South Africa Animal Health Market Size, Share, Trends and Forecast by Animal Type, Product Type, and Province, 2025-2033

South Africa Animal Health Market Overview:

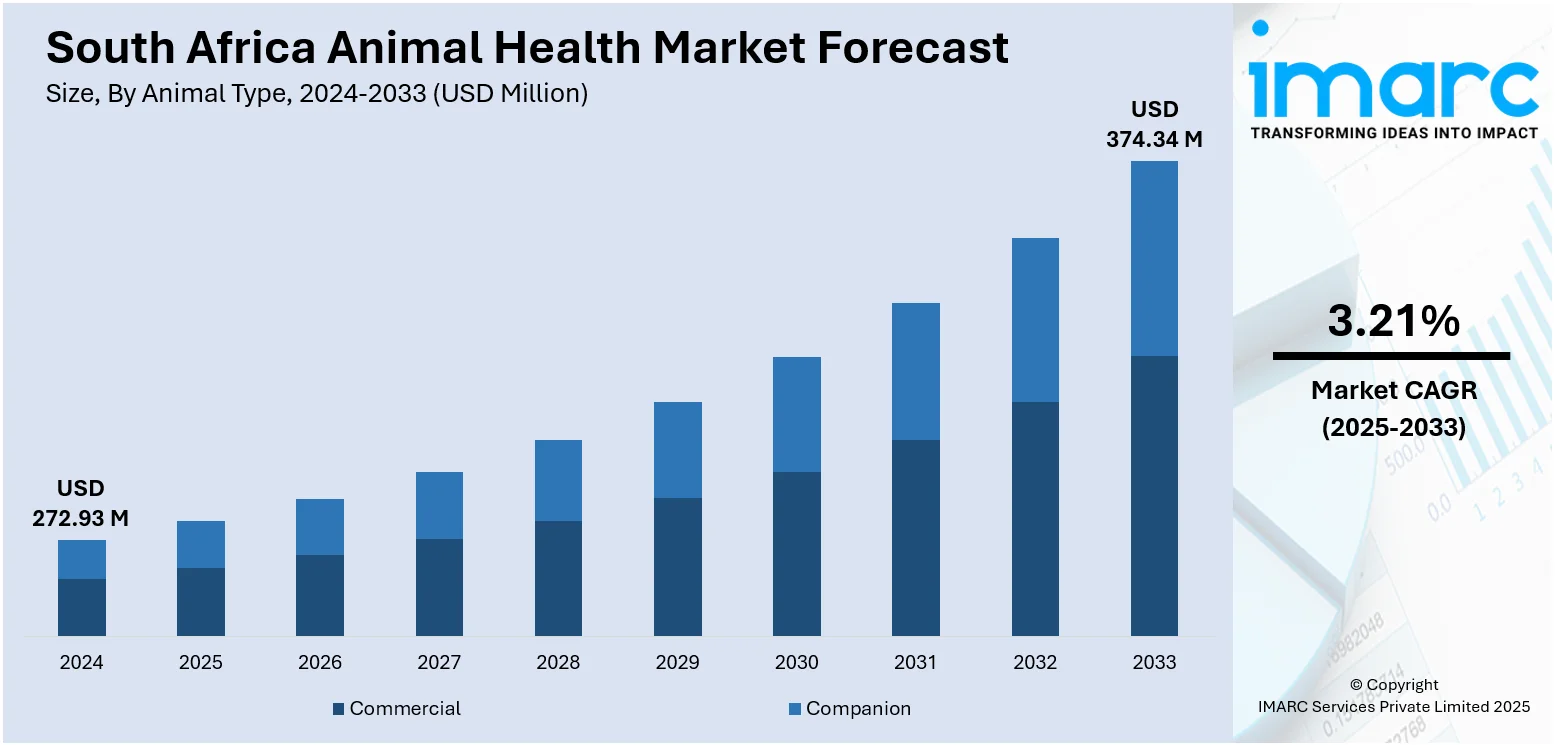

The South Africa animal health market size reached USD 272.93 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 374.34 Million by 2033, exhibiting a growth rate (CAGR) of 3.21% during 2025-2033. At present, the upgrading of veterinary healthcare infrastructure and the embracing of advanced technologies are impelling the market growth. Besides this, the increasing livestock population to satisfy growing domestic and foreign demand for meat, dairy, and other animal products is offering a favorable market outlook. Moreover, the heightened perception of zoonotic disease is expanding the South Africa animal health market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 272.93 Million |

| Market Forecast in 2033 | USD 374.34 Million |

| Market Growth Rate 2025-2033 | 3.21% |

South Africa Animal Health Market Trends:

Growth in Livestock Population and Commercial Livestock Farming Methods

The South African animal health market is experiencing rapid growth as the nation is increasing its livestock population to satisfy the domestic and foreign demand for meat, dairy, and other animal products. Farmers are also embracing commercial livestock farming methods, which call for formalized disease control and health management protocols. This transformation is promoting the application of vaccines, feed additives, and veterinary medicines for enhancing productivity and welfare of animals. Additionally, feedlot development and integrated livestock operations are encouraging sustained investment in animal health. Government policies favoring the agricultural industry are acting as a milestone factor by providing subsidies and veterinary care, thus increasing access to animal healthcare. With expanding farm operations, farmers are focusing on prevention of disease and biosecurity, and this is driving the demand for diagnostic equipment, preventive drugs, and therapeutic remedies. In 2025, Agriculture Minister John Steenhuisen pledged to expedite the execution of commodity-based development models, designed to evolve South Africa’s livestock sector and enhance market access for smallholder farmers. In his keynote speech at the first Total Mixed Ration (TMR) Conference, Steenhuisen presented five strategic foundations to steer South Africa towards achieving food security and increasing exports in the red meat and dairy industries. This encompasses biosecurity and resilience to diseases, changes in structure and inclusiveness, efficiency in regulations and facilitation of trade, adaptation to climate and care for the environment, alongside partnerships between the public and private sectors and coordination of institutions.

To get more information on this market, Request Sample

Growing Sensitization of Zoonotic Diseases and Public Health Issues

The rising awareness of zoonotic disease is supporting the South Africa animal health market growth. With a rise in global health issues due to outbreaks like avian influenza, rabies, and brucellosis, South African authorities and stakeholders are enhancing surveillance and prevention efforts. Veterinary health service is being incorporated in public health systems to track and regulate disease transmission at the interface of animals and humans. Mass public education campaigns and legislation are increasingly emphasizing early diagnosis, vaccination, and annual veterinary care, particularly in rural and peri-urban areas where contact between livestock and humans is high. Local agencies are also being partnered with by international organizations and non-governmental organizations (NGOs) to fund and roll out disease control programs, further catalyzing the demand for animal health products. For instance, in 2025, the government announced its plans of focusing on controlling foot-and-mouth disease affecting cattle. The government requested more than 900,000 doses of vaccines for foot-and-mouth disease, with the initial shipment anticipated to be delivered in June.

Improvements in Veterinary Healthcare Infrastructure and Technologies

The market is evolving with the upgrading of veterinary healthcare infrastructure and the embracing of advanced technologies. Veterinary clinics, mobile health units, and diagnostic laboratories are increasing their outreach, particularly in under-served rural and agricultural communities. These advancements are facilitating access to timely and professional animal healthcare services, thus promoting regular treatment, vaccination, and monitoring procedures. Furthermore, the incorporation of digital technology, including telemedicine and data-based livestock management systems, is simplifying veterinary procedures and allowing real-time monitoring of health. Veterinary drug firms are making investments in research and development (R&D) to develop region-specific drugs and vaccines targeting local disease patterns. Collaborations between the government, academia, and private industry are driving innovation in animal diagnostic and treatment techniques. In 2025, The University of the Free State (UFS) is progressing with efforts to launch a new veterinary science program, which will be the second of its type in South Africa. This project encompasses the creation of a professionally recognized Bachelor of Veterinary Science (BVSc) degree, and a modern veterinary teaching hospital located on the South Campus in Bloemfontein. It will also utilize the university’s Paradys Experimental Farm, which features modern agricultural facilities and established livestock herds.

South Africa Animal Health Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on animal type and product type.

Animal Type Insights:

- Commercial

- Companion

The report has provided a detailed breakup and analysis of the market based on the animal type. This includes commercial and companion.

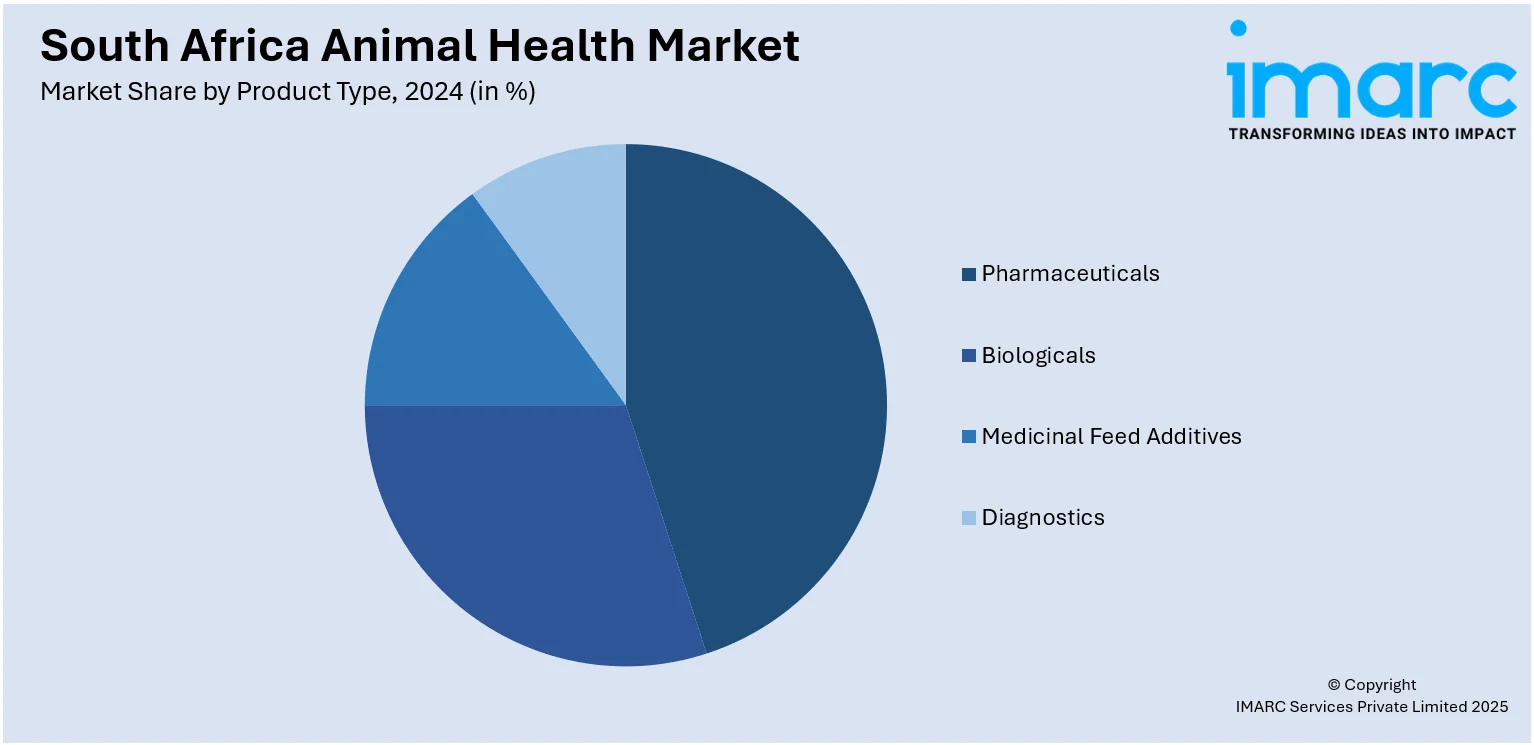

Product Type Insights:

- Pharmaceuticals

- Biologicals

- Medicinal Feed Additives

- Diagnostics

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes pharmaceuticals, biologicals, medicinal feed additives, and diagnostics.

Provinical Insights:

- Gauteng

- KwaZulu-Natal

- Western Cape

- Mpumalanga

- Eastern Cape

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Africa Animal Health Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Animal Types Covered | Commercial, Companion |

| Product Types Covered | Pharmaceuticals, Biologicals, Medicinal Feed Additives, Diagnostics |

| Provinces Covered | Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Africa animal health market performed so far and how will it perform in the coming years?

- What is the breakup of the South Africa animal health market on the basis of animal type?

- What is the breakup of the South Africa animal health market on the basis of product type?

- What is the breakup of the South Africa animal health market on the basis of province?

- What are the various stages in the value chain of the South Africa animal health market?

- What are the key driving factors and challenges in the South Africa animal health market?

- What is the structure of the South Africa animal health market and who are the key players?

- What is the degree of competition in the South Africa animal health market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Africa animal health market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Africa animal health market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Africa animal health industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)