South Africa Bottled Water Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, Packaging Type, and Region, 2025-2033

South Africa Bottled Water Market Overview:

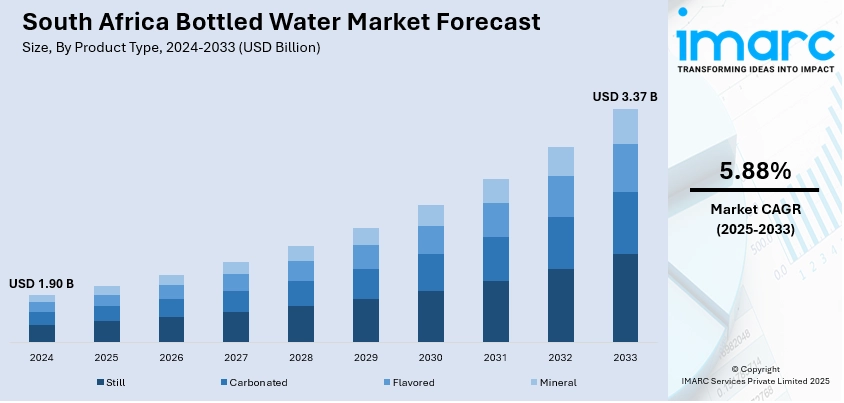

The South Africa bottled water market size reached USD 1.90 Billion in 2024. Looking forward, the market is projected to reach USD 3.37 Billion by 2033, exhibiting a growth rate (CAGR) of 5.88% during 2025-2033. The market is experiencing stable growth, driven by increasing health awareness, rising tourism, and concerns over municipal water quality. Urbanization and on-the-go lifestyles are boosting demand for convenient hydration options. Innovations in packaging and product offerings, including flavored and functional waters, are attracting diverse consumer segments. Competitive pricing and regional distribution expansion are shaping market dynamics, influencing the South Africa bottled water market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.90 Billion |

| Market Forecast in 2033 | USD 3.37 Billion |

| Market Growth Rate 2025-2033 | 5.88% |

South Africa Bottled Water Market Trends:

Eco-Packaging and Sustainability Push

Sustainability is emerging as a prominent trend within the South Africa bottled water sector, as consumers demonstrate a distinct preference for eco-friendly packaging. In response to this demand, brands are dedicating resources to innovations in eco-packaging, including biodegradable bottles, materials made from recycled PET, and refillable containers. In 2023, Petco achieved a 64% collection and 60% recycling rate for PET bottles, surpassing the 58% government target. Recycling saved 64,100 m³ of landfill space and reduced CO₂ emissions by 314,500 tonnes, supporting a circular economy. These initiatives contribute to the reduction of plastic waste and resonate with broader consumer values surrounding environmental responsibility. Numerous companies are adopting carbon-neutral production methods and utilizing minimalistic label designs to lessen their ecological impact. Retailers are supporting these sustainable products by allocating dedicated shelf space and implementing green labeling, which further shapes purchasing behavior. This trend is notably strong among younger and urban consumers who favor eco-conscious choices when buying. Consequently, packaging focused on sustainability is fulfilling environmental objectives and driving South Africa bottled water market growth by enhancing brand loyalty and facilitating market differentiation.

To get more information on this market, Request Sample

Urban Demand and Tourism Boosting Bottled Water Consumption

The swift increase in urban populations throughout South Africa is playing a significant role in boosting the demand for bottled water, especially in major cities like Johannesburg, Cape Town, and Durban. As individuals embrace fast-paced, mobile lifestyles, the need for accessible and safe hydration solutions continues to grow. According to data published by UN Habitat, by 2050, 80% of South Africa's population will reside in urban areas. In parallel, South Africa’s dynamic tourism industry driven by its natural beauty, cultural heritage, and international events is consistently generating demand for bottled water in hotels, restaurants, and leisure spots. Both local travelers and international visitors heavily depend on bottled water due to concerns surrounding the safety of tap water or simply for convenience. This combination of urban growth and tourism elevates consumption levels and motivates brands to enhance their distribution networks and product availability in high-footfall areas. Collectively, these elements are establishing a crucial growth pillar for the bottled water market in South Africa.

South Africa Bottled Water Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, distribution channel, and packaging type.

Product Type Insights:

- Still

- Carbonated

- Flavored

- Mineral

The report has provided a detailed breakup and analysis of the market based on the product type. This includes still, carbonated, flavored, and mineral.

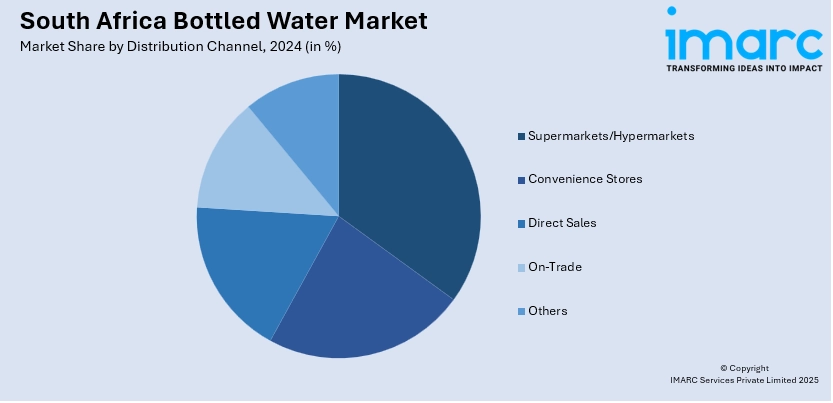

Distribution Channel Insights:

- Supermarkets/Hypermarkets

- Convenience Stores

- Direct Sales

- On-Trade

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets/hypermarkets, convenience stores, direct sales, on-trade, and others.

Packaging Type Insights:

- PET Bottles

- Metal Cans

- Others

The report has provided a detailed breakup and analysis of the market based on the packaging type. This includes PET bottles, metal cans, and others.

Regional Insights:

- Gauteng

- KwaZulu-Natal

- Western Cape

- Mpumalanga

- Eastern Cape

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Africa Bottled Water Market News:

- In April 2025, Manzi Water announced its plans to open seven new franchise stores in South Africa, responding to rising demand for bottled water amid water quality concerns. Founded in 2023, the company now operates over 105 locations. Its competitor, Oasis Water, has threatened legal action over franchise poaching disputes.

South Africa Bottled Water Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Still, Carbonated, Flavored, Mineral |

| Distribution Channels Covered | Supermarkets/Hypermarkets, Convenience Stores, Direct Sales, On-Trade, Others |

| Packaging Types Covered | PET Bottles, Metal Cans, Others |

| Regions Covered | Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Africa bottled water market performed so far and how will it perform in the coming years?

- What is the breakup of the South Africa bottled water market on the basis of product type?

- What is the breakup of the South Africa bottled water market on the basis of distribution channel?

- What is the breakup of the South Africa bottled water market on the basis of packaging type?

- What is the breakup of the South Africa bottled water market on the basis of region?

- What are the various stages in the value chain of the South Africa bottled water market?

- What are the key driving factors and challenges in the South Africa bottled water market?

- What is the structure of the South Africa bottled water market and who are the key players?

- What is the degree of competition in the South Africa bottled water market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Africa bottled water market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Africa bottled water market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Africa bottled water industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)