency, stringent environmental regulations, and increasing consumer demand for convenience and security. Numerous governments across Europe are actively promoting smart energy solutions through regulatory mandates and incentives, encouraging the adoption of smart meters, thermostats, and lighting systems. Rising energy costs have further prompted homeowners to invest in energy-saving technologies to reduce utility bills. Additionally, numerous consumers are showing a strong preference for smart systems that adapt to their routines, such as lighting and climate control that learn user behavior and adjust automatically for comfort and efficiency. The increasing demand for personalized living experiences and the growth of artificial intelligence (AI) in home automation are also encouraging innovation in the market. For instance, in January 2025, Netherlands-based Philips launched new next-generation smart lighting and home security solutions powered by artificial intelligence (AI). In the Hue app, Philips Hue introduced its first generative AI assistant, which allows users to create customized lighting scenarios according to mood, occasion, or style by speaking or typing commands. The assistant is also equipped with feedback features, guaranteeing continual improvement. As such, integration with voice assistants and mobile apps is making smart devices more user-friendly and accessible, supporting widespread adoption.

Latin America Smart Homes Market Analysis

The Latin America market is significantly influenced by growing urbanization, increasing internet connectivity, and rising consumer awareness about home automation benefits. Expanding 5G connectivity, which enhances the performance and responsiveness of smart devices, is enabling faster data transfer, lower latency, and more reliable connections, making it easier to operate multiple smart home systems simultaneously. As per industry reports, the number of 5G internet connections in Latin America reached 67 Million in Q3 2024, recording a robust growth rate of 19%. As cities expand and digital infrastructure improves, more households are gaining access to smart technologies. Local governments are also gradually promoting digital transformation and energy efficiency, creating a supportive environment for smart home adoption. The demand is particularly strong among younger, tech-savvy populations seeking modern, convenient, and connected lifestyles in urban environments.

Middle East and Africa Smart Homes Market Analysis

The Middle East and Africa market is experiencing robust growth due to the increasing adoption of smart technologies. Numerous governments in the region are heavily investing in smart city initiatives, encouraging the integration of connected home devices for enhanced security, energy efficiency, and convenience. The expanding young and tech-savvy population is also propelling demand for home automation solutions. As a result, in April 2025, Dreame Technology, a renowned provider of smart home technologies, launched its first flagship store in Dubai to meet the rising consumer demand for integrated, smart, and efficient living solutions in the region. This launch also included the debut of the company’s innovative smart home solutions, allowing customers to explore the future of smart living by giving them a hands-on experience with Dreame's cutting-edge products.

Competitive Landscape:

Key players are investing in R&D activities to create innovative products that offer enhanced functionality, convenience, and energy efficiency. They are developing new smart devices with improved user interfaces and are focusing on integrating advanced technologies like artificial intelligence (AI) and machine learning (ML). In line with this, many companies are working on ensuring that their smart devices can seamlessly connect and interact with other products and platforms. Furthermore, manufacturers are ensuring the security and privacy of user data by investing in advanced cybersecurity measures. Besides this, companies are focusing on providing users with the ability to customize and personalize their smart home setups according to their preferences and needs. This involves offering a wide range of device options and customization features within smart home apps. They are also developing energy-efficient solutions that help individuals reduce their environmental impact.

The report provides a comprehensive analysis of the competitive landscape in the smart homes market with detailed profiles of all major companies, including:

- ABB Ltd

- Amazon.com, Inc.

- Emerson Electric Co.

- Google LLC

- Johnson Controls

- Legrand S.A.

- LG Electronics Inc.

- Nice S.p.A.

- Panasonic Corporation

- Resideo Technologies, Inc.

- Robert Bosch Smart Home GmbH

- Schneider Electric SE

- Siemens AG

Latest News and Developments:

- June 2025: Gentex Corporation officially launched PLACE, its latest smart home security system. With room-specific capabilities, the PLACE suite of sophisticated, multi-featured smoke and carbon monoxide alarms is intended to improve home security, comfort, and safety through smart technologies.

- June 2025: GE Appliances finished an $180 million expansion of subsidiary Roper Corp.'s cooking products factory in LaFayette, Georgia, the company announced earlier this month. Furthermore, the funding will speed up the company’s introduction of new product lines, particularly its innovative features and the more accessible and budget-friendly GE Profile induction brand.

- June 2025: DAEWOO partnered with EBG Group to strengthen its presence in India. EBG will be responsible for retail, distribution, and after-sales service, using a franchise model to expand regional reach. DAEWOO will unveil a line of smart, energy-saving appliances with a strong focus on IoT capabilities and innovative features.

- June 2025: Panasonic Appliances (China) formed a strategic alliance with Alibaba Cloud to jointly develop a "Smart Living" platform fueled by Qwen, Alibaba's large language model (LLM). The partnership will introduce higher-level AI features to Panasonic home appliances, including refrigerators and washing machines, throughout China.

- May 2025: Arlo Technologies Inc. officially launched the Arlo Secure 6, the latest version of Arlo’s pioneering smart home security subscription service equipped with revolutionary artificial intelligence (AI) technologies. Arlo Secure 6 delivers a number of new AI-powered technologies, such as fire detection, advanced audio detection, descriptive video event descriptions, and sophisticated video search features, to give customers more relevant context and deeper insights into activities recorded by Arlo devices.

- May 2025: Brilliant NextGen, a renowned provider of innovative smart home solutions, launched its Second Generation Smart Home Products. This latest launch offers strong performance for both single-family and multifamily houses by combining dual-band Wi-Fi, seamless compatibility with devices, and powerful AI-ready capabilities.

- March 2025: Gopalan Enterprises, a Bengaluru real estate developer, is planning to launch AI-enabled smart homes in its foray into the housing segment in technology-driven homes. The company will develop 3,000 units by 2025 at an investment of ₹500 crore to meet the growing need for automated homes. The units will be in the range of ₹1.5-2 crore and will feature AI-based appliances and smart furniture solutions.

Smart Homes Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Applications Covered | Security and Surveillance, Lighting, Entertainment, Energy Management, HVAC, Smart Kitchen, Home Fitness and Wellness |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ABB Ltd, Amazon.com, Inc., Emerson Electric Co., Google LLC, Johnson Controls, Legrand S.A., LG Electronics Inc., Nice S.p.A., Panasonic Corporation, Resideo Technologies, Inc., Robert Bosch Smart Home GmbH, Schneider Electric SE, Siemens AG, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the smart homes market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global smart homes market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the smart homes industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The smart homes market was valued at USD 137.3 Billion in 2024.

The smart homes market is projected to exhibit a CAGR of 10.33% during 2025-2033, reaching a value of USD 347.5 Billion by 2033.

The market is driven by rapid technological advancements, integration of AI and IoT, growing demand for energy efficiency, rising consumer preference for home automation, and widespread high-speed internet adoption.

North America currently dominates the smart homes market, accounting for a share of 35.8%. The region is benefiting from rapid device adoption, strong internet infrastructure, and increasing demand for energy-efficient and secure smart home solutions.

Some of the major players in the smart homes market include ABB Ltd, Amazon.com, Inc., Emerson Electric Co., Google LLC, Johnson Controls, Legrand S.A., LG Electronics Inc., Nice S.p.A., Panasonic Corporation, Resideo Technologies, Inc., Robert Bosch Smart Home GmbH, Schneider Electric SE, Siemens AG, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)