Solar Vehicle Market Size, Share, Trends and Forecast by Propulsion Type, Vehicle Type, Battery Type, Solar Panel Type, Charging Type and Region, 2025-2033

Solar Vehicle Market Size and Share:

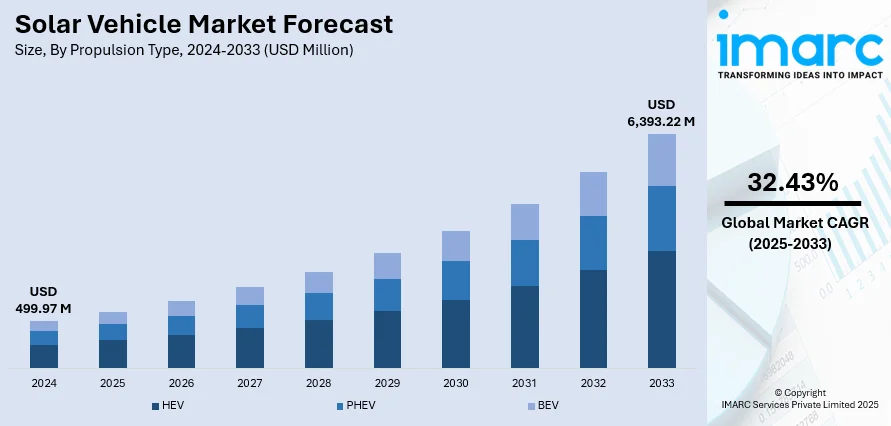

The global solar vehicle market size was valued at USD 499.97 Million in 2024. The market is projected to reach USD 6,393.22 Million by 2033, exhibiting a CAGR of 32.43% from 2025-2033. North America currently dominates the market, holding a market share of 37.6% in 2024. The surging need to reduce greenhouse gas emissions, rapid advancements in solar panel technology, and the introduction of government incentives, subsidies, and regulations to promote clean and renewable transportation are propelling the solar vehicle market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 499.97 Million |

| Market Forecast in 2033 | USD 6,393.22 Million |

| Market Growth Rate 2025-2033 | 32.43% |

Rising greenhouse gas emissions and the growing concerns about climate change are encouraging the use of renewable energy-based transportation options, with solar vehicles emerging as a competitive option. Solar vehicles are becoming more appealing due to increasing gasoline prices and the desire to reduce dependency on fossil fuels. Advancements in battery storage, solar cells, and lightweight materials are enhancing cost-effectiveness, efficiency, and range, which is expanding their commercial potential. Government incentives, subsidies, and policies that promote clean energy vehicles are further boosting their adoption. Moreover, rising need for energy-saving, low-maintenance, and environment-friendly transport options is fueling the solar vehicle market growth.

To get more information on this market, Request Sample

The United States has emerged as a major region in the solar vehicle market owing to many factors. Increasing concerns about carbon emissions are impelling the market growth. As per the EIA, US energy-related carbon dioxide (CO2) emissions are projected to rise by 1.6% in 2025. Incentives at the federal and state levels, along with tax credits and financial support for sustainable mobility initiatives, are motivating both producers and individuals to employ solar vehicles. Improvements in solar technology and energy storage are enhancing the performance and range of solar vehicles, increasing their usability for daily purposes. The growing focus on sustainable transportation in urban areas, coupled with rising fuel prices, is offering a favorable solar vehicle market outlook.

Solar Vehicle Market Trends:

Rising need to reduce greenhouse gas emissions

As nations around the globe are pledging to cut carbon emissions and meet climate goals, solar vehicles are gaining popularity as a viable solution. According to the United Nations Framework Convention on Climate Change (UNFCCC), to keep global warming at 1.5°C, worldwide greenhouse gas emissions need to reach their highest point before 2025 and decrease by 43% by the year 2030. This urgency highlights the critical role solar vehicles play in achieving climate goals. Solar vehicles produce zero tailpipe emissions during operation, mitigating the transportation sector's contribution to air pollution and greenhouse gas emissions. This alignment with climate goals positions solar vehicles as a crucial component of the broader effort to decarbonize transportation. Moreover, businesses are integrating sustainability into their operations and fleet management. Solar vehicles align with corporate sustainability goals by offering a way to lower carbon footprints. As companies are transitioning to cleaner transportation options, the demand for solar vehicles for corporate fleets and services is increasing across the globe.

Technological advancements

Ongoing breakthroughs in solar panel technology and energy storage systems are among the major solar vehicle market trends. As solar panel efficiency is improving and energy storage capacity is increasing, solar-powered vehicles are becoming more practical and viable for everyday use. These advancements are enabling vehicles to capture and store more solar energy, extending their driving range and reducing reliance on external charging sources. For instance, EMBER reported that national targets revealed at COP28 will reach 7,238 GW of renewable energy capacity by 2030, indicating a robust pipeline that supports complementary technologies like solar vehicles. Moreover, innovations in lightweight materials and aerodynamics are supporting the energy optimization of solar vehicles, enhancing their appeal to users and investors alike. Besides, as solar panels are becoming more efficient, they are contributing a larger share of the energy required to power the vehicle. This extension of the driving range through solar energy supplementation is a significant attraction for users.

Implementation of favorable government initiatives

Government policies, incentives, and regulations have a significant impact on the adoption of solar vehicles. Supportive policies, such as tax incentives, rebates, and preferential treatment for solar-powered vehicles, are encouraging people to consider solar options. Additionally, regulations aimed at reducing emissions and promoting sustainable transportation solutions are providing a favorable environment for the growth of the market. Clear guidelines for vehicle safety, infrastructure development, and energy standards are further enhancing user confidence in adopting solar vehicles. Moreover, government initiatives often include funding for research and development (R&D) in solar vehicle technology. These investments are driving innovations, leading to advancements in solar panels, energy storage systems, and vehicle efficiency. The availability of funding is encouraging manufacturers and researchers to collaborate on enhancing solar vehicle technology, ultimately benefiting users with improved performance and functionality. According to the International Energy Agency (IEA), global energy investment is set to reach USD 3.3 Trillion in 2025.

Solar Vehicle Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global solar vehicle market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on propulsion type, vehicle type, battery type, solar panel type, and charging type.

Analysis by Propulsion Type:

- HEV

- PHEV

- BEV

HEV held 98.8% of the market share in 2024. HEVs offer the perfect balance between conventional fuel systems and renewable solar-electric technology, making them practical and widely acceptable for users. HEVs integrate solar panels to supplement battery charging, extending driving range and reducing fuel usage without complete reliance on charging infrastructure. This versatility makes HEVs attractive in regions with limited EV charging facilities while still appealing to eco-conscious buyers. Their ability to provide backup through conventional fuel ensures reliability for long-distance travel, which is a crucial user preference. Automakers are integrating solar panels on HEV rooftops and hoods to optimize energy efficiency and enhance sustainability. Additionally, HEVs face fewer cost and technological barriers compared to fully solar-powered vehicles, accelerating their adoption in mainstream markets. As per the solar vehicle market forecast, with the growing demand for transitional green mobility solutions, HEVs will continue to dominate the industry as a highly efficient and practical choice.

Analysis by Vehicle Type:

- Passenger Cars

- Commercial Vehicles

Passenger cars account for 40.8% of the market share. They represent the largest segment of personal mobility, where the demand for eco-friendly and energy-efficient solutions is the highest. People are seeking sustainable alternatives to reduce carbon footprints, and solar-powered passenger cars align perfectly with this shift. Automakers are focusing on developing compact and mid-sized solar cars that integrate photovoltaic panels to extend range, minimize dependency on charging stations, and lower fuel costs. Since passenger cars are utilized for daily commuting and city travel, the integration of solar panels provides practical benefits like trickle charging and enhanced efficiency in stop-and-go traffic. Government agencies and manufacturers are also offering incentives and launching pilot projects to boost adoption in this segment. Compared to buses or commercial vehicles, passenger cars are easier to scale due to lower upfront costs and higher market demand.

Analysis by Battery Type:

- Lithium-ion

- Lead-Acid

- Others

Lithium-ion represents the largest market share since it offers significantly higher storage capacity in a compact size, enabling longer driving ranges and better performance. Lithium-ion batteries possess superior energy density, long cycle life, and lightweight design, which are essential for maximizing the efficiency of solar-powered mobility. Their ability to charge and discharge quickly makes them ideal for pairing with solar panels, which generate intermittent power throughout the day. Moreover, advancements in lithium-ion technology have improved safety, reduced charging times, and lowered costs, making them more commercially viable for automakers. Widespread use of lithium-ion batteries in electric vehicles (EVs) and consumer electronics is also creating economies of scale, further driving affordability. With solar vehicles requiring efficient storage to employ captured solar energy effectively, lithium-ion remains the preferred choice. Its balance of efficiency, durability, and cost-effectiveness ensures it continues to dominate the market’s battery type segment.

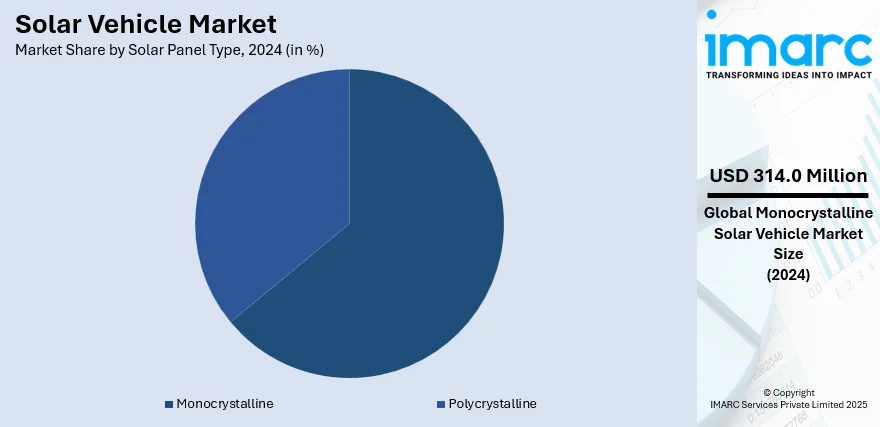

Analysis by Solar Panel Type:

- Monocrystalline

- Polycrystalline

Monocrystalline accounts for 62.8% of the market share. Monocrystalline panels offer superior efficiency, compact design, and durability, which are crucial for integration into vehicles with limited surface areas. Compared to polycrystalline or thin-film panels, they deliver higher energy output per square meter, maximizing solar capture even in small areas like rooftops and hoods. Their high efficiency in low-light and partial-shade conditions makes them ideal for real-world driving scenarios where sunlight availability can fluctuate. Additionally, monocrystalline panels have a longer lifespan and better aesthetic appeal, which enhances user acceptance in passenger cars and premium vehicles. Their energy yield and long-term benefits outweigh the investment for automakers and users alike. With continuous improvements in photovoltaic technology and decreasing costs, monocrystalline panels remain the most reliable and widely adopted choice for solar vehicles, driving their dominance in this segment of the market.

Analysis by Charging Type:

- Slow Charging

- Fast Charging

Fast charging holds the biggest market share as it addresses the user concern about charging time by significantly minimizing inactivity and making solar vehicles more practical for daily use. While solar panels can provide supplemental energy, vehicles still require efficient charging solutions for extended trips or low-sunlight conditions. Fast charging ensures quick replenishment of batteries, enabling longer driving ranges and enhancing user convenience. This capability is especially important in regions with the growing EV adoption, where charging infrastructure development prioritizes speed and accessibility. Automakers are integrating fast-charging compatibility into solar vehicles to enhance market appeal and align with user expectations shaped by modern EV standards. Furthermore, the rise of smart charging networks and renewable-powered fast-charging stations is reinforcing the adoption. By offering a seamless blend of solar supplementation and rapid charging, this segment ensures greater usability and reliability, securing fast charging’s leadership in the market.

Regional Analysis:

- North America

- Europe

- Asia-Pacific

- Rest of the World

North America, accounting for a share of 37.6%, enjoys the leading position in the market. The region benefits from significant government initiatives, including tax incentives, subsidies, and funding programs aimed at promoting renewable energy-based transportation. The presence of leading automotive companies and startups investing in R&D activities is further strengthening the market. The region’s advanced infrastructure, high adoption of EVs, and well-established charging networks provide a supportive ecosystem for solar vehicles to flourish. As per the IMARC Group, the United States EV market size reached USD 186.5 Billion in 2024. Additionally, rising fuel prices, increasing concerns about climate change, and a strong shift towards eco-friendly and energy-efficient solutions are driving the demand. The region’s emphasis on reducing carbon emissions and achieving clean energy targets aligns with the adoption of solar vehicles. With continuous innovations in solar panels, energy storage, and smart mobility solutions, North America is well-positioned to remain at the forefront of the market.

Key Regional Takeaways:

United States Solar Vehicle Market Analysis

The United States holds 85.80% of the market share in North America. The United States solar vehicle market is gaining traction, driven by increasing investments in advanced mobility technologies and supportive regulatory frameworks promoting cleaner transport alternatives. A rising inclination towards energy self-sufficiency and the integration of renewable energy sources within transportation networks are further catalyzing the demand. According to Clean Investment Monitors, during the first quarter of 2025, clean energy and transportation spending in the United States totaled USD 67.3 Billion, marking a 6.9% increase from Q1 2024, signaling consistent capital inflows into green transport initiatives like solar vehicles. The proliferation of smart city initiatives, coupled with the expansion of charging infrastructure integrated with solar grids, is fostering innovations in vehicle design and energy utilization. The market also benefits from tax credits and incentive schemes aligned with sustainability goals, encouraging individuals and fleet operators to transition towards solar-powered alternatives. Advancements in energy storage and photovoltaic panel efficiency are contributing to extended driving ranges, enhancing the practicality of solar mobility in diverse settings. Overall, the US market reflects a dynamic shift towards assimilating solar technologies into transportation to align with long-term carbon neutrality objectives.

Europe Solar Vehicle Market Analysis

The Europe solar vehicle market is witnessing notable growth, propelled by stringent environmental policies and ambitious regional decarbonization goals. Governments are actively supporting the transition to low-emission mobility through dedicated research programs and cross-border collaborations. According to the European Commission, by 2030, at least 30 Million zero-emission cars are set to be operational on European roads, underscoring a robust shift in user behavior and policy alignment. The growing emphasis on circular economy practices is stimulating innovations in sustainable vehicle components, including recyclable solar panels and lightweight materials. Increasing interest in shared mobility models is encouraging the development of solar-powered fleets tailored for urban commuting and last-mile connectivity. Public-private partnerships are enabling the creation of multi-modal transportation systems where solar vehicles play an integral role. Additionally, the shift towards digital infrastructure and smart traffic management is facilitating the integration of solar vehicles with real-time energy monitoring systems.

Asia-Pacific Solar Vehicle Market Analysis

The Asia-Pacific solar vehicle market is expanding rapidly, driven by the region’s strong focus on renewable energy adoption and transportation electrification. The rising demand for alternative mobility solutions in densely populated urban areas is encouraging the deployment of solar-powered vehicles. According to the Press Information Bureau (PIB), as of June 2025, non-fossil fuel sources accounted for 235.7 GW (49%) of the overall installed capacity in the area, comprising 226.9 GW from renewable energies and 8.8 GW from nuclear power, highlighting the growing foundation for solar-powered infrastructure. Government-backed programs aimed at localizing component manufacturing are accelerating innovations in solar vehicle platforms. Furthermore, advancements in lightweight chassis design and flexible solar cell integration are increasing vehicle adaptability across different road conditions. Enhanced awareness about long-term operational cost savings is influencing both commercial and individual users to explore solar-powered mobility.

Latin America Solar Vehicle Market Analysis

The solar vehicle market in Latin America is gaining momentum due to rising interest in low-cost renewable transportation alternatives. High solar irradiance across many parts of the region presents favorable conditions for solar mobility. Reports indicate that Brazil’s solar and energy storage markets have surpassed 53 GW in capacity as of early 2025, with growth driven by distributed generation and strong demand from commercial, industrial, and agribusiness sectors, establishing fertile ground for solar vehicle integration. Public awareness campaigns promoting sustainable transport are encouraging user openness towards solar vehicle adoption. Additionally, educational institutions and innovation hubs are increasingly involved in solar transport research, fostering localized innovation. These developments are translating into pilot projects and deployments in semi-urban areas. The region’s focus on sustainability and energy access is expected to fuel long-term solar mobility growth.

Middle East and Africa Solar Vehicle Market Analysis

The Middle East and Africa solar vehicle market is progressing steadily, supported by high solar potential and the growing strategic interest in clean energy. The Center on Global Energy Policy at Columbia notes that by 2030, Saudi Arabia plans to obtain at least 50% of its electricity from renewable sources, increasing its capacity to 130 GW, with solar energy projected to contribute 58.7 GW, illustrating a robust foundation for solar transportation initiatives. Infrastructure developments tailored for clean mobility, including solar-integrated transport corridors, are emerging in select urban centers. In remote or off-grid areas, solar vehicles offer practical solutions for improved connectivity. Local technological capacity-building initiatives are also fostering homegrown innovations, shaping a broader regional vision for sustainable transport.

Competitive Landscape:

Key players are investing heavily in research, innovation, and commercialization of advanced technologies. Automotive manufacturers and startups are focusing on integrating high-efficiency photovoltaic panels, lightweight materials, and improved battery storage to enhance the performance and range of solar vehicles. Their collaborations with technology providers, energy companies, and research institutions are accelerating product development and cost reduction. Key players are also influencing the market growth through strategic partnerships, pilot projects, and large-scale demonstrations that build user trust and awareness. By expanding production capacity, securing government support, and offering eco-friendly mobility solutions, these companies are shaping industry standards and increasing adoption. Their commitment to sustainability and innovation is pivotal in transforming solar vehicles from niche concepts into mainstream transportation solutions. For instance, in January 2025, Aptera Motors unveiled its solar EV at CES 2025, featuring a 400-mile range on a single charge and 40 miles of daily driving powered by solar energy. Featuring a three-wheeled configuration, a body draped in solar panels, and a lightweight carbon fiber structure, the vehicle transformed off-grid driving capabilities for areas abundant in sunlight.

The report provides a comprehensive analysis of the competitive landscape in the solar vehicle market with detailed profiles of all major companies, including:

- Ford Motor Company

- General Motors Company

- Hanergy Thin Film Power EME B.V.

- Jinko Solar

- Lightyear

- Mahindra & Mahindra Limited

- Nissan Motor Company Ltd

- Toyota Motor Corporation

- Volkswagen AG

Latest News and Developments:

- July 2025: Western Sydney University launched UNLIMITED 6.0, its latest and most advanced solar car for the 2025 Bridgestone World Solar Challenge. Showcasing lightweight elements, wireless control, and enhanced solar efficiency for winter scenarios, the three-wheeled automobile illustrated advanced design and internal production focused on maximizing performance through precise engineering excellence.

- February 2025: Bilal Mir, a mathematician from Kashmir, introduced BISA Ray, India’s inaugural high-tech solar vehicle featuring 5D solar panels, a unique patented chassis, and the capability to charge even on overcast days. Created over 15 years with three global patents, the vehicle represented a key achievement in India’s grassroots innovation for sustainable automotive design.

- January 2025: At the Bharat Mobility Global Expo 2025, Vayve Mobility launched EVA, the first solar-powered EV for the mass market in India. Starting at INR 3.25 Lakh, the EVA provided a range of 250 km and a maximum speed of 70 kmph. Its incorporation of smart solar-electric technology sought to transform economical, sustainable urban transportation with a running cost of 50 paise/km.

Solar Vehicle Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Propulsion Types Covered | BEV, HEV, PHEV |

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles |

| Battery Types Covered | Lithium-Ion, Lead-Acid, Others |

| Solar Panel Types Covered | Monocrystalline, Polycrystalline |

| Charging Types Covered | Slow Charging, Fast Charging |

| Regions Covered | North America, Europe, Asia Pacific, Rest of the World |

| Companies Covered | Ford Motor Company, General Motors Company, Hanergy Thin Film Power EME B.V., Jinko Solar, Lightyear, Mahindra & Mahindra Limited, Nissan Motor Company Ltd, Toyota Motor Corporation, Volkswagen AG, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the solar vehicle market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global solar vehicle market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the solar vehicle industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The solar vehicle market was valued at USD 499.97 Million in 2024.

The solar vehicle market is projected to exhibit a CAGR of 32.43% during 2025-2033, reaching a value of USD 6,393.22 Million by 2033.

Rising fuel prices and increasing concerns about environmental pollution are encouraging people and industries to adopt vehicles powered by renewable sources like solar energy. Advancements in photovoltaic technology have made solar panels more efficient, lightweight, and cost-effective, enabling their integration into cars, buses, and even trucks. Supportive government policies, tax incentives, and investments in green mobility are further accelerating the adoption of solar vehicles.

North America currently dominates the solar vehicle market, accounting for a share of 37.6% in 2024, due to strong government incentives, advanced R&D activities, and the presence of major automotive innovators. Rising fuel prices and high adoption of electric mobility are creating a favorable ecosystem.

Some of the major players in the solar vehicle market include Ford Motor Company, General Motors Company, Hanergy Thin Film Power EME B.V., Jinko Solar, Lightyear, Mahindra & Mahindra Limited, Nissan Motor Company Ltd, Toyota Motor Corporation, Volkswagen AG, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)