Solid State Transformer Market Size, Share, Trends and Forecast by Product, Component, Voltage Level, Application, End User, and Region, 2025-2033

Solid State Transformer Market Size and Share:

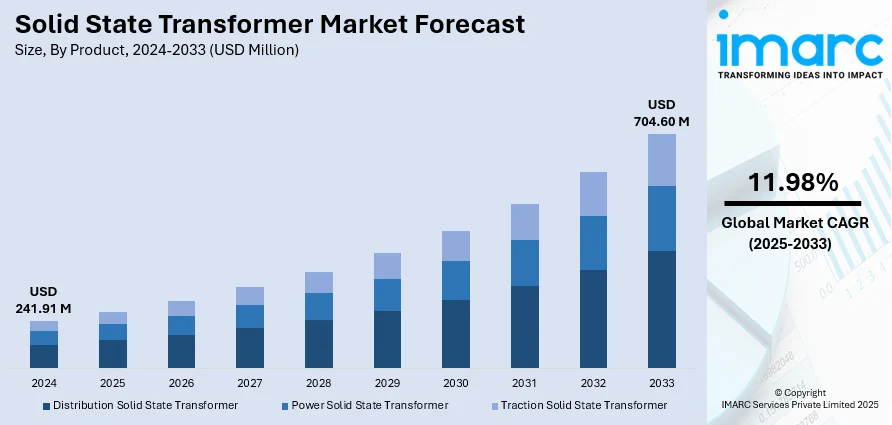

The global solid state transformer market size was valued at USD 241.91 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 704.60 Million by 2033, exhibiting a CAGR of 11.98% from 2025-2033. Europe currently dominates the market, holding a market share of 40% in 2024. The market is dominated by growing demand for smart grids, renewable energy integration, and transportation electrification, which necessitate compact, efficient, and robust power conversion. Growing usage of electric vehicles, energy storage systems, and microgrids further drives growth, as SSTs provide faster response, bidirectional power flow, and better voltage regulation. Technological innovations in semiconductor-based devices, wide-bandgap materials such as SiC and GaN, and the government's push towards energy efficiency also serve as main drivers of solid state transformer market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 241.91 Million |

| Market Forecast in 2033 | USD 704.60 Million |

| Market Growth Rate (2025-2033) | 11.98% |

In 2024, a record 92.5% of all new electricity generation capacity worldwide came from clean sources, with solar alone contributing 77.8% of additions. This rapid shift toward renewables drives strong demand for solid state transformers (SSTs), which efficiently manage variable and bidirectional power flows. SSTs are crucial for microgrids and smart grids because they provide accurate voltage management, enhanced power quality, and real-time monitoring, which regular transformers cannot match. Advanced features like fault detection and dynamic load management are also made possible by them. As utilities prioritize energy efficiency, resilience, and integration of distributed resources, SSTs play a critical role in supporting solid state transformer market outlook

To get more information on this market, Request Sample

In the U.S., SST market is driven by rising electric vehicle (EV) adoption, federal and state incentives, and the need for advanced charging infrastructure with a market share of 86.80%. With EV sales steadily growing, demand increases for efficient, compact, and high-performance power converters that can support fast charging and vehicle-to-grid (V2G) applications. SSTs enable bi-directional energy flow, helping utilities balance load, improve grid stability, and integrate renewable energy sources more effectively. Smart city initiatives and modernization of aging power infrastructure further boost adoption, as SSTs offer high efficiency and minimal energy loss. Additionally, strong government investments in clean energy and electrification policies reinforce SST deployment as a cornerstone technology for sustainable transportation and resilient U.S. energy systems.

Solid State Transformer Market Trends:

Integration of Renewable Energy and Smart Grids

In 2024, global renewable energy capacity surged by 585 GW, marking a 15.1% year-on-year increase and bringing total installed capacity to 4,448 GW. This unprecedented growth highlights the accelerating penetration of solar and wind power, which in turn drives demand for solid state transformers (SSTs). Traditional transformers often struggle with the variability and bidirectional power flows associated with renewable integration, whereas SSTs excel with their compact design, high-frequency power conversion, and ability to provide precise voltage regulation and real-time monitoring. Their support for bidirectional energy flow makes them essential for microgrids and distributed energy systems. As utilities embrace smart grid infrastructures, SSTs further enable advanced functions like dynamic load management, grid stabilization, and fault detection. Combined with regulatory incentives for renewable adoption, these factors position SSTs as a cornerstone technology for building resilient, efficient, and future-ready energy networks.

Advancements in Semiconductor Technology (SiC and GaN)

Another key solid state transformer market trends is the continued technological advancements in semiconductor materials, specifically silicon carbide (SiC) and gallium nitride (GaN) that is further supporting the market growth. These wide-bandgap semiconductors facilitate high-frequency switching, increased efficiency, and lower heat generation, making SSTs smaller, lighter, and more reliable compared to traditional transformers. SiC and GaN devices also provide increased fault tolerance and dynamic load management support, qualifying SSTs for use in future grids, microgrids, and industry. Ongoing R&D in power electronics lowers the cost of manufacturing, extends life, and enhances energy density, driving adoption. These improvements also allow integration with renewable energy, energy storage systems, and EV charging infrastructure. As the semiconductor business is evolving fast and shrinking in cost, high-performance devices are a key facilitator, placing SST technology within reach and economically feasible for widespread deployment.

Electrification of Transportation and EV Adoption

In 2024, global electric vehicle (EV) sales reached 17.1 million units, reflecting a 25% year-over-year increase and underscoring the rapid adoption of EVs worldwide. As charging infrastructure requires highly efficient, compact, and controllable power conversion systems thus supporting the solid-state transformer market growth. SSTs address these needs by enabling fast, bidirectional power transfer, precise voltage regulation, and lower energy losses compared to conventional transformers. Their capability to support vehicle-to-grid (V2G) integration enhances grid stabilization and energy storage, making them vital for widespread EV adoption. Additionally, government incentives and policy support for EV deployment are intensifying demand for advanced transformer technologies. With urbanization and smart cities accelerating the need for robust charging networks, SSTs are becoming indispensable for reliable, scalable, and energy-efficient electrification of future transportation systems.

Solid State Transformer Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global solid state transformer market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, component, voltage level, application, and end user.

Analysis by Product:

- Distribution Solid State Transformer

- Power Solid State Transformer

- Traction Solid State Transformer

Power solid state transformers hold the highest number of shares due to their widespread application in power transmission, distribution, and renewable energy integration. They support high power levels, making them essential for utility-scale applications like smart grids, solar and wind farms, and industrial-scale operations. Power SSTs facilitate effective voltage transformation, reverse energy flow, and grid stability with lower energy losses than traditional transformers. Their capacity to incorporate distributed energy resources, facilitate microgrids, and enable complex features such as dynamic load control and fault detection also boost demand. With increasing global electricity demand and grid upgrade, power SSTs lead adoption as an anchor technology for robust, efficient, and forward-looking energy infrastructure.

Analysis by Component:

- Converters

- High-frequency Transformers

- Switches

- Others

Converters control the solid state transformer market demand based on their vital function in facilitating efficient power conversion, voltage regulation, and bidirectional energy transfer. They are pivotal in the integration of renewable energy sources, electric vehicles, and energy storage systems with modern grids because they manage variable inputs without compromising stability and reliability. Converters also improve power quality, cut energy losses, and enable sophisticated capabilities such as real-time monitoring, grid stabilization, and dynamic load management. As smart grids, microgrids, and urban electrification schemes expand rapidly, high-performance converters remain in high demand. Their flexibility and responsiveness make them the cornerstone of SST systems, propelling their leadership in world market demand in both energy and transportation industries.

Analysis by Voltage Level:

- HV/MV

- MV/LV

Based on the solid state transformer market forecast, HV/MV accounts for most shares of 65.8% because of its extensive application in transmission, distribution, and integration of renewable energy sources. Such transformers are essential for effectively stepping down power from transmission lines of high voltage to medium voltage appropriate for distribution grids. With increasing need for smart grids, EV charging infrastructure, and renewable integration, HV/MV SSTs facilitate bidirectional power transfer, improved grid stability, and decreased energy losses than traditional systems. Their real-time monitoring, fault detection, and dynamic load management capabilities make them vital for the grid modernization process. While efficiency and reliability are top priorities for utilities and industries, HV/MV SSTs lead in adoption, guaranteeing stable, flexible, and robust energy networks across the globe.

Analysis by Application:

- Alternative Power Generation

- Electric Vehicle Charging Stations

- Power Distribution

- Traction Locomotives

- Others

As per the solid state transformer market forecast, HV/MV is the largest shares because of its extensive application in power distribution, transmission, and integration of renewable energy sources. These transformers play an important role in stepping down power from high-voltage transmission lines to medium-voltage levels appropriate for distribution networks efficiently. With increasing demand for smart grids, electric vehicle charging, and renewable integration, HV/MV SSTs facilitate bidirectional power flow, increased grid stability, and lower energy loss than traditional systems. Their real-time monitoring, fault detection, and dynamic load management capabilities make them essential for the grid infrastructure modernization process. With efficiency and reliability as utmost concerns for utilities and industries, HV/MV SSTs lead adoption in ensuring stable, flexible, and resilient energy networks across the globe.

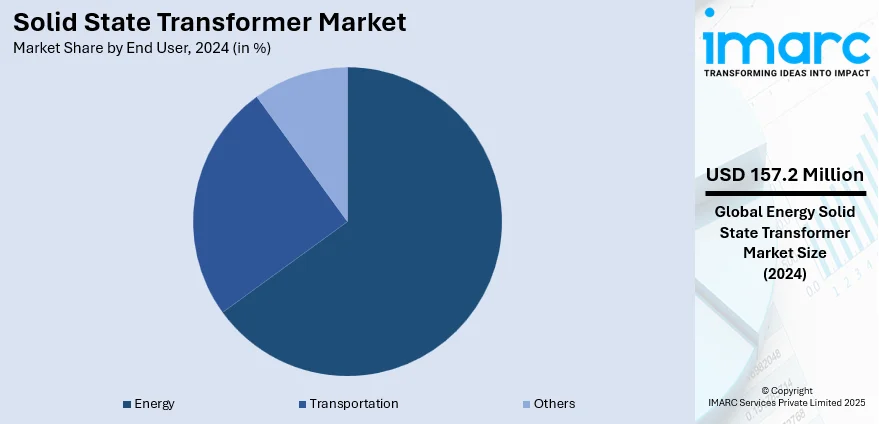

Breakup by End User:

- Energy

- Transportation

- Others

The energy sector dominates the solid-state transformer (SST) market with a market share of 65.0%, driven by rising integration of renewable energy, smart grids, and distributed generation. SSTs enhance efficiency, enable bidirectional power flow, and support voltage regulation, making them vital for renewable energy plants and power utilities. Their adoption ensures grid stability, seamless renewable integration, and modernization of energy infrastructure globally.

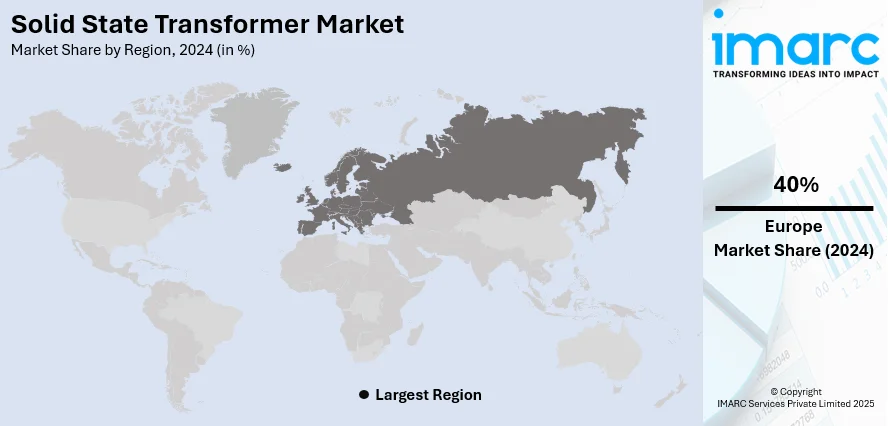

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Europe is the leading region in the solid state transformer market analysis with a market share of 40%, driven by its strong commitment to renewable energy integration, smart grid development, and rapid electrification of transportation. The European Union’s ambitious decarbonization targets, including achieving climate neutrality by 2050, are accelerating investments in advanced grid infrastructure. Widespread adoption of electric vehicles, supported by government incentives and stringent emission regulations, further fuels the need for efficient and flexible power conversion systems. Additionally, Europe’s focus on distributed energy resources, microgrids, and resilient energy networks enhances demand for SSTs, which offer bidirectional power flow, precise voltage control, and grid stabilization. Continuous research, supportive regulations, and collaborations across industries position Europe at the forefront of SST technology adoption and innovation.

Key Regional Takeaways:

North America Solid State Transformer Market Analysis

The SST market in North America is growing robustly, propelled by increased demand for smart power distribution solutions, renewable energy integration, and efficient grid modernization requirements. SSTs are more efficient, space-saving, have real-time monitoring facilities, and improved voltage regulation compared to conventional transformers and thus are well suited for smart grids, electric vehicle (EV) charging stations, and distributed energy systems. The region's swift uptake of clean energy resources like wind and solar, as well as rising investments in smart grids and microgrids, drives SST demand. The rapid growth of EVs and the demand for quick, effective charging solutions extend the market further. Government policies encouraging clean energy and sustainability also contribute to market growth. High upfront costs and low awareness are, however, the challenges. Even with this, technological progress and increased R&D expenditure should minimize costs in the long run. In general, North America is a core market for SST implementation, leading the future energy revolution.

United States Solid State Transformer Market Analysis

United States has witnessed an increasing deployment of electric vehicle charging stations, significantly boosting solid state transformer adoption. For instance, in 2025, America is on track to add 16,700 public fast-charging ports by the end of this year, which would be about 2.4 times the number of ports added in 2022. These transformers provide better efficiency, compactness, and voltage regulation suitable for fast-charging infrastructure. As the electric vehicle ecosystem expands, the demand for reliable, flexible power conversion systems is rising. Solid state transformers enable bidirectional power flow and high-frequency operation, essential for supporting rapid charging capabilities. Their modular design and integration with advanced power electronics make them a suitable solution for modern EV charging stations, ensuring optimized power delivery and grid stability.

Asia Pacific Solid State Transformer Market Analysis

Asia-Pacific is experiencing rising demand for smart grids driven by expanding smart cities, accelerating the need for solid state transformers. For instance, as of May 9, 2025, a total of 7,555 projects 94% of the total 8,067 smart cities projects have been completed in India. With urban infrastructure transforming through digitalization, smart grids require intelligent power systems that enable efficient load management, real-time monitoring, and energy efficiency. Solid state transformers meet these requirements by offering dynamic voltage regulation, enhanced fault isolation, and seamless integration with renewable and distributed energy sources. Their application supports stable, resilient power distribution networks crucial for smart city functionality, aligning with the broader goal of sustainable and connected urban development across the region.

Europe Solid State Transformer Market Analysis

Europe is advancing renewable energy adoption, which fuels the integration of solid-state transformers into modern power systems. According to reports, in the first quarter of 2025, 42.5% of net electricity generated in the EU came from renewable energy sources. With increasing penetration of solar and wind energy, power networks require advanced technologies capable of handling variability and bidirectional energy flow. Solid state transformers play a vital role in converting and regulating fluctuating inputs, enabling grid synchronization and efficient power transfer. Their compact design and digital control features support decentralized renewable integration, offering enhanced grid flexibility, minimal transmission losses, and real-time adaptability, which are essential for managing the evolving energy landscape in renewable-centric regions.

Latin America Solid State Transformer Market Analysis

Latin America is undergoing urbanization, resulting in rising power distribution needs that contribute to solid state transformer adoption. For instance, by 2025, 315 Million people will live in Latin America’s large cities where the per-capita GDP is estimated to reach USD 23,000. Urban expansion requires reliable and adaptable distribution systems, and solid-state transformers offer scalable solutions with improved load handling, power quality, and compact installation options.

Middle East and Africa Solid State Transformer Market Analysis

Middle East and Africa are witnessing rising electricity demand, encouraging utilities to integrate solid state transformers into evolving grids. For instance, UAE’s power capacity is set to reach 79.1GW by 2035. These transformers support high-efficiency distribution and voltage adaptability, catering to expanding residential and commercial electricity consumption patterns.

Competitive Landscape:

The competitive environment is marked by quick pace of technological change, strategic partnerships, and product differentiation. The players are making significant investments in research and development to boost efficiency, reliability, and miniaturization by utilizing state-of-the-art semiconductor technology like SiC and GaN. Competition in the market is fueled by the capability to provide tailor-made solutions to applications across smart grids, renewable integration, and electric vehicle infrastructure. Partnerships with utility companies and pilot project participation are typical strategies for achieving market presence. Cost saving, scalability, and regulatory compliance are also essential factors driving competitiveness. Generally, the environment is dynamic, with innovation and positioning constituting the drivers of market leadership and adoption rates.

The report provides a comprehensive analysis of the competitive landscape in the solid-state transformer market with detailed profiles of all major companies, including:

- ABB Ltd.

- Alstom SA

- Eaton Corporation PLC

- Electric Research and Manufacturing Cooperative Inc. (ERMCO) (Arkansas Electric Cooperatives Inc.)

- General Electric Company

- Hitachi Ltd.

- Kirloskar Electric Company Ltd.

- Mitsubishi Electric Corporation

- Schneider Electric SE

- Siemens AG

- Synergy Transformers

- Vollspark

Latest News and Developments:

- July 2025: Eaton agreed to acquire Resilient Power Systems, a Texas-based firm specializing in solid-state transformer technology, to enhance its capabilities in EV charging and high-power DC applications. The deal, announced in July 2025, positioned Eaton to tap into future opportunities in data centers, port electrification, and energy storage.

- June 2025: Heron Power, led by former Tesla executive Drew Baglino, unveiled a breakthrough solid-state transformer aimed at easing the grid strain and mitigating transformer shortages, following a USD 38 Million funding round backed by investors like Breakthrough Energy and JB Straubel. The innovation positioned the company to tackle widespread power electronics issues across solar, fusion, and energy storage sectors.

- April 2025: Former Tesla executive Drew Baglino launched Heron Power, a startup developing solid-state transformers to modernize the aging electric grid and began raising USD 30–USD 50 Million in Series A funding, reportedly led by Capricorn Investment Group, Axios reported.

- April 2025: Heron Power, led by former Tesla VP Drew Baglino, launched a new venture focused on solid-state transformers, aiming to modernize century-old grid infrastructure. The startup raised USD 30–USD 50 Million in Series A funding to develop compact, actively managed transformers suited for renewable energy integration.

- March 2025: ABB invested in DG Matrix to advance solid-state transformer solutions aimed at optimizing AI data center power systems and renewable microgrids. The collaboration enabled the development of a compact, energy-efficient platform that replaced up to 20 electrical devices, enhancing performance and reducing energy costs.

Solid State Transformer Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Distribution Solid State Transformer, Power Solid State Transformer, Traction Solid State Transformer |

| Components Covered | Converters, High-frequency Transformers, Switches, Others |

| Voltage Levels Covered | HV/MV, MV/LV |

| Applications Covered | Alternative Power Generation, Electric Vehicle Charging Stations, Power Distribution, Traction Locomotives, Others |

| End Users Covered | Energy, Transportation, Others |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ABB Ltd., Alstom SA, Eaton Corporation PLC, Electric Research and Manufacturing Cooperative Inc. (ERMCO) (Arkansas Electric Cooperatives Inc.), General Electric Company, Hitachi Ltd., Kirloskar Electric Company Ltd., Mitsubishi Electric Corporation, Schneider Electric SE, Siemens AG, Synergy Transformers and Vollspark |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the solid state transformer market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global solid state transformer market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the solid state transformer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The solid state transformer market was valued at USD 241.91 Million in 2024.

The solid state transformer market is projected to exhibit a CAGR of 11.98% during 2025-2033, reaching a value of USD 704.60 Million by 2033.

The solid state transformer market is driven by increasing renewable energy integration, growing adoption of electric vehicles, and rising demand for smart grids. SSTs enable efficient bidirectional power flow, improved voltage regulation, and compact design, making them ideal for modern power networks. Advancements in semiconductor technologies like SiC and GaN further enhance efficiency and reliability, while government initiatives promoting energy efficiency and grid modernization accelerate market growth.

Power solid state transformers (SSTs) hold the majority market share due to their critical role in power transmission, distribution, and renewable energy integration. They enable efficient voltage conversion, bidirectional energy flow, and grid stabilization, making them essential for modernizing energy infrastructure and supporting reliable, sustainable, and high-capacity electricity networks.

Converters dominate the SST market as they provide efficient power conversion, precise voltage regulation, and bidirectional energy flow. Essential for integrating renewables, EVs, and energy storage, they enhance grid stability, reduce losses, and support smart grid functionalities, making them a key driver of demand in modern power distribution systems.

HV/MV holds the majority share of 65.8% due to its vital role in power transmission, distribution, and renewable energy integration. These transformers ensure efficient voltage conversion, bidirectional energy flow, and grid stability, making them essential for modern smart grids and large-scale energy infrastructure.

The energy sector dominates the solid state transformer (SST) market with a share of 65.0% as it is central to renewable energy integration, grid modernization, and efficient power distribution. SSTs enhance voltage regulation, bidirectional power flow, and stability, making them essential for utilities to build resilient, sustainable, and future-ready energy networks worldwide.

Europe leads the solid state transformer market with a market share of 40% due to its strong focus on renewable energy adoption, smart grid implementation, and rapid electric vehicle electrification. Supportive government policies, regulatory incentives, and investments in advanced grid infrastructure drive SST deployment, positioning the region at the forefront of efficient, resilient, and modern energy networks.

Some of the major players in the solid state transformer market include ABB Ltd., Alstom SA, Eaton Corporation PLC, Electric Research and Manufacturing Cooperative Inc. (ERMCO) (Arkansas Electric Cooperatives Inc.), General Electric Company, Hitachi Ltd., Kirloskar Electric Company Ltd., Mitsubishi Electric Corporation, Schneider Electric SE, Siemens AG, Synergy Transformers and Vollspark, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)