South Africa Automotive Market Size, Share, Trends and Forecast by Type, Propulsion Type, Sales Channel, and Region, 2025-2033

South Africa Automotive Market Overview:

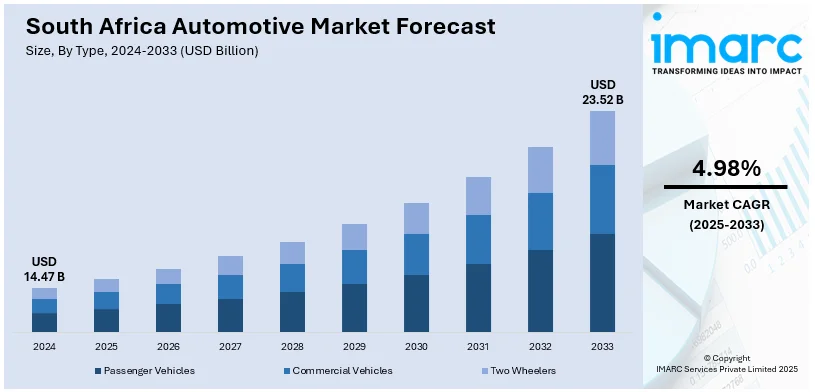

The South Africa automotive market size reached USD 14.47 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 23.52 Billion by 2033, exhibiting a growth rate (CAGR) of 4.98% during 2025-2033. Rising vehicle demand, government incentives for local manufacturing, expansion of electric vehicle adoption, infrastructure investment, favorable trade agreements, and growing consumer preference for affordable, fuel-efficient cars contribute to the South Africa automotive market share. Export opportunities, skilled labor, and technological upgrades also support sustained industry growth and competitiveness.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 14.47 Billion |

| Market Forecast in 2033 | USD 23.52 Billion |

| Market Growth Rate 2025-2033 | 4.98% |

South Africa Automotive Market Trends:

Surge in Electric and Hybrid Vehicle Interest

The South African automotive sector has started showing early signs of a shift toward electric and hybrid mobility. Even though the infrastructure for widespread EV adoption remains limited, consumer awareness and interest are rising. Government discussions about tax incentives and charging station rollouts have helped create momentum. Luxury brands were the first movers, introducing high-end electric models targeted at wealthier urban buyers, but local manufacturers are beginning to explore more affordable alternatives. A key driver is rising fuel costs, which make electric models increasingly appealing to cost-conscious drivers in the long run. Import dynamics also play a role: South Africa’s trade ties with Europe and Asia, where EV adoption is far ahead, ensure a steady inflow of models and technology. While mass adoption is still years away, dealerships report stronger inquiries and gradual year-on-year growth in sales for electrified vehicles. This indicates a potential long-term transformation in the market, especially if charging infrastructure and policy support keep improving. These factors are intensifying the South Africa automotive market growth.

To get more information on this market, Request Sample

Expansion of Used Vehicle and Financing Markets

A different development shaping the industry is the rapid expansion of the used car and vehicle financing segments. Economic pressures, including slow wage growth and rising living costs, have made affordability the central issue for buyers. Many households are now turning toward pre-owned cars rather than new ones, as they provide greater value for money without compromising on reliability. Dealerships and online platforms have responded by professionalizing used-car sales, offering certified vehicles, warranties, and financing options that were previously limited to new cars. Banks and fintech players have also entered this space aggressively, tailoring loan products for second-hand buyers. This trend has reshaped consumer behavior, as a growing portion of first-time buyers now enter the market through used cars. It also impacts automakers, who are being pushed to rethink after-sales strategies and capture revenue through servicing and maintenance. The resilience of the used-car segment underscores how South African consumers adapt to economic pressures while keeping personal mobility a priority.

South Africa Automotive Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, propulsion type, and sales channel.

Type Insights:

- Passenger Vehicles

- Commercial Vehicles

- Two Wheelers

The report has provided a detailed breakup and analysis of the market based on the type. This includes passenger vehicles, commercial vehicles, and two wheelers.

Propulsion Type Insights:

- Gasoline

- Diesel

- Electric

- Others

The report has provided a detailed breakup and analysis of the market based on the propulsion type. This includes gasoline, diesel, electric, others.

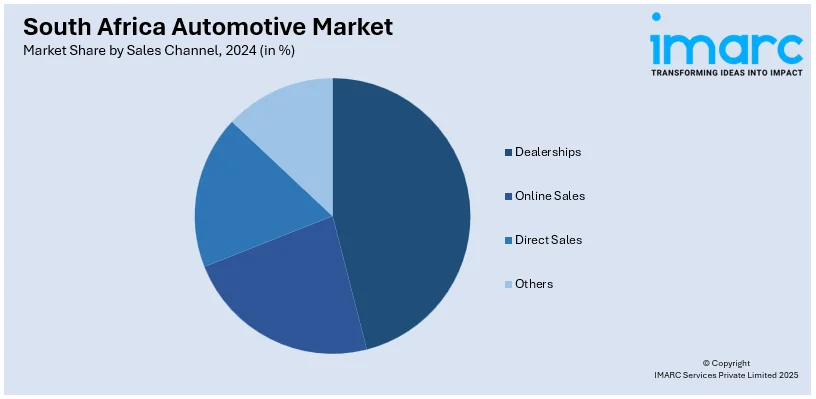

Sales Channel Insights:

- Dealerships

- Online Sales

- Direct Sales

- Others

The report has provided a detailed breakup and analysis of the market based on the sales channel. This includes dealerships, online sales, direct sales, and others.

Regional Insights:

- Gauteng

- KwaZulu-Natal

- Western Cape

- Mpumalanga

- Eastern Cape

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Africa Automotive Market News:

- In February 2025, Mahindra South Africa signed an MoU with the Industrial Development Corporation to conduct a feasibility study for setting up a Completely Knocked Down (CKD) vehicle assembly plant. The company is also expanding capacity at its KwaZulu-Natal facility operated by AIH Logistics. Celebrating its 25,000th locally assembled Pik Up, Mahindra reaffirmed South Africa as its “second home” and marked 20 years of strengthening its presence in the country’s automotive sector.

South Africa Automotive Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Passenger Vehicles, Commercial Vehicles, Two Wheelers |

| Propulsion Types Covered | Gasoline, Diesel, Electric, Others |

| Sales Channels Covered | Dealerships, Online Sales, Direct Sales, Others |

| Regions Covered | Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Africa automotive market performed so far and how will it perform in the coming years?

- What is the breakup of the South Africa automotive market on the basis of type?

- What is the breakup of the South Africa automotive market on the basis of propulsion type?

- What is the breakup of the South Africa automotive market on the basis of sales channel?

- What is the breakup of the South Africa automotive market on the basis of region?

- What are the various stages in the value chain of the South Africa automotive market?

- What are the key driving factors and challenges in the South Africa automotive market?

- What is the structure of the South Africa automotive market and who are the key players?

- What is the degree of competition in the South Africa automotive market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Africa automotive market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Africa automotive market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Africa automotive industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)