Smart Pole Market Size, Share, Trends and Forecast by Component, Hardware, Installation Type, Application, and Region, 2025-2033

Smart Pole Market Size and Share:

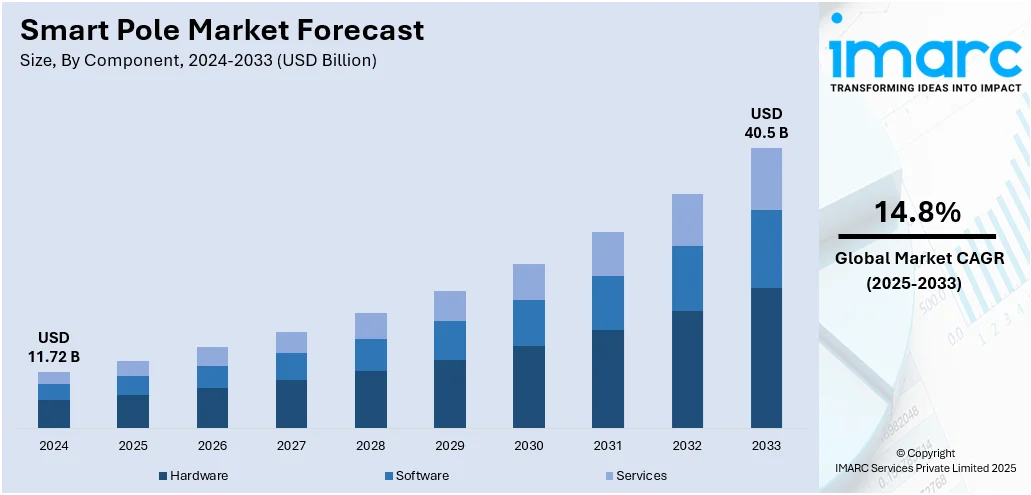

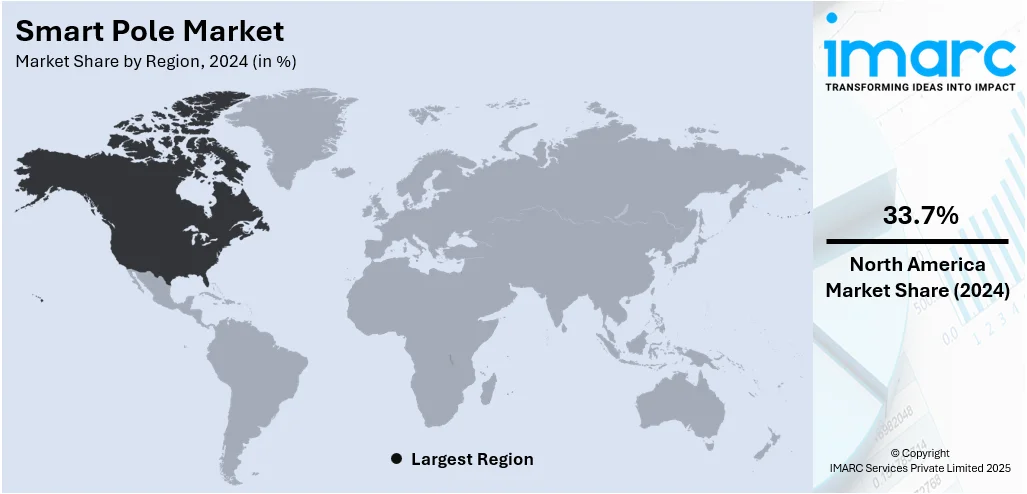

The global smart pole market size was valued at USD 11.72 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 40.5 Billion by 2033, exhibiting a CAGR of 14.8% during 2025-2033. North America currently dominates the market, holding a significant market share of around 33.7% in 2024. The market is driven by the growing adoption of multifunctional pole designs that accommodate renewable energy equipment and small cell devices is propelling the market. In addition to this, increasing smart city budgets, strong policy support for digital transformation, and advancements in sensor miniaturization are also augmenting the smart pole market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 11.72 Billion |

|

Market Forecast in 2033

|

USD 40.5 Billion |

| Market Growth Rate 2025-2033 | 14.8% |

The global market is primarily driven by the increasing need for wireless connectivity and network infrastructure to support data-intensive applications. In line with this, the rapid deployment of 5G technologies and dense cellular networks are also providing an impetus to the market. Moreover, the rising efforts by city administrations to develop integrated and smart urban ecosystems is also acting as a significant growth-inducing factor for the market. Besides this, the growing integration of environmental sensors and analytics tools for real-time data collection is creating lucrative opportunities for the smart pole market growth. The market is further driven by public-private partnerships focusing on energy-efficient lighting and data infrastructure. On October 16, 2024, Pegatron 5G and Flexsol Infra-Solutions announced a strategic collaboration to develop and deploy Make in India private 5G solutions, integrating smart poles, power systems, and edge computing infrastructure for sectors like mining, manufacturing, and smart cities. The partnership leverages Flexsol’s two decades of global smart infrastructure expertise and Pegatron’s O-RAN-compliant 5G network equipment to deliver end-to-end private network solutions domestically and internationally.

To get more information on this market, Request Sample

The United States stands out as a key regional market, which is primarily driven by significant investments in telecommunications infrastructure and connected public services. In line with this, the growing demand for edge computing systems integrated into urban networks is also providing an impetus to the market. According to the smart pole market forecast, the increasing prioritization of cyber-physical security through intelligent surveillance infrastructure is also acting as a significant growth-inducing factor for the market. Besides this, the development of multi-use smart infrastructure to accommodate EV charging stations is creating lucrative opportunities in the market. On April 3, 2025, Digicomm International announced the acquisition of EasyStreet Systems, a U.S.-based manufacturer of smart composite poles, to accelerate the deployment of smart infrastructure in smart cities and telecom networks. EasyStreet’s patented poles, which reduce installation costs by up to 70% and carbon emissions by 75%, will strengthen Digicomm’s broadband and 5G portfolio, enabling efficient deployment of small cells, IoT devices, EV charging, and lighting systems. This acquisition marks a key advancement in the United States market.

Smart Pole Market Trends:

Demand for Enhanced Wireless Connectivity and Network Densification

The increasing need for wireless connectivity and efficient cellular network densification is a key factor influencing the development and deployment of smart poles globally. These structures support the expansion of small and macro cells critical for delivering high-speed data services, particularly in densely populated urban areas. For instance, in March 2024, UK-based CU Phosco Lighting launched Connected Urban in response to the growing demand for 4G network densification and to facilitate the ongoing rollout of 5G. Connected Urban is a revolutionary new smart pole designed to improve connectivity by providing both macro and small cells inside a single compact footprint. These installations are essential for minimizing signal gaps, enabling smart device communication, and sustaining IoT ecosystems across metropolitan landscapes, which are creating a favorable smart pole market outlook.

Government-Led Urban Infrastructure Modernization Initiatives

Numerous governments are actively transforming conventional infrastructure into smart systems to enhance connectivity, public services, and urban efficiency. Smart poles, embedded with sensors and communication modules, support this transformation by integrating functionalities such as lighting, surveillance, and network transmission. For instance, in December 2024, the Kuching North City Commission (DBKU) in Malaysia installed five smart poles at the Kuching Waterfront to enhance connectivity for tourists and advance the smart development goals of the region. Municipalities are adopting intelligent technologies to foster tourism, economic activity, and digital integration within their urban planning frameworks. Such initiatives reflect a broader commitment by public authorities to build resilient, data-driven urban environments that can adapt to future technological and environmental demands.

Integration of Smart Poles with Autonomous Mobility and Traffic Management

One of the important smart pole market trends include the proliferation of autonomous vehicles, which is influencing how traffic systems are designed and managed, and in turn, driving the implementation of intelligent infrastructure components. Smart poles play a vital role by supporting vehicle-to-infrastructure communication, traffic monitoring, and parking regulation. These functions help reduce congestion, emissions, and accident risks in increasingly complex urban traffic environments. For instance, by 2035, autonomous trucks are projected to account for 30% of all new truck sales in the United States, according to the World Economic Forum. Smart poles are also equipped to monitor air quality, detect street flooding, and improve situational awareness for public agencies, reinforcing their value in adaptive traffic control and environmental sensing.

Smart Pole Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global smart pole market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, hardware, installation type, and application.

Analysis by Component:

- Hardware

- Software

- Services

Hardware stands as the largest component in 2024, holding around 57.2% of the market. This dominance is attributed to the essential role hardware plays in the physical infrastructure of smart poles, including components such as lighting systems, sensors, and connectivity modules. Hardware forms the foundation for enabling core functionalities such as real-time data capture, public lighting, environmental monitoring, and communication capabilities. Increasing deployment of smart poles for public safety, traffic management, and 5G support has further elevated the demand for advanced and durable hardware systems that ensure operational reliability and long-term performance across diverse urban settings.

Analysis by Hardware:

- Lighting Lamp

- Pole Bracket and Pole Body

- Communication Device

- Controller

- Others

Controller leads the market with around 30.0% of market share in 2024. Controllers are central to the operational efficiency of smart poles, managing and automating lighting, surveillance, data transmission, and connectivity functions. They serve as the intelligent interface that synchronizes various modules such as sensors, cameras, and communication devices. With cities prioritizing energy optimization and real-time analytics, demand for smart controllers has accelerated, especially as municipalities invest in responsive and adaptive infrastructure. Their ability to facilitate remote monitoring, diagnostics, and maintenance also reduces operational costs, making them indispensable in both new and retrofitted urban environments.

Analysis by Installation Type:

- New Installation

- Retrofit

Retrofit leads the market with around 60.5% of market share in 2024. The cost-effectiveness and time efficiency of retrofitting existing infrastructure have made it a preferred choice for city planners and utilities. Instead of building entirely new systems, retrofitting allows the integration of smart technologies into existing lamp posts and streetlight networks, minimizing civil work and disruptions. This approach is particularly appealing to municipalities with budget constraints, allowing them to transition toward smart infrastructure incrementally. Additionally, retrofitting aligns with sustainability goals by extending the lifecycle of existing assets and reducing material waste.

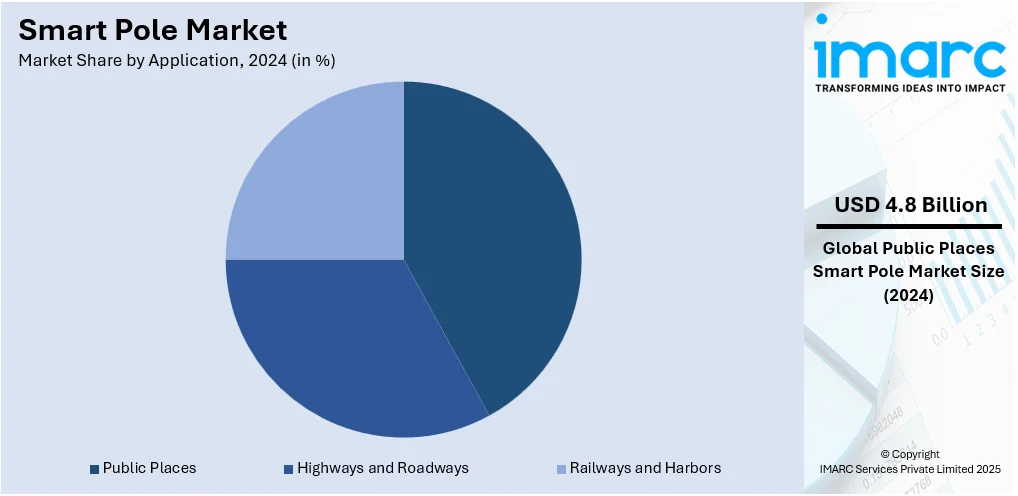

Analysis by Application:

- Highways and Roadways

- Public Places

- Railways and Harbors

Public places lead the market with around 41.2% of market share in 2024. Urban public spaces such as parks, plazas, promenades, and commercial areas are being increasingly equipped with smart poles to enhance safety, connectivity, and environmental monitoring. These locations require integrated lighting, Wi-Fi, CCTV, air quality sensors, and emergency communication systems, functions efficiently supported by smart poles. The ability to serve multiple public service needs from a single structure has made smart poles highly attractive for municipal deployments. Growing urbanization and the focus on smart city development are further driving installations across public zones to support citizen engagement and public services.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of around 33.7%. The region’s dominance is supported by strong investments in smart city initiatives, robust 5G infrastructure development, and widespread public-private collaborations. Governments across the United States and Canada have prioritized digital transformation, allocating funds for intelligent lighting, public safety systems, and environmental monitoring. Additionally, the presence of leading technology providers, coupled with supportive regulatory frameworks, has facilitated faster deployment of smart poles. Urban areas across North America are leveraging these installations to enhance mobility, connectivity, and sustainability in line with regional development goals.

Key Regional Takeaways:

United States Smart Pole Market Analysis

In 2024, the United States accounted for 85.00% of the total market share in the North America smart pole market. The United States smart pole market is primarily driven by rising demands for digital infrastructure and the increasing focus on sustainability goals. As cities grow denser and more technology-dependent, municipalities are turning to smart poles that consolidate LED street lighting, traffic and environmental sensors, surveillance cameras, and public Wi‑Fi into a single, multifunctional urban asset. For instance, in December 2024, South Korean digital transformation (DX) firm LG CNS signed a Memorandum of Understanding (MOU) with SomeraRoad, a real estate investment company based in New York, to expand its smart building DX operations in the United States. This agreement includes the installation of smart poles that gather outdoor city data to support the advancement of smart city initiatives. Additionally, integration with electric vehicle charging stations, public safety systems, and digital signage is adding both civic value and new revenue opportunities, allowing cities to monetize advertising or real-time information services. Federal infrastructure grants and local smart city funding programs are further making deployment more financially viable, particularly in mid-sized municipalities embracing digital transformation.

Asia Pacific Smart Pole Market Analysis

The Asia Pacific market is expanding rapidly due to robust urban growth and connectivity needs. By 2030, more than 55% of Asia's population is expected to live in urban areas, and the region is already home to over half of the world's urban population. Mega-cities in China, India, and Southeast Asia are embracing smart poles to reduce energy usage through intelligent LED lighting that adjusts based on traffic and daylight. These poles also serve as hubs for 5G small-cell networks and IoT sensors, enhancing coverage in densely populated areas while minimizing visual clutter. For instance, in October 2024, Pegatron 5G established a partnership with Flexsol to provide a private 5G solution that is ‘Made in India’ and will fulfill the increasing need for private 5G deployments. Through this partnership, a complete private 5G solution will be brought to market, which includes smart poles. Additionally, numerous governments are also integrating features such as surveillance cameras, air quality monitors, and smart parking displays into street infrastructure to bolster public safety and real-time city management. Multi-city smart city initiatives backed by regional funding are further accelerating pilot programs.

Europe Smart Pole Market Analysis

The growth of the Europe market is largely fueled by urban sustainability initiatives, digital transformation agendas, and evolving regulatory frameworks. Cities across Germany, France, and the Nordic countries are increasingly adopting smart poles as part of their climate action plans, leveraging integrated LED lighting with dynamic dimming, air quality sensors, and real-time noise monitoring to reduce energy consumption and enhance urban well-being. The European Union’s growing focus on digital connectivity under its Digital Decade strategy is also propelling the deployment of 5G small-cell nodes and IoT infrastructure, making smart poles key enablers of widespread network coverage. For instance, in May 2025, telecommunications firm O22 Telefónica entered into a partnership with 5G Synergiewerk to install 5G smart poles across the 25 largest cities in Germany. This project aims to enhance the mobile network for smartphone users and companies in crowded city centers and tourist areas by increasing the current 5G network coverage offered by mobile phone masts and adding more capacity overall. Additionally, the importance of preserving historic and aesthetic cityscapes is prompting demand for customizable, heritage-compatible designs that blend technology and architectural integrity. Other than this, data-driven mobility and traffic management strategies are also increasingly connecting smart poles with smart parking, autonomous transit corridors, and pedestrian flow solutions, transforming these light fixtures into intelligent, multifunctional assets within broader urban ecosystems.

Latin America Smart Pole Market Analysis

The Latin America market is experiencing robust growth as cities seek to modernize infrastructure to boost public safety, connectivity, and energy efficiency. Numerous municipalities are increasingly deploying smart poles equipped with integrated LED lighting, surveillance cameras, environmental sensors, and public Wi‑Fi to enhance nighttime security and provide real-time air quality and noise monitoring. The expansion of 5G networks is also driving demand for smart poles that support small cell installations, thereby improving digital access in urban centers. As per industry reports, the number of 5G network connections across Latin America reached 67 Million in Q3 2024, recording a growth rate of 19%. Besides this, smart poles are also being used to facilitate smart parking and traffic management solutions, helping municipalities alleviate congestion in growing metropolitan areas.

Middle East and Africa Smart Pole Market Analysis

The Middle East and Africa market is significantly influenced by expanding urbanization and infrastructure development. Governments are actively investing in smart cities, deploying poles equipped with IoT sensors, air-quality monitors, and surveillance systems to enhance safety and environmental management. As a result, the smart cities market in the Middle East reached USD 62,965.8 Million in 2024 and is projected to reach USD 3,73,897.8 Million by 2033, growing at a CAGR of 21.89% during 2025-2033, according to a report published by the IMARC Group. Other than this, the emergence of tourism-centric infrastructure in Gulf and North African regions is increasing the adoption of aesthetically designed smart poles that double as digital wayfinding and info-beacons in public spaces and resorts, supporting market growth.

Competitive Landscape:

Key players in the smart pole market are actively engaging in strategic collaborations with telecom providers, municipalities, and infrastructure firms to expand deployment across urban regions. They are investing in R&D to develop multifunctional poles with integrated 5G capabilities, EV charging, surveillance systems, and environmental sensors. Companies are also focusing on modular designs that simplify installation and support scalability. Additionally, they are offering retrofitting solutions to make existing infrastructure smart-enabled, thereby appealing to cost-sensitive municipalities. Through software advancements and cloud-based monitoring platforms, these players are enhancing real-time analytics, enabling predictive maintenance, and optimizing energy consumption, thereby driving sustained adoption and market growth.

The report provides a comprehensive analysis of the competitive landscape in the smart pole market with detailed profiles of all major companies, including:

- Bivocom

- Elko Ep

- Hapco Pole Products

- Kesslec

- KYOCERA Mirai Envision Co. Ltd (KYOCERA Communication Co. Ltd)

- Lumca Inc

- NomoSolar

- Norsk Hydro ASA

- Omniflow

- Shanghai Sansi Electronic Engineering Co. Ltd

- Signify Holding

- Sunna Design

- Wipro Lighting (Wipro Limited)

Latest News and Developments:

- May 2025: The Chief Minister of Hyderabad, India, announced plans to install smart electric poles within the GHMC limits as part of the ‘Future City’ project, which is being constructed on the outskirts of Hyderabad. Initially, these smart electric poles, which integrate lighting, communication, surveillance, and environmental monitoring, will be set up in a few specific locations, such as KBR Park, Necklace Road, and the Secretariat, on an experimental basis.

- April 2025: LG CNS secured its first formal contract with a U.S. government organization for the construction of smart city infrastructure in Hogansville, Georgia. As part of this agreement, LG CNS will construct and install smart poles and an integrated control system, utilizing its expertise in AI transformation to improve public safety and urban infrastructure operations in the city.

- April 2025: Digicomm International announced the acquisition of EasyStreet Systems, a provider of smart composite poles. With this acquisition, Digicomm will be able to expand its product offerings into the urban technology and infrastructure sectors.

- April 2025: Panasonic System Networks Research & Development Co., Ltd. (PSNRD) announced that it will supply the ‘ITS Smart Pole’ for the Maishima Expo P&R Shuttle Bus, an automated driving bus operated by the Osaka Metro. The ITS Smart Pole, a novel ICT infrastructure technology, was constructed by PSNRD in collaboration with the Smart Mobility Infrastructure Technology Research Association.

- February 2025: The Seoul Metropolitan Government (SMG) announced an investment of 51.3 Million Won, including the additional 6.3 Million Won from the previous year, to implement cutting-edge technologies for a quick and secure digital metropolis. This includes the establishment of 24 new smart poles across eight districts in select locations near school routes to safeguard children from road accidents.

Smart Pole Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software, Services |

| Hardwares Covered | Lighting Lamp, Pole Bracket and Pole Body, Communication Device, Controller, Others |

| Installation Types Covered | New Installation, Retrofit |

| Applications Covered | Highways and Roadways, Public Places, Railways and Harbors |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Bivocom, Elko Ep, Hapco Pole Products, Kesslec, KYOCERA Mirai Envision Co. Ltd (KYOCERA Communication Co. Ltd), Lumca Inc, NomoSolar, Norsk Hydro ASA, Omniflow, Shanghai Sansi Electronic Engineering Co. Ltd, Signify Holding, Sunna Design and Wipro Lighting (Wipro Limited) |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the smart pole market from 2019-2033.

- The smart pole market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the smart pole industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The smart pole market was valued at USD 11.72 Billion in 2024.

The smart pole market is projected to exhibit a CAGR of 14.8% during 2025-2033, reaching a value of USD 40.5 Billion by 2033.

The market is driven by growing demand for connected infrastructure in smart cities, rapid 5G deployment, and government-backed modernization of public utilities. Integration of environmental sensors, lighting, surveillance, and communication systems into multi-functional poles is also creating strong commercial and municipal demand worldwide.

North America currently dominates the smart pole market, accounting for a share of over 33.7%, supported by strong investments in digital transformation and infrastructure upgrades.

Some of the major players in the smart pole market include Bivocom, Elko Ep, Hapco Pole Products, Kesslec, KYOCERA Mirai Envision Co. Ltd (KYOCERA Communication Co. Ltd), Lumca Inc, NomoSolar, Norsk Hydro ASA, Omniflow, Shanghai Sansi Electronic Engineering Co. Ltd, Signify Holding, Sunna Design, and Wipro Lighting (Wipro Limited).

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)