South Africa Agribusiness Market Size, Share, Trends and Forecast by Product and Region, 2025-2033

South Africa Agribusiness Market Overview:

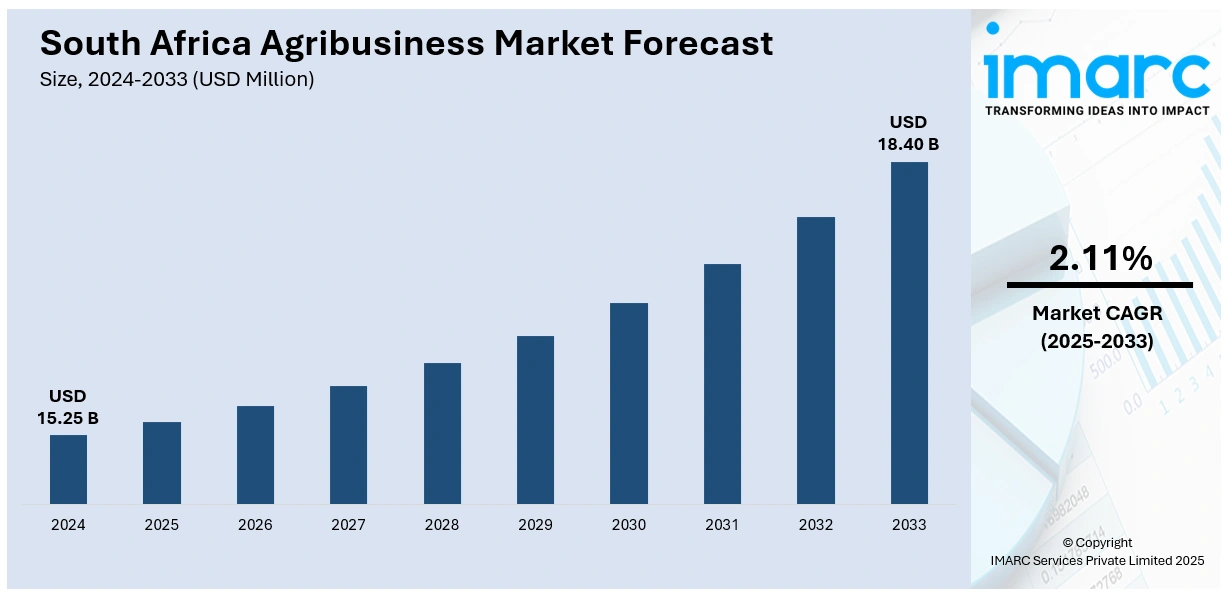

The South Africa agribusiness market size reached USD 15.25 Billion in 2024. The market is projected to reach USD 18.40 Billion by 2033, exhibiting a growth rate (CAGR) of 2.11% during 2025-2033. The growing adoption of digital logistics solutions, such as real-time tracking and automated inventory management, is streamlining operations for agribusinesses and improving reliability. Besides this, increasing investments in renewable energy projects and training programs that complement sustainable agriculture initiatives are contributing to the expansion of the South Africa agribusiness market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 15.25 Billion |

| Market Forecast in 2033 | USD 18.40 Billion |

| Market Growth Rate 2025-2033 | 2.11% |

South Africa Agribusiness Market Trends:

Growing focus on sustainable farming

Rising focus on sustainable farming is encouraging practices that improve resource efficiency and environmental balance while meeting the growing demand for responsibly produced food items. Farmers are adopting conservation agriculture, organic practices, regenerative farming, and precision agriculture to optimize inputs like water, fertilizers, and pesticides, thereby lowering costs and minimizing ecological damage. This shift is not only enhancing soil fertility and biodiversity but also ensuring resilience against climate variability. Sustainable farming practices are also opening opportunities for South African agribusinesses in global markets, as international buyers and trade partners are prioritizing eco-friendly and certified products. Local food companies are aligning with these trends, sourcing from sustainable farms and branding their products around traceability and environmental responsibility. Moreover, the government and private sector are investing in capacity-building, training programs, and renewable energy projects that complement sustainable agriculture initiatives. Financial institutions are also providing green financing models to support farmers in making this transition. Exhibitions and events are promoting awareness and showcasing sustainable agricultural solutions. In May 2025, at NAMPO 2025, Corteva Agriscience highlighted its lasting partnership with South African farmers by demonstrating its rich legacy and forward-looking innovations. The exhibition features the firm’s broadening biologicals portfolio, emphasizing the company’s dedication to sustainable farming.

To get more information on this market, Request Sample

Increasing investments in logistics

Rising investments in logistics are bolstering the South Africa agribusiness market growth by improving supply chain efficiency, reducing costs, and ensuring timely delivery of agricultural goods to both domestic and international markets. As per the IMARC Group, the South Africa logistics market size reached USD 25.34 Billion in 2024. With advanced logistics infrastructure, including cold chain storage, modern warehouses, and efficient transportation networks, perishable goods like fruits, vegetables, and dairy products can be preserved and transported with minimal losses, thus increasing profitability for farmers and exporters. Enhanced logistics systems also support the export of high-value agri-food products to key global markets, strengthening South Africa’s position as a competitive supplier. These investments alleviate obstacles in rural connectivity, allowing small and medium-sized farmers to reach larger markets and participate in value chains. Furthermore, digital logistics solutions, such as real-time tracking and automated inventory management, are streamlining operations for agribusinesses and improving reliability. By lowering post-harvest losses and ensuring consistent product quality, expenditure on logistics is boosting the overall efficiency of agricultural trade. International investors and local stakeholders are channeling funds into logistics hubs, port development, and distribution networks, which is enhancing the scalability of South Africa’s agribusiness sector.

South Africa Agribusiness Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product.

Product Insights:

- Grains

- Wheat

- Rice

- Coarse Grains – Ragi

- Sorghum

- Millets

- Oilseeds

- Rapeseed

- Sunflower

- Soybean

- Sesamum

- Others

- Dairy

- Liquid Milk

- Milk Powder

- Ghee

- Butter

- Ice-cream

- Cheese

- Others

- Livestock

- Pork

- Poultry

- Beef

- Sheep Meat

- Others

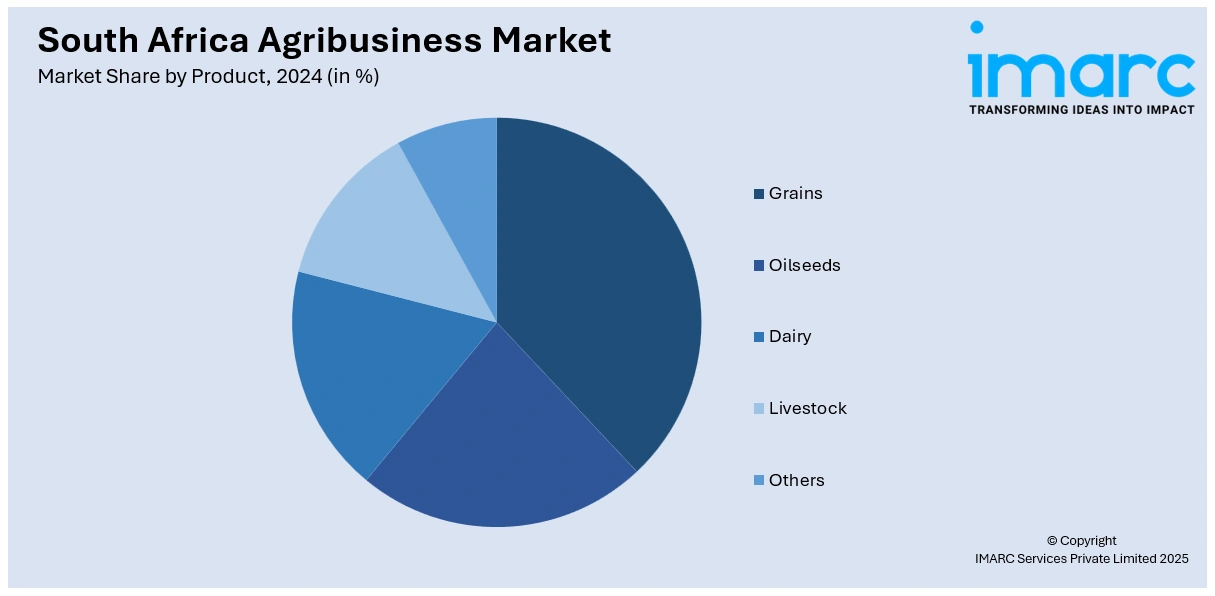

The report has provided a detailed breakup and analysis of the market based on the product. This includes grains (wheat, rice, coarse grains – ragi, sorghum, and millets), oilseeds (rapeseed, sunflower, soybean, sesamum, and others), dairy (liquid milk, milk powder, ghee, butter, ice-cream, cheese, and others), livestock (pork, poultry, beef, and sheep meat), and others.

Regional Insights:

- Gauteng

- KwaZulu-Natal

- Western Cape

- Mpumalanga

- Eastern Cape

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Africa Agribusiness Market News:

- In March 2025, the 2025 BRICS+ Agriculture Investment & Trade Summit was held in Durban, South Africa. The meeting featured significant agreements in agribusiness and infrastructure, including a USD 456 Million sugar export agreement between South African and Brazilian firms and the establishment of a USD 25.5 Million sugar factory modeled after the Brazilian agro-model in KwaZulu-Natal, South Africa.

- In March 2025, Norfund offered strategic financial support to the AFGRI Group, a South African agribusiness firm. The investment of ZAR 600 Million (approximately USD 33 Million) would aid AFGRI in funding working capital and financing for farmers.

South Africa Agribusiness Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Regions Covered | Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Africa agribusiness market performed so far and how will it perform in the coming years?

- What is the breakup of the South Africa agribusiness market on the basis of product?

- What is the breakup of the South Africa agribusiness market on the basis of region?

- What are the various stages in the value chain of the South Africa agribusiness market?

- What are the key driving factors and challenges in the South Africa agribusiness market?

- What is the structure of the South Africa agribusiness market and who are the key players?

- What is the degree of competition in the South Africa agribusiness market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Africa agribusiness market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Africa agribusiness market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Africa agribusiness industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)