South Africa Advertising Market Size, Share, Trends and Forecast by Type and Region, 2025-2033

South Africa Advertising Market Overview:

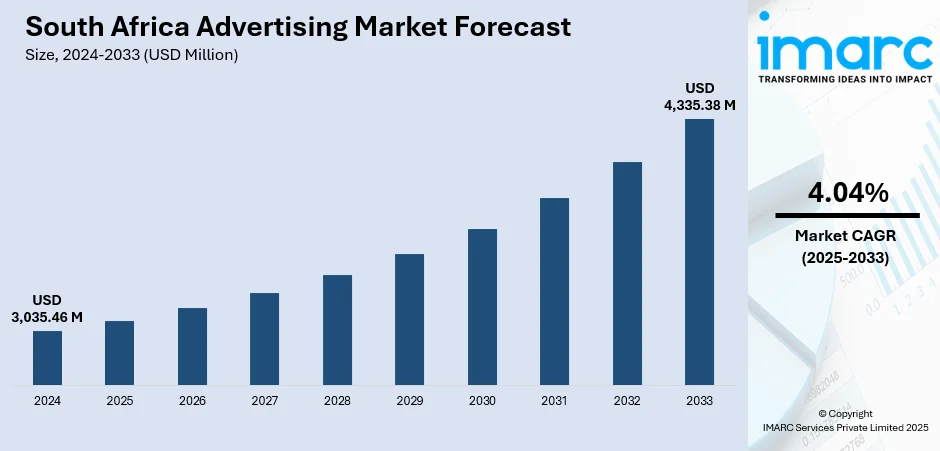

The South Africa advertising market size reached USD 3,035.46 Million in 2024. The market is projected to reach USD 4,335.38 Million by 2033, exhibiting a growth rate (CAGR) of 4.04% during 2025-2033. The market is evolving rapidly, driven by digital transformation, changing consumer behavior, and growing demand for targeted campaigns. Companies are increasingly using new age strategies in different forms of advertising to increase brand visibility and interaction. Conventional media remains relevant, but digital media are picking up a strong pace, impacting the way brands communicate with the audience. These relationships are important to appreciate the South Africa advertising market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3,035.46 Million |

| Market Forecast in 2033 | USD 4,335.38 Million |

| Market Growth Rate 2025-2033 | 4.04% |

South Africa Advertising Market Trends:

Rise of Entrepreneurial Activity

The growth of small and medium enterprises (SMEs) and heightened entrepreneurial efforts throughout South Africa are enhancing the development of the advertising sector. As SMEs aim to build their brands and compete across various industries, they need advertising services designed for constrained budgets while emphasizing significant visibility. This sector is driving the need for creative, affordable marketing strategies, including digital marketing, social media advertising, and grassroots initiatives. The entrepreneurial environment fosters flexibility and innovation, encouraging marketers to create scalable approaches that meet fast business expansion and evolving market demands. Furthermore, support from governmental efforts and private sector initiatives designed to promote entrepreneurship influence this trend, expanding advertising prospects. As these companies become more aware about the importance of strategic marketing for distinguishing their brands and attracting clients, their involvement serves as a driving force for growth and innovation in advertising sector.

To get more information on this market, Request Sample

Integration of Hyperlocal Print and Digital Advertising

The integration of conventional local newspapers with supportive digital platforms is allowing advertisers to execute more unified and focused campaigns that connect profoundly with particular communities. This method boosts audience interaction by utilizing reliable local media and broadening reach via online platforms. Hyperlocal advertising enables brands to customize messages based on the distinct preferences and requirements of targeted geographical audiences, enhancing relevance and impact. Moreover, the collaboration between print and digital formats offers advertisers increased versatility in media strategy and creative implementation. This combined approach enhances brand visibility and user engagement within the community, cultivating loyalty and trust. In 2024, Spark Media launched a new digital media sales arm to complement its existing print advertising solutions across Caxton's 115 local newspapers. This expansion included 58 local news websites, allowing Spark to offer integrated, hyperlocal print and digital campaigns. The initiative, branded as "leap into local," aimed to boost reach and engagement across South African communities.

Expansion of E-Commerce Platforms and Advertising Opportunities

With the rise of online retail, companies are more frequently utilizing digital advertising tools to engage with an expanding audience of tech-savvy shoppers. The growth of e-commerce offers novel opportunities for precise and quantifiable advertising, enabling brands to connect with clients directly in online retail spaces and marketplaces. This trend leads to the creation of unique ad formats designed for the online shopping experience, including sponsored product listings, brand storefronts, and customized display advertisements. The growing population of online shoppers is driving the need for advanced advertising strategies that improve visibility and conversion rates in competitive digital environments. As a result, the rise of e-commerce platforms not only broadens the advertising market's scope but also accelerates the implementation of performance-oriented and data-centric advertising approaches. In 2024, Amazon Ads launched Sponsored Ads and Brand Stores in South Africa, enabling eligible sellers and vendors to use Sponsored Products, Brands, Display, and Stores on Amazon.co.za. This launch supported businesses in reaching South Africa’s growing e-commerce market, expected to surpass 27 million online shoppers by 2028.

South Africa Advertising Market Growth Drivers:

Digital Transformation and Increased Internet Penetration

As internet usage grows, more people are engaging online, leading advertisers to redirect their spending from traditional media to digital channels. According to ITA, internet penetration increases from 68% in 2023 to more than 75% by 2025. This change is especially noticeable in the rise of mobile usage, as smartphones become less expensive and data prices reduce. These trends allow advertisers to connect with wider audiences through targeted messaging, utilizing data analytics and programmatic advertising tools. Social media sites, search engines, and online video channels are particularly appealing because of their ability to provide quantifiable outcomes and tailored content. Moreover, the adoption of e-commerce by individuals and businesses is driving the need for performance-focused advertising tactics. Companies are allocating resources to digital campaigns not just to enhance recognition but also to drive direct sales.

Increasing Role of Influencer Marketing and Peer Recommendations

Influencer marketing is becoming a critical approach to connect with specialized and difficult-to-reach audiences by utilizing the trustworthiness and relatability of content creators. This method leverages the trust that influencers have within their communities, frequently resulting in increased engagement and conversion rates versus conventional advertising. Advertisers partner with influencers to produce genuine, user-created content that appeals to specific demographics, improving brand recognition and loyalty. Recommendations from peers, disseminated via digital and offline social networks, enhance the effectiveness of these campaigns. This growing dependence on social proof redirects the advertising emphasis towards fostering community and tailored engagements. Additionally, the affordable nature and scalability of influencer campaigns make them appealing, particularly for smaller brands and SMEs. As a result, influencer marketing and peer influence are vital aspects supporting innovation and efficiency in South Africa’s changing advertising landscape.

Advancements in Data Analytics and Market Research

The growing complexity of data analysis and market research techniques serves as an essential factor in the growth of the South African advertising industry. Advertisers currently possess comprehensive client insights sourced from numerous data channels, allowing them to create more accurate targeting strategies. Improved analytics tools enable the assessment of campaign effectiveness, client interaction, and brand perception instantly, supporting quick adjustments to advertising strategies. This data-focused strategy reduces resource waste by making sure that messaging targets the most pertinent audiences at the best time. Moreover, developments in artificial intelligence (AI) and machine learning (ML) are offering new abilities in forecasting user behavior and tailoring advertisements. Market research, encompassing both qualitative and quantitative methods, fosters a deeper grasp of cultural subtleties and client motivations, essential in a diverse society such as South Africa.

South Africa Advertising Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type.

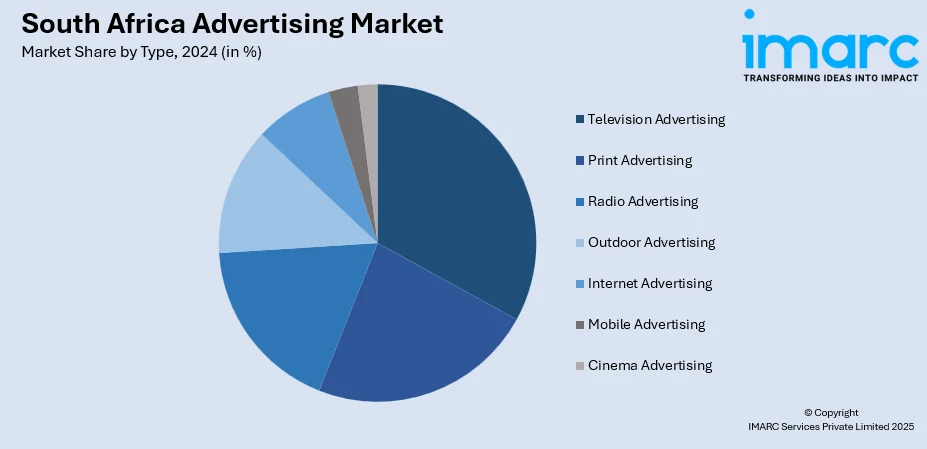

Type Insights:

- Television Advertising

- Print Advertising

- Newspaper Advertising

- Magazine Advertising

- Radio Advertising

- Outdoor Advertising

- Internet Advertising

- Search Advertising

- Display Advertising

- Classified Advertising

- Video Advertising

- Mobile Advertising

- Cinema Advertising

The report has provided a detailed breakup and analysis of the market based on the type. This includes television advertising, print advertising (newspaper advertising and magazine advertising), radio advertising, outdoor advertising, internet advertising (search advertising, display advertising, classified advertising, and video advertising), mobile advertising, and cinema advertising.

Regional Insights:

- Gauteng

- KwaZulu-Natal

- Western Cape

- Mpumalanga

- Eastern Cape

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Africa Advertising Market News:

- July 2025: South Africa’s Network X OOH has partnered with DoohClick, a global ad management platform, to enhance Out-of-Home advertising across urban and township areas. This collaboration integrates DoohClick’s advanced technology into Network X’s expanding digital network, improving campaign management, reporting, and scalability. Network X OOH works closely with grassroots entrepreneurs to deliver impactful advertising solutions. Together, they aim to drive a more efficient, inclusive, and authentic audience engagement throughout South Africa’s diverse advertising landscape.

- April 2025: MediaHeads 360 and Media Host launched a partnership to revolutionize community radio advertising in South Africa by introducing monitoring technology that verifies ad airtime. This ensures transparency and builds advertiser trust. The initiative enhances credibility and revenue potential for local community radio stations.

- March 2025: Kagiso Media Radio and Mediamark launched a groundbreaking campaign across East Coast Radio and Jacaranda FM called **'A Million & Change'**, blending massive cash prizes with advanced, real-time ad performance analytics. Advertisers gain access to live data dashboards and can contribute questions to gather first-party audience insights. The initiative marks a shift toward data-driven radio advertising in South Africa.

- October 2024: MTN’s Digital Services has appointed Aleph Group as its sales partner for the MTN Ads solution in South Africa. This collaboration enables advertisers to leverage MTN’s extensive first-party data for precise audience targeting across telco channels like SMS and platforms such as Ayoba, MTN’s all-in-one super app. The partnership offers device-agnostic, data-free, and rewards-based advertising solutions, providing businesses with immediate engagement and measurable attribution. With access to over millions of subscribers, this initiative aims to enhance digital advertising effectiveness in South Africa.

- July 2024: JCDecaux South Africa announced the integration of Programmatic Digital Out-of-Home (DOOH) advertising, combining traditional, digital, and automated methods for precise real-time targeting. This innovation allowed advertisers to dynamically adjust campaigns using data-driven insights. JCDecaux aimed to lead the future of OOH advertising across South Africa.

South Africa Advertising Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Regions Covered | Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Africa advertising market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Africa advertising market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Africa advertising industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the mark.

Key Questions Answered in This Report

The advertising market in South Africa was valued at USD 3,035.46 Million in 2024.

The South Africa advertising market is projected to exhibit a CAGR of 4.04% during 2025-2033, reaching a value of USD 4,335.38 Million by 2033.

The South Africa advertising market is driven by expanding digital adoption, increasing brand investment in innovative campaigns, and growing user engagement across multiple media platforms. Supportive government policies, strong economic activity, and rising demand for creative marketing solutions further support the market growth, offering opportunities for both domestic and international advertisers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)