Sodium Benzoate Excipient Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2025 Edition

Sodium Benzoate Excipient Price Trend and Forecast

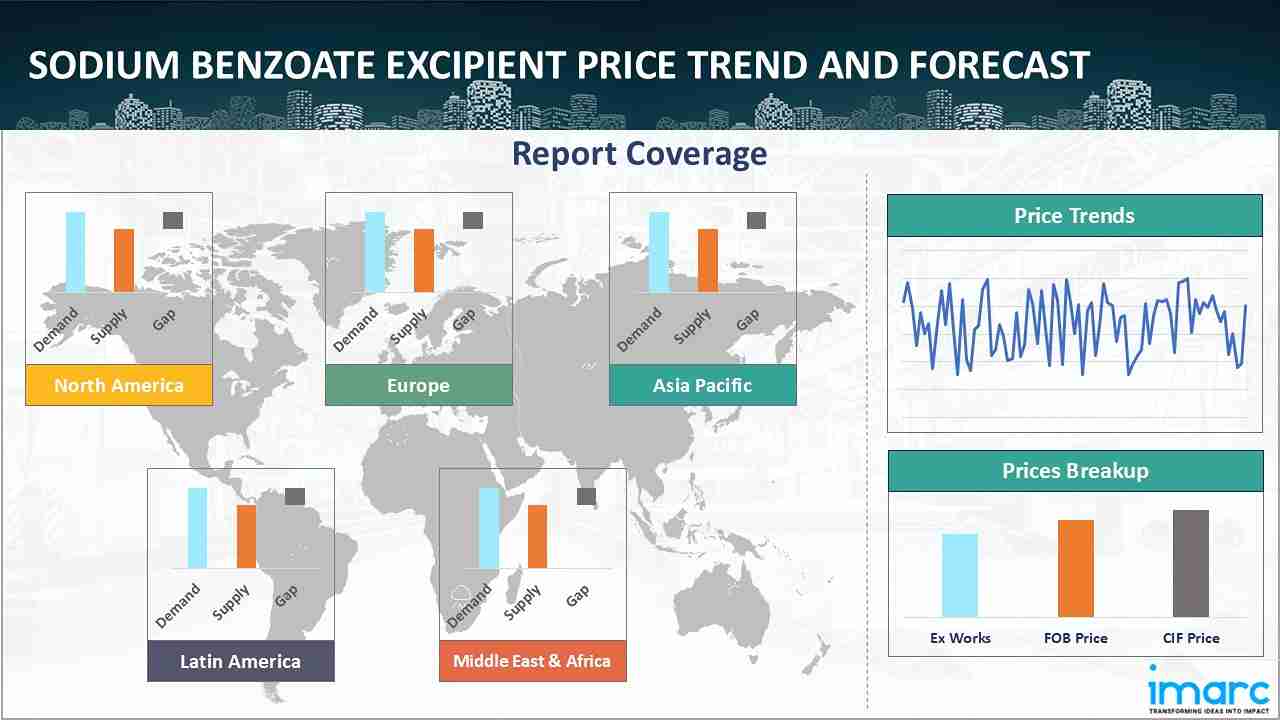

Track the latest insights on sodium benzoate excipient price trend and forecast with detailed analysis of regional fluctuations and market dynamics across Europe, North America, Middle East & Africa, Asia Pacific, and Latin America.

Sodium Benzoate Excipient Prices Q4 2024

|

Product

|

Category | Region | Price |

|---|---|---|---|

| Sodium Benzoate Excipient | Specialty Chemical | United States | 1,475 USD/MT |

| Sodium Benzoate Excipient | Specialty Chemical | China | 1,245 USD/MT |

| Sodium Benzoate Excipient | Specialty Chemical | Germany | 1,360 USD/MT |

During the fourth quarter of 2024, the sodium benzoate excipient prices in the United States reached 1,475 USD/MT in December. The market had a drop in Q4 2024 as a result of continuous production contraction and poor demand. Market mood remained cautious despite minor improvements, driven by uncertainty tied to politics and the weather. Chinese imports put pressure on local costs, which resulted in a more cautious trading climate.

In the fourth quarter of 2024, sodium benzoate excipient prices in China remained mostly stable with minor fluctuations. The quarter ended with sodium benzoate excipient priced at 1,245 USD/MT in December. The region’s market faced issues due to oversupply and sluggish demand. Despite growth in local manufacturing, market recovery was slow, worsened by international trade issues and geopolitical tensions. Producers in China adopted aggressive pricing techniques, but high inventory levels and weak export performance kept the market under pressure.

During the fourth quarter of 2024, sodium benzoate excipient pricing in Germany saw fluctuations. The quarter ended with sodium benzoate excipient priced at 1,360 USD/MT in December. The quarter saw persistent price drops on the German market, which were caused by the weakening of the euro and poor demand from important industries. Due to aggressive pricing methods from suppliers brought on by high stock levels and constrained purchases, the industry faced with oversupply. The market as a whole remained gloomy, favoring buyers, despite a modest improvement in manufacturing.

Sodium Benzoate Excipient Prices Q3 2024

|

Product

|

Category | Region | Price |

|---|---|---|---|

| Sodium Benzoate Excipient | Specialty Chemical | United States | 1,520 USD/MT |

| Sodium Benzoate Excipient | Specialty Chemical | China | 1,360 USD/MT |

| Sodium Benzoate Excipient | Specialty Chemical | Germany | 1,415 USD/MT |

The sodium benzoate excipient prices in the United States for Q3 2024 reached 1,520 USD/MT in September. The region saw a marked price decline due to oversupply and weak demand in pharmaceuticals and preservatives. Buyers reduced activity amid logistical constraints and manufacturing disruptions, amplifying market challenges. Sentiment remained bearish, reflecting broader industry struggles and global economic uncertainties.

The price trend for sodium benzoate excipient in China for Q3 2024 settled at 1,360 USD/MT in September. The market faced steep pricing declines, driven by oversupply, subdued demand, and global economic pressures. Market conditions were worsened by plant shutdowns and disruptions, while shifting consumer preferences further emphasized bearish sentiment. The quarter reflected consistent pricing challenges across the region.

In Germany, the sodium benzoate excipient prices for Q3 2024 reached 1,415 USD/MT in September. The market experienced significant price drops due to oversupply, lower production costs, and reduced demand in key sectors. Disruptions in manufacturing and bearish market sentiment compounded challenges, with import cost pressures adding to the unfavorable conditions for suppliers and producers.

Sodium Benzoate Excipient Prices Q4 2023

|

Product

|

Category | Region | Price |

|---|---|---|---|

| Sodium Benzoate Excipient | Specialty Chemical | USA | 1345 USD/MT |

| Sodium Benzoate Excipient | Specialty Chemical | China | 1225 USD/MT |

| Sodium Benzoate Excipient | Specialty Chemical | Germany | 1320 USD/MT |

The sodium benzoate excipient prices in the United States for Q4 2023 reached 1345 USD/MT in December. In Q4 2023, the sodium benzoate excipient prices in the United States rose as a result of increasing demand for preservatives in the food industry and expansion in pharmaceuticals. Higher raw material costs, such as benzoic acid, along with supply chain difficulties and labour shortages, drove prices even higher, but market confidence fueled new investment.

The price trend for sodium benzoate excipient in China for Q4 2023 settled at 1225 USD/MT in December. During Q4 2023, China’s market experienced rising prices driven by high demand following winter festivities and disruptions from labor shortages. Production setbacks and logistical challenges tightened supply, while strong demand for sorbates outstripped local capacities. Despite lower feedstock costs, the overall market maintained an upward price trend throughout the quarter.

In Germany, the sodium benzoate excipient prices for Q4 2023 reached 1320 USD/MT in December. In Q4 2023, Germany's market experienced a sustained price growth due to strong demand from food and pharmaceutical sectors. A stronger Euro and higher costs for benzoic acid contributed to this trend. Despite these price pressures, stock levels were adequate to meet demand, and market outlook stayed optimistic, anticipating continued price growth.

Regional Coverage

The report provides a detailed analysis of the sodium benzoate excipient market across different regions, each with unique pricing dynamics influenced by localized market conditions, supply chain intricacies, and geopolitical factors. This includes price trends, price forecast and supply and demand trends for each region, along with spot prices by major ports. The report also provides coverage of ex-works, FOB, and CIF prices, as well as the key factors influencing the sodium benzoate excipient price trend.

Global Sodium Benzoate Excipient Price Trend

The report offers a holistic view of the global sodium benzoate excipient pricing trends in the form of sodium benzoate excipient price charts, reflecting the worldwide interplay of supply-demand balances, international trade policies, and overarching economic factors that shape the market on a macro level. This comprehensive analysis not only highlights the current price but also provides insights into sodium benzoate excipient historical price trends, enabling stakeholders to understand past fluctuations and their underlying causes.

The report also delves into sodium benzoate excipient price forecast models, projecting future price movements based on a variety of indicators such as expected changes in supply chain dynamics, anticipated policy shifts, and emerging market trends. By examining these factors, the report equips industry participants with the necessary tools to make informed strategic decisions, manage risks, and capitalize on market opportunities. Furthermore, it includes a detailed sodium benzoate excipient demand analysis, breaking down regional variations and identifying key drivers specific to each geographic market, thus offering a nuanced understanding of the global pricing landscape.

Europe Sodium Benzoate Excipient Price Trend

Q4 2024:

Due to sluggish demand, especially from the preservative industry, the sodium benzoate market in the region continued to drop in price in Q4 2024, mirroring broader global trends. The devaluation of the euro raised import prices, which further reduced demand. Despite a modest revival in the production sector, prices were under pressure from increased global competition from cheaper APAC exporters. Due to excess caused by high stock levels and decreased procurement activity, suppliers were compelled to implement aggressive pricing measures. Buyers had advantageous negotiation terms given the sluggish demand, which kept prices under downward pressure despite labor shortages and port delays.

Q3 2024:

The European sodium benzoate market in Q3 2024 experienced a significant pricing downturn, heavily influenced by weakened demand from sectors such as food preservatives and pharmaceuticals. Oversupply challenges were compounded by lower production costs due to raw material prices and reduced energy. In Germany, the market saw pronounced price declines, impacted further by disruptions and plant shutdowns. Import costs remained under pressure, exacerbating the difficult conditions for producers and suppliers. This quarter highlighted the region’s ongoing struggle with bearish sentiment and unfavorable market dynamics, reflecting the challenges of aligning supply with demand.

Q2 2024:

The European sodium benzoate market in Q2 2024 remained stable, supported by balanced supply-demand conditions and adequate inventories. The resumption of production post-holiday season and limited trade disruptions helped maintain equilibrium. Germany observed notable price shifts influenced by increased freight costs and inflation. Despite these factors, demand from the food industry for preservatives remained strong, sustaining market stability. Seasonal demand patterns and strategic destocking further bolstered equilibrium, ensuring smooth inventory clearance and preventing deterioration of stock. The quarter concluded with a stable and well-supported pricing environment.

Q1 2024:

In Q1 2024, Europe’s sodium benzoate market experienced fluctuating prices, starting with an increase in January driven by robust demand and elevated shipping costs. February saw a sharp decline as trade disruptions from the Red Sea crisis and higher freight expenses dampened market sentiment. The drop was exacerbated by challenges like order cancellations and stringent packaging regulations. By March, prices rebounded moderately due to improved regional consumption and export opportunities fueled by the Euro's depreciation. Sufficient inventories helped stabilize the market, supporting traders in managing costs and profitability efficiently.

Q4 2023:

In the final quarter of 2023, the European sodium benzoate excipient market, especially in Germany, showed a strong upward price trend. This increase was driven primarily by heightened demand from end-user industries, such as frozen and processed foods. The rise in the Euro's value added to the price increases by making imports more expensive. Rising costs of upstream materials, such as benzoic acid, also supported this trend. In spite of considerable rise in prices, the market maintained sufficient stock levels to meet demand, with inquiries from major industries, including food, drug, and medical sectors, remaining strong. Market sentiment remained optimistic, with expectations of continued price growth in the following months, reflecting broader economic trends.

This analysis can be extended to include detailed sodium benzoate excipient price information for a comprehensive list of countries.

| Region | Countries Covered |

|---|---|

| Europe | Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal, and Greece, among other European countries. |

North America Sodium Benzoate Excipient Price Trend

Q4 2024:

The region's sodium benzoate market saw severe negative trends in Q4 2024, including declining manufacturing activity in important industries including medicines and food preservatives and low demand. Market confidence remained muted despite slight gains, primarily due to weather-related issues and uncertainty around the next election. Prices were under pressure to decline as competition from Chinese imports grew as inventory levels rose. A negative market forecast resulted from cautious buyer behavior and conservative procurement techniques, as well as output and demand that fell short of expectations despite modest employment improvements.

Q3 2024:

The sodium benzoate market in North America faced significant challenges in Q3 2024, marked by a sharp decline in prices. Persistent oversupply and subdued demand across critical sectors, including pharmaceuticals and preservatives, led to a cautious approach by buyers, reducing purchasing activity. Broader industry challenges, such as manufacturing disruptions and logistical constraints, further exacerbated market pressures. Coupled with uncertain global financial environment, these factors collectively contributed to a bearish market outlook. Compared to the previous year, pricing exhibited considerable weakness, reflecting the ongoing disparity between demand and supply fundamentals.

Q2 2024:

During Q2 2024, the sodium benzoate market in North America maintained steady pricing, driven by a stable supply-demand interaction. Key influences included competitive market conditions, consistent stockpile liquidation, and stable input costs, such as energy and feedstock materials. While the manufacturing sector contracted, the expanding services sector created a mixed economic environment. Import volumes and adequate inventories mitigated any potential for price volatility. With minimal seasonal impacts and no major operational disruptions, the quarter reflected a stable market environment with negligible price fluctuations, underscoring the resilience of the regional Sodium Benzoate market.

Q1 2024:

The North America's sodium benzoate market during Q1 2024 showcased complex pricing trends. Early price increases, driven by seasonal demand in the pharmaceutical sector and higher freight costs due to geopolitical tensions, gave way to declines. Supply chain disruptions and abundant inventories reduced downstream demand, prompting destocking efforts among suppliers. The food and pharmaceutical sector saw decreased manufacturing activity, further contributing to price contractions. However, March saw a recovery, supported by increased demand from the food sector, easing freight costs, and a stronger US dollar, which collectively improved market sentiment and production activity.

Q4 2023:

The market for sodium benzoate excipient in North America had a steady increase in pricing in Q4 2023, due to various contributing variables as well as rising demand. Retailers must hoard sodium benzoate throughout the winter months due to the increased demand for the preservative in processed and frozen foods. The expanding pharmaceutical industry further increased demand for the excipient. Benzoic acid and other raw material costs were rising, which further drove up prices. The stronger Chinese Yuan and problems with port congestion caused supply chain disruptions. Prices were also driven up by labor shortages in important industries such as agriculture, food processing, and medicines. Increased investments resulted from a favorable outlook for the firm, particularly during the holiday season when businesses expected robust consumer demand.

Specific sodium benzoate excipient historical data within the United States and Canada can also be provided.

| Region | Countries Covered |

|---|---|

| North America | United States and Canada |

Middle East and Africa Sodium Benzoate Excipient Price Trend

The report explores the sodium benzoate excipient pricing trends in the Middle East and Africa, considering factors like regional industrial growth, the availability of natural resources, and geopolitical tensions that uniquely influence market prices.

In addition to region-wise data, information on sodium benzoate excipient prices for countries can also be provided.

| Region | Countries Covered |

|---|---|

| Middle East & Africa | Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco, among other Middle Eastern and African countries. |

Asia Pacific Sodium Benzoate Excipient Price Trend

Q4 2024:

The Asia Pacific sodium benzoate market, especially in China, suffered from supply-demand mismatches in Q4 2024. As production capacity expanded, the market was oversupplied, yet the demand remained weak despite government stimulus attempts. Exports were further hurt by weak international trade, as import activity decreased, and instability was increased by cross-border instabilities. In order to stay competitive, Chinese producers’ aggressive sales methods, and the glut was made worse by excessive inventory levels. The market suffered ongoing difficulties, characterized by low export charges and decreased trading activity, due to the limited recovery of demand.

Q3 2024:

The APAC sodium benzoate market encountered a challenging environment in Q3 2024, characterized by declining prices driven by weakened demand and oversupply. Shifting consumer preferences and global economic uncertainties added further strain. In China, market sentiment remained particularly bearish, with notable pricing fluctuations observed throughout the quarter. Plant shutdowns and operational disruptions intensified the oversupply issues, creating additional pressure on the market. This period underscored the industry's ongoing challenges, with the region's pricing landscape reflecting a consistent downward trajectory across key markets.

Q2 2024:

The APAC sodium benzoate market in Q2 2024 saw rising prices due to strong demand and supply shortage. The pharmaceutical and food sectors drove demand, while soaring energy and freight costs, higher production expenses, and currency depreciation intensified supply-side pressures. China experienced significant market fluctuations, with seasonal consumption patterns during summer further bolstering demand. Although steady production prevented severe supply disruptions, insufficient inventories failed to counter escalating costs. The quarter highlighted a dynamic market environment, with robust fundamentals supporting a bullish pricing trend across the region.

Q1 2024:

The sodium benzoate market in APAC during Q1 2024 faced downward pressure due to oversupply and weakened demand. Early in the quarter, inventory surpluses and subdued purchasing led to price declines, compounded by post-Lunar New Year dynamics and the devaluation of the Chinese yuan. While a surge in production and international orders following the spring festival offered temporary stability, trade momentum remained weak overall. By quarter’s end, improved domestic demand and renewed purchasing activity provided a rebound, as suppliers aimed to clear inventories in preparation for the upcoming quarter.

Q4 2023:

During Q4 2023, the sodium benzoate excipient market in Asia Pacific saw significant price fluctuations. An increase in demand from various end-user sectors drove prices upward early in the quarter, supported by the end of Golden Week holidays and rising interest from overseas markets. However, production disruptions in China, caused by lack of labor and logistical difficulties, added strain to the market. Despite these issues, demand continued to grow, particularly from the sorbate sector, which outpaced local production capacities. This, combined with strengthened prices for benzoic acid, pushed sodium benzoate excipient prices higher. Even though feedstock prices weakened, the market maintained its upward trend through December, supported by strong global and regional demand dynamics .

This sodium benzoate excipient price analysis can be expanded to include a comprehensive list of countries within the region.

| Region | Countries Covered |

|---|---|

| Asia Pacific | China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand, among other Asian countries. |

Latin America Sodium Benzoate Excipient Price Trend

The analysis of sodium benzoate excipient prices in Latin America provides a detailed overview, reflecting the unique market dynamics in the region influenced by economic policies, industrial growth, and trade frameworks.

This comprehensive review can be extended to include specific countries within the region.

| Region | Countries Covered |

|---|---|

| Latin America | Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru, among other Latin American countries. |

Sodium Benzoate Excipient Price Trend, Market Analysis, and News

IMARC’s newly published report, titled “Sodium Benzoate Excipient Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2025 Edition,” offers an in-depth analysis of sodium benzoate excipient pricing, covering an analysis of global and regional market trends and the critical factors driving these price movements.

It encompasses an in-depth review of spot price of sodium benzoate excipient at major ports, a breakdown of prices including Ex Works, FOB, and CIF, alongside a region-wise dissection of sodium benzoate excipient price trend across North America, Europe, Asia Pacific, Latin America, the Middle East and Africa.

The report examines the elements influencing sodium benzoate excipient price fluctuations, such as changes in raw material costs, supply-demand dynamics, geopolitical factors, and industry-specific developments. Additionally, it integrates the latest market news, providing stakeholders with up-to-date information on market shifts, regulatory changes, and technological advancements, thereby offering a comprehensive overview that aids in strategic decision-making and forecasting.

Sodium Benzoate Excipient Industry Analysis

The global sodium benzoate excipient industry size reached 477.2 Thousand Tons in 2024. By 2033, IMARC Group expects the market to reach 753.1 Thousand Tons, at a projected CAGR of 4.94% during 2025-2033.

- Growth in the pharmaceutical sector is augmenting the demand for sodium benzoate as an excipient in pharmaceutical formulations, supported by its pivotal role in drug formulation and retention.

- The increasing consumption of packed foods and beverages is driving the sodium benzoate excipient market due to its major preservative role in extending shelf life. The increasing globalization of the world's food industries, more so in developing countries, further stimulates this demand.

- Sodium benzoate is increasingly used as an antimicrobial product in cosmetic and personal care formulations. A fast-growing cosmetic industry, influenced by increased consumer awareness and expenditure on cosmetic products, is, in turn, driving the market for sodium benzoate used as excipients.

- The existing regulatory approvals and established safety profiles of sodium benzoate as an excipient contribute significantly to its acceptance across various industries. The trust demonstrated by regulatory bodies boosts manufacturers' confidence, thereby enhancing market adoption and confidence.

- Innovations in preserving technologies make the excipient sodium benzoate much more efficacious, much more flexible in its applications, and usable in several sectors. These ever-changing scenarios related to the development of technology are making sodium benzoate excipient more user-friendly in these regards and turning it into a more attractive, versatile option for manufacturers.

- With growing consumer concerns toward food safety and the role of preservatives in maintaining contamination, the demand for sodium benzoate excipient is growing. The market for safe and approved preservatives, such as sodium benzoate excipient, is expanding as consumers become increasingly health conscious.

- Rapid urbanization and a shift towards convenience food and beverage reflect a demand for proper preservation solutions, hence expanding the market of sodium benzoate excipient. It is most prominent within highly densely populated and rapidly growing regions.

- The growth of the dairy industry has resulted in market growth for sodium benzoate excipients. This preservative is important for an extended shelf life without issues touching on safety in dairy products.

- Enhanced R&D activities aimed at discovering new applications and improving the efficacy of sodium benzoate excipients in various products are propelling the market. Continuous innovation ensures that sodium benzoate excipient remains relevant and in demand.

- The globalization of the food and beverage trade mandating the adoption of reliable means of preservation for products to be able to withstand long shipping duration is driving the demand for sodium benzoate excipients. The more international trade, the more effective preservatives would be required.

Sodium Benzoate Excipient News

The report covers the latest developments, updates, and trends impacting the global sodium benzoate excipient market, providing stakeholders with timely and relevant information. This segment covers a wide array of news items, including the inauguration of new production facilities, advancements in sodium benzoate excipient production technologies, strategic market expansions by key industry players, and significant mergers and acquisitions that impact the sodium benzoate excipient price trend.

Latest developments in the sodium benzoate excipient industry:

- It was announced on June 25, 2024, that SyneuRx International, a Taiwan-based company specializing in developing drugs for central nervous system-related disorders, is engaging in the clinical development of sodium benzoate for the treatment of adolescent schizophrenia, refractory schizophrenia, add-on therapy in schizophrenia, and dementia, targeting D-amino acid oxidase (DAAO), with the drug currently being in Phase III trials.

Product Description

Sodium benzoate is a commonly used preservative, it plays a preservative role mainly in most pharmaceutical formulations, as it is a compound consisting of the sodium salt of benzoic acid, which shows high antimicrobial activity. It thus effectively inhibits the growth of bacteria and other microorganisms, such as yeast, and fungi. It is, therefore, active in drug formulations, enhancing stability and assuring the longevity of the product by protecting it against microbial contamination. The excipient's water solubility ensures that it finds its way into liquid formulations.

In addition, the compound is deemed safe and fit for use via recommendations by both the FDA and several other regulatory bodies. It is in that regard that the sodium benzoate excipient in pharmaceuticals comes in of much importance on its preservative and on matters contributing to consistency and quality; hence, affirms that the products are effective and, most importantly, safe for use by consumers all over a long time. Moreover, its cost-effective nature and its applicability in the most diverse areas of pharmaceuticals make it a very useful excipient.

Report Coverage

| Key Attributes | Details |

|---|---|

| Product Name | Sodium Benzoate Excipient |

| Report Features | Exploration of Historical Trends and Market Outlook, Industry Demand, Industry Supply, Gap Analysis, Challenges, Sodium Benzoate Excipient Price Analysis, and Segment-Wise Assessment. |

| Currency/Units | US$ (Data can also be provided in local currency) or Metric Tons |

| Region/Countries Covered | The current coverage includes analysis at the global and regional levels only. Based on your requirements, we can also customize the report and provide specific information for the following countries: Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand* Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece* North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru* Middle East & Africa: Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco* *The list of countries presented is not exhaustive. Information on additional countries can be provided if required by the client. |

| Information Covered for Key Suppliers |

|

| Customization Scope | The report can be customized as per the requirements of the customer |

| Report Price and Purchase Option |

Plan A: Monthly Updates - Annual Subscription

Plan B: Quarterly Updates - Annual Subscription

Plan C: Biannually Updates - Annual Subscription

|

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

| Delivery Format | PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report presents a detailed analysis of sodium benzoate excipient pricing, covering global and regional trends, spot prices at key ports, and a breakdown of Ex Works, FOB, and CIF prices.

- The study examines factors affecting sodium benzoate excipient price trend, including raw material costs, supply-demand shifts, geopolitical impacts, and industry developments, offering insights for informed decision-making.

- The competitive landscape review equips stakeholders with crucial insights into the latest market news, regulatory changes, and technological advancements, ensuring a well-rounded, strategic overview for forecasting and planning.

- IMARC offers various subscription options, including monthly, quarterly, and biannual updates, allowing clients to stay informed with the latest market trends, ongoing developments, and comprehensive market insights. The sodium benzoate excipient price charts ensure our clients remain at the forefront of the industry.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Why Choose Us

IMARC offers trustworthy, data-centric insights into commodity pricing and evolving market trends, enabling businesses to make well-informed decisions in areas such as procurement, strategic planning, and investments. With in-depth knowledge spanning more than 1000 commodities and a vast global presence in over 150 countries, we provide tailored, actionable intelligence designed to meet the specific needs of diverse industries and markets.

1000

+Commodities

150

+Countries Covered

3000

+Clients

20

+Industry

Robust Methodologies & Extensive Resources

IMARC delivers precise commodity pricing insights using proven methodologies and a wealth of data to support strategic decision-making.

Subscription-Based Databases

Our extensive databases provide detailed commodity pricing, import-export trade statistics, and shipment-level tracking for comprehensive market analysis.

Primary Research-Driven Insights

Through direct supplier surveys and expert interviews, we gather real-time market data to enhance pricing accuracy and trend forecasting.

Extensive Secondary Research

We analyze industry reports, trade publications, and market studies to offer tailored intelligence and actionable commodity market insights.

Trusted by 3000+ industry leaders worldwide to drive data-backed decisions. From global manufacturers to government agencies, our clients rely on us for accurate pricing, deep market intelligence, and forward-looking insights.

Request Customization

Request Customization

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst Request Brochure

Request Brochure

.webp)

.webp)