South Africa Animal Feed Market Size, Share, Trends and Forecast by Form, Animal Type, Ingredient, and Region, 2025-2033

South Africa Animal Feed Market Overview:

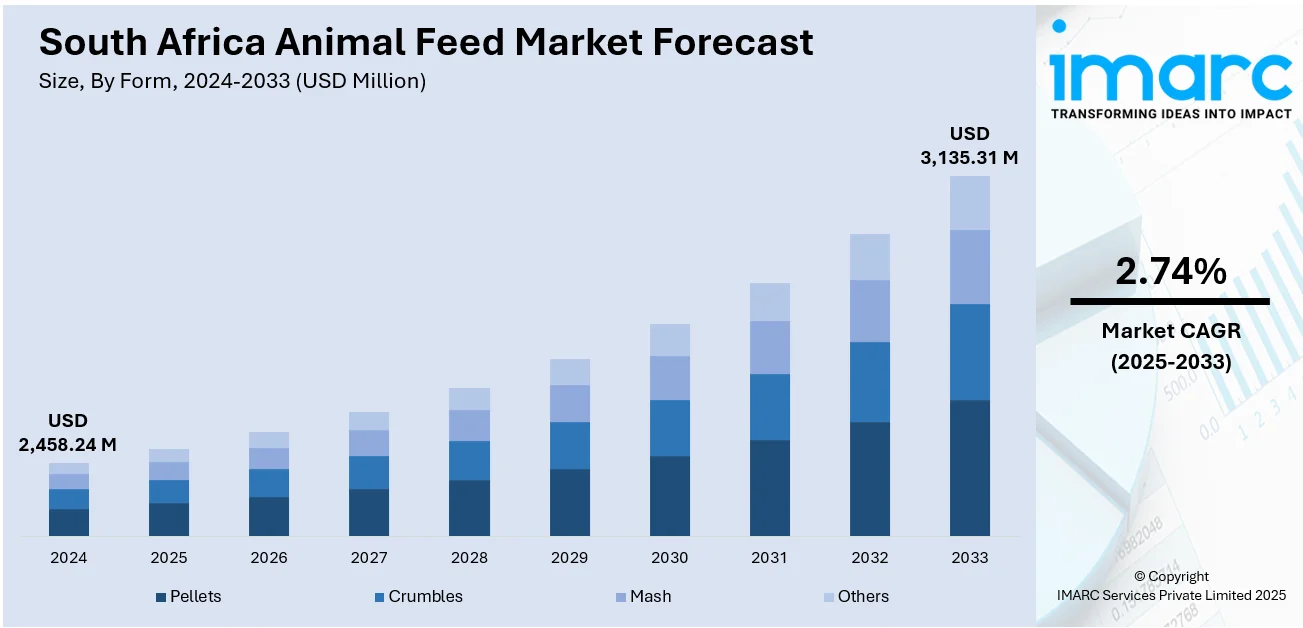

The South Africa animal feed market size reached USD 2,458.24 Million in 2024. The market is projected to reach USD 3,135.31 Million by 2033, exhibiting a growth rate (CAGR) of 2.74% during 2025-2033. The market is experiencing growth driven by increasing livestock production and a rising focus on nutrition-enhancing additives. As demand for quality animal products grows, advancements in feed formulation and sustainable practices continue to support the South Africa animal feed market share across diverse agricultural sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,458.24 Million |

| Market Forecast in 2033 | USD 3,135.31 Million |

| Market Growth Rate 2025-2033 | 2.74% |

South Africa Animal Feed Market Trends:

Rising Demand for Sustainable Feed Solutions

The South African animal feed industry is trending towards significantly greener and sustainable feed solutions. As the level of environmental concerns and the focus on sustainability have improved, farmers and manufacturers alike are seeking alternatives that do not negatively affect the environment. Generally, this is driven by increased application of sustainable feed ingredients such as insect-based proteins, algae, and additives based on plants. These substances not only reduce the environmental footprint but also address the need for green protein feedstock in animal feed. Furthermore, with increased global consciousness around climate change, South African farmers are now also shifting towards locally sourced feed materials, reducing the use of imported products and increasing local agriculture industries. This transition is brought about by stricter regulation and the demand for a greener food production system. South Africa animal feed market growth is also fueled by sustainable modes of producing feeds, which guarantee ethical forms of farming. Consumers are becoming conscious of the ethics involved in food production, which pushes farmers to seek practices that also portray their ethics. Therefore, demand for sustainable feed solutions will be on the rise and will go a long way in supporting the market growth.

To get more information on this market, Request Sample

Technological Innovations in Feed Production

Technological innovations are revolutionizing the South Africa animal feed market growth, providing solutions that enhance efficiency, minimize costs, and enhance the quality of feed. Advances like automation, artificial intelligence, and big data analytics are transforming the process of feed manufacturing. Through the integration of precision feeding systems and smart management tools, farmers are now able to optimize the nutritional diet of animals, minimize wastage, and maximize farm productivity. These technologies enable improved animal health and nutrition monitoring, so that feed formulations are specific and efficient. Also gaining acceptance is the use of feed additives like probiotics, enzymes, and prebiotics since they enhance the digestibility of feed and animal health, resulting in improved growth rates and lower risks of disease. In addition, research has enabled researchers to formulate customized feed options for various animals, enabling producers to address the unique nutritional requirements of livestock, poultry, and aquaculture. The heightened level of utilization of such technologies not only improves productivity but also helps to make feed production cost-effective. As South African farmers look to remain competitive in the international market, adopting technological solutions will be key to fueling additional market expansion, creating more efficient and sustainable feed production.

South Africa Animal Feed Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on form, animal type, and ingredient.

Form Insights:

- Pellets

- Crumbles

- Mash

- Others

The report has provided a detailed breakup and analysis of the market based on the form. This includes pellets, crumbles, mash, and others.

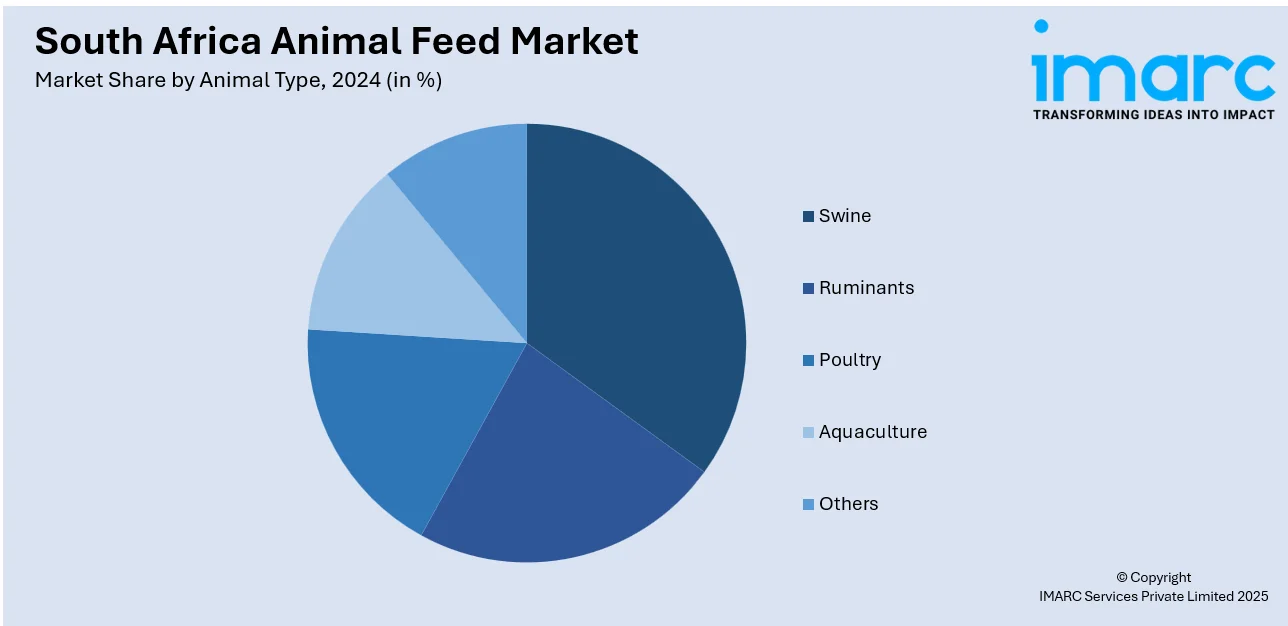

Animal Type Insights:

- Swine

- Starter

- Finisher

- Grower

- Ruminants

- Calves

- Dairy Cattle

- Beef Cattle

- Others

- Poultry

- Broilers

- Layers

- South Africas

- Others

- Aquaculture

- Carps

- Crustaceans

- Mackeral

- Milkfish

- Mollusks

- Salmon

- Others

- Others

The report has provided a detailed breakup and analysis of the market based on the animal type. This includes swine (starter, finisher, and grower), ruminants (calves, dairy cattle, beef cattle, and others), poultry (broilers, layers, south africas, and others), aquaculture (carps, crustaceans, mackeral, milkfish, mollusks, salmon, and others), and others.

Ingredient Insights:

- Cereals

- Oilseed Meal

- Molasses

- Fish Oil and Fish Meal

- Additives

- Antibiotics

- Vitamins

- Antioxidants

- Amino Acids

- Feed Enzymes

- Feed Acidifiers

- Others

- Others

The report has provided a detailed breakup and analysis of the market based on the ingredient. This includes cereals, oilseed meal, molasses, fish oil and fish meal, additives (antibiotics, vitamins, antioxidants, amino acids, feed enzymes, feed acidifiers, and others), and others.

Regional Insights:

- Gauteng

- KwaZulu-Natal

- Western Cape

- Mpumalanga

- Eastern Cape

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Africa Animal Feed Market News:

- March 2025: De Heus South Africa launched a new feed mill in Middelburg, Eastern Cape, focused on ruminant feeds with a 15,000-Ton monthly capacity. This expansion improved local access to high-quality animal nutrition, boosting livestock productivity and supporting regional agricultural growth, positively impacting the animal feed market.

South Africa Animal Feed Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Forms Covered | Pellets, Crumbles, Mash, Others |

| Animal Types Covered |

|

| Ingredients Covered |

|

| Regions Covered | Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Africa animal feed market performed so far and how will it perform in the coming years?

- What is the breakup of the South Africa animal feed market on the basis of form?

- What is the breakup of the South Africa animal feed market on the basis of animal type?

- What is the breakup of the South Africa animal feed market on the basis of ingredient?

- What is the breakup of the South Africa animal feed market on the basis of region?

- What are the various stages in the value chain of the South Africa animal feed market?

- What are the key driving factors and challenges in the South Africa animal feed market?

- What is the structure of the South Africa animal feed market and who are the key players?

- What is the degree of competition in the South Africa animal feed market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Africa animal feed market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Africa animal feed market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Africa animal feed industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)