South Africa Carbon Black Market Size, Share, Trends and Forecast by Type, Grade Wise Application, and Region, 2025-2033

South Africa Carbon Black Market Overview:

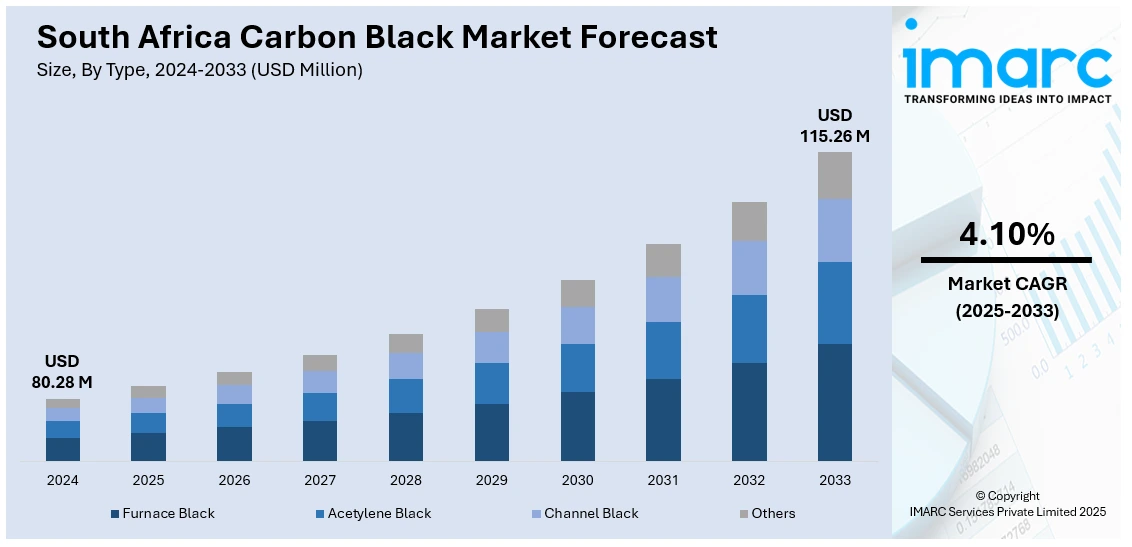

The South Africa carbon black market size reached USD 80.28 Million in 2024. Looking forward, the market is projected to reach USD 115.26 Million by 2033, exhibiting a growth rate (CAGR) of 4.10% during 2025-2033. The market growth can be attributed to the robust tire manufacturing, growing infrastructure investments, and rising demand for industrial coatings. South Africa’s mining and automotive sectors rely heavily on carbon black-reinforced rubber and high-performance coatings. With consistent investments in heavy industries, local compounding, and regulatory compliance, the additive remains essential across material performance applications, further augmenting the South Africa carbon black market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 80.28 Million |

| Market Forecast in 2033 | USD 115.26 Million |

| Market Growth Rate 2025-2033 | 4.10% |

South Africa Carbon Black Market Trends:

Tire Manufacturing and Retreading Industry Growth

South Africa remains the dominant player in sub-Saharan Africa’s automotive manufacturing ecosystem, with notable investments in tire production from global brands such as Goodyear, Continental, and Bridgestone. These facilities not only cater to domestic demand but also serve regional export markets. Carbon black is an indispensable reinforcing agent in tire treads, sidewalls, and inner liners, and its demand is closely aligned with new tire manufacturing, retreading operations, and replacement tire sales. In addition, South Africa’s robust commercial vehicle sector, particularly in mining, logistics, and agriculture, requires high-durability tires, intensifying the need for high-performance carbon black grades. For instance, in September 2024, Dunlop Tyres South Africa launched its new SP TOURING R1 L tyres, designed specifically for local road conditions in South Africa, targeting 15-inch tyres and below. The tyres feature deep tread depth, narrow sipes for wet conditions, and wide grooves to resist hydroplaning, providing better mileage and improved handling stability. Retreading is particularly significant, given its cost efficiency and sustainability advantages, both of which align with South Africa’s circular economy goals. The presence of local carbon black producers, such as those supplying N220 and N330 grades, further supports consistent availability for domestic compounding. The South Africa carbon black market growth is firmly linked to the expansion of tire manufacturing and retreading operations, which rely on consistent quality, reinforcement strength, and performance enhancement.

To get more information on this market, Request Sample

Coatings and Industrial Rubber Segment Expansion

South Africa’s industrial base is diversified across mining, manufacturing, and transport, all of which require durable surface coatings and specialty rubber components. Carbon black is heavily used in anti-corrosion paints, heavy-duty coatings, and sealing compounds designed to withstand UV exposure, chemical contact, and abrasive environments. Industrial rubber goods such as conveyor belts, gaskets, hoses, and vibration-dampening pads rely on carbon black to deliver mechanical strength and thermal resistance. The mining sector, in particular, drives substantial demand for high-performance rubber and protective coatings due to its dependence on ruggedized equipment and environmental protection systems. Paint manufacturers and ink producers in South Africa also incorporate carbon black for pigmenting architectural finishes, signage inks, and packaging materials. In August 2024, Prominent Paints launched the revolutionary Neuklad Range, a breakthrough exterior coating system engineered for enhanced protection and durability on South African buildings. The Neuklad Range targets moisture ingress and harsh weather, promising extended maintenance cycles and sustainability benefits. The country’s regulatory alignment with international safety and quality standards has further elevated demand for engineered carbon black grades that support extended service life, low VOC formulations, and high-opacity coatings, ensuring sustained demand from both heavy industry and consumer-facing sectors.

South Africa Carbon Black Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and grade wise application.

Type Insights:

- Furnace Black

- Acetylene Black

- Channel Black

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes furnace black, acetylene black, channel black, and others.

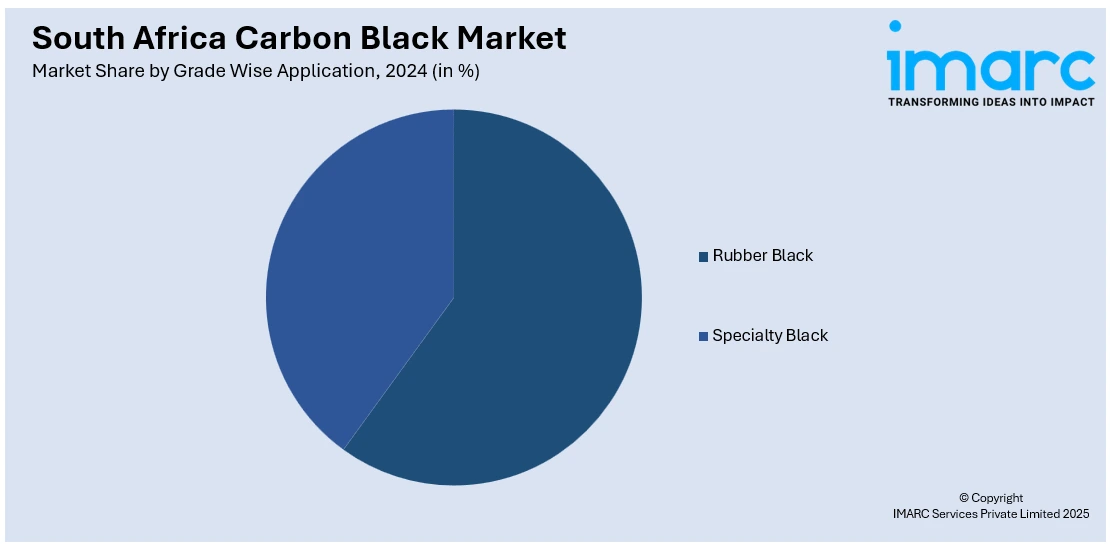

Grade Wise Application Insights:

- Rubber Black

- Tire Treads

- Inner Liner and Tubes

- Conveyor Belts

- Hoses

- Others

- Specialty Black

- Plastics

- Ink and Toners

- Paint and Coatings

- Wires and Cables

- Others

The report has provided a detailed breakup and analysis of the market based on the grade wise application. This includes rubber black (tire treads, inner liner and tubes, conveyor belts, hoses, and others) and specialty black (plastics, ink and toners, paint and coatings, wires and cables, and others).

Regional Insights:

- Gauteng

- KwaZulu-Natal

- Western Cape

- Mpumalanga

- Eastern Cape

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Africa Carbon Black Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Furnace Black, Acetylene Black, Channel Black, Others |

| Grade Wise Applications Covered |

|

| Regions Covered | Gauteng, KwaZulu-Natal, Western Cape, Mpumalanga, Eastern Cape, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Africa carbon black market performed so far and how will it perform in the coming years?

- What is the breakup of the South Africa carbon black market on the basis of type?

- What is the breakup of the South Africa carbon black market on the basis of grade wise application?

- What is the breakup of the South Africa carbon black market on the basis of region?

- What are the various stages in the value chain of the South Africa carbon black market?

- What are the key driving factors and challenges in the South Africa carbon black market?

- What is the structure of the South Africa carbon black market and who are the key players?

- What is the degree of competition in the South Africa carbon black market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Africa carbon black market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Africa carbon black market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Africa carbon black industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)