Soil Treatment Market Size, Share, Trends, and Forecast by Type, Technology, End User, and Region, 2025-2033

Soil Treatment Market Size and Share:

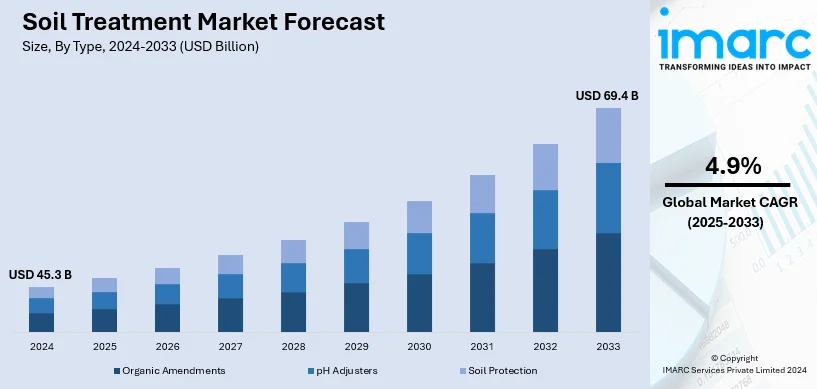

The global soil treatment market size was valued at USD 45.3 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 69.4 Billion by 2033, exhibiting a CAGR of 4.9% during 2025-2033. North America currently dominates the market, holding a significant market share of over 38.5% in 2024. Increasing adoption of sustainable and organic soil treatment methods and the integration of digital technologies for real-time monitoring and data-driven decision-making in soil treatment processes are some of the key factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 45.3 Billion |

|

Market Forecast in 2033

|

USD 69.4 Billion |

| Market Growth Rate 2025-2033 | 4.9% |

The global market for soil treatment is currently thriving due to the growing requirement to enhance agricultural productivity while combating soil degradation. High demand for food across the globe and diminishing land available for cultivation is fueling the use of soil treatments to improve fertility and structure. In addition, the need for organic food products increased the demand for organic farming and precision agriculture techniques; hence, it created avenues for eco-friendly soil treatment products. According to IMARC Group, the size of the global organic food market has been forecasted to grow up to US$ 528.9 Billion by 2032, with a projected CAGR of 10.97% during 2024-2032. The adoption of advanced treatment methods also addresses environmental concerns and regulatory requirements. Moreover, the increasing use of soil treatment in landscaping and horticulture, along with government initiatives that promote soil health, is further encouraging overall industry growth.

The United States has emerged as a key regional market for soil treatment. The United States soil treatment market stands out as a key market disruptor, as increasing interest is being shown towards sustainable agriculture and fertile land restoration in areas heavily influenced by intensive farming operations. Increasing awareness about the significance of soil health to yield crops has led to demand for more advanced treatment methods of soils, including bio-based and organic amendments. In addition, rising needs for organic, high-quality produce, and decreasing chemical use through fertilizers also increases soil treatment adoption in the United States. As per a report published by the IMARC Group, the United States organic food market size is expected to reach US$ 158.2 Billion by 2032, exhibiting a CAGR of 7.47% during 2024-2032. Besides this, government schemes and financial aids encouraging green farming practices are enhancing market growth.

Soil Treatment Market Trends

Escalating Need for Effective Pest Management

The increasing prevalence of soilborne pests, such as nematodes, fungi, and bacteria, is significantly impacting crop yields and soil health, which is primarily driving the need for soil treatment techniques that enhance soil microbiome balance or suppress pest populations. For instance, according to a study, the white grub infestation reduces the root system by approximately 25% in soybeans and 64% in maize. It was observed that Phyllophaga capillata and Aegopsis bolboceridus damaged all evaluated variables, reducing overall soybean productivity by 58.62% and maize productivity by 59.76% in South American countries such as Brazil. Similarly, Nematodes such as Meloidogyne incognita and Pratylenchus brachyurus cause big losses in fruits and vegetables. For instance, carrots can lose up to 20.0% of their crop due to such pests. As these pests live in the soil, the need to use nematicides to mitigate them and protect the crops is essential. Consequently, there is a rising need for soil treatment solutions, which is anticipated to significantly propel the soil treatment market share in the coming years.

Growing Demand for Quality Food

The increasing demand for organic and quality food is further creating a positive outlook for the global soil treatment market. Quality food production relies heavily on fertile soil that provides essential nutrients to crops. This, in turn, influences crop yield, nutrition content, and overall food quality. The growing global population, inflating disposable incomes, and elevating standards of living are resulting in an increased demand for food and agricultural products. According to industrial data, the total food grain demand will grow to the level of 311 Million Tons, which includes 122, 115, 47, and 27 Million tons of rice, wheat, coarse cereals, and pulses, respectively, by the year 2030. Besides this, the government authorities of various nations are taking initiatives to promote organic farming practices, which is further stimulating the market for soil treatment solutions. For instance, the introduction of favorable initiatives, such as the National Program on Organic Farming and the Paramparagat Krishi Vikas Yojana by the Government of India (GoI) to promote bio-agriculture in the country through financial assistance to farmers, is facilitating overall industry expansion.

Technological Advancements

Adoption of advanced soil treatment technologies such as bioremediation, thermal desorption, and electrokinetic for efficient contaminant removal are creating lucrative growth opportunities to the market. Moreover, various key market players are increasingly investing in soil treatment technologies to develop more advanced techniques and methods. For instance, in March 2024, the CSIR-Indian Institute of Chemical Technology (IICT) successfully demonstrated the conversion of dry leaves into a 'soil conditioner'. This method, known as Accelerated Anaerobic Composting (ACC), ensures that only bio-manure is generated, not biogas. Similarly, in October 2023, Rice University scientists and collaborators at the United States Army Engineer Research and Development Center (ERDC) developed a rapid high-temperature process that removes heavy metals and organic contaminants from the soil. Moreover, ongoing research and development (R&D) in soil treatment technologies are expanding the market's potential to address diverse soil contaminants and meet stringent regulatory requirements worldwide. Recently, Downforce Technologies, a digital measurement, reporting and verification startup focused on soil organic carbon (SOC) measurement and prediction, has raised USD 4.2 Million in a funding round led by Equator VC.

Soil Treatment Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global soil treatment market report, along with forecasts at the global and regional levels for 2025-2033. Our report has categorized the market based on type, technology, end user, and region.

Analysis by Type:

- Organic Amendments

- pH Adjusters

- Soil Protection

pH adjusters lead the market globally. pH adjusters in soil treatment are vital for modifying soil acidity or alkalinity to optimize plant growth and remediate contaminated soils. They include substances such as lime (calcium hydroxide) to raise pH for neutralizing acidic soils, and sulfur to lower pH for alkaline soil remediation. These adjusters help regulate nutrient availability, enhance microbial activity, and improve soil structure, which is essential for agricultural productivity and environmental restoration. Additionally, pH adjusters play a vital role in ensuring effective uptake of nutrients by plants, promoting sustainable soil management practices, and mitigating adverse effects of soil contaminants through tailored pH correction strategies.

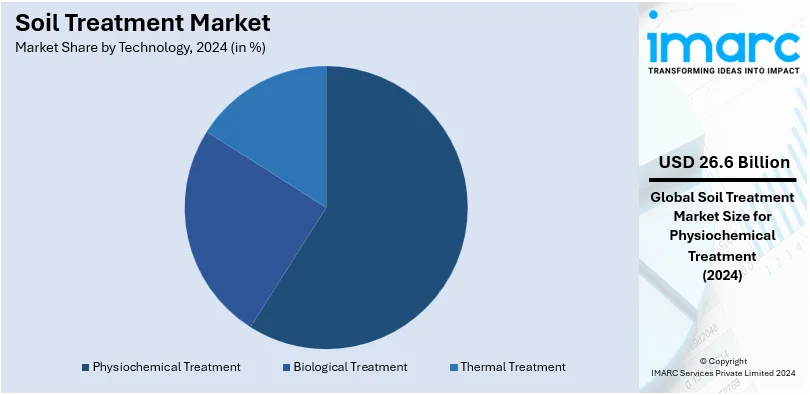

Analysis by Technology:

- Biological Treatment

- Thermal Treatment

- Physiochemical Treatment

Physiochemical treatment leads the market with around 58.8% of market share in 2024. Physiochemical treatment in soil treatment involves processes that physically and chemically alter contaminants in soil to reduce their toxicity or mobility. This method combines physical techniques such as soil washing, screening, or thermal desorption with chemical methods such as oxidation, precipitation, or stabilization. Soil contaminants such as heavy metals, petroleum hydrocarbons, and persistent organic pollutants are targeted through these processes, aiming to degrade or isolate pollutants from soil matrices. Physiochemical treatment offers versatility in addressing diverse contaminants and is often tailored to site-specific conditions to achieve effective remediation and restore soil quality for safe land use purposes.

Analysis by End User:

- Agricultural

- Construction

- Others

Agricultural sector leads the market worldwide. Managing pests effectively is essential for ensuring food security and maintaining a stable food supply. Additionally, the escalating demand for quality food is also propelling the growth of this segment. For instance, the total global food demand is expected to increase by 35% to 56% between 2010 and 2050, while the population at risk of hunger is expected to change by −91% to +8% over the same period. Besides this, increasing infestation of soilborne pests, diseases, and weeds is also bolstering the need for effective soil treatment solutions. By optimizing soil health through treatments such as fertilization, organic amendments, and pH adjustments, agricultural productivity can be maximized while minimizing environmental impact. Ultimately, soil treatment ensures long-term soil sustainability, supporting food security and maintaining ecosystem health in agricultural landscapes.

Regional Analysis

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 38.5%. Agriculture in North America is highly diverse, with a wide range of crops cultivated across different countries. The region's diverse climate and fertile land enable the cultivation of crops such as wheat, corn, soybean, canola, and various fruits and vegetables. Furthermore, as per the soil treatment market forecast by IMARC, the significantly rising population across the region is bolstering the demand for high-quality food. According to the Canadian Agriculture Human Resource Council, Canada's farm labour deficit is anticipated to double by 2029 and lead to a 123,000-worker shortage. This will increase the need for soil treatment solutions to enhance crop yield. Additionally, various key market players are collaborating to introduce new and improved soil treatment solutions, which are further catalysing market growth. For instance, in May 2021, Corteva Agriscience and BASF Canada Agricultural Solutions (BASF) partnered toward a joint approach to weed control by recommending the combined use of Liberty 200 SN and Enlist herbicides on Enlist E3TM soybean acres. This partnership is anticipated to increase the use of herbicides, thereby expanding the market growth.

Key Regional Takeaways:

United States Soil Treatment Market Analysis

In 2024, United States accounts for over 72.5% of the soil treatment market in North America. The large-scale farming, combined with tougher environmental regulations, is driving the market for soil treatments in the United States. As per USDA, over 45% of arable land was classified as degraded in 2023. Consequently, government initiatives such as Conservation Reserve Program (CRP) and Environmental Quality Incentives Program (EQIP) are investing heavily in soil health and conservation. Adoption of bio-based soil conditioners registered 15% growth during 2023, when farmers increasingly sought products such as compost, biochar, and microbial amendments to enhance the fertility and water retention capacity. Moreover, numerous companies, including UPL and BASF, are using advanced technologies to deliver controlled-release soil conditioners and nutrient enhancers. Rising awareness among U.S. farmers regarding climate change mitigation has also boosted the demand for soil carbon sequestration techniques, contributing to the country’s goal of achieving net-zero emissions by 2050.

Europe Soil Treatment Market Analysis

Europe's market for soil treatment is gaining momentum, backed by tough frameworks of regulation and sustainable agriculture. Approximately 35% of agricultural land in the European Union is suffering from soil degradation. This highlights a pressing need for soil treatment solutions in Europe. The Common Agricultural Policy (CAP) provided USD 58.8 Billion in 2023 for sustainable farming and environmental conservation. Germany, France, and the Netherlands are keen in adopting bio-based soil amendments and pH balancers, with a 16% increase recorded in demand for eco-friendly products in 2023. Moreover, the European Green Deal's "Farm to Fork" strategy outlines a reduction of at least 50% of chemical pesticide use and 20% of fertilizer use by 2030. This is encouraging innovation in microbial-based soil conditioners. Additionally, advanced products by companies such as Bayer and Syngenta address specific challenges related to soil health while adhering to regional sustainability goals, further propelling industry expansion.

Asia Pacific Soil Treatment Market Analysis

The market for Asia Pacific soil treatment is rapidly growing, driven by increasing food demand in the region and decreasing soil fertility. According to the Food and Agriculture Organization (FAO), 62% of farmland in Asia Pacific suffers moderate to severe soil degradation, with water erosion and desertification being the major concerns in the region. Consequently, numerous countries are increasingly investing in improving soil health in this region with various governmental programs. Some of these include China’s "Black Soil Protection Program" and the Soil Health Card Scheme in India, where over 220 Million farmers have benefited since 2023. Furthermore, organic soil amendments and biofertilizers experienced a 20% uptake in 2023 due to increasing awareness about sustainable agricultural practices. Japan and South Korea are also making heavy investments in precision agriculture technologies to optimize soil health and reduce chemical dependency. Local companies such as Coromandel International are working in partnership with global players to introduce innovative solutions tailored to diverse regional needs and to create a more resilient agricultural sector.

Latin America Soil Treatment Market Analysis

Latin America's agricultural sector is significantly influencing its soil treatment market. The region faces challenges in terms of soil erosion and nutrient depletion, which have decreased agricultural productivity. According to an industrial report, approximately 267 Million people in Latin America and the Caribbean suffer from food insecurity. This means that 40% of the population lacks physical or economic access to sufficient safe and nutritious food to meet their daily needs and lead a healthy life. Consequently, investment in conservation practices is increasing, where countries such as Brazil are adopting soil amendment methods for better crop yields. Companies such as Yara and Mosaic are also expanding their businesses in this region with solutions best suited to the soil conditions in Latin America.

Middle East and Africa Soil Treatment Market Analysis

The Middle East and Africa region deals with dry conditions and land degradation. As per FAO, around 28% of the land area in the region is experiencing some degree of land degradation. As a result, Saudi Arabia is committing investments through initiatives such as Vision 2030 toward agricultural sustainability projects, which are increasing the demand for soil conditioners and pH balancers. Firms such as FMC Corporation are innovating water-saving soil treatment products as suited to the requirements of the region.

Competitive Landscape:

Key players in the global soil treatment market are actively driving growth through strategic initiatives aimed at innovation and sustainability. Numerous companies are investing in research and development (R&D) to introduce bio-based and eco-friendly soil treatment solutions, such as organic soil conditioners and microbial amendments, aligning with the growing demand for sustainable agriculture. Collaborations with agricultural research institutions and partnerships with farmers are also fostering the adoption of advanced soil health management practices. Moreover, leading manufacturers are expanding their global presence through mergers, acquisitions, and regional partnerships to tap into emerging markets. Digital transformation efforts, including precision agriculture technologies and soil health monitoring systems, are being integrated into product offerings to enhance efficiency and performance. Additionally, companies are focusing on educating end-users through awareness campaigns and training programs on the benefits of soil treatment. These proactive measures by key players are positively influencing the market, supporting sustainable farming and boosting agricultural productivity worldwide.

The report provides a comprehensive analysis of the competitive landscape in the soil treatment market with detailed profiles of all major companies, including:

- AMVAC Chemical Corporation (American Vanguard Corporation)

- Arkema S.A.

- BASF SE

- Bayer AG

- Compagnie de Saint-Gobain S.A.

- Corteva Inc.

- Novozymes A/S

- Solvay S.A.

- Swaroop Agrochemical Industries

- Syngenta Group (China National Chemical Corporation)

- Tata Chemicals Ltd.

- UPL Limited

Latest News and Developments:

- September 2024: Bayer announced the launch of ForwardFarm initiative in India emphasizing regenerative agriculture, focusing on improving soil health, water conservation, and reducing greenhouse gas emissions. Its Direct Seeded Rice (DSR) system reduces water usage by 30-40%, greenhouse gas emissions by 45%, and labor reliance by 40-50%. Through the DirectAcres program, Bayer has supported 5,000 Indian farmers across 8,600 hectares and aims to reach 1 Million smallholder farmers by 2030. These efforts align with Bayer’s commitment to sustainable and profitable farming practices.

- July 2024: AMVAC GreenSolutions announced that they have partnered with Biome Makers to study the impact of biological products on soil and plant health using BeCrop technology. This collaboration aims to provide data-driven insights for sustainable agriculture and improved soil health.

- June 2024: Chennai Chief Minister M K Stalin launched the Mannuyir Kaathu Mannuyir Kaappom Scheme to preserve soil fertility by distributing green manure seeds to farmers. The ₹206 crore scheme announced in the state agriculture budget is anticipated to benefit around two lakh farmers.

- March 2024: CSIR-Indian Institute of Chemical Technology (IICT) successfully demonstrated the conversion of dry leaves into a ‘soil conditioner.’ This method called Accelerated Anaerobic Composting (ACC), ensures that only bio-manure is generated, not biogas.

- January 2024: BioConsortia, Inc., a leading agricultural technology company, announced the launch of nitrogen-fixing products to expand the addressable market to new crop opportunities. Their field trial results confirmed that nitrogen-fixing microbial seed treatment products increased yields and reduced fertilizer use in vegetable crops like potatoes.

Soil Treatment Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Organic Amendments, pH Adjusters, Soil Protection |

| Technologies Covered | Biological Treatment, Thermal Treatment, Physiochemical Treatment |

| End Users Covered | Agricultural, Construction, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AMVAC Chemical Corporation (American Vanguard Corporation), Arkema S.A., BASF SE, Bayer AG, Compagnie de Saint-Gobain S.A., Corteva Inc., Novozymes A/S, Solvay S.A., Swaroop Agrochemical Industries, Syngenta Group (China National Chemical Corporation), Tata Chemicals Ltd., UPL Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, soil treatment market forecast, and dynamics of the market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global soil treatment market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the soil treatment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Soil treatment involves improving soil quality and fertility through physical, chemical, or biological methods to enhance its structure, nutrient content, and productivity. It addresses issues such as contamination, degradation, and imbalance, promoting sustainable agriculture and healthier plant growth.

The global soil treatment market was valued at USD 45.3 Billion in 2024.

IMARC estimates the global soil treatment market to exhibit a CAGR of 4.9% during 2025-2033.

The growing demand for sustainable agriculture, rising awareness about soil health and fertility, increasing adoption of bio-based and organic amendments, technological advancements in soil treatment methods, and government initiatives promoting sustainable farming are primarily driving the global soil treatment market.

According to the report, pH adjusters represented the largest segment by type, driven by their widespread use in correcting soil pH, which ensures improved nutrient availability and crop productivity across various agricultural practices.

Physiochemical treatment leads the market by technology owing to its exceptional ability to address contamination and improve soil structure efficiently.

The agricultural sector is the leading segment by end user as it relies heavily on enhancing soil fertility and health to meet growing food demands.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global soil treatment market include AMVAC Chemical Corporation (American Vanguard Corporation), Arkema S.A., BASF SE, Bayer AG, Compagnie de Saint-Gobain S.A., Corteva Inc., Novozymes A/S, Solvay S.A., Swaroop Agrochemical Industries, Syngenta Group (China National Chemical Corporation), Tata Chemicals Ltd., UPL Limited, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)