South Africa ATM Market Size, Share, Trends and Forecast by Solution, Screen Size, Application, ATM Type, and Province, 2025-2033

South Africa ATM Market Overview:

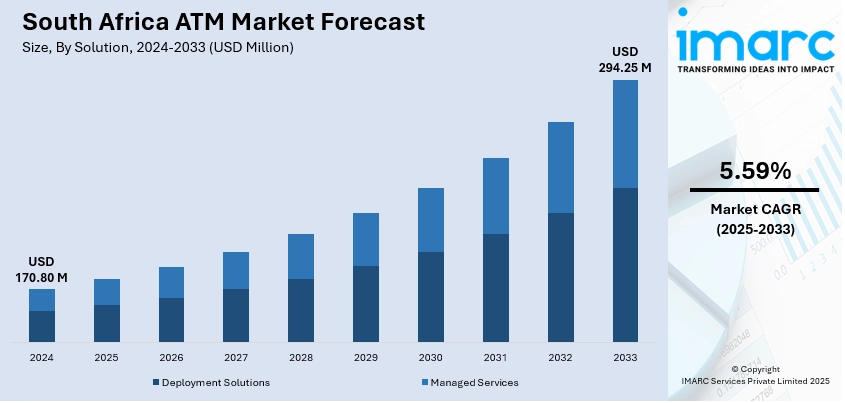

The South Africa ATM market size reached USD 170.80 Million in 2024. Looking forward, the market is expected to reach USD 294.25 Million by 2033, exhibiting a growth rate (CAGR) of 5.59% during 2025-2033. Drivers of the market include strong demand for convenient, 24/7 cash access due to a largely cash-based economy, rising digital and mobile banking adoption, independent ATM growth in underserved areas, and enhanced transaction services like deposits and bill payments. Robust cash usage sustains high South Africa ATM market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 170.80 Million |

| Market Forecast in 2033 | USD 294.25 Million |

| Market Growth Rate 2025-2033 | 5.59% |

South Africa ATM Market Trends:

White‑Label and Independent ATM Expansion

White-label and independent ATMs are gaining prominence, bridging the gap left by traditional banks in underserved areas. Chem systems like ATM Solutions deploy machines in retail outlets and townships, reducing cash-in-transit costs and promoting financial inclusion. These ATMs facilitate a broad range of accessible services, withdrawals, bill payments, mobile wallet top-ups, catering to communities reliant on cash. Institutions and merchants benefit from increased foot traffic and diversified revenue streams. With strategies focused on expanding reach to rural and peri-urban zones, this decentralized model supports South Africa ATM market growth by embedding cash services into everyday consumer environments. For instance, as per industry reports, despite digital growth, cash remains central to South Africa’s payments, with 87% still relying on it for everyday use. As banks reduce ATM numbers, independent operators like ATM Solutions are ensuring continued access, especially in under-served communities. Their 4,500+ ATMs support withdrawals from bank accounts, mobile wallets, and crypto. Consumer preference for cash, due to simplicity, affordability, and reliability, underscores its ongoing relevance. This reinforces the South Africa ATM market growth and highlights the critical role of independent deployers in financial inclusion.

To get more information on this market, Request Sample

Security-Driven ATM Innovation and Resilience

Security threats, including vandalism, theft, and power outages, have prompted ATM operators in South Africa to adopt resilient technologies and preventive measures. For instance, in May 2025, two suspects were arrested for allegedly stealing R7-million from ATMs in South Africa using “specialised software.” Disguised as Fidelity Cash Solutions guards, they accessed ATMs in the Western Cape before being caught near Peddie with a laptop linked to the crime. Banks are upgrading machines with reinforced materials, surveillance, and improved site selection . Independent and white-label ATM networks are integrating uninterrupted power supplies and remote monitoring to ensure reliability during load shedding. Additionally, the adoption of biometric authentication and remote video teller functions is underway to deter crime and maintain consistent service levels. These enhancements amplify ATM utility and trust, supporting South Africa ATM market growth by making cash access safe, secure, and dependable.

South Africa ATM Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on solution, screen size, application, and ATM type.

Solution Insights:

- Deployment Solutions

- Onsite ATMs

- Offsite ATMs

- Work Site ATMs

- Mobile ATMs

- Managed Services

The report has provided a detailed breakup and analysis of the market based on the solution. This includes deployment solutions (onsite ATMs, offsite ATMs, work site ATMs, and mobile ATMs) and managed services.

Screen Size Insights:

- 15" and Below

- Above 15"

A detailed breakup and analysis of the market based on the screen size have also been provided in the report. This includes 15" and below and above 15".

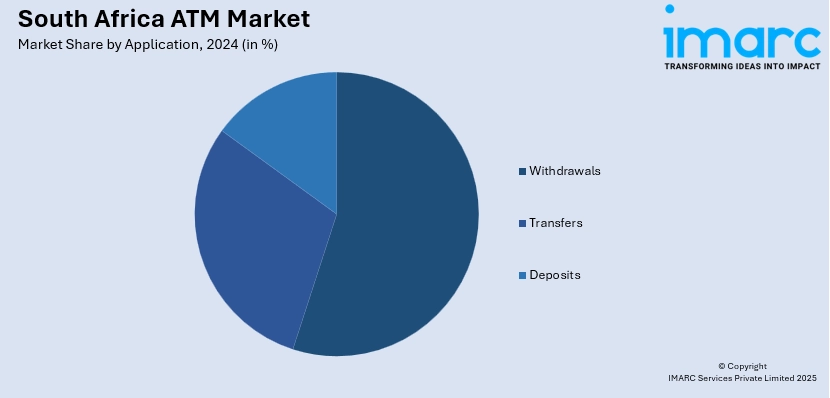

Application Insights:

- Withdrawals

- Transfers

- Deposits

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes withdrawals, transfers, and deposits.

ATM Type Insights:

- Conventional/Bank ATMs

- Brown Label ATMs

- White Label ATMs

- Smart ATMs

- Cash Dispensers

A detailed breakup and analysis of the market based on the ATM type have also been provided in the report. This includes conventional/bank ATMs, brown label ATMs, white label ATMs, smart ATMs, and cash dispensers.

Province Insights:

- Gauteng

- KwaZulu-Natal

- Western Cape

- Mpumalanga

- Eastern Cape

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Africa ATM Market News:

- In April 2025, Standard Bank upgraded its ATM network across South Africa, aiming to enhance customer experience and security. This modernization aligns with the growing digital banking shift, ensuring ATMs remain relevant in a tech-driven landscape. The bank is investing in new software and hardware to support contactless transactions, biometric authentication, and advanced fraud protection. These upgrades also aim to reduce downtime and improve service availability. The initiative reflects broader South Africa ATM market growth as banks adapt to evolving consumer and cybersecurity demands.

South Africa ATM Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Solutions Covered |

|

| Screen Sizes Covered | 15" and Below, Above 15" |

| Applications Covered | Withdrawals, Transfers, Deposits |

| ATM Types Covered | Conventional/Bank ATMs, Brown Label ATMs, White Label ATMs, Smart ATMs, Cash Dispensers |

| Provinces Covered | Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, and others. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Africa ATM market performed so far and how will it perform in the coming years?

- What is the breakup of the South Africa ATM market on the basis of solution?

- What is the breakup of the South Africa ATM market on the basis of screen size?

- What is the breakup of the South Africa ATM market on the basis of application?

- What is the breakup of the South Africa ATM market on the basis of ATM type?

- What is the breakup of the South Africa ATM market on the basis of region?

- What are the various stages in the value chain of the South Africa ATM market?

- What are the key driving factors and challenges in the South Africa ATM market?

- What is the structure of the South Africa ATM market and who are the key players?

- What is the degree of competition in the South Africa ATM market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Africa ATM market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Africa ATM market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Africa ATM industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)